For small businesses and exporters, staying compliant with Goods and Services Tax (GST) regulations and e-waybill requirements is important. To simplify the process, the GST e-waybill exemption checker has been designed to help businesses determine their eligibility for exemptions. Small companies can input their turnover, type of goods, and distance information into the user-friendly interface, guided by a decision algorithm tailored to specific small business criteria.

Similarly, an e-waybill exemption checker for exporters can use the tool by providing details such as export turnover, destination, and goods specifics.

The e-waybill exemption checker for small businesses tool, integrated with the official GST portal, ensures real-time accuracy and compliance. Educational resources are included to aid users in understanding exemption criteria, while privacy and security measures are implemented for data protection.

GST Exemption Types

In India, you can choose from three different kinds of GST exemptions.

-

Absolute

Full and unconditional exemptions are known as “absolute” exemptions since they do not impose any limitations or requirements on the recipient. An excellent illustration of this is the exemption on RBI services.

-

Conditional

When an exemption is subject to a specific limitation, condition, or restriction, we say that it is conditional. For example, there is a limit to how much hotel services are excluded rather than a complete exemption.

-

Partial

Under the reverse charge, unregistered individuals whose products are supplied to a registered person inside the state are not required to pay GST, provided the total value of their supply does not exceed Rs.5,000 per day.

Who generates e-way bills and why?

If the shipment is being delivered by air, rail, or vessel, an e-way bill has to be created by either the sender or the receiver.

The transporter will create an e-way bill whenever they receive the products for road transportation from the registered person, as long as the registered person updates part B and provides data for part A.

The transporter can create Part-A after receiving consent from the Consigner or the Consignee.

Furthermore, suppose the distance between the consignor’s place of business and the transporter’s place of business is less than 50 km within the State or Union territory. In that case, neither the supplier, recipient, or transporter is required to disclose the details of the conveyance in Part-B of FORM GST EWB-01.

Moreover, it doesn’t matter how valuable the consignment is; the e-way bill must be created by either the principal or the job worker if registered when products are delivered from one state to another.

No matter how little the consignment is worth, the e-way bill must be created by the same individual if the products are handmade goods and the sender is exempt from the registration requirement.

Transport of goods as described in Annexure to Rule 138 (14) of the CGST Rules, 2017, is an exemption from the requirement to create an e-Way Bill.

Also Read: Who is Required to Generate an E-Way Bill?

Nonmotorized shipments

The SGST Rules, 2017 describe specific exceptions for shipments that use non-motorized modes of transportation.

Shipping items from airports or ports to container ports for customs clearance, transferring within designated areas, transporting goods listed in certain schedules, transporting goods in limited supply, and certain commodities like alcoholic drinks and petroleum products are all exempt from this rule. It is also acceptable to transfer containers from inland depots or freight terminals to airports or ports using customs bonds.

Additionally, there are exceptions for some government institutions participating in rail transport for the Ministry of Defense, as well as for the local transportation of empty freight containers.

Importantly, e-Way Bill creation is not necessary for specific commodities that are free from central tax as per announcement 02/2017-Central Tax (Rate), with the exception of de-oiled cake.

The CGST Rules also provide an exemption for movements that are exempt under the SGST/UTGST Rules.

To be in line with the ever-changing regulatory conditions, an e-Way Bill may be required depending on the items’ characteristics, their final destination, and the regulations governing intra- or interstate transportation.

