In the ever-changing world of tax compliance, staying up-to-date is essential for your business to stay ahead. Goods and Services Tax (GST) is a remarkable tool; you can stay updated about your tax liabilities, have better transparency, and improve your overall tax journey.

In this blog, we will understand the meaning of GSTR-2B and its purpose.

What is GSTR-2B?

GSTR-2B is an auto-generated input tax credit statement (ITC) introduced recently on the GST portal. It provides eligible and ineligible ITC; it is similar to GSTR-2A but remains unchanged for a period.

To make it simple, whenever a GSTR-2B for a month is opened on the GST portal, the data it contains remains constant without getting changed for the changes made by the suppliers in the coming months.

captainbiz.com/ (FREE DEMO) CLICK HERE!

GSTR-2B is accessible to every normal, SEZ, and casual taxpayer, and every user can generate it based on the GSTR-1, GSTR-5, and GSTR-6 provided by their suppliers.

The statement provides all the details about ITC eligibility, and the ITC information gets covered from the filing date of GSTR-1 for the preceding month (M-1) until the filing date of GSTR-1 for the current month (M).

Read more: Benefits and Limitations of using GSTR- 2B

Purpose and Features of GSTR- 2B

Remains Unchanged

The documents filed by the suppliers in their respective returns become available in the next GSTR 2B of the recipient without considering the filing date. For example, GSTR 2B generated for July 2020 will have the documents filed by the suppliers from 12 a.m. on July 12, 2020, up to 11:59 p.m. on August 11, 2020. The statement from July 2020 will be generated on August 12, 2020, and you can avail of the input tax credit in the following month.

Information about Imports

GSTR 2B includes information related to imports given by the units of Special Economic Zones and Customs.

Segregation of ITC

Input Tax Credit is divided into two parts: ‘available’ and ‘not available’, and the documents available on the ‘ITC available’ tab automatically reflect in GSTR 3B. But it is important to note that ITC may not be available for the taxpayers to claim if it is void or where IGST has been incorrectly charged for the intra-state supply of goods. For instance, the supply and state of the supplier are the same, but the recipient of the goods is from another state.

Provides Detailed Information

GSTR 2B provides all the information about the suppliers and taxpayers who can view or download each invoice, debit note, and credit note. Moreover, you can also select to view supplier-wise details for each month.

Maximum Convenience

GSTR 2B provides many features to make the process more convenient. You can view and save it to your devices in PDF or Excel format. And apart from the search option, you can also sort, filter, or hide data as per your requirements. Every month, you receive an SMS or an e-mail that informs you of the generation of auto-populated statements.

View Advisory

You can find the ‘View Advisory’ option in each section of the return and get all the clarity in this tab regarding the action required to be taken in the particular area of this return.

How to View and Download GSTR 2B

You can view and save the statement on your devices from the GST portal by following the steps:

Step 1: Open the official website of the GST Portal

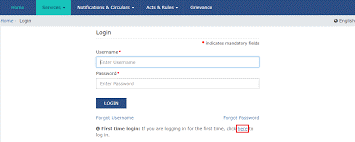

Step 2: Enter your credentials and captcha code in the GST portal.

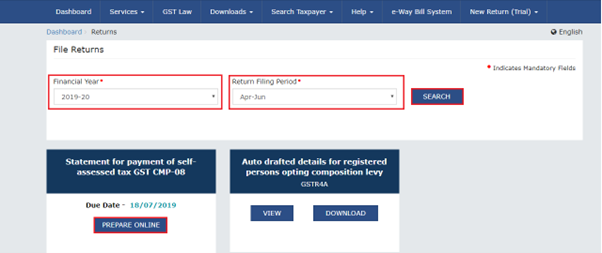

Step 3: Look for ‘Services’ and click the ‘Returns Dashboard’ option under the ‘Returns’ option.

Step 4: Select the appropriate tax period.

Step 5: Select the month and year accordingly.

Step 6: Click on GSTR 2B

Step 7: Click on the ‘download’ option to download the statement, and you can save it in your system and access it even offline.

Related read: GSTR-2A and GSTR-2B: A Guide for Taxpayers

The Bottom Line

GSTR-2B plays a crucial role in the Goods and Services Tax (GST) era by providing the business with a comprehensive and reliable summary of its supplies and allowing you to make better decisions and improve your day-to-day business operations.

Are you struggling with complex invoicing procedures, inventory management, and ever-changing GST compliance? CaptainBiz is the ultimate GST billing software that helps you with simple invoicing, real-time inventory management, and cost reduction, which allows you to grow your business seamlessly.

Frequently Asked Questions (FAQs)

1. What is the difference between GSTR-2A and 2B?

The GSTR 2A is a dynamic statement that updates whenever a taxpayer’s supplier files their GST return for outward supplies. While GSTR 2B is a static statement containing all the input tax credit details for a specific return period,.

2. What is the purpose of GSTR-2B?

Taxpayers must use Form GSTR-2B to ensure they get the proper input tax credit (ITC) on the specific sections of Form GSTR- 3B.