The Goods and Services Tax Network is one of India’s most elaborate and mother databases of everything related to Goods and Services Tax. Operating as a nonprofit, the organization manages the entire IT system and collects appropriate taxes on goods and services levied in the country. The government relies on the network to track taxpayers’ financial transactions, from the registration process to filing all records.

The GST network doubles up as a front end of the IT ecosystem connecting the government and business taxpayers. The network handles over 2 billion monthly invoices and returns for over 65 lakh taxpayers.

The complex IT infrastructure offers a uniform interface for taxpayer’s central and state governments. It includes a registration front end whereby people and businesses register for tax purposes. Consequently, it issues GST Identification Numbers to respective taxpayers and files information with the tax authorities.

It also contains a Returns section whereby people and businesses file the necessary taxes depending on the goods they transact and services rendered. The network has a processing and forwarding front end that returns taxes to the central and state governments.

In addition, the GSTN enhances the tallying of the purchase invoice with the sale invoice to check for any mismatches. It also fixes them, thus ensuring taxpayers can enjoy Input Tax credit benefits. Finally, there is a payment segment where all the necessary payments are made.

GSTN Unique Features

While private players own 51% of GSTN and the government the remaining 49%, it has unique features that make it stand out.

-

National Information Utility

The GSTN network serves as a trusted national information utility, ensuring a reliable, robust, and seamless IT infrastructure for taxpayers. It also facilitates smooth information exchange and assurance between the network and taxpayers.

-

Facilitating Complex Operations

Authorities established GSTN to simplify taxpayer registration, tax payments, and GST return claims. In addition, it has evolved to enable complex business analytics while calculating and settling Integrated GST with Input Tax credit. Therefore, its primary goal is to power solutions to complex and exhaustive taxation requirements.

-

Information Security

GSTN is solely responsible for ensuring the protection and security of taxpayers’ data. As one of the shareholders, the government ensures the security of all the information taxpayers provide. It does so by guaranteeing the composition of the board and agreements made with other state governments.

-

Seamless Payment

GSTN provides taxpayers with online and offline methods to ensure seamless payment on all tax requirements. Taxpayers make online payments through internet banking via approved agency banks. The network has also made provisions for offline patents via over-the-counter payments.

What Is GSTR-1?

Every taxpayer registered on the GST portal must file tax returns monthly or quarterly. GSTR-1 is the filling that summarizes all the sales of outward supplies that taxpayers make monthly or quarterly. The filing contains details of all transacted goods, including the legal and trade names and the aggregate turnover.

The due date of GSTR-1 filling depends on the aggregate turnover of the goods transacted. For instance, businesses that handle sales worth up to Rs. 5 crore have to make filings every quarter, due on the 13th of the month of the respective quarter.

While every registered person must file GSTR-1, there is a provision or facility to file nil returns if no transaction occurs during the accounting period. The only persons exempted from making GSTR-1 returns include:

- Input Service Distributors

- Composition Dealers

- Suppliers of online information and database access or retrieval services

- Non-resident taxable person

- Taxpayer liable to collect TCS

- Taxpayer liable to deduct TDS

GSTN Portal Enhancements for GSTR

Over the past four years, the GSTN portal has undergone various upgrades and changes in the race to improve taxpayers’ experience while filling GSTR-1. The changes have come into being to enhance GST compliance and make the process seamless.

The enhancements that have come into being have made GSTR-1 filling more efficient and user-friendly, allowing the GST to meet its revenue collection goals over the years. Nevertheless, the changes have not in any way changed the functionality and the operations of the GSTN.

In addition, the changes have been made gradually, allowing taxpayers to adapt smoothly and enabling compliance. Gradual enhancements also minimize disruptions to taxpayers.

