Table of Contents

Excel Mastery: Crafting The Perfect GST Tax Invoice Format For Your Business

The GST Invoice solidifies financial transparency and compliance more than anything else. Our advanced solution will raise the bar in invoicing, modernizing your financial procedures, and taking your business to new heights of operational efficiency. There is the GST Bill, not a mere piece of paper but an expression in ink and figures. Our user-friendly interface means that you can easily create and manage your GST invoices format, so all the effort is gone into growing your business. A GST Bill customized to meet the demands of modern enterprises our invoicing makes a seamless transition. We cover everything from a detailed breakdown of the tax system to real-time compliance queries. It’s not just an invoice; it’s your key to hassle-free, compliant, and effective financial management.

GST Invoice

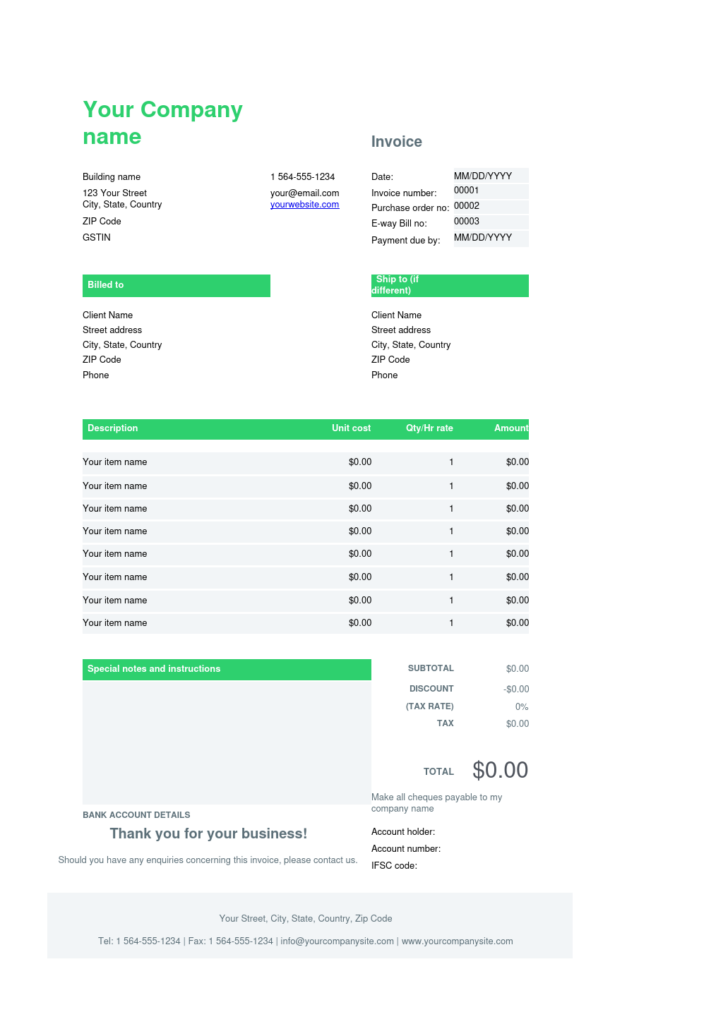

A GST invoice is an important piece of paperwork for the world of commercial transactions. It’s a legal record that shows that goods or services are provided and indicates in turn what kind of taxes apply. Under Goods and Services Tax, a tax invoice becomes a GST bill that expresses the concepts embodied in its system. The GST bill is an instrument that specifics a deal offering transparency and adherence to the taxation regime. GST bill format is more look alike Tax Invoice Format. The key points include the name and address of parties buying and selling, unique invoice number, date of issuance, complete description with quantities indicated for goods or services supplied including the total amount due; and applicable taxes to be included. The GST bill has several features that make it all the more unique. For one thing, its structure is directly based on the GST framework itself–the regulations in this area state clearly which taxes CGST and SGSC or IGST are depending upon how each transaction takes place.

