Harmonized System of Nomenclature (HSN) codes offer a uniform item classification system essential to global trade and business. Adopted by numerous nations globally, these codes enable smooth cross-border communication and product comprehension. The HSN code system was developed to facilitate the classification of goods and make it simpler for businesses, customs officers, and other stakeholders to identify things consistently.

HSN codes provide a standard language for trade, facilitating precise tariff, duty, and regulatory compliance determination. In addition to being essential for quick customs clearance, this standardized coding system is also crucial for statistical analysis, helping governments and organizations learn about trade trends and patterns.

Practical Use of HSN Codes

Besides their usage for the classification of different goods, these codes are also used to determine each product’s tax slabs accurately. The HSN codes in India come under the GST or Goods and Services Tax, which applies to the state and central governments. Moreover, these are also used during the trading process as the traders are interested in understanding the government’s tax on products.

Traders can often refer to the tax data and national HSN codes provided by the government to understand the same. The usage of HSN codes has been in practice since its implementation by the WCO. Almost 200 countries follow these today, and over 98% of products sold worldwide are labeled with HSN codes. Thus, these codes offer uniformity in cross-border trade.

Applying HSN Codes in Transactions

The most important thing to understand is how these HSN codes are used and applied in day-to-day transactions. The first step is to understand the order in which these HSN codes are applied for different products:

- Transaction (cannot specify HSN at this level)

- Ledger

- Ledger group

- Stock item

- Stock group

- Company

Let’s look at how the HSN codes impact the taxation and at what level:

| Business Requirement | Reporting Level |

| When most of the goods have the same tax rate and HSN code |

|

| When a group of items have the same tax rate and HSN code |

|

| When a few items have different tax rates and HSN code |

|

| When want to apply the same tax rate and HSN code for different transaction types |

|

| When want to segregate the purchase or sale of items with the same tax rate and HSN code |

|

| When want to change only the tax rate and not the HSN code during a transaction |

|

Incorporating HSN Codes in Invoices

The government has made it mandatory for taxpayers who fall under a specific aggregate annual turnover to include HSN codes in their invoices. These are necessary at the time of GST filing. Until 31st March 2021, taxpayers with turnovers of less than 1.5 crores were not required to mention the HSN codes. However, the same has been changed from 1st April 2021, and below are the new rules:

- All taxpayers with a turnover of more than INR 5 crores are required to mention 6-digit HSN codes for all their invoices.

- Taxpayers with turnover less than or equal to INR 5 crores must mention the 4-digit HSN code for all their B2B invoices. For B2C invoices, this option is optional for taxpayers.

HSN Codes for Product Categorization

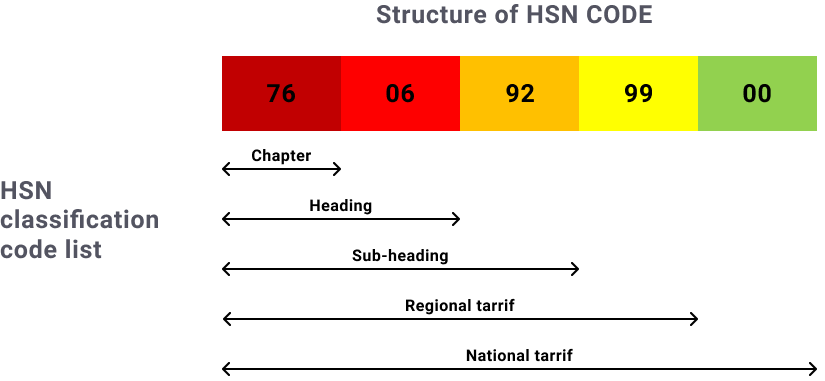

HSN code is either a six or 8-digit number used to classify different products. However, in India, the code consists of 8 digits and can be read as below:

- The first two digits are the chapter.

- The following two digits are referred to as the headings.

- The following two digits are called the subheadings.

- The final two (the extra added ones) are the tariff items.

