Introduction:

GST, or Goods and Services Tax, is a single tax that makes paying taxes easier for businesses in India. Understanding and using GST is not just a rule; it’s a smart move for businesses to work better and save money. It’s a big deal for businesses because it simplifies taxes, reduces the tax burden, and helps them stay organized. Many types of businesses, like those making things, offering services, selling goods, or doing online business, can use GST. Even small businesses need to use GST if they earn a certain amount, making taxes fair for everyone.

If someone runs more than one business, they can add them all under the same GST registration. This is good because it makes things simpler. To do this, businesses just need to show that they are all part of the same legal group and fill out the right paperwork. It’s like putting all the businesses in one basket for tax purposes. In this blog, we will deep dive into the details of how to add multiple businesses under the same GST, consolidate businesses under one GST, and manage several businesses under a single GST registration. We’ll also explore the benefits of having one GST for multiple companies, making the process clear and easy to follow.

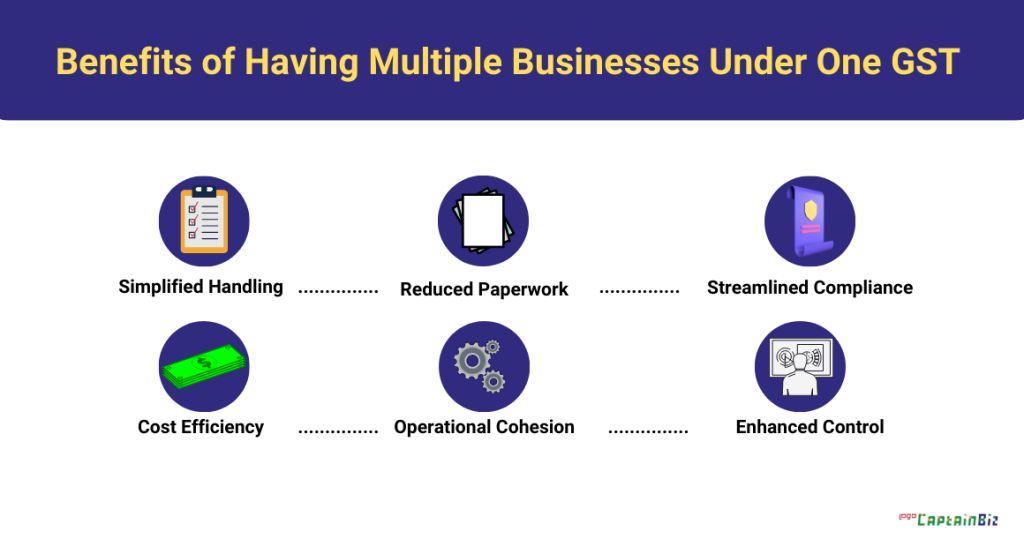

Benefits of Having Multiple Businesses Under One GST Registration:

Here are the different benefits for Multiple Businesses Under One GST Registration:

-

Simplified Handling:

Dealing with taxes becomes easier when all businesses are under one GST.

-

Reduced Paperwork:

Having a single GST registration means less paperwork, making things more straightforward.

-

Streamlined Compliance:

It’s easier to follow and meet tax rules when everything is consolidated under a common GST framework.

-

Cost Efficiency:

Managing one GST registration can save time, effort, and resources compared to handling separate registrations for each business.

-

Operational Cohesion:

Consolidating businesses promotes better coordination and organization in your operations.

-

Unified Reporting:

Reporting and tracking become more unified and coherent, enhancing overall financial management.

-

Optimized Tax Responsibilities:

One GST for multiple businesses ensures a more efficient and effective approach to meeting tax obligations.

-

Enhanced Control:

Centralized GST registration provides better control and oversight of the tax aspects of each business.

-

Ease of Expansion:

Adding new ventures or expanding existing ones is more straightforward under a consolidated GST registration.

-

Comprehensive Business View:

Having all businesses under one GST allows for a holistic view of your overall business activities.