Also Read: How To Create A Tax Invoice That Is Compliant With The GST Laws?

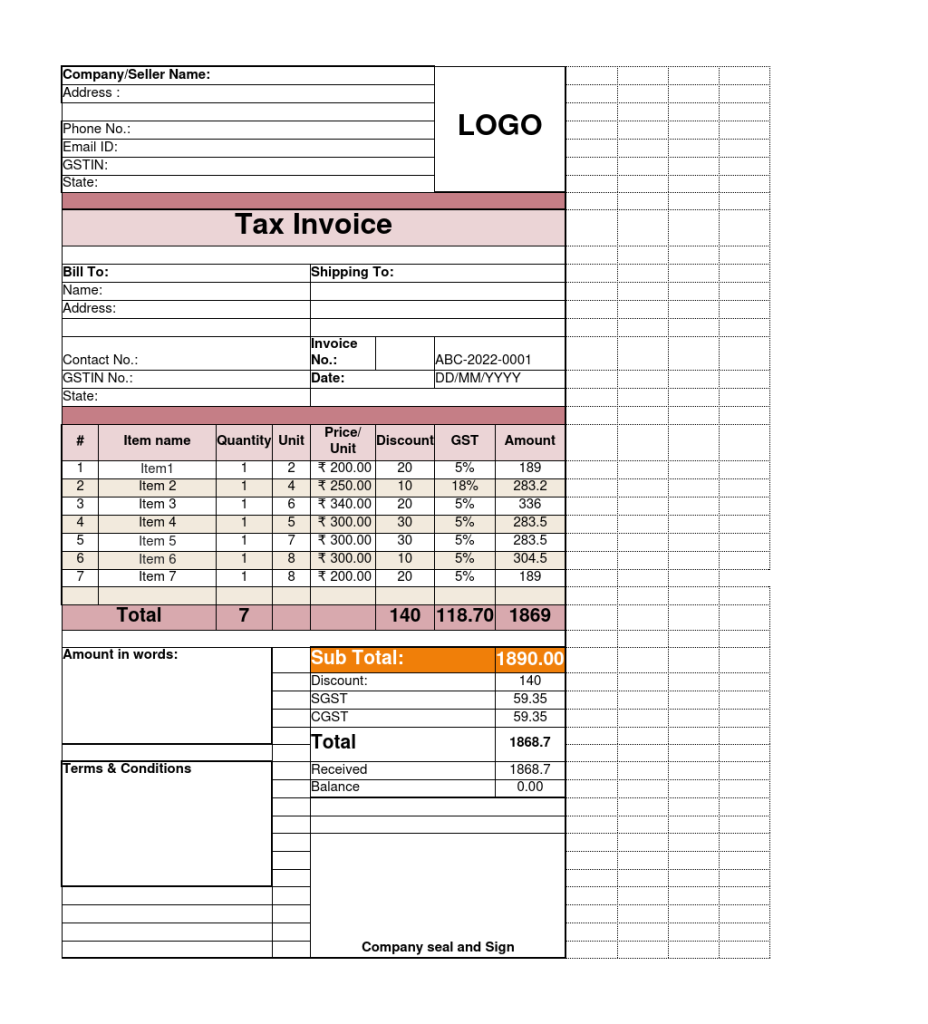

GST Invoice Format in Excel

Making a GST invoice for Excel, meanwhile, is child’s play; it represents an equally convenient way to automate your accounting while playing by the taxman’s rules.

