Filing the QRMP CMP-08 Part 3 return is a systematic process that can be efficiently completed by following these steps. This guide will take you through the QRMP CMP-08 Part 3 filing procedure, ensuring compliance and accuracy in your tax submissions.

QRMP CMP-08 Part 3 Filing Guide

A. Login and Navigate to Form GST CMP-08 Page

QRMP CMP-08 Part 3 Filing Procedure

The initial step in the filing process involves logging into the GST portal (www.gst.gov.in) and navigating to the ‘Returns Dashboard’. Here, you’ll select the relevant financial year and quarter for filing. It’s imperative to carefully enter all necessary details, especially in Table 3 which covers tax liabilities. If your situation warrants a NIL return, ensure to select the corresponding option.

- Visit the GST portal at www.gst.gov.in.

- Log in with your valid credentials.

- Go to Services > Returns > Returns Dashboard. Alternatively, use the Returns Dashboard link on your dashboard.

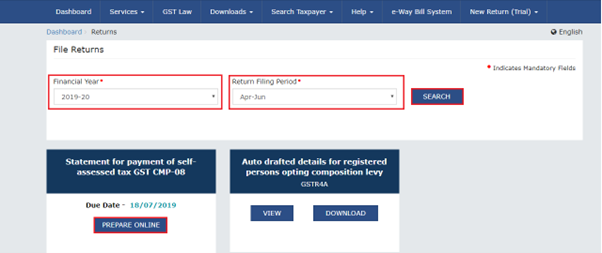

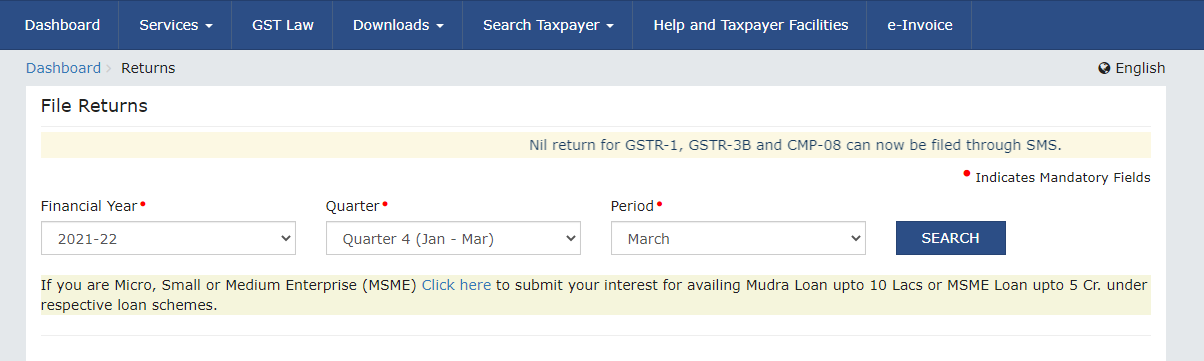

- On the File Returns page, select the appropriate Financial Year and Return Filing Period (Quarter) from the dropdown list, then click SEARCH.

- In the GST CMP-08 tile, click PREPARE ONLINE.

B. File NIL Form GST CMP-08, If Required

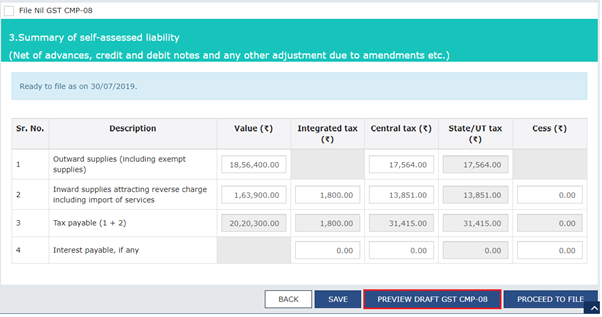

- If you need to file a Nil GST CMP-08, select the checkbox for this option.