-

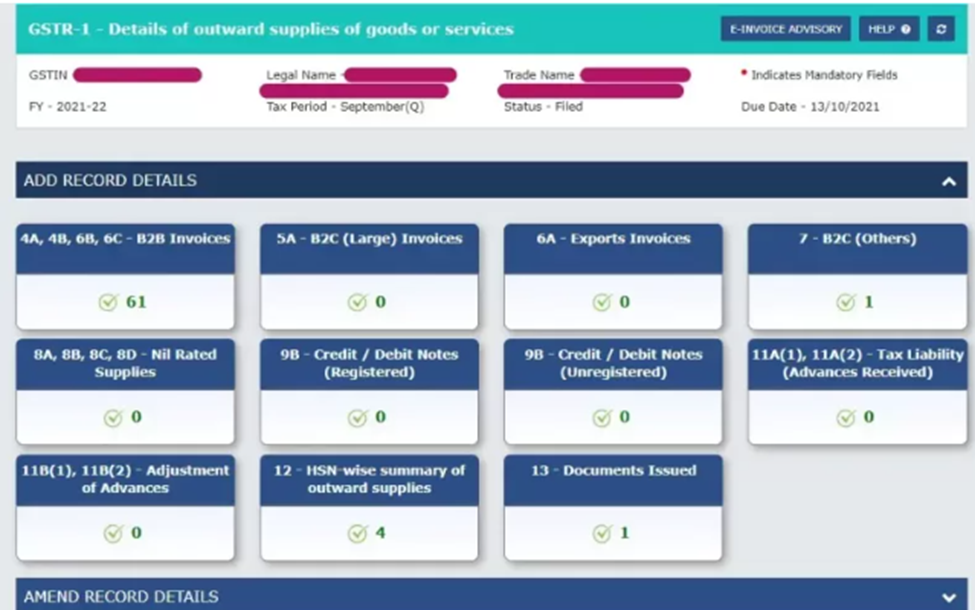

GSTR-1 Dashboard Changes

In 2021, the GSTN carried significant changes on the GSTR-1 dashboard as it sought to enhance how taxpayers navigate the fillings. One of the significant changes entailed the reorganization of the GSTR-1 dashboard with the inclusion of the following:

- Add Record Details

- Amend Record Details

Including the two new features has made it much easier for taxpayers to navigate while looking to add or amend record details in their GSTR-1/ IFF fillings.

Consequently, adding record details in expanded visible form is now more accessible by default. On the other hand, one can amend record details in the collapsed state hidden. Amend record details are collapsed or hidden because taxpayers only amend 1% of their details most of the time.

In addition to including the add record details and amend record details on the GSTR dashboard, there is also an e-invoice section. The section is for selective taxpayers that have an aggregate turnover above a particular threshold.

-

Table/ Tile Document Enhancements

The inclusion of more informative color coding in the GSTR-1 file has also become an effective way of enhancing taxpayers’ experience while filling out the form. GSTN added the count of documents uploaded as one of the ways of making it easier for taxpayers to know the number of documents they have filled out.

Source: taxpowergst

In addition to the numbering, Status, Saved, Pending, and Error columns were added to keep track of all the changes. In case of any pending errors, taxpayers can now keep track with ease of a count of record-enhancing reconciliation.

-

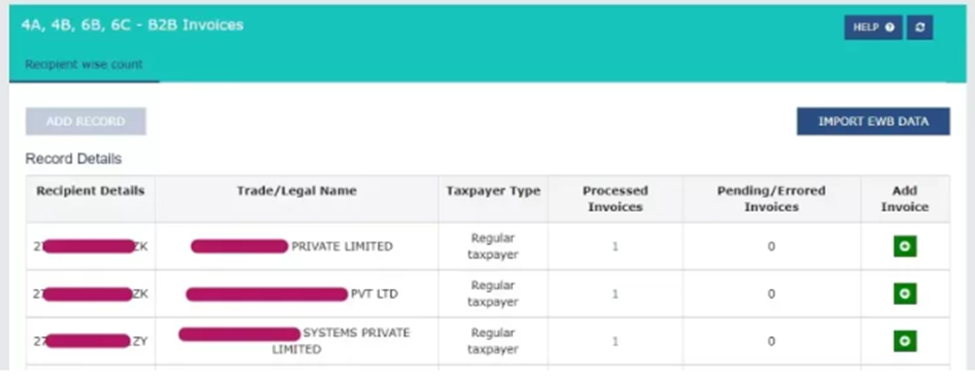

Business-to-Business Filing Enhancement and CDNR Table

Another critical enhancement that has come into being on the GSTN portal for GSTR-1 is the appearance of the recipient-wise count of records.

Taxpayer Type: It’s now possible to see the type of taxpayer making the filing whereby one can differentiate between regular, SEZ, and composition recipient taxpayers.

Source: taxpowergst

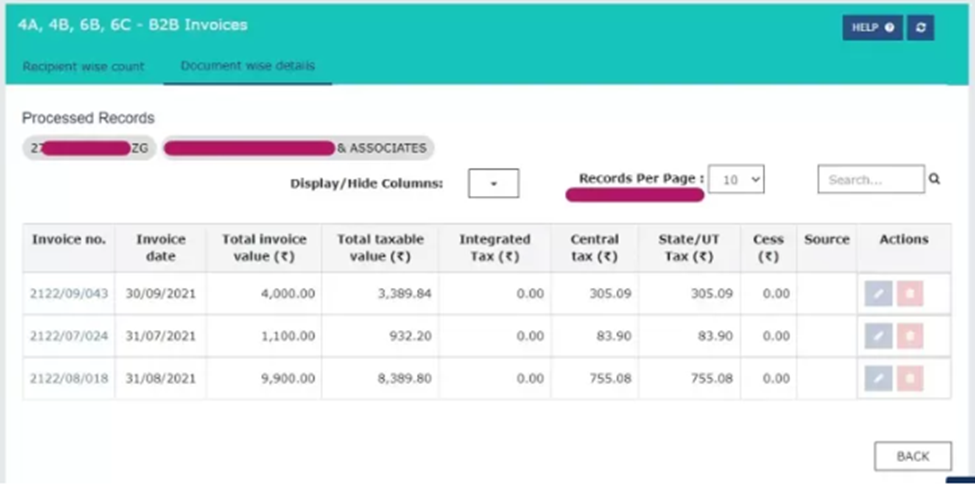

Processed Invoice: With the enhancements in the B2B column, taxpayers can now see the number of processed invoices by clicking a column with a hyperlink. In the column, taxpayers can view all the records added.