Steps to generate professional and accurate GST invoices

Step 1: Set Up Your Invoice Template in Excel

Open Excel and create a new spreadsheet. Design your template with clear sections for essential information such as:

- Your business name and logo

- Invoice number and date

- Customer details

- Description of goods or services

- Quantity, rate, and total amount

- GST (CGST, SGCT or IGST) details

- Total

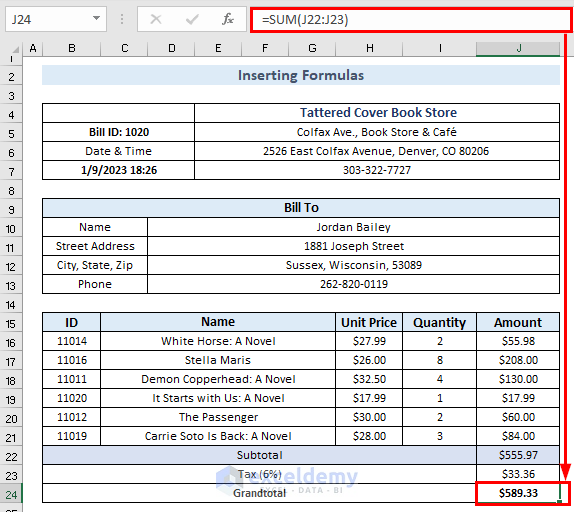

Step 2: Incorporate Formulas for Automatic Calculations

Excel is great for automating calculations. Automatically calculate the subtotal, GST amounts and final total using formulas. This not only saves time but also reduces the chance of an error.

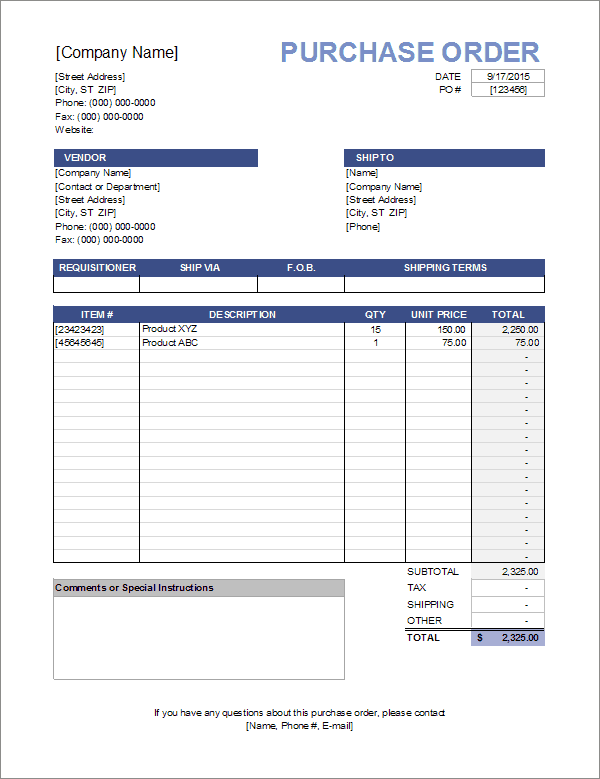

Step 3: Add a professional touch with formatting.

Help your invoice stand out by formatting cells and text. Select a font that is easy to read, use bold for headings and put borders between sections. This makes your invoice look neat and helps with readability.

Step 4: Include GST Details

In order to follow GST rules, clearly specify the details of each transaction’s GST. According to business location and customer’s address, differentiate between CGST, SGST & IGST. This transparency leads to greater accuracy, and earns more trust.

Step 5: Save and Send

After you’ve finished your GST invoice, save it in a safe place on your computer. Or you could try using cloud storage for easy access. After compilation, you can send the invoice to your customer by email or print it out for more traditional records.

Bonus Tip: Use Excel Templates for Efficiency

If you find yourself preparing similar invoices repeatedly, it might be convenient to save a template. This lets you use a per-populated invoice, doing away with retyping time and eliminating spurious variations between transactions.

Excel is the friend of all those who need high-quality GST-compliant invoices. Following these steps will streamline your invoicing process and also present a neat, clean front to clients.

Also Read: Billing Innovation: Transform Your Invoices with Our GST Format in Word and Excel

Features of GST Invoice in Excel

-

User-Friendly Interface:

Minimalism at its best, our GST Invoice in Excel. An interface easy to use by anyone. No more tangled spreadsheets, and no need for complex software either!

