Finance Minister Nirmala Sitharaman presented the Interim Budget for 2025-26 in the Parliament on February 1, 2025. Developing infrastructure, increasing agriculture, encouraging green growth, improving the railway industry, and empowering youth and women were the main goals of the 2025 Interim Budget.

No significant tax announcements were proposed, and only a few necessary proposals concerning GST were introduced.

What are GST Rates in India?

Several Goods and Services Tax (GST) rates are defined to enhance trust and transparency between sellers and customers in the taxation process. Each GST slab consists of various categories of items based on particular parameters.

The GST Council decides the GST rate slabs. Since the Goods and Services Tax (GST) was established, there have been multiple revisions to the GST rates for different products. In general, the GST rates are very high for luxuries and relatively low for necessities.

Additionally, those subject to the composition tax are required to pay GST at lesser or nominal rates, such as 1.5%, 5%, or 6% of their revenue. Under GST, TDS and TCS also exist, with rates of 2% and 1%, respectively.

The GST law also imposes a cess on selling several goods, including cigarettes, tobacco, aerated water, gasoline, and motor vehicles, in addition to the preceding GST rates, ranging from 1% to 204%.

Manage the Latest GST Updates & Your Invoices with Ease. Try Our Software Free!

Also Read: How GST Rates Could Impact Your Business Strategy

Highlights from the 52nd GST Council Meeting

Here are the highlights of the 52nd GST Council Meeting:

- A GST Amnesty Scheme will extend appeal filing time until January 31, 2025, compared to the three months under the statute for all orders granted until March 2023. A 12.5% tax pre-deposit of 2.5% is paid in cash.

- CGST Section 159 will be changed. After one year, all provisionally attached property will be automatically restored.

- It is also stated that no GST will be levied on personal guarantees supplied by directors to the bank for loans or credit limits sanctioned to the company.

- The GST Council has given states the right to tax Neutral Alcohol (ENA) found in alcoholic beverages for human use.

- The taxable value of a corporate guarantee between related parties (a holding company and a subsidiary) is 1% of the promised amount or the actual compensation.

Also Read: 52nd GST Council Meeting Update: Key Highlights and Decisions

Highlights from the 51st GST Council Meeting

The following are the highlights of the 51st GST Council Meeting:

- The supply of online gaming and actionable claims in casinos is valued based on the amount deposited/payable to/paid with the provider by the player rather than the whole value of a single bet placed. As a result, the sum entered into the games or bets from the previous games’ winnings will be deducted from the total value.

- The 28 percent GST charged on the face value will remain unchanged, regardless of whether it is a skill game.

- The Integrated Goods and Services Tax Act 2017 (including Schedule III of the CGST Act 2017) and the Central Goods and Services Act 2017 will clarify the tax levied on casinos, horse racing, and online gambling supplies.

- The CGST Rules of 2017 are to be revised to incorporate specific rules for valuing online gaming supply and the supply of actionable claims in casinos.

- The GST Council will meet again six months after implementation to assess the situation.

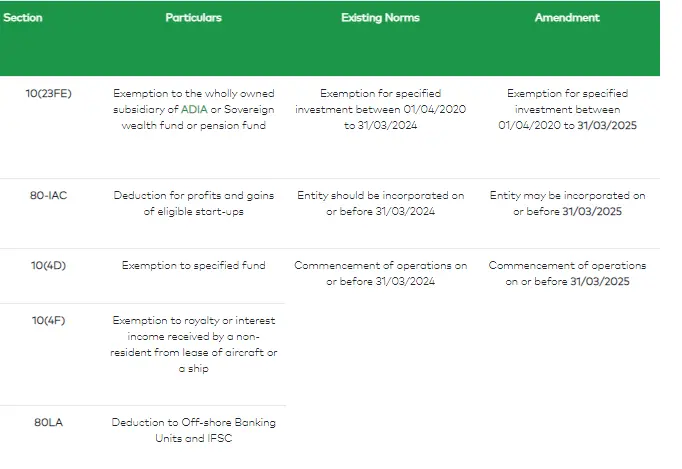

A roundup of crucial alterations is included in the Finance Act of 2025

The Finance Act 2025, which took effect on February 15, includes updates to the Central Goods and Services Tax Act, 2017 (CGST Act) regarding input service distributors (ISD), some changes to income-tax provisions, and penalties for failing to register specific machinery used in manufacturing under special procedures. The Act focuses on compliance, defines tax rates, and strengthens rules to streamline tax administration and improve corporate activities.

For the distribution of input tax credits (ITC), the input service distributor system is now mandatory. This requirement involves the buying of standard services for branches or distinct individuals so that they can obtain ITC, which can then be awarded to multiple branches or enterprises using the same permanent account number (PAN). This makes it easy to assign credits for services such as approved consulting, security, or protection, which are accessible at the same time but used in different subdivisions.

