Introduction

GST registration requirements apply for businesses based on the annual turnover. In India, businesses with a turnover of over Rs. 40 lakhs must register and get their GST registration number. In some particular category states, this threshold limit is Rs. 20 lakhs. Dealers with an annual turnover of over Rs. 20 lakh must also register for GST. All e-commerce companies and operators must also complete GST registrations.

The GST Council recently increased the minimum threshold necessary for GST registration. This is done to reduce the compliance burden of small business owners. Moreover, MSMEs with a lower annual turnover can continue their operations without worrying about GST implications. Additionally, they do not need to pay GST, and these cost savings can be transferred to the customer. The GST registration can be completed online.

In this blog, we will also give you step-by-step guidance on how to get your GSTIN number.

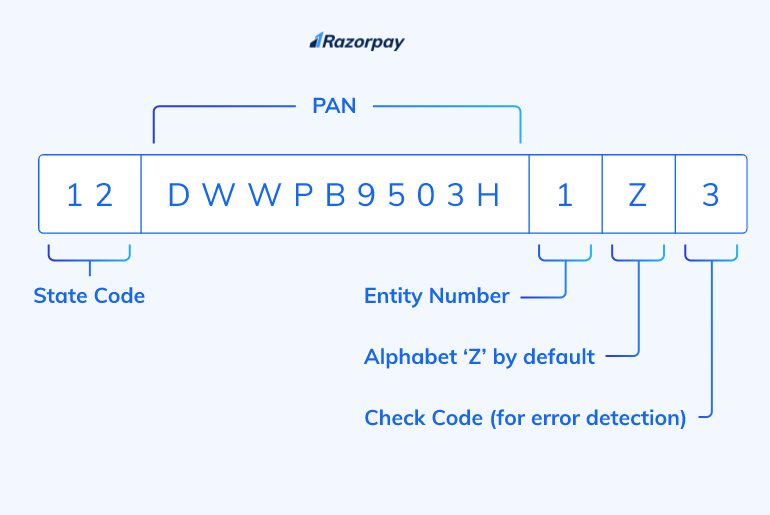

What is GSTIN?

GSTIN is a unique GST registration number given for each business. Every business that meets the GST requirements can operate only with the GSTIN. The GST invoices must contain this number, and also companies must comply with this requirement.

You must register and get GST when your business meets the annual turnover threshold of Rs. 40 lakh. You are liable to pay GST tax when you supply taxable goods and services. Once you obtain GSTIN, you must start paying GST tax and ensure GST compliance throughout the business operations.

Documents Needed for GST Registration

Individuals and businesses that must register for GST are required to submit the following documents:

- Business PAN card

- Individual PAN card

- Aadhaar card

- Proof of business registration

- Bank account details of business

- Bank account details of individual

- Proof of business address

- Digital signature

- Digital photograph

Additional documents may be necessary based on the type of business. Export businesses may need to provide further information as they deal with international currencies. Moreover, The GST council determines the documents required to complete the GST registration for the companies. Generally, you can get your GSTIN within 2-6 days of applying for GST. Once your GSTIN is approved, you will get a notification through email or SMS on your mobile number.

GST Registration Types

GST registration is available in multiple types based on the type of taxpayer. Registering under the correct type is also crucial as it determines the GST rates and tax liabilities. Moreover, the different types of GST registration are:

- Regular taxpayer – Common for most businesses that supply goods or services. There is no registration fee applicable.

- Casual taxable person – People who set up seasonal shops and sell GST-applicable goods and services. Under this type of GST registration, you must pay an advance equal to the expected GST liability. This GST registration is valid for 3 months, after which you can renew or extend the registration.

- Composition taxpayer – Applicable for businesses under the composition scheme. A lower GST rate is charged, but you must pay a flat deposit during registration. Under the composition scheme, you cannot claim the input tax credit.

- Non-resident taxable person – Applicable for businesses or people outside India, supplying to individuals in India. At registration, you must pay an advance equal to the expected GST liability. The registration is valid for 3 months, after which it can be extended or renewed.

