Certain categories of taxpayers in the GST regulatory framework must deduct tax at source from payments to suppliers and vendors exceeding a specified threshold. They must pay this TDS amount to the government and report it in GSTR-7 periodic tax returns.

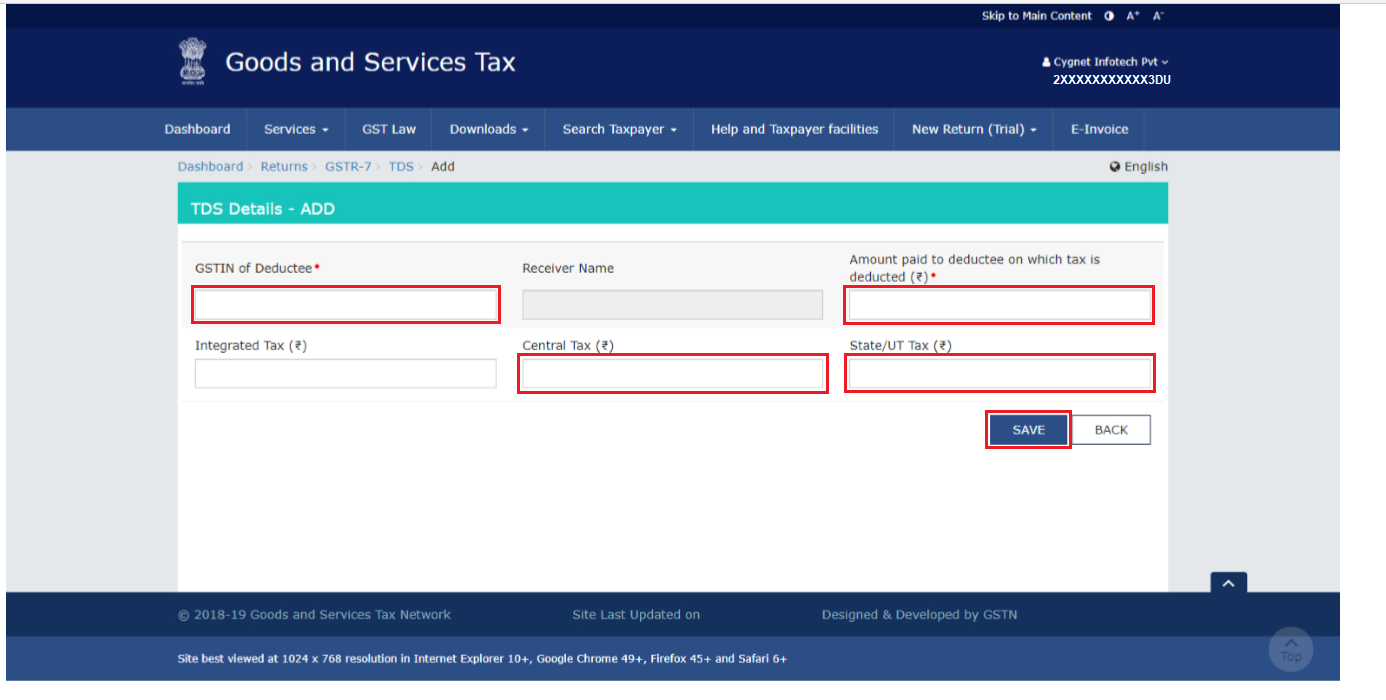

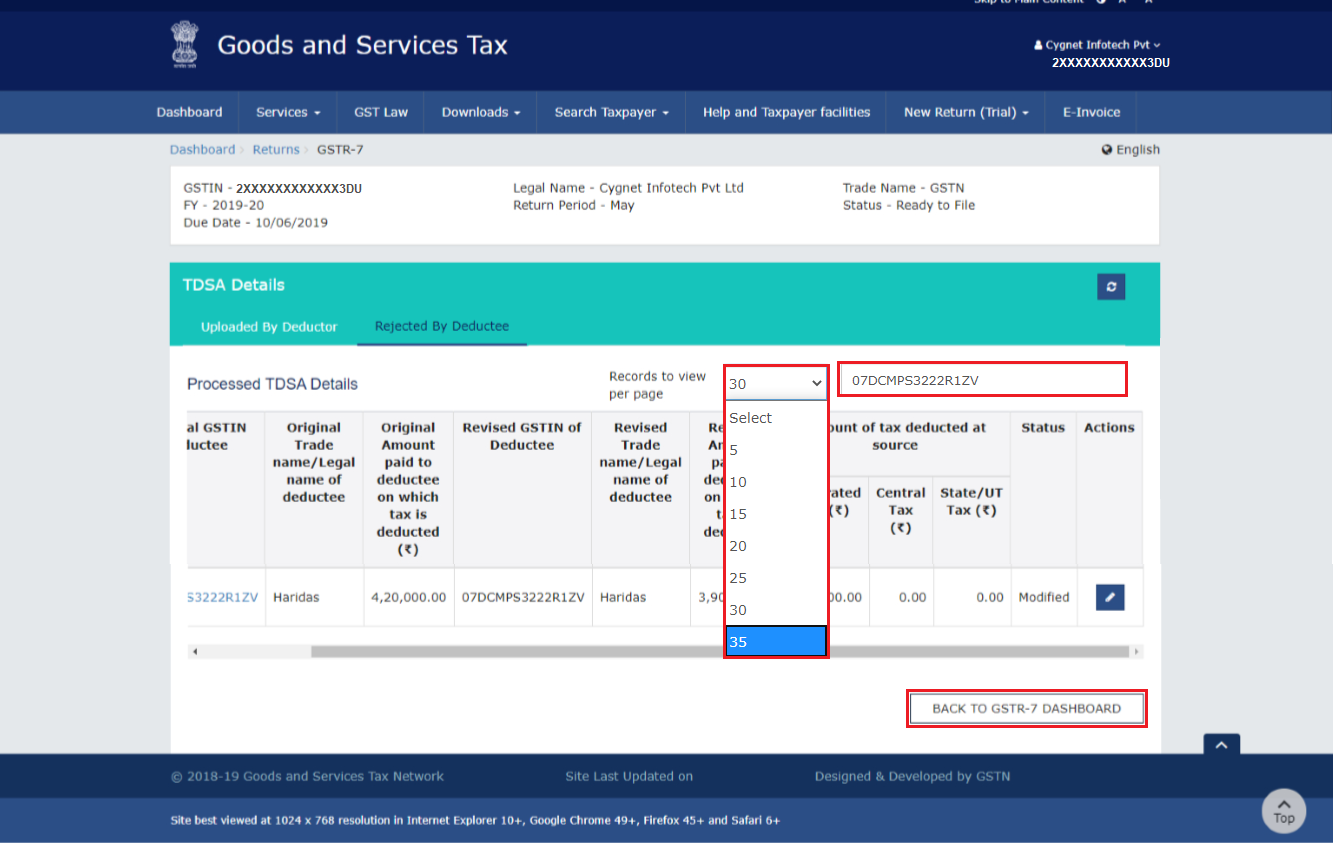

In Part 1 of the GSTR-7 monthly returns, they declare the consolidated values, while in Part 2, they furnish the deduction details separately for each supplier in a statement format.

Hence, it becomes vital to grasp the correct assessment protocols for TDS amounts under GST, followed by accurate reporting across Parts 1 and 2.

Accurate computation aligned to prescribed calculation formulae and procedures also enables deductees, i.e., suppliers, to seamlessly claim input tax credit from these deductions in their respective GSTR-3B returns. Any deviations can hamper their cash flows severely, apart from attracting interest liabilities if the deductions are short.

Let us dive deep into the mechanics of deriving TDS values for reporting in GSTR-7 Part 2:

Step-by-step Guide To Calculating TDS Liability In GSTR-7 Part 2:

Section 51 of the CGST Act 2017 governs the provisions related to tax deduction at source by specified categories of taxpayers under GST laws. It mandates deduction of tax from payments made to suppliers if invoice value excluding tax exceeds ₹2.5 lakhs when a contract caters to:

- Public works contract

- Contract for goods

There will be two applicable rates for tax deduction:

- 1% GST TDS under Section 51(1)

- 2% GST TDS under Section 51(2)

Now let us see how to derive the actual TDS amount through a logical sequence:

Step 1: Detect all purchases from suppliers exceeding ₹2.5 lakhs in value for the tax period. Capture supplier name, GSTIN, place of supply, and invoice value

Step 2: Exclude applicable GST taxes from aggregate invoice value to derive base figure liable for TDS

Step 3: Apply the relevant rate percentage (1% or 2% basis) for the contract type

Step 4: Arrive at the GST TDS amount by applying the chosen rate on the base figure

Step 5: Round off the TDS amount thus calculated to the nearest multiple of ₹10

Step 6: Ensure total TDS thus derived matches values disclosed in GSTR-7 Part 1 and Part 2

Thus, by following the systematic sequence of identifying applicable purchases, removing taxes, applying prescribed rates, and rounding off, we can accurately calculate TDS liability for reporting.