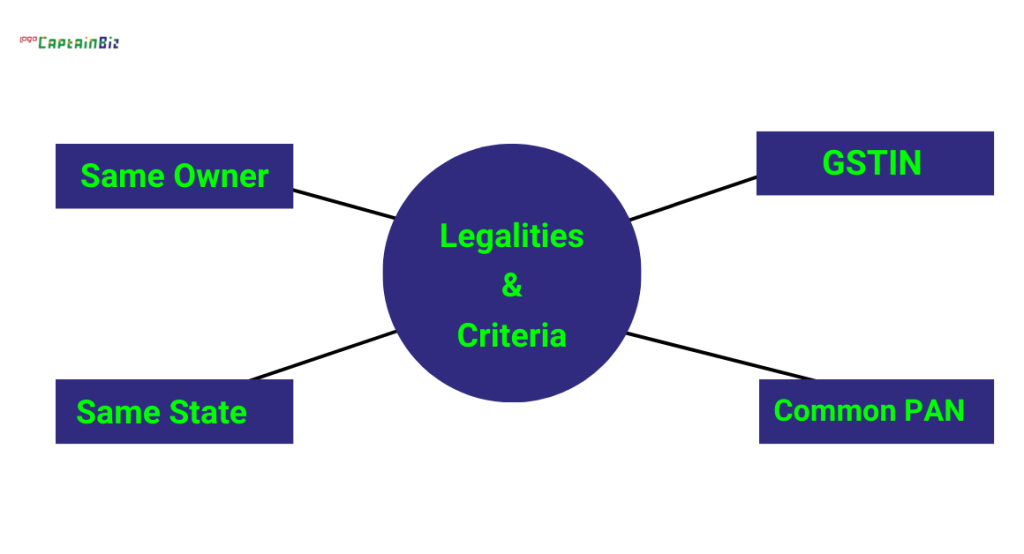

Legalities and Criteria for Adding Multiple Businesses Under One GST

When you want to add multiple businesses under one GST, there are some important legalities and criteria to consider. Here’s a simplified overview:

-

Same Owner:

All the businesses you want to group together under one GST registration should have the same owner or owners.

-

Same State:

These businesses should operate in the same state for a smoother GST consolidation process.

-

Similar Type of Business:

The businesses should be of a similar nature, meaning they engage in comparable types of activities.

-

Common PAN Number:

It’s essential to have a common PAN (Permanent Account Number) that links all the businesses.

-

Individual GSTIN:

Each business will still have its own unique GSTIN (Goods and Services Tax Identification Number), but they will be interconnected under one registration.

-

Unified Business Operations:

The businesses need to demonstrate a unified way of operating, showing a clear connection between them.

-

Proper Documentation:

Ensure that all required documents, such as business registration papers and PAN cards, are in order.

-

Informing Authorities:

Notify the GST authorities about your intention to consolidate these businesses under a single GST registration.

-

Tax Advisor Consultation:

Consulting with a tax advisor is advisable to ensure you’re meeting all the necessary legal requirements.

-

Adherence to GST Rules:

Follow the rules and regulations specified by the Goods and Services Tax to ensure compliance.

Step-by-Step Guide to Adding Multiple Businesses Under a Single GST Registration

Here’s a more specific step-by-step guide for adding multiple businesses under a single GST registration:

-

Access the GST Portal:

Visit the official Goods and Services Tax (GST) portal

-

Login or Register:

Log in to your existing GST account or register if you are a new user.

-

Navigate to ‘Add Business’ Section:

Within your GST account dashboard, locate and access the ‘Add Business’ or ‘Amendment of Core Fields’ section.

-

Provide Business Details:

Enter the details of each business you want to add, including the legal name, trade name, business address, and principal place of business.

-

Upload Required Documents:

Upload supporting documents, including:

- Business registration certificate

- PAN card of the business

- Address proof

- Identity proof of the business owner(s)

- Verify Additional Details:

- Verify additional details such as the business constitution, bank account details, and authorized signatory information.

-

Pay Application Fee (if applicable):

Check if there is any fee associated with adding businesses and make the payment online through the portal.

-

Submit Application Form:

Complete the application form for adding businesses and submit it through the online portal.

-

Receive Application Reference Number:

After submission, you will receive an acknowledgment or application reference number.

-

Wait for Processing:

Allow the GST authorities time to process your application. You can track the status of your application on the portal.

-

Verification and Approval:

The authorities will verify the information provided, and upon approval, the businesses will be added under a single GST registration.

-

Consult with a Tax Advisor:

Consider consulting with a tax advisor to ensure that all aspects of the consolidation comply with GST laws and regulations.

By following these specific steps on the official GST portal and adhering to the documentation requirements outlined by Indian regulations, you can successfully add multiple businesses under a single GST registration.

Also read: All You Need To Know About GST Registration

Challenges and Solutions in Managing Multiple Businesses Under One GST

| Challenges | Solutions |

| 1. Complex Record-Keeping: Managing records for multiple businesses can become complicated, leading to potential errors. | 1. Centralized Record-Keeping System: Implement a centralized system to streamline and organize data for all businesses. This ensures a more straightforward approach to record-keeping, minimizing the chances of errors. |

| 2. Varied Tax Rates: Different businesses may have varied tax rates, making it challenging to ensure accurate calculations. | 2. Use of Accounting Software: Utilize accounting software that accommodates different tax rates. This software allows for easy customization, ensuring accurate calculations for businesses with varied tax rates. |

