For a more efficient international trade system, properly classifying goods is crucial. Moreover, this classification not only aids identification but also simplifies the customs process. Consequently, the Harmonized System Nomenclature comes into play, serving manufacturers, importers, and exporters for decades.

What is HSN?

The Harmonized System Nomenclature (HSN) code is a standardized system that classifies goods worldwide in a systematic manner. Moreover, it mainly consists of 4 to 6 digits, which remain the same for every good in each country that adopts the system. However, in India, it includes an additional two digits, making it an 8-digit code. Consequently, authorities use it to implement the Goods and Services Tax (GST), determining the applicable tax rate in customs.

The system classifies over 5,000 accepted products worldwide, making it easy to define them in a structured manner. Consequently, it eliminates ambiguity while enhancing international trade between countries. Moreover, in India, the HSN system enables customs officials to determine the applicable tariffs and taxes on imports and exports.

The HSN Code helps businesses and people to:

- Properly classify their products

- Calculate applicable GST rate for their products

- Comply with GST invoicing requirements

Additionally, the globally recognized classification system removes the need for detailed descriptions of goods. Moreover, the 4 to 8-digit codes simplify how businesses and tax authorities identify goods and understand transaction details.

Also Read: What Is An HSN Code?

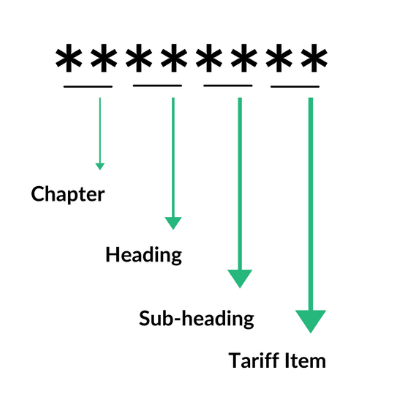

HSN Code Structure

In India, the HSN system includes 21 sections, 99 chapters, 1,244 headings, and 5,244 subheadings. Moreover, these divisions ensure proper classification and detailed categorization of goods. Consequently, the chapters and sections come with titles that detail the categories in which the products belong. The headings and subheadings are used to provide further details.

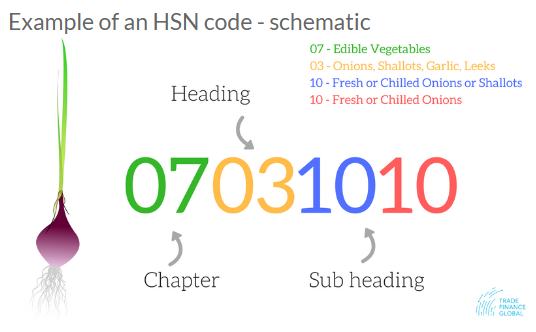

In most cases, the HSN code comprises six digits. The first two digits detail the chapter in which the product belongs. The following two digits detail the headings of the products, while the last two digits detail the product.

For custom purposes, the HSN code comes with 8 digits. The last two digits detail the tariffs for the products for customized purposes.

Example

If you wish to classify a television set, the HSN code would be 85.28.12.11. In this case, the first two digits (85) represent the chapter under which the TV set falls in the HSN system. The following two digits (28) represent the heading under which the product falls, while the next two (12) represent the subheading. Finally, the last two digits in the 8 HSN code will define the tariff heading for custom purposes.

How to Determine the HSN Code for a Product

Search by Product Name

- Step 1: Log in to the GST Portal Home Page.

- Step 2: Navigate to the HSN code in GST Portal homage and sign in with your credentials. Select Services, User Services, and Search HSN from the menu.

- Step 3: Type the product name you wish to get the recommendation of the most relevant 4-digit HSN code.

- Step 4: If the search result does not contain the correct HSN code, click on the 4-digit and 6 codes to get details for export and import purposes.

How to Find HSN Code

Finding the HSN code of a given product is pretty simple, given the vast array of resources available. Some of the ways available include:

Check the product package: All products for distribution or export come with an HSN code. You can always confirm the code by looking at the label or sticker.

Manufacturer’s Website: A manufacturer’s website can also come in handy in confirming the exact HSN code of a product up for sale. A product data sheet on the website can provide all the necessary details.

Government Website: The government website comes with a searchable database that one can use to confirm the HSN codes for all products. The Central Board of Indirect Taxes and Customs updates the websites with all the relevant codes.

Also Read: How Do HSN Codes Work?

HSN Code in Invoices What to Remember

The government requires businesses and individuals to adhere to the following while detailing HSN in Invoices.

- Business’ that earn less than Rs. 1.5 Crores do not have to use HSN codes.

- Business’ that earn more than 1.5 Crores and less than 5 Crores have to use a 2-digit HSN for goods.

- Business’ with a turnover of over Rs. 5 Crores must adopt a 4-digit HSN code.

- Businesses in import and export trade must adopt an 8-digit HSN code

Also Read: What Are The Requirements For Printing HSN Codes On Tax Invoices?

Conclusion

It is vital to assign or identify the correct HSN code of a product when engaging in international trade. In addition, accurate HSN codes simplify the customs process, ensuring proper taxes are billed. Incorrect, HSN code can lead to wrong taxation, leading to penalties and sometimes legal complications.