Whether you’re a startup or a well-established online store, issuing a GST invoice for your online business is not just a legal requirement but also an essential part of building trust with your customers. By the end of this blog, you’ll have all the information you need to correctly and efficiently create a GST invoice.

To guide you through the process, we’ll outline the essential components of a GST invoice, discuss important timelines, and suggest useful tools you can use. You’ll learn not only the basics but also advanced tips for issuing GST invoices. If you’re an e-commerce business or an online retailer, this guide aims to simplify the process and help you avoid common mistakes, ensuring you’re always in line with legal requirements.

Why You Need a GST Invoice for Your Online Business

Creating a GST invoice for an online business is a fundamental aspect of any e-commerce operation. This document serves a dual purpose. Firstly, it’s a legal necessity to comply with the Goods and Services Tax (GST) laws in place. Secondly, a well-crafted invoice can serve as a valuable point of contact between you and your customer, helping to build trust.

Besides meeting legal requirements, having a proper GST invoice format for online business adds an extra layer of professionalism to your operations. It shows that your business pays attention to detail and is committed to transparency. This can go a long way in enhancing customer satisfaction and encouraging repeat purchases. So, a GST invoice is more than just a billing formality; it’s a strategic tool for customer retention and for establishing your brand’s reputation.

When Should You Create a GST Invoice?

Understanding when to generate a GST invoice is crucial for maintaining compliance with tax laws. If you’re running an online business that is registered under the GST regime, you’re required to issue an invoice for every sale or service provided. This is how to generate a GST invoice for an online business effectively while keeping in sync with legal requirements.

Furthermore, not just for legal reasons but also for practical business operations, the timing of issuing your GST invoice matters. For instance, issuing the invoice right after the transaction can speed up the payment process. This is particularly important for online retailers and e-commerce businesses that often deal with high volumes of sales in short periods. Prompt invoicing means quicker payments, improved cash flow, and ultimately, a more efficient business.

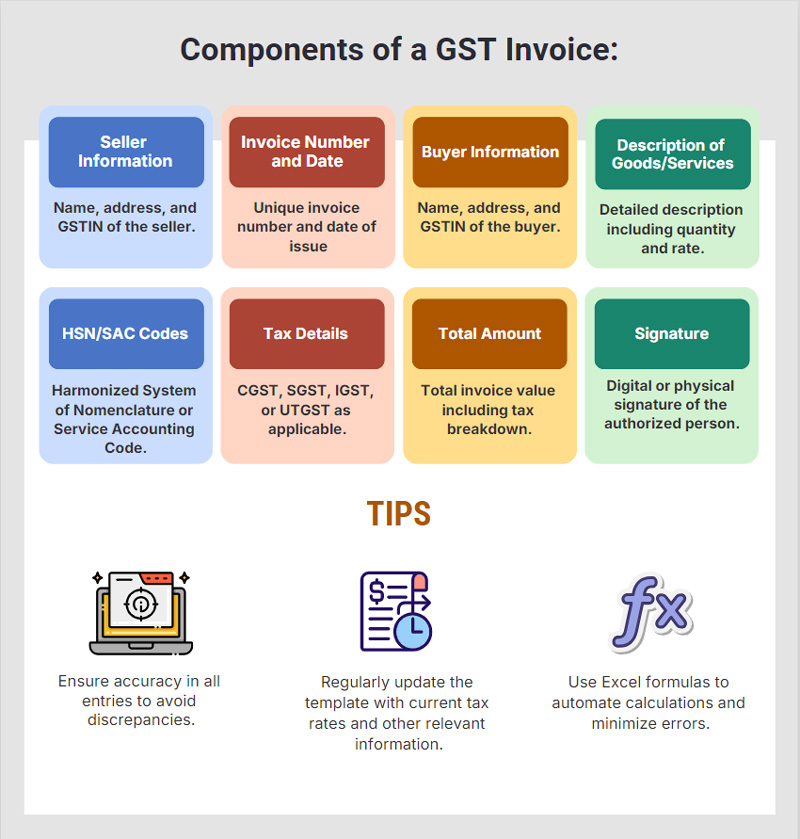

What Should Be Included in Your GST Invoice?

Making sure your invoice includes all the essential components ensures you’re not just checking a box but also setting the stage for smooth business transactions. Here’s a rundown of the mandatory fields you need to have in a GST invoice, as per the GST Act:

- Date and Invoice number: For record-keeping and to avoid confusion in future transactions.

- Customer’s name and address: For clarity on who the purchaser is.

- Billing and Shipping address of the customer: Important for tax calculations and delivery.

- Your business’s GSTIN and the customer’s GSTIN (if registered): Crucial for tax filings for both parties involved.

- Place of supply: Affects how the tax amount is calculated.

- HSN Code: The universal code for goods and services.

- Taxable value and any applicable discount: The base upon which taxes are calculated.

- GST rates and the total GST charged: The exact tax amounts that need to be paid.

- Signature of the supplier: Your official seal of approval on the transaction.

Following this format ensures you’re meeting the legal requirements for a GST invoice for online retailers and other e-commerce businesses. Moreover, this standardization helps in streamlining the accounting process, making tax filing simpler for your online business.

Including all these elements minimizes the potential for errors or misunderstandings in the future. This attention to detail in your GST invoice format for online business also contributes to a more professional image, fostering greater trust between you and your customers.

Available Formats for GST Invoice

You have options when it comes to the format of your GST invoice. Many businesses use Excel sheets customized with all the mandatory fields. Excel GST format can be a good choice for small businesses.