Also Read: The Benefits Of Each Type Of GST Registration

Online GST Registration Process Steps

The GST registration is streamlined through the GST portal. The following steps must be completed for registration:

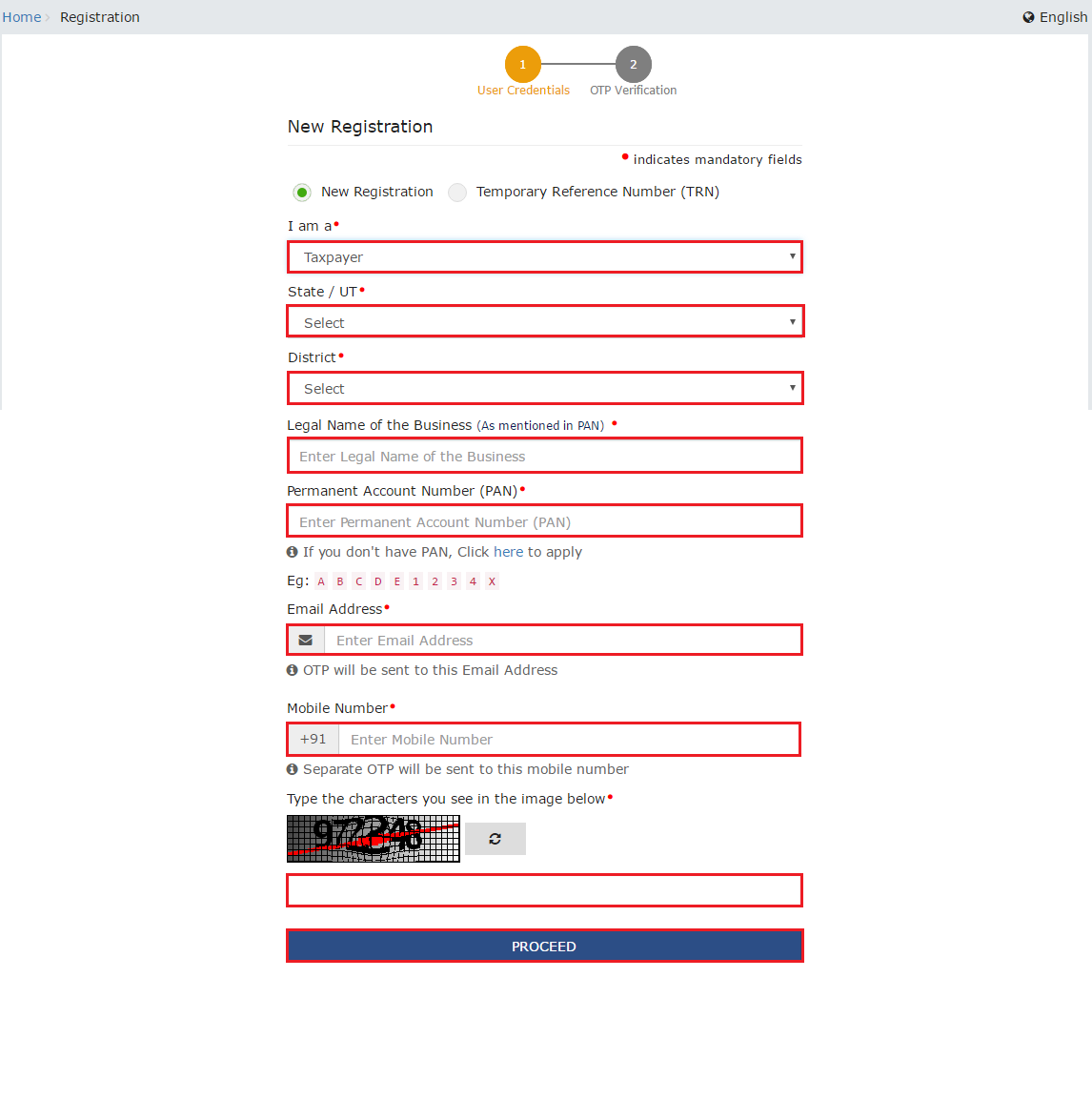

Step 1: Go to the GST portal at https://www.gst.gov.in/

Step 2: Click on Register Now under the Services tab

Step 3: Choose New Registration

Step 4: Select GST Registration Type under the dropdown menu. The standard choice is the Taxpayer.