Pending/ Error Invoice: It’s a column or portal that details all the invoices with errors that must be rectified before submission to the respective recipients.

Add Invoice: A column tailored to allow taxpayers to add new records for a selected recipient. Clicking the save button opens a new page whereby taxpayers can add multiple records.

Search: the search portal presents an option for searching specific records of particular GSTIN using the utility.

-

Records Per Page Enhancements

Integrating a viewing system on the GSTIN portal is one of the key enhancements that have come into being, therefore enhancing access to GSTR-1. Viewing the record per page in all the tables under the Add Credo Details is now possible.

Additionally, the number of records per page is customizable. While the records per page are set at ten records, it can be increased to 50 records per page.

-

Summary Feature

A new summary feature has also been added to allow taxpayers to view whether they have filled everything and added new records. In this case, the Submit portal will remain disabled until the system generates a summary upon updating the records in case of changes.

The new feature is designed to make it easier for taxpayers to make all the necessary changes and updates and counter-check if everything is in order. The feature seeks to ensure everything is correct before submitting.

Uploading GSTR 1

When uploading the final GSTR-1 file with all the details filled out, a taxpayer must click on the “Generate Summary” button once they save all the records.

The system will then enable the Preview and Submit option. The preview option makes it possible to counter-check everything. Once everything checks out, click the Submit button to send the flea.

Self Service Portal

GSTIN upgraded its Help Desk by introducing a self-service desk that enhances how people raise queries and get responses to them. In the past, taxpayers had to mail their queries to get responses and answers to burning issues.

With the introduction of the Self Service desk, taxpayers have to pen down all their issues and related queries on the platform. In Return, everybody with access to the platform can read and provide the necessary responses to the queries raised.

The Self-Service portal is designed to provide solutions to the GST-related problems that people might have.

Source: Selfservice.gstvsystem

The process is simple, as people only have to visit the Grievance Redressed Portal and raise any concerns they might have

In the portal, people can report an issue or complaint and also check the status of their complaint.

Enhancement of the Registration Module

In 2023, some changes that have come into being on the GSTIN touch on the registration process. The following changes have been made to the registration portal.

- It’s now possible to generate colored registration certificates Reg. The colored certificate applies to all types of taxpayers except GSTP.

- It’s mandatory to mention jurisdiction details in the track application status.

- Taxpayers can also download the latest registration certificate by clicking on the My Registration Certificate under profile and Taxpayer Profile 360.

Conclusion

Officials at GSTIN and GST are constantly looking for the hardships taxpayers face while trying to file their tax returns on the GST portal. Consequently, they are continually upgrading and updating the GSTIN framework to improve the compliance framework. The framework has given rise to new features and tools on the GST portal, streamlining the GSTR-1 filling process.

Also Listen: CaptainBiz Account Main Sales Invoice Banane ki Process

Frequently Asked Questions

1. What is GSTN?

It is a nonprofit non-government corporation tasked with providing the IT system that oversees the Goods and Service Styx Portal. It is promoted jointly by the Central and State Governments to provide shared IT infrastructure and services to both central and state governments.

2. Why Was GSTN Created?

The corporation created a network to ensure the efficient and effective implementation, regulation, and administration of GST. Consequently, it designed the network as the front-end service for registration, returns, and payments. It also strives to provide an interface between the government and taxpayers while providing back-end services to tax officers.

3. What are the services offered by GSTN?

GSTN renders the registration of new taxpayers and updates the details of existing taxpayers. It also handles payment management by providing payment gateways and integration of banking systems. Nevertheless, its primary goal is to make return filling and processing.

4. What is GSTR-1 Filing?

It is a statement that details supplies filed by all the normal & casual taxpayers on a monthly or quarterly basis. Taxpayers must provide details of all the monthly or quarterly sales in this Return.

5. Who must File GSTR-1?

All taxpayers registered in the GST portal must file GSTR-1 monthly or quarterly. There is a penalty of Rs. 200 per day for taxpayers who delay filing. Nevertheless, taxpayers under the Composition Scheme & Input Service Distributors are exempt.

6. What is the role of tax officers regarding the GST system being developed by GSTN?

The tax officers rely on the information shared in the GST portal to reject and approve the enrollment of taxpayers. They also carry out tax administration, including audit refunds and investigations. In addition, they listen to taxpayer feedback and push for necessary changes that enhance how people file their returns on the portal.

7. Does GSTN provide mobile-based apps to view ledgers and other accounts?

Yes, one of the latest enhancements includes adding mobile app support that enhances how people make fillings using their handheld devices. It’s become increasingly possible to see ledgers like cash ledger, liability ledger, and ITC ledger on mobile phones using compatible browsers.

8. Why does the GST portal undergo changes and updates?

GSTN constantly updates the portal with new features and tools to enhance taxpayers’ filing experience. By making the GST portal user-friendly, GSTN seeks to improve compliance to achieve revenue generation targets on GST.