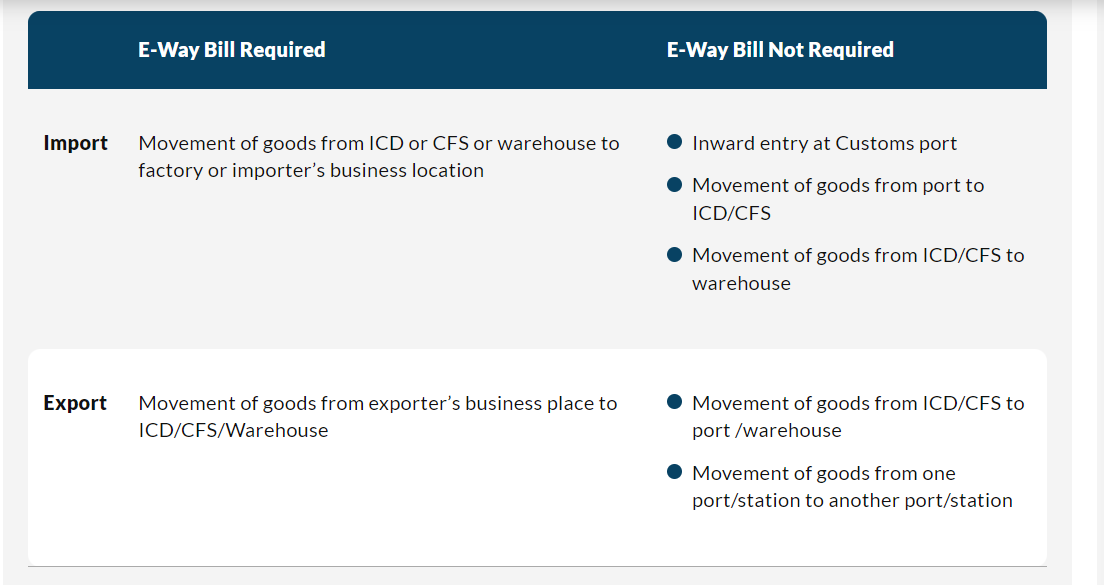

How to Create Export and Import E-way Bills

The procedure for producing an e-way bill stays the same for import and export. However, it is important to take note of the following e-way bill details while generating one for import and export.

Although it is obligatory to produce a GST e-way bill for the import and export of products, the generated e-way bill must remain valid. The legitimacy of an e-way bill is contingent upon the distance traveled by the possessions.

| Particulars | Import | Export |

| Transaction Subtype | Import | Export |

| Document Number and Type | Bill of Entry | Tax invoice meant for the export of goods |

| Bill From | Unregistered Person (URP) | Details of the exporter (name and GSTIN number) |

| Dispatch From | Pin code: 999999, State: Other Countries | Address of the warehouse/business place of exporter |

| Bill To | Details of the Importer (name and GSTIN) | Unregistered person living outside (mention URP) |

| Ship To | Address of the warehouse/business place of importer | Pin code: 999999, State: Other Countries |

| Information about Transportation | Transporter details (transporter ID, vehicle characteristics, etc.) | Information about the Driver (driver’s license number, car description, etc.) |

When it comes to imports, the distance is determined by measuring the distance between the ICD/CFS and the location of the factory or importer’s business.

However, when it comes to exports, the distance is determined by checking the distance between the ICD/CFS and the warehouse or exporter’s company site.

How to check if I am exempt from generating e-waybill

In order to find out if an e-waybill is required or not, you need to look at the rules and regulations of the place where you’re transporting the products.

The countries and locations in concern may have different exemptions from the need for E-waybills. The basic steps to determine your exemption status are as follows:

You should be familiar with the exclusion criteria

Give specific examples of when an exception might be appropriate. Some examples of such factors are the value of the cargo, the objects’ qualities, the distance the shipment must travel, and the type of things themselves.

Understand the rules that apply to your region

Learn the ins and outs of the municipal regulations that govern the e-waybill creation process. Learn all you can about the GST (goods and services tax) and any other relevant tax legislation.

Check Notifications of Exemption

Look for official tax notifications or circulars that spell out the specific kinds of deals or companies that aren’t required to use e-waybills.

Exporters can benefit from using online portals, tools, or e-waybill exemption checkers for exporters.

Many countries have websites where people may check if they are exempt from or need to submit an e-waybill. These sites can provide help in determining if your particular situation is eligible for an exception.

Verify the necessary documentation prerequisites.

Conduct a thorough examination of the documentation that pertains to the shipment of goods. Occasionally, specific transactions or items may be explicitly excluded, and this information may be stated in official papers.

Get Advice from Tax Experts

Consult with tax experts or consultants who possess expertise in local tax regulations. They can offer valuable information on special exemptions that are applicable to your company.

Reach out to the Tax Authorities

Contact the local tax authority or GST department to obtain clarity. They may supply information on exemptions and address particular inquiries pertaining to your business operations.

Make use of E-Waybill Systems.

