HSN codes and product classification are extremely important for accurate E-waybill documentation while playing a crucial role in taxation and international trade. We explore here the significance of HSN codes, their role in E-waybill documentation, recent updates, real-world examples, proactive steps for businesses, case studies, key considerations, strategies, lessons learned, and the impact of a well-executed strategy in aligning HSN codes and product classification for seamless E-waybill compliance.

HSN Codes and Product Classification:

The Harmonized System of Nomenclature (HSN) codes, developed by the World Customs Organization, serve as a global classification system for goods. Its primary function is to classify goods for taxation in international trade and is integral to calculating Goods and Services Tax (GST). HSN codes and product classification are crucial in E-waybill documentation for several reasons.

Source: Deskera.com

Firstly, they determine the applicable GST rate, ensuring accurate tax calculation and preventing revenue leakage. Secondly, these codes provide a uniform classification system, facilitating easy understanding for businesses, transporters, and tax authorities. Thirdly, compliance with GST law mandates the inclusion of correct HSN codes in E-waybill documentation, failure of which may result in penalties.

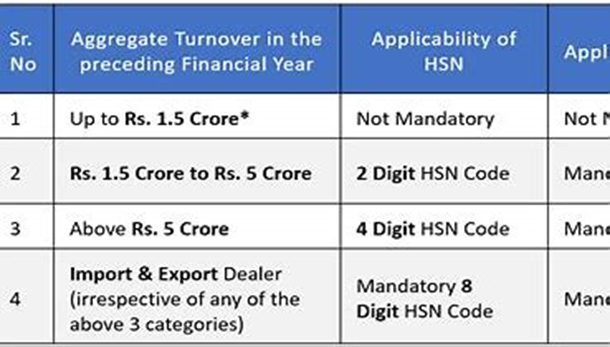

One must note effective from October 1, 2023, taxpayers with an annual turnover of Rs. 5 crore or more must use at least a 6-digit HSN code in their e-invoices and e-way bills, while those with a turnover less than Rs. 5 crore are required to use at least a 4-digit HSN code.

This change not only reflects regulatory updates but also emphasizes the ongoing evolution of the international trade landscape. Beyond the legal requirements, businesses should view HSN codes as a tool for optimization. An in-depth understanding, coupled with regular checks on the GST portal, ensures that businesses decode alphanumeric sequences accurately, preventing errors in documentation.

Also Read: How Are HSN Codes Used?

Proactive Steps

Global trade dynamics and the prevention of fraudulent activities are intricately linked to the effective implementation of HSN codes. One notable aspect is the prevention of undervaluation of goods in international trade, a critical factor in deterring fraudulent practices, as documented by reputable organizations like the World Bank.

To ensure the accuracy of HSN codes and product details in E-waybill documentation, businesses can adopt a proactive stance through the following measures:

- Understanding HSN Codes: A foundational step involves gaining a comprehensive understanding of HSN codes relevant to the specific industry and goods being traded. This knowledge forms the basis for accurate classification.

- Checking on the GST Portal: Regularly checking and verifying HSN codes on the Goods and Services Tax (GST) portal is imperative. This also ensures that the codes align with the latest updates and adhere to the regulatory framework.

- Decoding Alphanumeric Sequences: HSN codes often comprise alphanumeric sequences that require careful decoding. Businesses should invest time and resources in accurately interpreting these codes to prevent errors in documentation.

Source: zetran.com

- Staying Updated with Regulations: Given the dynamic nature of trade regulations, businesses must stay abreast of changes in HSN code requirements. Also, timely updates ensure compliance and prevent any discrepancies in E-waybill documentation.

- Seeking Expert Assistance: Recognizing the complexity of HSN codes, seeking expert assistance when in doubt is a prudent approach. Engaging professionals well-versed in the intricacies of product classification also adds an extra layer of assurance. CaptainBiz, a professionally run online portal can be considered for businesses to make use of when it comes to GST.

Also Read: Benefits Of E-Way Bill Registration

Lessons Learnt from Successful Businesses

There are many valuable lessons one can learn from successful businesses when it comes to managing HSN codes and product obligations for E-waybill processes. These lessons extend beyond technicalities and highlight the broader also implications:

- Accurate Classification for Global Trade: Successful businesses emphasize the pivotal role of accurate product classification in fostering seamless global trade. Precise HSN codes also contribute to the reliability and efficiency of cross-border transactions.