Step 5: Select the state and district

Step 6: Enter the business name

Step 7: Enter business PAN details

Step 8: Enter your email ID and mobile number. You will receive OTPs on this mobile number.

Step 9: Enter captcha details and click Proceed

Step 10: Enter the OTP sent to your mobile number and email ID to verify both details; click on Proceed and note the Temporary Reference Number (TRN) shown on the screen.

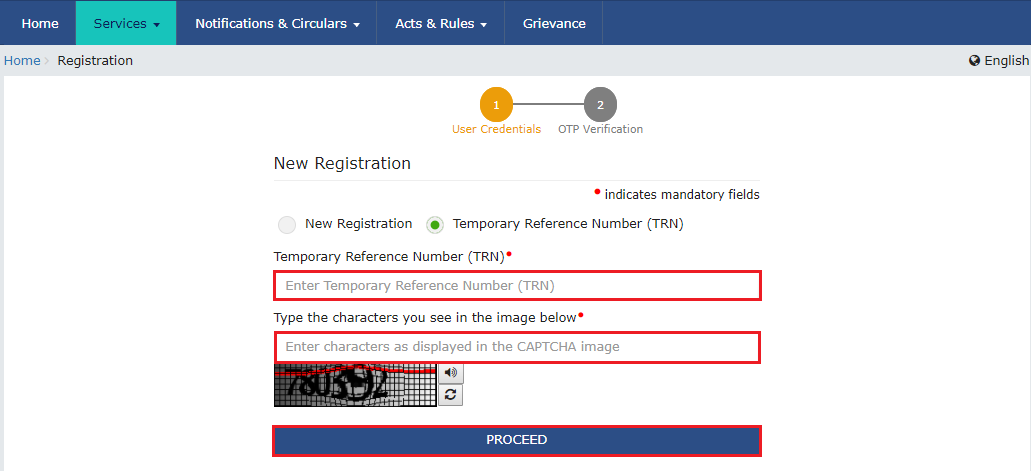

Go Back to the GST Portal:

Step 11: Go back to the GST Portal

Step 12: Click on Register under the Services menu

Step 13: Select Temporary Reference Number (TRN)

Source – https://tutorial.gst.gov.in/userguide/registration/assets/images/A_14.png

Step 14: Enter the TRN number

Step 15: Fill captcha details and click on Proceed

Step 16: Again, enter the OTP received on your mobile number and email ID

Step 17: Click on Proceed

Step 18: You can see the application on the next page. Click on the Edit icon.

Step 19: Fill in all the details and upload the required documents.

Step 20: Click on Submit

Step 21: Go to the Verification page and check the declaration. You can submit the application in different ways. Under EVC, enter the code sent to the mobile number. You can also use a Digital Signature Certificate (DSC). Use the e-sign method and enter the OTP sent to the mobile number with the Aadhaar card.

Step 22: Note the Application Reference Number (ARN), which will also be sent to your mobile number.

You can check the status of your application on the GST portal using your ARN. Once your application is approved, you can get your GST registration number and certificate.

To download your GST registration certificate after approval, follow the below steps:

Step 1: Go to the GST portal https://www.gst.gov.in/

Step 2: Click on Login

Step 3: Enter the username and password and click on Login

Step 4: Click on Services -> User Services

Step 5: Select View/ Download Certificates to view or download your GST registration certificate.

Also Read: How To Do GST Registration Online

Understanding GST Registration

As per GST regulations, you must register with each state if you supply goods and services to different states. Even if you have registered in one state, your GSTIN will be considered unregistered in another state. Your GSTIN is unique to the state. You only have to register once for GST, and you can charge IGST, CGST, SGST, or UTGST based on the GST charges on the goods or services you supply.