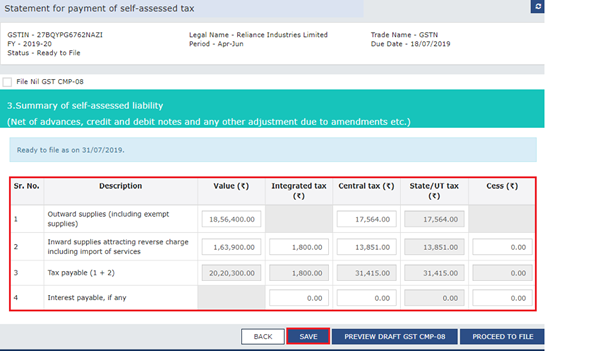

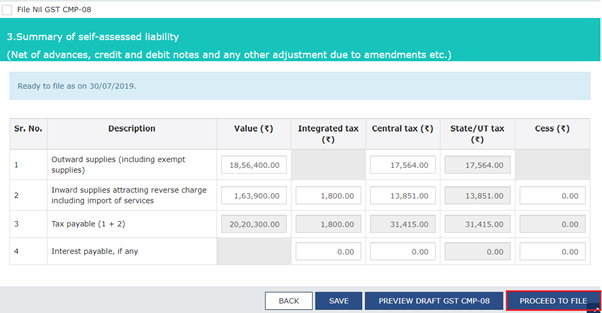

C. Enter Details in Table 3

- Fill in the details in Table 3 and save your entries.

D. Preview GST CMP-08

QRMP CMP-08 Part 3 Submission Process

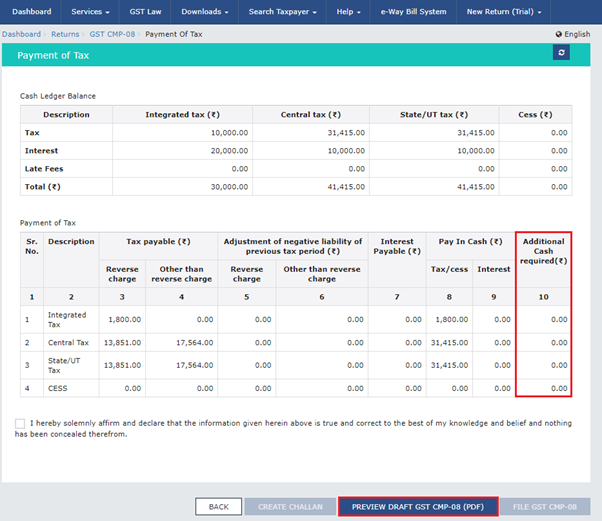

After completing the entry of details in Table 3, the next vital step is to preview the form. This is where you verify all the information you’ve entered for accuracy. If additional tax payment is required, this stage will involve creating a challan and completing the payment process. It’s a crucial step to ensure that all tax liabilities are accurately reported.

- Preview the draft GST CMP-08 by downloading the PDF file to review your entries.

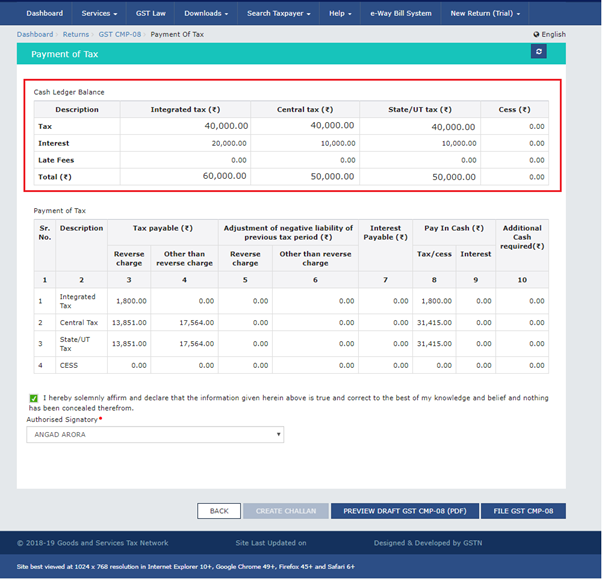

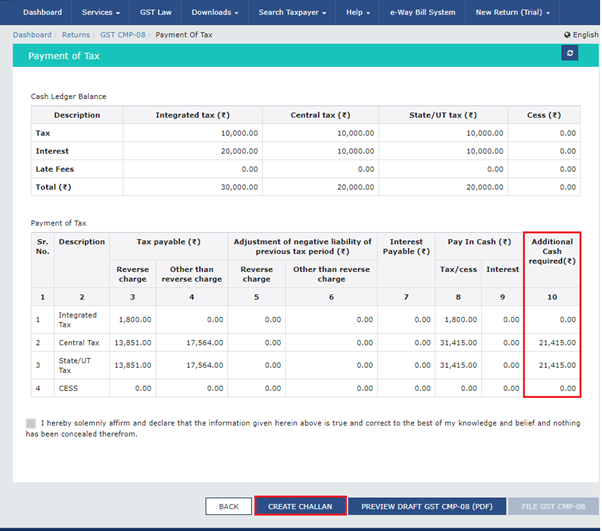

E. Proceed to File and Payment of Tax

- Click PROCEED TO FILE to begin the filing process.

