If Customs control or a Customs seal carries the goods, you do not need an e-way bill. Taxpayers would not face e-way bill blocking for non-filing of GSTR-1 or GSTR-3B (two months or more for monthly filers and one quarter or more for QRMP taxpayers) from May 1, 2021, to August 18, 2021.

What is an e-way Bill?

An e-way bill is an electronic waybill which created on the e-way bill portal for the movement of goods. A GST-registered person can only transport goods worth Rs. 50,000 (Single Invoice/bill/delivery challan) in a vehicle with an e-way bill created on e-waybillgst.gov.in.

You can also generate or cancel e-way bills via SMS, the Android App, and site-to-site connections through the API by inputting the correct GSTIN of the parties. Before using the GSTIN, authenticate it using the GST search tool.

The e-way bill generates a unique e-way Bill Number (EBN), accessible to the provider, recipient, and transporter.

When Should an e-way Bill Be released?

When goods are transferred in a vehicle/conveyance with a value greater than Rs. 50,000 (per invoice or aggregate of all invoices in a vehicle/conveyance), an e-way bill will be created.

- In the context of supply,’

- For causes other than supply (for example, a return),

- Because of an unregistered ‘supply’ from the outside

A supply for this purpose could be either of the following:

- A business makes a supply for consideration (payment).

- An exchange of goods or services for money, which may or may not take place in a formal business transaction.

- A supply made without money or consideration.

- Payment is provided for the sale of commodities.

- Branch transfers of such a transfer.

- Barter/Exchange involves exchanging products for other products instead of money.

As a result, e-way Bills for all these movements must be generated on the shared platform.Even if the value of the assignment of commodities is less than Rs. 50,000, you must generate an e-way bill for certain designated goods:

- Inter-state transportation of goods by the Principal to the registered job worker

- Inter-State Handicraft Goods Transport by a Dealer Exempt from GST Registration

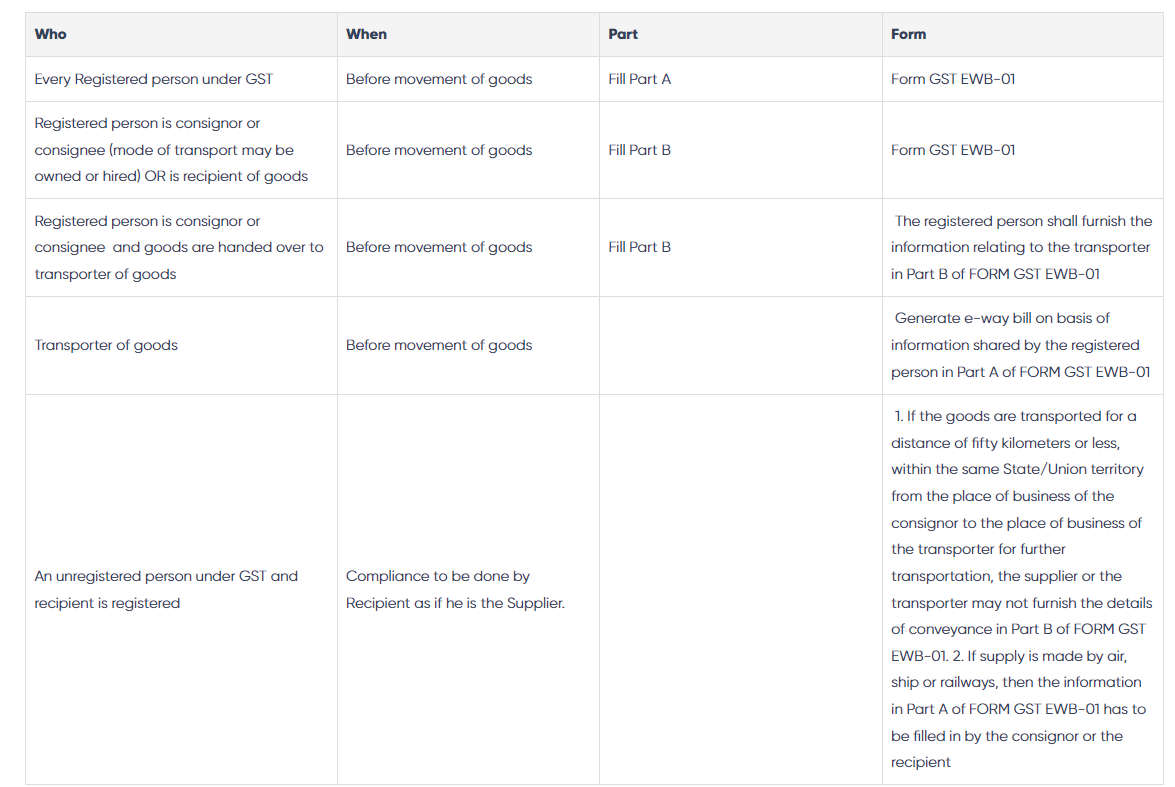

Who Should Produce an e-way Bill?