Conclusion

If your business meets the GST registration threshold, you must register and get your GSTIN. It is legally required to register for GST if you supply taxable goods or services and your annual turnover exceeds the threshold. Once you get your GSTIN, you must mention it in all the invoices. Moreover, you must always generate GST-compliant invoices, bills, and notes as per the business requirement. E-invoicing is also applicable when your business meets the criteria of annual turnover. Once you get your GSTIN, you can submit your GST forms using your GSTIN and claim the input tax credit.

CaptainBiz is an automated GST billing software that ensures GST compliance for all business transactions. You only need to mention your GSTIN once, and the software will automatically generate GST tax invoices and e-invoices for your transactions. For more details on ensuring GST compliance, visit CaptainBiz.

FAQs

1. Can I use the same GSTIN in different states?

You must register in every state to which you supply goods and services. The GSTIN will be different with each registration. Your GSTIN is a unique 15-digit number that is specific to the state. You cannot register with one state and supply to another state. This can also result in GST penalties and charges.

2. Can I run my business without GST registration?

You need not apply for GST registration if your business’s annual turnover is less than Rs. 40 lakh. Without GSTIN, you cannot charge GST to your customers. Also, you cannot claim input tax credit. Moreover, this minimal threshold requirement allows small-scale businesses to thrive without worrying about GST compliance complexities.

3. What happens if I fail to register for GST after meeting the threshold requirement?

To conduct business legally in India, you must complete GST registration and get your GSTIN. All registered taxpayers can collect GST and pay the same to the government. They can claim input tax credits for their purchases and offset GST liabilities. Moreover, failing to register after meeting the threshold requirement will be considered tax evasion and fraud. Additionally, depending on the severity of the case, you may be charged 100% of pending tax as a penalty, or you may even face jail time.

4. Can I register for GST offline?

The online process for GST registration is simple and can be done from anywhere. However, you can also submit your GST application form offline in any one of the GST service centers in your city. You also must submit all the required documents at the time of application.

5. Do I have to pay any fees for GST registration?

No, GST registration is free for taxpayers. Moreover, if you register under a different category, like the Composition Scheme, you may have to pay the advance amount as required. The registration process will also vary if you want to register as a different type of business.

6. How long does it take to get my GSTIN after application?

If you use the online application process, getting your GSTIN is quick and straightforward. Also, After providing all the necessary documentation, you may have to wait 3-5 working days to get your GSTIN. Once your application is approved, you can download your GST registration certificate. Moreover, it must be displayed at the principal office location.

7. How long is my GSTIN valid?

Once you register as a taxpayer, your GSTIN is valid for life. If you stop doing your business, you can cancel your GSTIN anytime. Your GSTIN will be cancelled only if there is no tax due. If there is any unpaid tax, your GSTIN will be canceled only after you pay the tax due. Otherwise, interest will be incurred on the tax-due amount.

8. Can I change the GSTIN details?

Yes, if you need to change the GSTIN details, you can also log in to the GST portal using your login credentials. Additionally, you can edit the necessary information. Based on the type of details you wish to edit, you may also have to submit additional document proof.

9. Can I get different GSTINs for different businesses in the same state?

Yes, if the businesses have different principal locations, you can obtain different GSTINs for various business verticals. In that case, you must be careful with invoice generation because you must supply the correct GSTIN number.

10. Is there a time duration within which I have to apply for GST?

If your business meets the criteria for GST registration, you must apply for GSTIN immediately within 30 days of meeting the threshold value. Once your annual turnover exceeds Rs. 40 lakh (or other value as per latest GST regulations), you must apply for GSTIN. You can also start collecting GST after you get your GSTIN. Usually, payment aggregators deduct their fees when settling them in merchant accounts. Moreover, Under GST, authorities could consider these fees as an advance collection, requiring GST payment at the time of deduction. An automated GST billing software will also help calculate accurate GST liabilities.