In today’s hectic world, it is important that any business, supplier, and individual for that matter, manages their bills efficiently. This is perhaps one of the most vital methods for remaining organised. It is possible with the Internet bill receipt generator, as it can streamline the bill payment process.

Gone are the days, when one had to manage several paper bills & receipts. It can be tedious, inefficient, and strenuous to keep track of so many bills & receipts. Besides, when the supplier or the business requires a particular bill or receipt urgently, then it may take an eternity to find the paperwork.

Thanks to the Internet bill receipt, creating detailed receipts for different bills has become an easy task. There is no need to sit for hours pondering on the various details of the customers & the users. Moreover, all this can be done at the click of a button.

It helps save time and also tracks the expenses effectively. The manual documentation of each payment is a strenuous method of managing bills. The generator is perfect for those who are extremely busy or somebody who wants to simplify their finances.

The Internet bill receipt generator is a go-to solution. Now, users can embrace the convenience of this software & control their bill management.

Understanding What Are Internet Bills

Internet bills are the receipts or the invoices that have been designed and generated by the Internet service providers (ISPs). These service providers provide the users with the Internet services for the customers.

These receipts are designed for billing purposes for the customers who have made the Internet services. These bills contain the details of the monthly Internet access along with the additional services.

Besides, the bill also contains the details about the payment deadline. The Internet bills are generated on a monthly basis. The frequency of billing can vary depending on the Internet service provider and the plan selected by the user.

There are several key components that are consistent in the Internet bill receipts. They not only offer the users with a piece of detailed information but are required for the supplier as well. Below are some of the features offered in the Internet bill receipt.

Details about the account holder: The details about the account holder are provided in this segment. Some of them include the customer’s account number, billing address, and the email address.

Service details: This contains the kind of the Internet service plan that was used by the user for the particular month. This may be the broadband, wireless, and fibre-optics. The plan is specific to the package details.

Billing period: The billing period refers to the specific dates on which the services are being charged. This is typically done on a monthly basis.

Usage charges: The charges of the usage are provided or listed on the invoice. Sometimes, there can be the data usage charges (if applicable). Besides, the additional services can be included.

Amount due: The invoice contains the amount that is due by the customer or the user. These include the fees, charges, and taxes suggesting the total amount for payment.

Dates payment due: The deadline for payment is also provided so that the users know when to do it, to avoid late fees or disconnected service.

Payment options: The payment option is also provided on the receipt. Most of them include bank transfers, online portals, checks, or credit/debit cards.

Customer support details: When the user or the customer has doubts or queries, then they can contact the customer support through the details that are provided in the receipt.

The Internet bills are crucial documents for ensuring that accurate billing is done. Moreover, it is a form of transparent communication between the Internet service provider and the customers.

It also ensures that there is a clear understanding of service usage and associated charges. The Internet invoices are a crucial part of the Internet service providers (ISPs). In conclusion, the Internet invoices are important for ensuring that there is a transparent billing done, maintaining the payment records, and an effective mode of communication between the ISPs and customers about the Internet services.

What is the Internet bill receipt format?

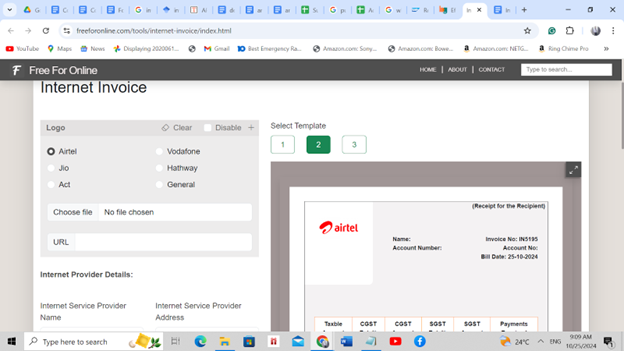

Below are a few screenshots of what an Internet bill receipt format looks like.

Source: https://freeforonline.com/tools/internet-invoice/index.html

In the above image, the different Internet service providers are mentioned. The user has to choose the ISP, and then proceed.

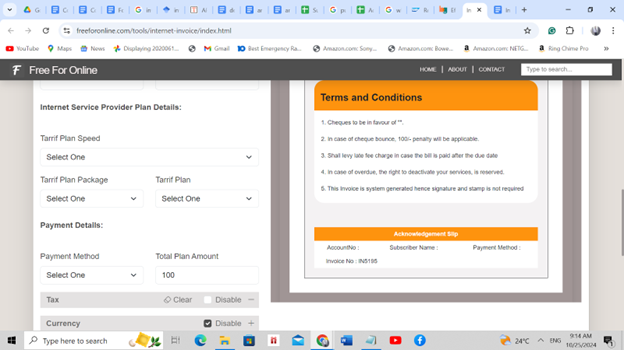

Source: https://freeforonline.com/tools/internet-invoice/index.html

In the above image, the details about the ISP plan and the billing information have to be entered by the supplier. The amounts can be visible once the data is entered.

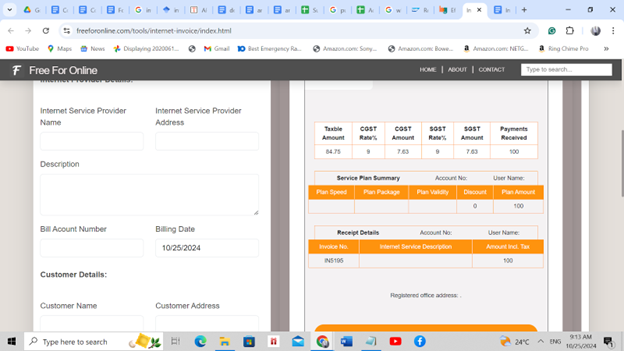

Source: https://freeforonline.com/tools/internet-invoice/index.html

Benefits of using the Internet bill receipt generator

In the above image, the terms & conditions of the internet bill receipt are visible. From the above, it is quite obvious that utilising technology in the right manner for streamlining the operations is needed to ensure that the business is successful.