- Significance of Fraud Prevention: Robust product classification acts as a deterrent, safeguarding businesses from potential fraudulent practices.

- Compliance with India’s Harmonized System Code: Complying with India’s Harmonized System Code is non-negotiable. Every business must commit to meeting regulatory standards, ensuring the E-waybill processes are maintained correctly.

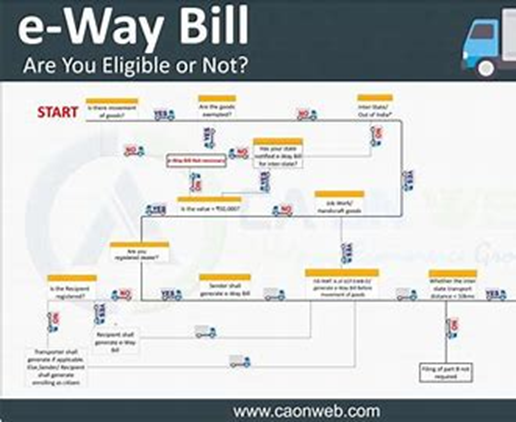

Source: caonweb.com

Moreover, beyond their role in regulatory mechanisms, HSN codes become instrumental strategic tools, as they are meant to guide businesses across the dynamic landscape of international trade. Furthermore, as businesses embrace the imperative of understanding, optimizing, and strategically leveraging HSN codes, they pave the way for seamless global trade, fraud prevention, unwavering compliance, and heightened operational efficiency.

Also Read: E-Waybill For Job Work: Understanding The Special Considerations

Also Listen: Labour Charges HSN Code With GST Rate: Explained

Frequently Asked Questions

1.What is the significance of HSN codes in the context of E-waybill compliance?

HSN codes, or Harmonized System of Nomenclature codes, also play a crucial role in E-waybill compliance by providing a standardized global classification system for goods. They are pivotal for accurate taxation and also facilitate the seamless movement of goods.

2. How do HSN codes impact international trade and prevent fraud?

HSN codes prevent the undervaluation of goods in international trade, acting as a deterrent against fraudulent activities. Additionally, this ensures fair trade practices and aligns with global standards, as documented by organizations like the World Bank.

3. What is the role of HSN codes in determining the applicable GST rate?

HSN codes are integral in determining the Goods and Services Tax (GST) rate applicable to goods. They also ensure accurate tax calculation, preventing revenue leakage and contributing to transparent taxation.

4. Are there recent updates regarding the usage of HSN codes in E-waybills?

Yes, effective from October 1, 2023, businesses with an annual turnover of Rs. 5 crore or more are required to use at least a 6-digit HSN code in their e-invoices and e-waybills, while those with turnover less than Rs. five crore need to use at least a 4-digit HSN code.

5. What proactive steps can businesses take to ensure accurate HSN codes in E-waybill documentation?

Businesses can take several proactive steps, including understanding HSN codes, regularly checking them on the GST portal, decoding alphanumeric sequences accurately, staying updated with regulations, and seeking expert assistance when needed.

6. How do HSN codes contribute to preventing errors in E-waybill documentation?

HSN codes contribute to preventing errors by providing a standardized classification system. Moreover, accurate coding ensures that goods are appropriately categorized, preventing discrepancies and errors in E-waybill documentation.

7. What are the key considerations for optimizing processes related to HSN codes and product information?

Key considerations for optimization include understanding, checking, decoding alphanumeric sequences, staying updated with regulations, and seeking expert assistance. These measures also ensure adherence to compliance requirements and prevent errors in E-waybill documentation.

8. Can businesses strategize for success in managing HSN codes for E-waybill compliance?

Yes, a comprehensive approach involves understanding the nuances of HSN codes, regularly checking and decoding them, staying updated with regulations, and seeking expert assistance. Successful strategies also contribute to accurate E-waybill documentation and regulatory compliance.

9. How do successful businesses manage HSN codes and product obligations for E-waybill processes?

Successful businesses highlight the importance of accurate classification for global trade, fraud prevention, and compliance with India’s Harmonized System Code. They emphasize understanding entity-specific issues and streamlining systems accordingly.

10. What is the impact of a well-executed strategy for aligning HSN codes with E-waybill compliance?

A well-executed strategy has significant impacts, including facilitating global trade, preventing fraud, ensuring compliance, and enhancing operational efficiency. Aligning HSN codes strategically is crucial for the seamless functioning of E-waybill processes and contributes to the overall success of businesses in international trade compliance.