Registered Person

When a registered individual moves products worth more than Rs 50,000, they must generate an e-way bill. Even if the value of the items is less than Rs 50,000, a registered person or carrier may choose to create and carry an e-Way bill.

Unregistered Person

Unregistered individuals must also generate an e-Way Bill. An unregistered person supplying goods to a registered person requires the receiver to ensure compliance with all regulations as if they were the supplier.

Transporter

If the provider has not generated an e-Way Bill, transporters who express products by road, air, rail, or other methods must do so.

Transporters do not need to prepare an e-way bill (Form EWB-01 or EWB-02) listing all the consignments in the conveyance:

- Individually (a single document**) is less than or equal to Rs 50,000, but

- Generally (all documents** together), it exceeds Rs 50,000.

Unregistered Transporters will receive a Transporter ID after registering on the e-way bill site, and e-way bills will be created.

Also Read: Who is Required to Generate an E-way Bill?

Note:

If a transporter conveys many consignments in a single conveyance, GST EWB-02 can generate a consolidated e-way bill by supplying the e-way bill numbers for each shipment. Suppose neither the consignor nor the consignee has established an e-way bill. In that case, the transporter can do so * by completing PART A of FORM GST EWB-01 using the invoice/bill of supply/delivery challan provided to them.

Cases Where You Do Not Need an E-Way Bill

It is not crucial to generate e-Way bill in the following scenarios:

- You do not need an e-way bill if the mode of transportation is non-motorized.

- Goods transported for Customs clearance from a Customs port, airport, air cargo complex, or land customs station to an Inland Container Depot (ICD) or Container Freight Station (CFS).

- If Customs control or a Customs seal carries the goods, you do not need an e-way bill.

- Goods transferred from ICD to Customs port or from one customs station to another under Customs Bond.

- In transit cargo to or from Nepal or Bhutan.

- Goods movement generated by defense formations under the Ministry of Defense as a consignor or consignee

- Consignors transport empty cargo containers to or from a weighbridge for weighing at a distance of 20 kilometers, accompanied by a delivery challan.

- Goods are transported by rail where the consignor is the Central Government, a state government, or a local government.

- Goods listed in the various State/Union territory GST Rules are exempt from E-Way bill requirements.

- Transportation of certain specified commodities- Includes a list of exempt supplies of goods, an annexure to Rule 138(14), goods considered as no supply under Schedule III, and a schedule to Central Tax Rate notifications. (List of Goods in PDF format).

Note:

- If the distance between the consignor or consignee and the transporter is less than 50 kilometers and the transport occurs within the same state, you do not need to complete Part B of the e-way bill.

e-Way Bill Rules and Limits by State

Since its adoption on April 1, 2018, there has been an increase in the amount of e-way invoices generated for inter-state goods transit. The state-by-state deployment of the e-way bill system has received a positive reaction, with all states and union territories joining the league in generating e-way bills for goods transportation inside the state/UT.

However, authorities have granted relief to residents of a few states by exempting them from generating waybills if their monetary limits fall below a specific threshold or if they own certain designated products

Delhi

As of June 16, 2018, e-Way invoices are only necessary for intra-state transfer of goods worth more than Rs. 1 lakh.

In Delhi, businesses do not need to create an e-way bill for moving products between registered sellers and unregistered clients.

West Bengal

As of June 6, 2018, businesses must create an e-Way bill only when they transport items valued at more than Rs. 1 lakh inside West Bengal.

Tamil Nadu

- As of June 2, 2018, businesses must create an e-Way bill only when they transport products worth more than Rs. 1 lakh inside Tamil Nadu.

How can I create an e-Way Bill on the portal?

The e-Way Bill Portal can generate an e-Way Bill and an e-Way Bill number. You only need a Portal login. Check out our post – tutorial to generate e-Way Bill online – for a thorough step-by-step tutorial on e-Way Bill Generation.