Verify the official e-waybill system for any functionalities that enable you to determine if your transaction is eligible for an exemption. Specific systems offer automatic tests that rely on predetermined criteria.

Also Read: What are the Exemptions from Generating an E-way bill?

Why Is the GST Act Necessary for Understanding Imports and Exports?

The backbone of every country’s trading with other countries and the source of its foreign currency is its imports and exports. The Goods and Services Tax (GST) Act provides e-way bill regulations that all firms engaging in import and export transactions in India must follow. The Act defines “Import” as the process of importing commodities into India from foreign countries. Exporting, in contrast, refers to the process of moving commodities from India to another nation.

Regarding the function of a GST E-Way bill, one is required for each transport of products that crosses state boundaries and has a market worth exceeding ₹50,000. The Integrated commodities and Service Tax (IGST) is a legal levy that applies to certain commodities. On the other hand, because it is a zero-rated supplier, exporting products is free of any taxes.

E-Way Bill Cancellation

If an e-Way Bill has been created according to this Rule but has not been transported according to the details provided in the e-Way bill, the e-Way bill can be electronically canceled through the common portal within 24 hours of its generation.

Nevertheless, once an e-Way Bill has been authenticated in transit, it cannot be canceled, as stated in Rule 138B of the CGST Rules, 2017.

Additionally, e-Way Bill creation and cancellation abilities will be accessible by various means such as SMS, Android app, Application Process Interface (API), etc.

Also Read: How Do a Person Cancel an E-way Bill and What are the Consequences of Non-cancellation

Does GST provide any relief for the creation of an e-way bill for imports and exports?

In the cases listed below, it is not necessary to generate an e-way bill –

- Transportation of goods to or from Nepal or Bhutan; Import and export of gasoline, diesel, and kerosene;

- Transport of commodities between the customs port, the inland container depot (ICD), and the customs freight station (CFS).

It is important to note that the following would be subtracted from the total value of the aggregate turnover:

- Investors have already paid any applicable CGST, SGST, or IGST taxes.

- Payments of taxes that are due on the basis of a method known as reverse charge

- The value of the exportation of products and services to the domestic market

- Goods and services that are not subject to taxation# Exemptions from the Goods and Services Tax

FAQs

-

What is an e-way bill?

The government mandates e-way bills for products worth above 50,000 rupees, as per Section 68 of the products and Services Tax Act and Rule 138 of the rules issued thereunder. The GST Common Portal generates e-Way bill reports for registered individuals or carriers who move products of consignment before the movement begins.

-

What happens if the e-way bill is incorrect?

The e-way bill cannot be changed or rectified for errors. Only solution is to cancel e-way bill and generate a new one with accurate facts.

-

How long is the e-way bill good for?

Yes. E-way bills are valid based on goods transit distance. Regular vehicles or transportation modes have a one-day validity for every 100 KMs or part of their journey. Each 20 KMs of transportation for Over Dimensional Cargo trucks is valid for one day. Last day’s midnight ends this validity.

-

Which transactions require e-way bills?

E-way bills are required for all sorts of products transportation, including outward and inbound supply, including from unregistered individuals and for non-supply purposes. Refer to applicable notifications/rules for information. E-way is only necessary for interstate transportations.

-

How do I unblock my e-way bill?

- Visit the EWB portal and choose the option – Search Update Block Status.

- Enter the GSTIN, and CAPTCHA Code and click on – Go.

- Click on – Update Unblock Status from GST Common Portal.

-

Is e-Way bill compulsory for exempted goods?

A company must keep in mind that e-way bills are not necessary for exempted objects.

-

What kinds of papers need to be brought with the things that are being moved?

The individual responsible for the vehicle must have the relevant paperwork on board, including the appropriate bills of supply, delivery challans, bills of entry, and an electronic way bill number obtained from the shared portal.

-

Is e-Way bill required for less than 50 km?

The shortest distance for which an e-way bill is not required is not specific.

-

Who can reject the E-Way Bill and why?

A taxpayer has access to reject the e-way bills generated by other parties on the former’s GSTIN.

-

What is the latest notification for e-way bill 2023?

2023, has changed the standards for E-waybills, lowering the value restriction for shipments to 50,000 INR.