What Is The Formula For TDS Calculation?

A mathematical formula can also explain the computation logic.

TDS Amount = (Aggregate Invoice Value – Applicable Taxes) x Applicable TDS rate %

Here,

Aggregate Invoice Value will be the sum of purchases exceeding ₹2.5 Lakhs per supplier

Furthermore, it is important to consider that the Applicable Taxes will include the sum of all GST, cess, and other taxes on invoices.

Similarly, the TDS Rate % will be 1% or 2% based on the contract type

By populating these value sets, the final TDS contribution can be derived. This must further undergo rounding off as per the prescribed protocol.

Let’s take an example to crystallize the understanding:

- Gross Invoice Value = ₹3,00,000

- Taxes @ 18% GST = ₹ 48,000

- Effective Base Value = ₹ 3,00,000 – ₹ 48,000 = ₹ 2,52,000

- Applicable TDS Rate @1% = 1% of ₹2,52,000 = ₹2,520

- Rounded Off TDS Amount = ₹2,520 rounded off to ₹2,510

Taxpayers can determine the correct figures by systematically applying the formula.

What Are The Compliance Standards For TDS In GSTR-7 Part 2 Calculations?

While computing deductions, certain compliance standards as per GST laws must be ensured:

- Threshold Limits: TDS provisions kick in only if the aggregate invoice value from a particular supplier exceeds ₹2.5 lakhs in a financial year. Hence, this threshold limit needs compliance. They must exclude any payments that fall below the specified limit.

- Correct Rates Application: They need to apply the appropriate tax deduction rates of 1% under Section 51(1) and 2% under Section 51(2), depending on whether the contract involves work, goods, or services procurement.

- Itemized Breakup: They cannot disclose the entire TDS amount in a consolidated manner. Instead, they must split it supplier-wise across goods and services, providing respective invoice references and deducted amounts.

- Timely Deposit Into Government Account: As per Section 51(5), they must deposit the deducted amounts into the appropriate government account by the 10th of the succeeding month to avoid interest liability.

- TDS Amount Limit: The total tax deducted at source cannot exceed total tax liability. Hence, after adjusting our output liability, the remainder of tax credits can only be utilized for discharging TDS provisions. This cap needs compliance.

By adhering to thresholds, rate accuracy, itemization requirements, monthly deposits, and liability limits protocols, organizations can ensure compliance standards in TDS implementation.

What Are The Efficient Strategies For TDS Computation?

Automated Flagging Of Applicable Invoices:

Configure accounting software to automatically detect purchases from a supplier crossing the annual threshold limit of ₹2.5 lakhs based on running totals and flag them for TDS applicability. Additionally, it must promptly alert the procurement team to take the necessary action.

Granular Tax Rates Mapping:

To avoid manual rate selection errors, integrate accurate HSN-code-wise or item-wise tax rate applicability master data into the system. Consequently, businesses should progressively update this data for any change notifications to maintain accuracy. Moreover, the application of these rates should happen automatically based on code-wise lookups to minimize errors.

Centralized Liability Recording:

Instead of the account payable team manually computing and paying TDS dues, auto-trigger value entries into specific TDS control accounts from invoices for centralized visibility and reconciliation efficiency.

Layered Payment References:

While making payments, capture references linked to contracting, suppliers, and tax filings like GSTR-7 to enable seamless document-to-document matching, subsequently analyzing deviations if any.

System-driven Driven Reconciliation:

After-tax deduction settlements, perform automatic reconciliation based on system feeds instead of manual efforts between derived liability vs deposited amount vs claimed input tax credit amount—flags mismatch instantly for corrections.

Thus, by focusing on making identification, calculation, recording, and reconciliation automated through rules-based triggers and system feeds, significant efficiency can be achieved, preventing manual effort duplication.

What Are The Legal Aspects Of TDS Assessments For GSTR-7 Part 2?