- Refresh the screen to view the Payment of Tax page, showing your cash balance in the “Cash Ledger Balance” table.

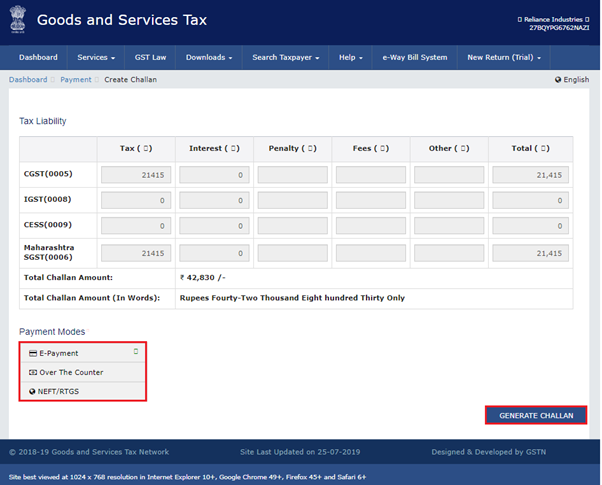

- Depending on your cash balance in the Electronic Cash Ledger, you may need to create a challan for additional cash by clicking on CREATE CHALLAN.

- Select your payment mode (E-Payment/ Over the Counter/ NEFT/RTGS) and generate the challan.

- Make the payment and update the Returns Dashboard with the new balance.

F. File Form GST CMP-08 with DSC/ EVC

Steps to File QRMP CMP-08 Part 3

Once you have previewed and confirmed the details, proceed to file the form. This involves selecting the appropriate method of submission – either DSC (Digital Signature Certificate) or EVC (Electronic Verification Code). Moreover, this step finalizes the process, and upon submitting it successfully, you will receive an ARN (Application Reference Number) as confirmation.

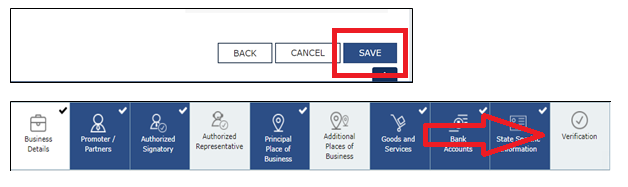

- Select the declaration checkbox and choose the Authorized Signatory.

- File the GST CMP-08 using DSC, EVC, or STAK.

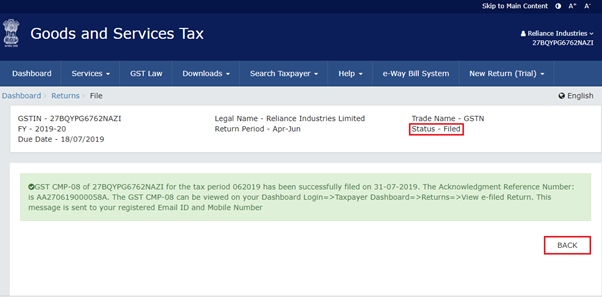

- On successful submission, an ARN is generated, indicating that the form has been filed.

Steps to File QRMP CMP-08 Part 3

E-filing QRMP CMP-08 Part 3 is designed to be user-friendly. Moreover, if there are any discrepancies in your electronic cash ledger or additional payments are required, the system will guide you through creating and paying the required challan. This ensures that all tax liabilities are cleared before the final submission.

- Review and Verification: Before filing, ensure all information is accurate.

- Payment of Tax: If additional cash is needed, create and pay the required challan.

- Submission: Choose your preferred method of submission (DSC, EVC, or STAK) and complete the filing process.