In addition to using Excel sheets and specialized billing softwares, some businesses also opt for cloud-based invoicing solutions that can be integrated directly into their existing sales platforms. This is particularly useful if you’re operating an e-commerce website, as it allows for real-time invoicing as soon as a customer completes a purchase. It’s another layer of efficiency that can streamline your online business operations even further.

Adding Personal Touches to Your GST Invoice

An invoice is not only a list of charges but also an extension of your brand; it’s a branding opportunity. While complying with GST rules, you can still add your logo or include a thank-you note to the customer. This not only enhances the customer’s experience but also sets your online business apart. In addition, these personal touches serve to reinforce your brand identity every time a customer looks at the invoice. It’s a simple yet effective way to leave a lasting impression and encourage repeat business.

When to Issue GST Invoices

The time limit for issuing a GST invoice depends on whether you’re selling goods or services. For goods, the invoice needs to be issued before or at the time of delivery. For services, the invoice must be issued within 30 days of providing the service. Following these timelines is essential for compliance and for keeping good records.

Being punctual with your GST invoice issuance also impacts your cash flow and tax filing. Timely invoices mean quicker payments and a smoother tax filing process, especially relevant for online businesses with high transaction volumes. Moreover, adhering to these deadlines can save you from potential penalties and improve your business reputation for professionalism and reliability.

How Many Copies Do You Need?

For goods, you must issue three copies of the invoice: one for the recipient, one for the transporter, and one for your own records. For services, only two copies are necessary: one for the customer and one for your records.

Keeping Everything in Check

Compliance is not just about issuing an invoice; it’s about issuing it correctly. Be meticulous in including all the required details and meeting the issuance timelines. This helps in ensuring that your GST invoice for e-commerce businesses is fully compliant with the law.

Being precise and diligent in your invoicing process not only ensures compliance but can also simplify your financial audits and tax reviews. Additionally, a carefully crafted, accurate invoice can act as a useful record for both you and your customers, aiding in dispute resolution and warranty claims. In the long run, this meticulousness can contribute to smoother business operations and more satisfied customers.

Choosing the Right GST Invoice Software

Selecting the right software can simplify the process of creating a GST invoice for an online business. Look for software solutions that are easy to use and include features like automated GST calculations and customizable templates.

On top of the basic features, you might also want invoicing solutions that can integrate with your existing e-commerce platform or accounting tools. This integration can help you streamline your operations, making it easier to track sales, manage inventory, and even generate reports for business analysis. Moreover, some software solutions offer additional security measures to protect your financial data, which adds an extra layer of assurance for your business. Choosing a comprehensive software not only simplifies the invoicing process but can also bring efficiency to other aspects of your online business.

Conclusion

In summary, a well-crafted GST invoice is more than just a legal requirement for your online business. It’s an opportunity to strengthen your brand and build lasting relationships with your customers. By paying attention to the finer details, staying updated with GST regulations, and choosing the right invoicing software, you can transform this obligatory task into a strategic asset for your business.

Armed with the information from this blog, you’re now better prepared to handle the complexities of GST invoicing while making it a valuable part of your business operations. So, don’t just view invoicing as a routine job; see it as an investment in your business’s long-term success.

Also Listen: How to Create E-Way Bill

FAQs

-

What is a GST invoice?

A GST invoice is a legal document that must be issued when selling goods or services under the GST regime. It’s especially important for compliance when you’re running an online business.

-

When am I legally required to issue a GST invoice?

You are legally required to issue a GST invoice whenever you make a sale or provide a service. This includes both traditional and online businesses, such as e-commerce platforms and online retailers.

-

What fields are mandatory in a GST invoice?

Fields like date, invoice number, customer details, GSTIN, and GST rates, among others, are mandatory. The GST invoice format for online business is especially important to follow. Missing out on any mandatory fields can make your invoice invalid.

-

Can I use Excel for creating GST invoices?

Yes, you can use Excel for creating GST invoices. Excel templates tailored to meet the criteria for a GST invoice for an online business are available. However, you may also consider software specifically designed for this for added functionalities.

-

How can I make my GST invoice stand out?

You can make your GST invoice stand out by adding personal touches like your company logo. This is applicable to both traditional and online businesses, including e-commerce operations. A well-designed invoice adds professionalism to your business image.

-

What are the time limits for issuing a GST invoice?

The time limits for issuing a GST invoice depend on whether you are selling goods or providing services. This remains the same whether it’s a brick-and-mortar shop or an online business. Always stick to the time limits to avoid potential legal troubles.

-

How many copies of a GST invoice do I need to issue?

You need to issue three copies for goods and two for services. Online retailers often send digital copies to streamline the process. Ensure you keep copies for your own records as well.

-

What happens if I don’t comply with GST invoicing rules?

If you don’t comply with GST invoicing rules, you may face legal consequences. It’s crucial to know how to generate a GST invoice for an online business to avoid such issues. Penalties for non-compliance can be quite steep.

-

Is GST invoice software worth the investment?

Yes, GST invoice software is especially worth the investment for automating calculations and ensuring compliance. It’s very useful for online retailers and e-commerce businesses. Investing in software could save you time and minimize errors.

-

Where can I find reliable GST invoice templates?

You can find reliable GST invoice templates from various sources online. Many GST software options offer customizable templates that fit the GST invoice format for online business specifically. Always make sure the template you choose meets all legal requirements.