Another notable change in the Finance Act 2025 is the inclusion of Reverse Charge Mechanism (RCM) invoices in clause (61) of Section 2, which was not previously permitted. This change requires the inclusion of RCM invoices in the ISD system for the distribution of ITC from the Head Office to branches only.

Following this change, any tax paid by an ISD under RCM can only be transferred to branches in accordance with ISD rules; no other methods, such as cross charges, are permitted. This regulatory amendment aims to provide consistency in ISD-related compliance across all taxpayers.

The Finance Act 2025 also includes a new section, 122A, which establishes fines for failing to register specific devices used in the creation of commodities. This particular method, notified under Section 148 of the CGST Act of 2017, applies only to tobacco, pan-masala, and comparable items.

Manage the Latest GST Updates & Your Invoices with Ease. Try Our Software Free!

What is the Finance Act of 2025?

The Finance Act of 2025 proposes to alter certain enactments, provide exceptional help to taxpayers, and retain current income tax rates for fiscal year 25. The Act provides a detailed roadmap for the government’s desired allocation of financial resources and simplifies the country’s tax regulations.

These changes affect a variety of current laws governing various taxes in the country, including the Income Tax Law, the Stamp Act, and the Money Laundering Law. The Act also implements significant elements from the Union Budget 2025.

INDIRECT TAXES

Amendment to Section 2 of the Central Goods and Services Tax (CGST)

The Central Goods and Services Tax Act, 2017 (from this point on referred to as the Central Goods and Services Tax Act), in section 2, for clause (61), An office of the supplier of goods or services or both that receives tax bills towards the receipt of input services is considered a “Input Service Distributor” under the new definition: “(61)” , including invoices in respect of services liable to tax under sub-section (3) or sub-section (4) of section 9, f.

Amendment to the manner in which the ISD distributes ITC (Section 20 of the CGST Act)

“20 (1) In order to distribute the input tax credit for invoices that are subject to tax under subsections (3) and (4) of section 9 and for individuals mentioned in section 25, any supplier’s office that receives tax invoices for input services, including those for services that are taxable under those sections, must register as an Input Service Distributor under clause (viii) of section 24.

(2) The credit of central or integrated tax that has been charged to invoices received by the input service distributor, as well as the credit of central or integrated tax for services that are subject to tax under subsection (3) or subsection (4) of section 9, must be distributed by the input service distributor in a timely manner and subject to any restrictions or conditions that may be prescribed.

(3) The credit of central tax shall be given as central tax or integrated tax, and integrated tax as integrated tax or central tax, by issuing a document specifying the amount of input tax credit in the manner authorized.”

Also Read: Updates in Indirect Tax – Interim Budget 2024

Section 122A: Penalties and Registration Procedures for Specific Machines

Section 122A has been inserted to address the penalty for failing to register specific machinery used to manufacture specified commodities, as notified under Section 148 of the CGST Act of 2017.

The text of proposed new section 122A provides as follows:

“122A. (1) Irrespective of any other provision of this Chapter, a manufacturer of goods for which a special procedure pertaining to machine registration has been announced under section 148 is also liable to pay a fine of INR 100 in addition to any penalties paid or payable under Chapter XV or any other provision of this Chapter if he acts in violation of the said special procedure.”

(2) In addition to the penalty under subsection (1), any machine that is not so registered is subject to seizure and confiscation.

Provided that such machine shall not be confiscated where,

- The penalty is paid, and

- The machine is registered within three days of receiving the penalty order, following specified procedures.

What is Section 148?

Section 148 of India’s CGST Act 2017 specifies unique rules for specific processes. As a result, based on the Council’s advice and subject to any circumstances and safeguards prescribed, government agencies may notify particular categories of individuals who are registered and the special procedures to be followed by such persons, including those pertaining to registration, return filing, tax payment, and administration of such persons.

Who Is The GST Council?

GST implementation in India is overseen by the GST Council of India. Working together as a group, members of the Council ensure that the country’s goods and services tax is well implemented.

They determine the rates of taxes and their imposition on items. In order to make changes, the GST Council consolidated proposals and rules into one document before sending notifications and circulars to departments under it as well as to finance ministry.

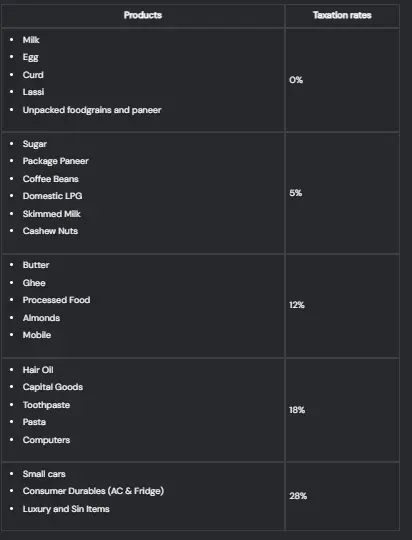

What are GST slabs?

