The introduction of GST laws brought about uniformity and transparency in the indirect taxation system in our country. The composition scheme was introduced to help small businesses with a limited turnover file GST returns without much difficulty. The main benefits of this scheme are reduced tax rates and simpler compliance.

It is mandatory for all taxpayers who have opted for the composition scheme to file GSTR-4 comprising of summarized details of their outward and inward supplies and tax liability. They have to file this return annually as per notification CGST Notification No.21 dated 23rd April 2019. Previously until 2018-19, GSTR 4 return had to be filed quarterly. As per the amendment, CMP-08 has to be filed quarterly and GSTR-4 must be filed annually. Let us understand everything related to the filing of GSTR-4 in detail.

Benefits of GSTR-4 Filing

- Simplified Compliance:

- Lower Tax Rates

- Lesser burden of tax obligations

- Allocate time for Business Growth

- Timely and accurate filing

Important Points to Note While Filing GSTR-4

- The taxpayer must have opted for the composition scheme for any period, even for a single day during the financial year. Only businesses with a turnover of less than 1 crore and 75 lakhs for those residing in Himachal Pradesh and North Easter States, can opt for the composition scheme.

- Those who were registered under the composition scheme during the year and not opted out during the financial year have to file GSTR-4

- Those who were registered under the composition scheme at the beginning of the year and never opted out subsequently also have to file GSTR-4

- One of the significant features of GSTR-4 is that it can be filed annually unlike other GST returns which makes filing easier for small, micro and medium businesses.

- GSTR-4 is a self-declared return and no invoice details are required to be provided, but only a summary of supplies made and tax paid are reflected in the return.

- If the GSTR-4 returns are not filed within the due date, late fees are applicable

- Third party apps or software can be used to file GSTR-4

- GSTR-4 once filed cannot be revised or modified. So, accuracy of information has to be ensured before filing the return. The modifications can to be reflected in the next return.

- Taxpayers must have filed all Form CMP-08 quarterly statements and Taxes paid for the applicable period during the relevant financial year.

- Taxpayers registered under the composition scheme cannot claim input tax credit on their input supplies.

Also Read: Eligibility Criteria for Filing GSTR-4

Late Fees

A late fee of Rs.50/- per day with a maximum limit of Rs.2000/- is levied for late filing of GSTR-4/ For nil return the maximum limit is Rs.500/-

Penalty for Non-Filing of GSTR-4

The penalty for non-filing of GSTR-4 is Rs.100/- per day ( Rs. 50 as SGST and Rs. 50 as CGST) subject to a maximum of Rs.2000/-( Rs. 1000 as SGST and Rs. 1000 as CGST), and maximum is Rs.500/-for Nil returns.