-

Effortless Data Entry:

No more headaches over manual data entry! Our GST Invoice template in Excel simplifies the process, so you just fill in your information easily. Save time, save errors and concentrate on the important things.

-

Automatic GST Calculations:

No worry about complicated tax math. The heavy lifting is done by our Excel template. With automatic GST calculations, you can enjoy the luxury of being compliant and accurate.

-

Customizable Design:

Make your invoices stand out! The included Excel template features a variety of design options you can customize to fit your brand image. Use professionally crafted, personalized invoices to impress clients with your business style.

-

Real-Time Updates:

Up to date with real-time updates! Keep control over your finances. We guarantee that your financial records will always be accurate and up-to-date, because our GST Invoice in Excel automatically calculates everything. Make informed decisions with confidence!

-

Secure and Reliable:

Enjoy having financial data in safe hands. Our GST Invoice template in Excel emphasizes security, providing a safe environment for you to store your billing information. You concentrate on growing your business, and we take care of the rest.

-

Seamless Integration:

Integrate with ease! Our Excel template integrates perfectly with other accounting programs. Synchronizing financial data is a cinch! Enjoy a smooth workflow that saves time and money.

-

Professional Communication:

Communicate like a professional to impress your clients! Creating neat properly formatted invoices that make your business look good. Using clear, concise and elegant documents to build trust.

Want to upgrade your invoicing? Check out our GST Invoice in Excel and see your billing process transformed. Simplify, streamline and succeed — because your business is worth it.

Benefits of GST Invoice in Excel

-

Efficiency Redefined:

Our GST Invoice in Excel will help you make a quantum leap forward in efficiency as it allows you to automate your billing process. Shrug off burdensome paperwork and enjoy the efficiency of digital invoicing.

-

Error-Free Calculations:

Bid farewell to manual errors! Its Excel template automates GST calculations and ensures that all figures are accurate, and up-to -date with the latest tax regulations. Worry no more about cumbersome tax arithmetic. You’re in business, not a calculator activity service provider.

-

Global Compliance:

Glide through global business complexity with ease. This invoice in Excel is compatible with international tax standards. Whenever you sell products overseas, your choice of the GST Invoice complies effortlessly with International trade requirements.

-

Data-Driven Insights:

Harness the power of data! The Excel template can give you objective indicators of your financial state. Informed decisions, trends identification and confident business solutions.

-

Brand Reinforcement:

Stand out in style! Make your invoices personalized with our Excel template to match your branding. Our professional, polished documents will make a lasting impression on clients and display the ease of doing business with you.

-

Cloud Accessibility:

Anytime, anywhere access your invoicing data. We have also made our GST Invoice available in Excel, which is compatible with the cloud. So you can manage your invoices wherever and whenever you want. Take advantage of cloud convenience and travel the world with your business.

-

Security First:

Peace of mind that your data is safe! Our Excel template places great emphasis on data security, taking strict measures to safeguard your financial information. Focus on growth and innovation, leaving the security of your invoicing data to us.

-

Seamless Integration:

Harmonize your workflow effortlessly! This GST Invoice in Excel syncs effortlessly with different accounting software, making data exchange simple. Our convenient integration features permit users to save time and avoid the hassle of manually transferring data.

Are you ready to revolutionize your invoicing? GST Invoice in Excel is the future of streamlined billing. So go down and start your business moving in a direction of higher productivity, accuracy, and success.

Tax Invoice under GST

Tax Invoice under GST is a type of document that sellers give to their customers when they make a sale of goods or services. For these reasons, and mainly for the sake of complying with GST regulations, it is an important document for both the seller and the buyer.

Here are some key points to understand

-

Identification

The tax invoice must expressly indicate the name of the seller and buyer. This includes both parties ‘names, addresses and GSTIN.

-

Invoice Number and Date

Every tax invoice must bear a unique number and show the date on which it is issued. This also assists in tracing and locating.

-

Description of Goods or Services

It should give an accurate description of the goods or services on offer. They include quantity, unit price and any discounts or taxes.