These are just the tax brackets you will use when computing your GST. The new rates for GST are 5%, 12%, 18% and 28%. This is how it would work for everyday products:

How does it affect the new increase or decrease in GST rate?

For most goods and services bought by consumers today, higher taxes would have to be paid. Many of our daily purchases come with no change or slightly increased tax incidence on them. Also, in which people need to pay a fee, compliance is driven by charging amounts required for meeting requirements.

It seems that these small-scale producers and traders who have also objected may not be able to afford this. They might charge more for their goods.

GST will therefore in the long term, do much more than just lower taxes but also set up minimum tax rates. It means countries whose economies are changing under Goods and Services Tax have only two or three tax rates. One is a “median” rate with lower rates on essential items and high charges on luxurious products.

In India, there exists five different types of slabs, each having its own unique new GST rate at time. There are three rates; central, integrated and state. Each has its own rules. Besides, there’s an imposition of tax as well. This government does not want to take chances of losing money by reducing interest rates.

As such, designing tax slabs and changing GST rates frequently would fail to curb inflation since taxation will play a crucial role in shaping the economy. Thus, it is likely to last for some years ahead.

With the increased number of people it could reach, the government is more likely to get more taxes. The government would as well keep its fiscal deficit in check. Increase in FDI and exports will also increase. Most business leaders feel that this is the greatest tax reform ever made in Indian history.

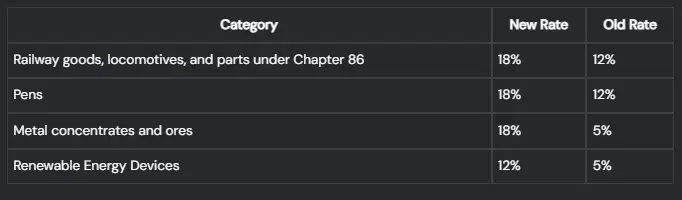

Revision of New GST Rates Announced at 45th GST Council Meeting

It is called 45th meeting because it was the 45th GST Council meeting held on September 17, 2021. Taxes rates have changed for several groups. The date for change in GST rates has been announced as October 1, 2021. Some aspects of such changes are indicated in the table below.

Wrapping It Up

To stay current on the latest developments and changes to Goods and Services Tax (GST) scheme across India, individuals and firms need to be aware of these significant matters concerning them. Other amendments and improvements are simplified compliance processes, revised tax rates as we move into the year 2025 that may be worth mentioning include new reporting obligations among others.

Compliance and competitiveness in today’s business demands that companies are proactive in addressing them. To help deal with the changing GST system successfully, taxpayers should keep themselves updated on current happenings and optimize available resources. If we want to be able to cope with the rapidly changing world of GST rules, we must be constantly vigilant.

FAQs

-

What exactly is the new Rule 37 of the GST?

Rule 37A of the GST Act also gives a relief for buyers who failed to collect their ITC genuinely because of the mistake of the seller.

-

Will the GST be refunded?

Moreover, this Act allows a preliminary return amounting to 90% of the total refund claim if it relates to a refund arising out of zero-rated supplies.

-

What is the 104th Amendment Act?

The 104th Constitutional Amendment Act scrapped Anglo-Indian seat reservations in Lok Sabha and State Legislative Assembly while extending SC/ST reservations by another decennium.

-

Is the GST on gold refundable?

It is possible to obtain a refund of GST if gold jewelry has been dispatched or obtained for exportation or manufacture.

-

How much is the GST on gold?

Currently, gold and jewellery made from it attract 3% GST.

-

Is it mandatory to declare turnover in GST?

According to the legislation, the provider must register if his turnover hits 20 lakhs and begin paying taxes from that time.

-

Can an individual get ITC without GST registration?

Without registration, a person cannot collect tax from his customers or claim an input tax credit for taxes paid by him.

-

What happens if you do not pay GST?

An offender who fails to pay tax or makes short payments is required to pay a penalty of 10% of the tax amount owed, with a minimum of Rs. 10,000.

-

Is VAT subtracted after GST?

The Goods and Services Tax (GST), which replaced Central and State indirect taxes such as VAT, excise duty, and service tax, was implemented on July 1, 2017.

-

Can I return sales under GST after 180 days?

According to the new Rule 37, the assessee is required to pay the amount when filing the return in Form GSTR-3B for the tax period that follows the 180-day period from the invoice issuing date.