| 3. Compliance Issues: Ensuring compliance with diverse GST rules for each business can be time-consuming and prone to oversight. | 3. Regular Compliance Checks: Conduct regular compliance checks to ensure adherence to GST rules for each business individually. This proactive approach helps in identifying and addressing compliance issues promptly. |

| 4. Unified Reporting: Creating unified reports for all businesses may pose a challenge due to differences in accounting practices. | 4. Standardized Reporting Formats: Develop standardized reporting formats that accommodate variations across businesses. This ensures consistency in reporting practices and facilitates a unified view of financial data. |

| 5. Administrative Burden: The administrative workload increases, requiring more time and effort to handle multiple businesses effectively. | 5. Delegated Responsibilities: Delegate specific responsibilities to individuals or teams for each business. This strategic delegation helps distribute the administrative burden effectively, ensuring tasks are managed more efficiently. |

Tips for Effectively Managing Multiple Businesses Under One GST

Here are the few ways to manage the multiple businesses under one GST:

-

Stay Organized:

Keep everything neat and organized to avoid confusion between businesses.

-

Use Technology:

Embrace simple technology like spreadsheets or apps to track transactions for each business.

-

Set Clear Roles:

Define roles and responsibilities for each business to avoid overlapping tasks.

-

Regular Check-ins:

Have regular check-ins to stay updated on the status and needs of each business.

-

Unified Banking:

Consider using a common bank account for all businesses to simplify financial transactions.

-

Centralized Records:

Maintain a centralized system for records to easily access information for each business.

-

Standardized Processes:

Create standardized processes to streamline operations across all businesses.

-

Delegate Wisely:

Delegate tasks to capable individuals, ensuring everyone knows their responsibilities.

-

Stay Informed:

Keep yourself informed about changes in GST rules to stay compliant with regulations.

-

Seek Professional Advice:

When in doubt, consult with a professional or advisor to navigate complexities effectively.

Common Mistakes to Avoid When Adding Multiple Businesses Under GST

- Mixing Finances:

Avoid mixing the money of different businesses; keep their finances separate. - Incomplete Documentation:

Ensure all required documents are complete and accurate for each business. - Ignoring GST Rules:

Stay updated on GST rules to avoid unintentional violations and penalties. - Overlooking Differences:

Acknowledge and address any unique features or differences among your businesses. - Forgetting Regular Checks:

Don’t forget to regularly check and update business information on the GST portal. - Skipping Professional Advice:

Seek advice from professionals to avoid misunderstandings or missteps. - Not Delegating Effectively:

Delegate responsibilities clearly to avoid confusion and errors. - Ignoring Communication:

Maintain open communication between businesses to prevent misunderstandings. - Missing Renewals:

Keep track of renewal dates for registrations and licenses to avoid lapses. - Neglecting Record-Keeping:

Consistently maintain accurate records to avoid complications during audits or reviews.

Conclusion:

Adding multiple businesses under the same GST is a positive step and it streamlining operations for all types of businesses. It simplifies compliance, particularly benefiting SMEs with the Composition Scheme. E-invoicing and digital return filing act as safeguards against fraud. Stringent compliance ensures efficient audits, and digital tools assist businesses seamlessly. Continuous upgrades in GST laws are essential to keep pace with the evolving digital landscape, especially for digital companies and operations. Overall, the move towards consolidation is a positive stride.

Also Read: Know Everything About GST Billing Software

Also Listen: GSTR Filing Process with CaptainBiz – Tutorials

FAQ’s:

-

Why would I want to add multiple businesses under the same GST?

Adding multiple businesses under the same GST simplifies tax procedures and makes management easier.

-

What benefits come with having multiple businesses under one GST registration?

It streamlines operations, reduces costs, and allows for unified management of all businesses.

-

What legal criteria should I be aware of when adding multiple businesses under one GST?

Ensure common ownership, similar business activities, and compliance with GST regulations.

-

Can you guide me through the step-by-step process of adding multiple businesses under a single GST registration?

Yes, the process involves common ownership, similar activities, and proper documentation.

-

What challenges might I face when managing multiple businesses under one GST, and how can I overcome them?

Challenges may include complex record-keeping; solutions involve centralized systems and clear roles.

-

What tips can you provide for effectively managing multiple businesses under one GST?

Stay organized, use technology, delegate wisely, and maintain clear communication.

-

Are there common mistakes I should avoid when adding multiple businesses under GST?

Yes, avoid mixing finances, ensure complete documentation, and stay compliant with rules.

-

How does having a unified GST benefit small businesses and startups?

It simplifies the tax system, reduces administrative costs, and improves cash flow.

-

Can I claim input tax credits for each of my businesses individually?

Yes, under a unified GST, you can claim input tax credits for each business.

-

What is the importance of regularly checking and updating business information on the GST portal?

Regular checks ensure that your information is accurate, up-to-date, and compliant with GST regulations.