-

GST Details

The tax invoice must state the applicable GST rate for every item. If a transaction involves CGST (Central GST), then the SGST/UTGST (State/Union Territory GST) or IGST (Integrated GST) should be shown separately where applicable.

-

Total Amount

The invoice should state the total amount payable by the buyer, including all taxes and any other fees.

-

Payment Terms

If there are any special payment terms, then they should be written on the invoice.

-

Place of Supply

In the case of inter-state transactions, in addition to recording the name of the state, the place of supply must also be indicated on the tax invoice.

-

Signature or Digital Signature

The authorized person or a digital signature should be affixed to the tax invoice.

For companies, good maintenance and issue of tax invoices are just the basis on which to seek input tax credits or comply with GST regulations. In the eyes of buyers, a valid tax invoice is necessary for claiming input tax credit and making sure that the taxes paid get recorded properly in GST.

Also Read: Tax Invoice For Goods: Key Components And Legal Requirements

Conclusion

Using our format in Excel for GST invoices, you’ll be able to seek greater efficiency and accuracy in your business dealings. Our invoicing format is easy to use so that you can fill in the details you need without making a lot of effort. Completing this task, your financial record-keeping will be child’s play!

Our Excel format is simple but conforming. It lets you get on with the important business of growing your own. GST tax invoice format in Excel–Switch today to improve your current invoices. Quicken your financial procedures, reinforce accordance and master the GST environment that is changing by the second. Your company truly deserves the best, and our template will bring it to you in the form of that excellence with just a few clicks.

FAQ

-

What is a GST Invoice?

A GST tax invoice is a printed document issued by the seller to the buyer specifying goods or services supplied and the applicable amount of GST. It is an important document for tax compliance, and can also be used as evidence of input tax credit.

-

What about Excel? What is a GST Tax Invoice, and why do we need to keep one?

Excel allows businesses to store and regulate their dealings via the GST tax invoice. Also, Excel provides a format with the structure for recording information like the invoice number and date as well as product details including the amount of GST. Businesses are thus much more easily able to keep their records for taxation.

-

What are the essential components of an Excel GST Tax Invoice?

The key components include:

- Invoice Number

- Invoice Date

- Supplier’s Name and Address

- Buyer’s Name and Address

- The Goods and Services Tax Identification Number (GSTIN).

- Description of goods or services.

- Quantity and Unit

- Rate and Total Amount

- GST Details (CGST/SGST, IGST)

- Total Invoice Amount

-

How can I format the GST Tax Invoice in Excel?

Yes, Excel allows for customization. When preparing the invoice template, you can adjust it to suit your business environment and yet still make sure all necessary GST particulars are included. Also utilize Excels functions, formulae for calculation and cell formatting to give a professional touch.

-

How do I calculate GST in Excel?

The formula in Excel is simple to use for GST calculation.

GST Amount = (Original Amount × Rate of GST) ÷ 100

Original Amount = Invoice Total + GST

-

What are the special requirements of GST authorities for Excel invoices?

No need to fill out a particular form. However according to GST rules, everything needed should be included. The GST rules provide a structure, but there is room for variation.

-

How can I ensure my Excel Tax Invoice conforms to GST regulations?

Familiarize yourself with the latest GST rules and regulations. Listen for amendments or notices from time to time. Make sure your Excel template is up to date with the latest requirements.

-

Are there templates available on the Internet for Excel GST Tax Invoices?

OK, there are a number of Websites where you can get Excel format GST invoice templates. Confirm the template to GST rules for your business and customize it when necessary.

-

How can I prevent getting into trouble with Excel for GST Tax Invoices?

Backups normally, passwords for confidential files and repeated calculations so as not to make errors. You should watch for GST rule changes that could affect your invoice format.

-

Do you need to have someone professionally design Excel GST invoices?

If you don’t know whether GST applies to you, or your template is too difficult, resorting to professional help may be a good solution. Professionals can create a spreadsheet template tailored to your business needs.