Also Read: E-Way Bill Generation Process: Step-by-Step Guide

SMS e-way bill generation on mobile

Using a registered mobile phone, you can produce e-way bills by SMS. To begin, enable the SMS e-way bill generation feature. Register your mobile phone for SMS e-way bill creation. Then, to generate, manage, and cancel e-way bills, transmit simple SMS codes to a specific mobile number handled by the e-way bill portal/GSTN. For additional information, see our page on the e-way bill creation SMS mode.

e-way Bill Validity

An e-way bill is valid for the periods specified below, depending on the distance the items traveled. The system determines the validity of an e-way bill based on when you generate it.

| Type of conveyance | Distance | Validity of EWB |

| Apart from over-dimensional transport | Less Than 200 Kms | 1 Day |

| For every additional 200 Kms or part there | additional 1 Day | |

| For over-dimensional transport | Less Than 20 Kms | 1 Day |

| For every additional 20 Kms or part there | additional 1 Day |

You can also extend the validity of an e-way bill. The creator of such an e-way bill must prolong the validity of the e-way bill either eight hours before or eight hours after it expires.

Documents or information required to generate an e-way Bill

- Invoice/Bill of Supply/Challan for a consignment of commodities

- Road transportation – Transporter ID or Vehicle Identification Number

- Rail, air, or ship transportation – Transporter ID, Transport document number, and document date

What is the format of an e-way bill?

Part A and Part B of the E-way bill are separate documents. Part A of the E-way bill collects consignment details, typically the invoice details. As a result, the following information must be submitted.

- The recipient’s GSTIN must be provided.

- You must specify the PIN code of the delivery location.

- You must submit the invoice or challan number used to supply the items.

- Make sure to mention how much the shipment is worth.

- You must enter the HSN code of the items being transported. If the turnover is less than INR 5 crores, the first two digits of the HSN code should be stated. A four-digit HSN code is necessary if the revenue exceeds INR 5 crores.

- The purpose for transportation should be specified, and the best option should be chosen.

- The transport document number must be specified. It contains the goods receipt number, the railway receipt number, and the airway bill number.

Wrapping It Up

If a train delivers products, the recipient must produce the e-way bill at the time of receipt, even though the e-way bill is not required for the delivery. Public transportation, such as a bus, must carry an e-way bill when transporting products from one business to another.

The GST Council has further stated that such transportation is only subject to a single examination during a journey. That is, if a vehicle has once been inspected and passed by a tax inspector, it will not be reviewed again during the trip.

Also Listen: How to create E-way Bill With CaptainBiz

FAQs

What is the idea of the way bill?

GST E-way bill is a document introduced under the items and Services Tax to trace items in transit.

Who is responsible for paying the e-way bill?

The e-way bill is a document that must be carried by a person in charge of a conveyance carrying any consignment of goods worth more than fifty thousand rupees, as mandated by the government under section 68 of the Goods and Services Tax Act and rule 138 of the rules issued under it.

Is e-way required for amounts less than $50,000?

You must use an e-way bill to transport all commodities, except for products exempted under notifications or laws. You must also generate an e-way bill for handcrafted goods or goods moved for job-work purposes under specific conditions.

What documents are needed for the e-way bill?

Documents such as a tax invoice, bill of sale, or delivery challan, as well as the Transporter’s Id of the person conveying the products, as well as the transporter document number or vehicle number in which the items are transported, must be available to the person generating the e-way bill.

What is the punishment for refusing to accept the e-way bill?

Moving goods without an invoice and an e-way bill is a violation punishable by a fine of Rs. 10,000 or the amount of tax claimed to be evaded (whichever is greater). As a result, the bare minimum penalty for failing to comply with the rules is Rs. 10,000.

Is it possible to reject an e-way charge after 24 hours?

The receiver has the option to cancel the e-way.

What are the three kinds of GST?

There are three forms of GST in India: CGST, SGST, and IGST.

What is the e-way bill limit in 2023?

The CGST regulations, which primarily apply to interstate transportation, imposed a limit of Rs. 50,000.

What is the distinction between GST and an e-way bill?

E-way bills are a technique for ensuring that products being transported conform with the GST Law and are an excellent instrument for tracking goods movement and detecting tax fraud.

What happens if the waybill expires?

In general, when an e-way bill’s validity term expires, the GST Authorities take action under Section 129 of the CGST Act. They issue the detention order and impose the appropriate penalties.