Due Dates for Filing GSTR-4

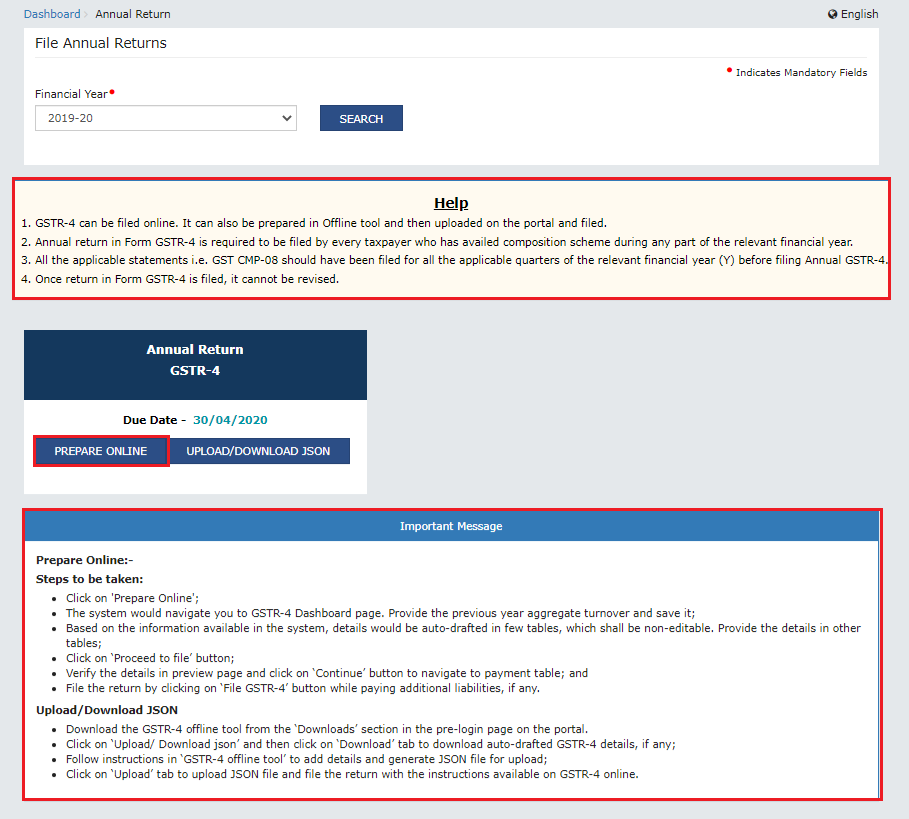

GSTR-4 has to be filed annually and the due date for filing the return is 30th of the month succeeding the financial year. For example, the due date for the tax accrued in the financial year 2022-23, is 30th April 2023.

GSTR-4 Filing Process

The process for taxpayers to file GSTR-4 online is as follows:

Step 1: The taxpayer has to login using their credentials in the GST portal.

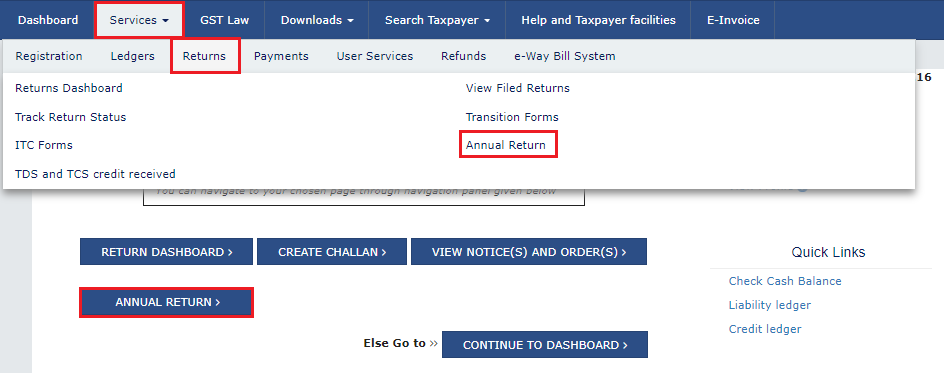

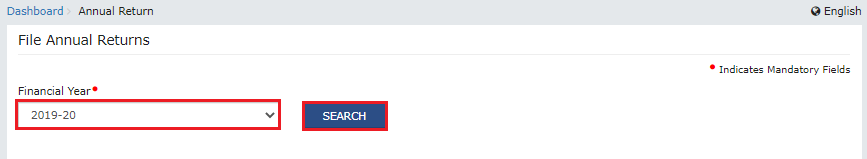

Step 2: They must navigate to the returns dashboard in the services tab and choose GSTR-4 return.

Step 3: The relevant details in various tables must be checked and discrepancies noted.

Step 4: Read the instructions displayed on the page carefully then select the ‘prepare online’ option.

Step 5: Review the updated GSTR-4 by selecting either download GSTR-4 summary in pdf or excel format.

Step 6: After selecting the declaration and authorized signatory checkboxes, click on file GSTR-4 button.

Step 7: A warning message is displayed on the screen. After selecting yes on it, select either ‘file with DSC (Digital Signature Certificate’ or ‘file with EVC ( Electronic Verification Code)’.

After all the steps are completed, the status of the return changes to ‘Filed’, and the taxpayer received the application reference number (ARN) and a confirmation message through SMS or email that is registered in the GST portal.

Read More: Everything You Need to Know About Form GSTR-4: Filing, Due Dates, and More

Frequently Asked Questions

1.Do taxpayers who have opted out of the composition scheme need to file GSTR-4 return?

Answer: Yes, taxpayers who have been a part of the composition scheme during any part of the financial year, even for a day, have to file GSTR-4 return.

2. Where can we view and download the form GSTR-4 already filed?

Answer: After logging in to the GST portal, navigate to Services->Returns->View /Download Filed Returns.

Also Listen: Understanding accounting under GST

Conclusion

Taxpayers who have opted for the composition scheme must file GSTR-4 annually which is a summary return with details of all outward, inward supplies, import of supplies and services attracting reverse charge, and tax liability. Filing GSTR-4 is mandatory and has to be filed within the due date. Late filing or non-filing will attract penalties including late fees, and interest. So it is important for taxpayers registered under the composition scheme to have a thorough knowledge of the filing frequency, due dates and other information required for the filing to avoid complications of non-compliance.