Tracking the status of your GST return filing is a vital aspect of maintaining tax compliance under the Goods and Services Tax (GST) system. Filing returns is mandatory for businesses, and understanding the filing status helps ensure timely submissions and compliance with GST regulations.

Comprehending GST Return Filing

Under the GST regime, businesses report their sales, purchases, and tax liabilities through various returns, such as GSTR-1, GSTR-3B, GSTR-4, GSTR-9, and GSTR-9C. These returns vary based on the nature of the business and their registration category, whether monthly, quarterly, or annually.

Ensuring timely return filing is crucial to avoid penalties, interest, and legal consequences. Late filing can result in financial penalties, interest on unpaid tax liabilities, and even suspension of certain GST functionalities.

Need of Tracking Return Status

-

Compliance Monitoring:

Monitoring return filing status helps businesses identify any pending or overdue returns, ensuring they comply with GST regulations.

-

Timely Rectification:

Tracking filing status enables businesses to quickly identify rejected or defective returns. This allows them to rectify errors, omissions, or discrepancies promptly, reducing the risk of non-compliance.

-

Avoiding Penalties and Interest:

Late or non-filing of returns can lead to penalties and interest charges by GST authorities. By monitoring filing status, businesses can meet deadlines and avoid unnecessary financial liabilities.

Methods To track GST return filing status

-

GSTN Portal:

To check your GST return status based on the return filing period through the government portal, you’ll need access to your GST account. If you have the necessary access, you can follow these steps:

- Visit the official GST portal at www.gst.gov.in.

- Enter your valid login credentials.

- Navigate to the “Service” section, then proceed to “Returns,” and locate the option for “Track Return Status.”

-

Through ARN:

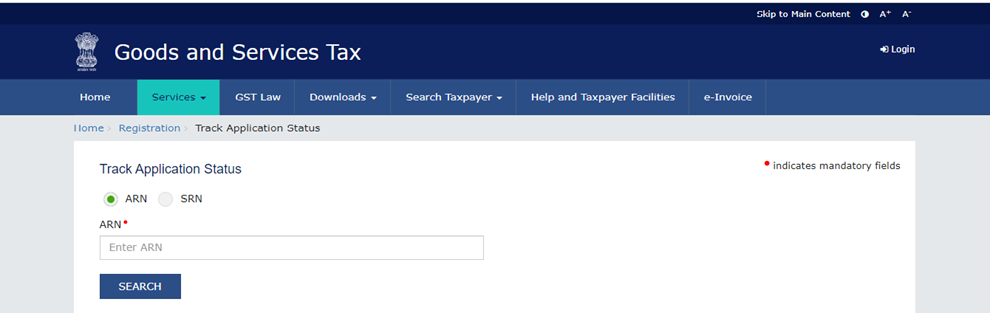

To check your GST return status using an Application Reference Number (ARN), which is assigned to taxpayers when they file their tax return and is typically sent to their provided email or phone number, you can follow these steps:

- Access the official GST portal by visiting www.gst.gov.in.

- Provide your valid login credentials on the login page.

- Navigate your cursor to the “Service” section, then choose “Returns,” and select “Track Return Status.”

- In the designated ARN field, enter your ARN number.

- Click the “Search” button to proceed.

-

GST Suvidha Providers (GSPs):

Authorised intermediaries known as GSPs offer services to track the status of GST return filings. If businesses use a GSP, they can access this service via the GSP’s platform.

-

GST Helpdesk:

Businesses experiencing issues or awaiting updates on their return filing status can contact the GST helpdesk for assistance. The helpdesk can provide the necessary information and guidance to track return filing status.

Maintaining GST compliance is crucial to avoid penalties and ensure a smooth tax administration. By leveraging the available tracking methods, businesses can monitor their filed returns, take corrective actions, and maintain a strong compliance record in the GST ecosystem.

Also Read : Details Required In GSTR-6

The Bottom Line

In the world of GST compliance, staying informed about your return status is your compass to smoother financial waters. Learn how to effortlessly navigate the sea of GST return filings with our guide on checking GST return status.

Frequently Asked Question

-

How many GST returns per month?

GST-registered businesses typically have to file three returns per month (GSTR-1, GSTR-2 and GSTR-3) in each state where they operate. An annual GST return is also required. This means a business will have to complete 37 returns per annum in each state where they are trading.

-

What is the GST return status, and how can you check it?

A taxpayer can easily verify the status of their filed GST Returns and download the submitted return by following these steps:

- Visit the common portal at https://www.gst.gov.in/

- Enter your valid login credentials on the login page.

- Click on the “Service” tab, then select “Returns,” and find the “View e-Files.”

-

Can you check the GST return status of another person?

Yes, you can check the return status of someone else by entering their GSTIN. Here’s how:

- Open the common portal at https://www.gst.gov.in/

- Click on the “Search taxpayer” tab, then select “Search by GSTIN/UIN.”

- Enter the GSTIN of the other person.

- Complete the characters/Captcha verification.

- Click the “Search” button. You will then see the GSTIN validity status and the option to view filed returns.

-

How can you determine if a vendor has filed their GST returns?

A GST taxpayer can easily check whether their vendor has filed GST returns or not by following these steps:

- Log in to the common portal at https://www.gst.gov.in/

- Select the GSTR dashboard.

- Choose the return period for which you want to check the invoices.

- Click on the GSTR-2A return form to review the data filed by your vendors.

If your invoices are not updated in your GSTR-2A, it is advisable to contact your vendor, as this may impact your ability to claim Input Tax Credit for the invoices you’ve reported. Please note that if your vendor files GST returns on a monthly basis, your GSTR-2A will be updated monthly after your vendor files their GST return. If the vendor files GST returns quarterly, your GSTR-2A will be updated quarterly.

How do I check my GST return filed status?

To verify the status of your filed GST returns, you can follow these steps:

-

Visit the common portal at https://www.gst.gov.in/.

-

Enter your valid login credentials in the designated login area.

-

Navigate to the “Service” tab, then select “Returns.”

-

Find and click on the “View e-Files Return” option.

-

From the drop-down menu, select the Financial Year, Return Filing Period, and Return Type.

-

Click the “Search” button to check and view the GST Return Status for all the returns you have filed.