Certain significant aspects of legal and compliance regulations around TDS computations are:

- Changes in TDS rates need to be immediately updated and made applicable for provisioning

- Any reversals or refunds of input tax credit have to be accordingly reflected in TDS calculations

- Interest to be paid for short or delayed payments compared to derived tax deduction amounts

- All credit notes or amendments related to supplies under TDS also need factoring

Hence, aspects around rate modifications, credit reversals or additions, interest payments, and document adjustments will demand careful implementation to limit future disputes and financial implications.

What Are The Benefits Of Accurate TDS Submissions?

Compliance With Tax Regulations:

In addition to that, filing TDS returns accurately will help companies and businesses comply with Indian tax regulations regarding tax deducted at source. According to the Income Tax Act, deductors are required to deduct a certain percentage of tax on specific payments made, and they must also submit the TDS to the government within the prescribed due dates.

Therefore, timely and accurate TDS filing is crucial, as it ensures that the income and TDS amounts deducted from payments to vendors, suppliers, and contractors are appropriately reported to the tax authorities. Hence, the government can track the actual tax collected at the source. As a result, the Income Tax Department might impose penalties for non-compliance or delays in filing.

Limiting Penalties:

When delayed TDS returns or inaccurate filings happen, the tax department may impose penalties. According to the Income Tax Act, penalties for late or non-submission of TDS returns will be imposed.

During those scenarios, late fees, interest charges, and other financial penalties will be levied. Deductors need to ensure that the TDS submissions will be accurate and within due dates. It helps them limit such punitive action from the taxman and will keep their tax compliance record clean.

Enhanced Cash Flow Management:

Vendors, suppliers, or contractors from whom tax is deducted at source should accurately file their TDS. Timely e-filing of TDS returns by the deductor will ensure they receive the TDS certificates on time. These certificates will mention the amount of tax deducted during the financial year.

It helps the deductees correctly assess their tax liability and claim credits during tax filing. It will support them with better cash flow planning and management of tax outgos.

Minimized Tax Audit Risk:

Filing TDS returns correctly and timely will create a good tax compliance history for businesses and companies. It will portray them as responsible tax deductors and minimize the risk of tax audits in the future. The tax department’s scrutiny of returns filed accurately is also relatively less compared to those with errors or delays. It can help deductors avoid inconvenient tax audits and investigations.

Faster Refunds And Credits:

TDS returns filed accurately and completely have less chance of being selected for detailed scrutiny by tax officers. It will limit the processing time taken by the department. It ensures deductees receive their refunds, if eligible, or TDS credits promptly.

The above are some of the pivotal perks of ensuring accurate TDS submissions by businesses and companies.

Listen: Why GST Billing is so important for MSME’s ?

Frequently Asked Questions:

Q1. What are the sections under which TDS can be deducted?

Common sections are 194-I (rent), 194-J (professional fees), 194C (contractors), and 194Q (e-commerce operator).

Q2. Is there any threshold limit for TDS deduction?

Yes, threshold limits are applicable as per the sections. For instance, consider 194C, where the threshold is Rs. 30,000 per day.

Q3. What if TDS is deducted but not deposited by the due date?

Taxpayers must pay late fees and interest as per the law if they deduct TDS but fail to deposit it within the due date.

Q4. How do I account for late fees and interest in GSTR-7?

They need to add the late fees and interest amounts to the TDS liability in Part 2.

Q5. Can I adjust the excess TDS deposited for one month in other months?

They cannot adjust TDS deposited month-wise across different months in GSTR-7.

Q6. What if the TDS-deducted amount does not match the TDS-deposited amount?

The deposited amount cannot exceed the deducted amount. They must reconcile and correct any mismatches found.

Q7. Can quarterly filing be done instead of monthly?

No, GSTR-7 needs to be filed monthly, irrespective of the amount of TDS deducted.

Q8. What if TDS is deducted but GSTR-7 is not filed?

Tax authorities may issue a show cause notice and initiate penalty proceedings.

Q9. How do I calculate TDS liability in Part 2?

They calculate TDS liability by summing up the TDS deducted as per the TDS certificates issued during the month. The system auto-populates this amount from Part 1.

Q10. Is the revised GSTR-7 allowed if mistakes are found in the original filing?

They can revise GSTR-7, but only within the due date of the original filing, which is the 10th of the following month.