How to Submit QRMP CMP-08 Part 3 Returns

The final step in the process is the submission of the CMP-08 form. Post-filing, it’s also important to download and save a copy of the filed GST CMP-08 for your records. This acts as proof of submission and is useful for future reference, especially in cases of discrepancies or audits.

- Final Steps: After filing, download the filed GST CMP-08 for your records.

- Acknowledgement: You will receive an acknowledgment message, and the status of your CMP-08 will be updated to “Filed”.

This comprehensive QRMP CMP-08 Part 3 e-filing steps guide aims to simplify the process, making it straightforward for taxpayers to comply with the GST requirements. But remember, accurate and timely filing of the CMP-08 is essential to avoid penalties and maintain proper tax records.

Best Practices for Filing QRMP CMP-08 Part 3

To ensure a smooth and error-free filing of QRMP CMP-08 Part 3, adhering to certain best practices is also crucial. These guidelines not only streamline the filing process but also help in maintaining compliance with GST regulations.

1. Timely Preparation and Filing

- Early Start: Begin preparing your CMP-08 form well before the deadline. Procrastination often leads to errors or omissions.

- Adherence to Deadlines: Be aware of the filing deadlines for each quarter to avoid last-minute rushes and potential penalties.

2. Accurate and Detailed Record-Keeping

- Organized Documentation: Maintain a systematic record of all invoices and receipts related to outward and inward supplies. This makes the process of filling out Table 3 more straightforward and accurate.

- Reconciliation: Regularly reconcile your books with the GST returns to ensure all transactions are accurately reported.

3. Understanding Tax Liability

- Clarity on Tax Rates: Be clear about the applicable tax rates (CGST, SGST/UTGST, IGST) for your supplies.

- Calculation of Reverse Charge Mechanism: Understand the concept of reverse charge mechanism and how it applies to your inward supplies.

4. Utilizing the GST Portal Features

- Preview Function: Use the preview feature on the GST portal to review your form before submission thoroughly. This helps in identifying and rectifying any errors.

- GST Portal Updates: Stay updated with any new features or updates on the GST portal that might affect the filing process.

5. Seeking Professional Help When Needed

- Consultation with Experts: In case of complexities or uncertainties, don’t hesitate to consult with a GST expert or a tax consultant.

- Staying Informed: Stay updated with the latest GST notifications, circulars, and changes in tax laws.

6. Secure Filing

- Confidentiality: Ensure the security of your GST credentials and personal data while filing.

- Backup and Documentation: After filing, keep a backup of the filed return and acknowledgment for future reference.

By following these best practices, taxpayers can achieve a more efficient and compliant process in filing QRMP CMP-08 Part 3. This not only minimizes the risk of errors but also ensures peace of mind with regard to GST obligations.

Common Mistakes to Avoid in QRMP CMP-08 Filing

When filing QRMP CMP-08 Part 3, certain common mistakes can lead to complications in the process. Being aware of these pitfalls can also help ensure a smoother filing experience:

| Mistakes | Issue | Solution |

| Incorrect Data Entry | Entering wrong figures or misreporting data in the form. | Double-check all entries, especially in Table 3. |

| Misunderstanding Tax Rates | Applying incorrect tax rates for CGST, SGST/UTGST, and IGST. | Verify current tax rates applicable to your supplies. |

| Late Filing | Missing the filing deadline, leading to penalties. | Mark due dates in your calendar and start early. |

| Overlooking Reverse Charge Mechanism | Not accounting for inward supplies that attract reverse charge. | Review and include all such supplies in your calculation. |

| Neglecting Nil Returns | Assuming no filing is needed in case of no transactions. | File a Nil return if there are no taxable supplies. |

| Technical Errors on GST Portal | Encountering errors or glitches on the GST portal. | File during non-peak hours or contact the helpdesk. |

Impact of Incorrect Filing

Filing QRMP CMP-08 Part 3 accurately is crucial for businesses under the GST regime. Incorrect filing can also lead to a cascade of negative consequences that extend beyond mere financial penalties. Moreover, it can invite legal challenges, disrupt financial integrity, and tarnish the business’s reputation. This importance is also magnified by the potential loss of Input Tax Credit (ITC), a significant financial aspect for any GST-registered entity. Therefore, understanding the broader impact of incorrect filings is essential for maintaining compliance, ensuring financial accuracy, and upholding the credibility of the business.