Among them, the Internet bill receipt generator has revolutionised the billing process. Below are some of the benefits of using the Internet bill receipt.

Convenience: Using the internet bill receipt generator provides exceptional convenience for the users. The supplier can instantly generate the invoice for the users. There is no requirement for making use of manual paperwork, and moreover, it decreases the chances of making mistakes.

Environmental impact: There is also the environmental impact that the bill receipt generator offers the users, where the suppliers can reduce the damage to the environment. This is caused due to the use of paperwork that requires the cutting down of many trees. With the help of the Internet bill receipt generator, green initiatives can be taken.

Customisation options: There is a wide range of customisation options provided for the users who want to opt for the bill receipt generators. Now, they can have or create their own brand image through the generators. This can be done on the invoice layouts, and the suppliers can design their invoices to reflect their brand identity.

Speed and accuracy: The receipt generator comes infused with fields that are already pre-filled and automated calculations. The bill can be generated within a couple of seconds or under a minute, not more. It saves time for the users and ensures that the calculations are spot-on. When these are done manually, then the chances of making errors are high.

Access to multiple templates: The suppliers can choose from a wide range of bill receipt templates provided by the Internet receipt generators. It allows the business to come up with its own design that blends with its policies & beliefs.

Integration with vendors and payment options: The receipt generators allow for a sublime integration capability with several platforms for suppliers & users alike. Besides, the users can make the payments using the generator. It not only streamlines the billing process but also enhances the payment collection which offers a sturdier vendor relationship.

Enhanced customer support and data security: The receipt generator offers the suppliers & the users with a reliable customer support and stringent data security measures. These can be termed as one of the most prominent features of the Internet bill receipt generator. The suppliers ensure that their customer’s data is protected & safe with them.

Now, businesses can significantly improve their efficiency of operations, save on their time, and enhance their customer experience. Features like instant invoice delivery, customisable templates, and a robust customer support streamline the entire billing process.

Besides, it helps the business to have a professional image, by making sure that there is compliance with taxation regulations. The Internet bill receipt generator is a dependable and an efficient solution for any business that wants to smoothen their billing process. Besides, it also helps them to concentrate on their primary business activities.

FAQs

What can be seen on the internet bill?

The internet bill shows the device being used to access the internet. It also shows the data used by the user in the prior month. However, the websites visited will not be shown as they are merely bills.

What do internet bills include?

The internet bills come with a summary of the present and past balances and payments. Besides, they provide an invoice breakdown of the total charges for the current billing period. However, outstanding payments can also be provided on the internet bill.

What is an internet electronic bill?

The Internet electronic bill is also known as an e-bill. This digital invoice is usually produced by the supplier for the users. This can be done with the help of using an accounting software solution or manually too.

However, in today’s technology-filled world, the use of software is more convenient & easier for generating the internet electronic bill. The e-bill can be sent to the user with the help of the web-based portal that is present in the software system.

What are the main details of the internet bill?

Any internet service provider ensures that they provide the basic details of the account and service plan. It includes the monthly charge, subscription package, the data usage total, and also the additional fees.

How to fill out the internet bill receipt?

Filling out the internet bill receipt is quite simple. All the details have been provided on the form or the template. The user needs to just enter the data or information that is required there. First, there can be the name of the user or the date of the payment.

Then the address of the user has to be entered, and the amount of the payment as well. Then the payment method (credit card, debit card, etc.), and the name of the internet service provider. Finally, the account or reference number for the payment can be entered. A printout may be taken for future reference.

What is the purpose of the internet receipt bill?

The purpose of an internet receipt bill is to ensure that there is proof of payment for online transactions. This can be used as proof like a document for the purchase of goods or services. Moreover, the supplier can keep track of the customer’s purchases.

Besides, it offers the supplier with the reference number of the customer so that they can contact them if required.

What determines the internet bill?

The kind of service package that the user has used from the Internet service provider will have a say on the monthly amount. It is usually billed at the end of the month. However, some users prefer to opt for the annual payment method, which is also fine.

Then there are two kinds of plans, one is the pre-paid plan & the other is the post-paid plan. The pre-paid is kind of cheaper than the post-paid plan. However, the post-paid plan comes with many benefits that are incredibly useful for users with higher needs.

What is the Internet billing?

Internet billing is a process of producing invoices to users through a digital platform. This is done with the help of emails & online platforms. It offers the vendors with an efficient transaction system and independent freelancers.

What is an Internet invoice?

The electronic invoicing is a bill that can be offered to the users in an electronic format. This form of exchange between the supplier & the buyer streamlines the entire process and automates everything.

How are payments made through the Internet receipt?

The payments are made through the online transactions with the help of the Internet receipt. They do not require the physical transfer of cash, or cheques & demand drafts. Everything is done with the help of the UPI that is available in India.

Also, Read – Who is Required to Generate an E-way Bill?

Conclusion

The benefits of the Internet bill receipt extend beyond avoiding any disputes regarding the payments & tracking the budgets. The internet bill receipts enable the users to keep track of their payments, streamline the billing process, and enhance the security as well.

This enables both the parties, the suppliers & the users to manage their internet bills efficiently. That is why, it is vital that the users invest their time in using a simple internet bill receipt generator software to empower themselves to make more informed financial decisions.