Utilizing HSN Codes for Taxation

Many often ask why we need HSN codes for taxation, especially for GST purposes. To simplify, the primary purpose of using HSN codes is to make GST globally and systematically accepted worldwide. The government also mandates these HSN codes to save time uploading a detailed description of each product mentioned in the invoice.

Doing so will save taxpayers much time, especially while uploading their GST forms online. So, it is necessary for all taxpayers who fall under the tax slabs mentioned above to mention the HSN codes in their GSTR-1 forms.

HSN Code Implementation in Business

As per GST regulations, the HSN code is mandated in all invoices. Hence, there are a few essential points a business should remember while implementing HSN codes in their business:

-

Including HSN Codes

You must include the HSN code in the GSTR-1 return if you are a goods dealer. It will be a 6-digit code for people with an annual turnover of over five crores. For less than or equal to INR 5 crores, it should be a mandated 4-digit HSN code for all B2B and an optional 4-digit HSN code for all B2C invoices.

-

Time Limit

Businesses are required to mention HSN codes for all outward supplies of goods every month in their GSTR-1 returns. Companies can file for this return by the 11th of the following month for an annual turnover of INR 1.5 crores and by the 13th of the following month if the turnover crosses INR 1.5 crores.

-

Fine and Penalty

Since it is a mandate, fines and penalties are attached if the taxpayer misses. A penalty of INR. Fifty per day (or INR. 20 per day for taxpayers with an annual turnover of INR 1.5 crore) may be imposed for each day of lateness. The penalty can be up to INR 5,000.

-

Benefits

By mentioning HSN codes, they offer a detailed description of their goods. It can assist the government in better analyzing the tax base and evasions. It can also help reduce taxpayers’ compliance burden in the long run.

Final Thought

HSN codes are essential to international trade since they offer a regulated and organized way to classify products. HSN codes provide a global language that crosses boundaries to help businesses handle international commerce. In addition to their valuable uses, these codes help build extensive trade databases that help organizations and governments assess and comprehend economic trends. HSN codes are committed to efficiency, transparency, and cooperation in international trade. They embody a common language that cuts over linguistic and regulatory barriers to promote an interconnected global marketplace.

FAQs

-

What are the conditions for using the HSN code?

All invoices with over INR 5 crore turnover should have a 6-digit HSN code. All B2B invoices with a turnover equal to or less than INR 5 crore must have a 4-digit HSN code.

-

How does the HSN code work?

Over 5000 products are categorized using the six-digit HSN code, which is placed in a logical and legal order. The HSN codes are globally recognized and backed by well-defined regulations to ensure universal classification.

-

Why is there a need for using the HSN code?

Globally, the HSN code is extensively utilized for taxation purposes. Finding the tax rate in any country for a particular product is helpful and easy because of these codes. Businesses can also compute their tax benefits with an HSN code.

-

Can taxpayers edit the HSN code in the GST portal?

Taxpayers must go to the HSN masters part of the GST portal. From there, they can choose the HSN code to be amended and make the necessary changes to the information.

-

Is it a mandate to mention the HSN code in the GST invoice?

Yes, for all taxpayers above INR 5 crores, it is mandated that they mention the HSN code in their GST invoice.

-

What will happen if the taxpayer misses or enters an incorrect HSN code?

Every taxpayer must mention the correct HSN code on tax Invoices and GSTR-1. Failure to mention the HSN code correctly or at all in GST returns and tax Invoices can result in a penalty of INR 50000 (INR 25000 for CGST and INR 25000 for SGST).

-

Can one HSN code have multiple GST rates?

A product’s HSN code is used to calculate the GST rate. Therefore, a single HSN code may not have more than one GST rate.

-

What is the primary objective behind the implementation of the HSN code?

People can use the HSN code to determine how many products are collected in any country. It removes doubt and facilitates accessible business on a national and international level.

-

Can the HSN code be used for services as well as products?

For services, it is not an HSN code but an SAC code. HSN codes are only for products.

-

Can the same HSN code be used for two products?

Yes, the same HSN code can be used for two products.