| Impact | Issue | Solution |

| Financial Penalties | Late or incorrect filing results in penalties. | Adhere to filing deadlines and ensure accurate data entry. |

| Legal Repercussions | Consistent non-compliance or significant errors lead to legal actions. | Update knowledge of GST regulations and seek expert advice. |

| Impact on Business Reputation | Non-compliance affects business credibility. | Maintain a consistent record of timely and accurate filings. |

| Discrepancies in Financial Records | Inaccuracies in GST filings cause discrepancies in accounts. | Regularly reconcile GST filings with internal records. |

| Loss of Input Tax Credit (ITC) | Errors in filing can lead to the loss or delay in availing ITC. | Ensure accurate and timely filing to claim ITC benefits. |

Common Mistakes to Avoid When Filing QRMP

In Conclusion

The process of filing QRMP CMP-08 Part 3 is an important aspect of GST compliance for composite taxpayers. Moreover, through this guide, we aimed to demystify the procedure, highlighting each step from initial login to final submission and emphasizing common mistakes to avoid. Understanding the process is not just about adhering to regulatory requirements but also about safeguarding your business against possible financial and legal repercussions.

Also Listen: CaptainBiz Ke Sath Apne Reports Ko Generate Karein

Frequently Asked Questions (FAQs)

-

What is the QRMP CMP-08 Part 3 filing procedure?

The QRMP CMP-08 Part 3 filing procedure involves logging into the GST portal, selecting the correct financial year and quarter under the ‘Returns Dashboard,’ entering relevant details in Table 3, previewing the form for accuracy, making any necessary tax payments, and finally submitting the form using DSC or EVC.

-

Can you explain the QRMP CMP-08 Part 3 submission process?

The submission process for QRMP CMP-08 Part 3 includes several key steps: accessing the GST portal, filling in the required details, especially tax liabilities in Table 3, previewing the form for correctness, completing tax payments if due, and then submitting the form electronically with appropriate authentication.

-

What are the steps to file QRMP CMP-08 Part 3?

To file QRMP CMP-08 Part 3, start by logging into the GST portal, navigate to ‘Returns Dashboard,’ select the relevant quarter, fill in details in Table 3, review the information, make any tax payments, and also submit the form using DSC or EVC.

-

Is it necessary to pay tax before submitting QRMP CMP-08 Part 3?

Yes, paying the calculated tax is essential before submitting QRMP CMP-08 Part 3. Moreover, the form essentially serves as a statement for the payment of self-assessed tax. Ensure that your tax payment is completed, either through the electronic cash ledger or by creating a challan for any additional amount required, before finalizing the submission of the form.

-

What are the QRMP CMP-08 Part 3 e-filing steps?

The e-filing steps for QRMP CMP-08 Part 3 encompass logging into the GST portal, accurately completing Table 3, previewing the form, ensuring tax payment completion, and also electronically submitting the form with authentication through DSC or EVC.

-

How do I submit QRMP CMP-08 Part 3 returns?

To submit QRMP CMP-08 Part 3 returns, log in to the GST portal, fill out the CMP-08 form with accurate details, ensure all tax liabilities are addressed, preview the form for accuracy, and then submit it electronically with either DSC or EVC as authentication.

-

Is there a specific deadline for QRMP CMP-08 Part 3 filing?

Yes, the deadline for QRMP CMP-08 Part 3 filing is typically the 18th day of the month following the quarter’s end. It’s also crucial to file by this date to avoid penalties.

-

What happens if I make a mistake in QRMP CMP-08 Part 3 filing?

If you make a mistake in QRMP CMP-08 Part 3 filing, it can also lead to incorrect tax liabilities, resulting in penalties or legal issues. Moreover, It’s important to review and correct errors promptly by refiling if necessary.

-

Can I file QRMP CMP-08 Part 3 if I have no taxable transactions?

Yes, even if you have no taxable transactions, you should file a Nil return in QRMP CMP-08 Part 3. Filing a Nil return is also mandatory for maintaining compliance.

-

What should I check before submitting QRMP CMP-08 Part 3?

Before submitting QRMP CMP-08 Part 3, ensure all financial data is accurate, tax calculations are correct, and the form is thoroughly reviewed. Also, Double-check the details against your financial records to avoid discrepancies.