The GST rate list is critical for every Indian business and consumer. When the GST Council revises GST rates, it affects specific industries, trade bodies, and end consumers, affecting the economy. Everyone evaluates their position as a result of this development. Our HSN cum GST rates finder assists you in determining the most accurate and current GST rate applicable to the product/service.

In this post, you will learn what a GST rate is and get all the newest details on GST rates in India 2025.

What are the GST rates in India?

Various GST rates have been established to improve transparency and confidence between customers and sellers during the tax procedure. Each of these slabs has several types of goods based on specific parameters.

These rates are set by the GST Council. This Council periodically revises the rate slab for products and services. The GST rates are often high for luxury items and low for necessities. In India, the GST rate for various goods and services is divided into four slabs: 5%, 12%, 18%, and 28%.

Meaning of GST Rates

GST rates are the percentage rates of tax levied on the sale of goods and services under the CGST, SGST, and IGST Acts. A GST-registered business must issue invoices that include GST amounts charged on the value of supplies.

The GST rates for CGST and SGST (for intrastate transactions) are roughly the same. The GST rate in the event of IGST (for inter-state transactions) is approximately the sum of the CGST and SGST rates.

Types of GST Rates and GST Rate Structure in India

The primary GST slabs for each regular taxpayer are now set at 0% (nil-rated), 5%, 12%, 18%, and 28%. There are a few lesser-used GST rates, including 3% and 0.25%.

Furthermore, the composition taxable people must pay GST at lower or nominal rates, such as 1.5%, 5%, or 6% of their sales. TDS and TCS are also part of the GST system, with rates of 2% and 1%, respectively.

These are the total GST rate of IGST for interstate supply or the sum of CGST and SGST for intrastate supply. To calculate the GST amount on a tax invoice, multiply the GST rates by the assessable value of the supply.

Furthermore, the GST law imposes a cess in addition to the above GST rates on the sale of certain commodities such as cigarettes, tobacco, aerated water, gasoline, and motor vehicles, with rates ranging from 1% to 204%.

The following table shows the GST rate structure for some of the most widely used consumable products.

| Tax Rates | ||

| 0% | Milk | Kajal |

| 0% | Eggs | Educational Services |

| 0% | Curd | Health Services |

| 0% | Lassi | Children’s Drawing & Colouring Books |

| 0% | Unpacked Foodgrains | Unbranded Atta |

| 0% | Unpacked Paneer | Unbranded Maida |

| 0% | Gur | Besan |

| 0% | Unbranded Natural Honey | Prasad |

| 0% | Fresh Vegetables | Palmyra Jaggery |

| 0% | Salt | Phool Bhari Jhadoo |

| 5% | Sugar | Packed Paneer |

| 5% | Tea | Coal |

| 5% | Edible Oils | Raisin |

| 5% | Domestic LPG | Roasted Coffee Beans |

| 5% | PDS Kerosene | Skimmed Milk Powder |

| 5% | Cashew Nuts | Footwear (< Rs.500) |

| 5% | Milk Food for Babies | Apparels (< Rs.1000) |

| 5% | Fabric | Coir Mats, Matting & Floor Covering |

| 5% | Spices | Agarbatti |

| 5% | Coal | Mishti/Mithai (Indian Sweets) |

| 5% | Life-saving drugs | Coffee (except instant) |

| 12% | Butter | Computers |

| 12% | Ghee | Processed food |

| 12% | Almonds | Mobiles |

| 12% | Fruit Juice | Preparations of Vegetables, Fruits, Nuts or other parts of Plants including Pickle Murabba, Chutney, Jam, Jelly |

| 12% | Packed Coconut Water | Umbrella |

| 18% | Hair Oil | Capital goods |

| 18% | Toothpaste | Industrial Intermediaries |

| 18% | Soap | Ice-cream |

| 18% | Pasta | Toiletries |

| 18% | Corn Flakes | Computers |

| 18% | Soups | Printers |

| 28% | Small cars (+1% or 3% cess) | High-end motorcycles (+15% cess) |

| 28% | Consumer durables such as AC and fridge | Beedis are NOT included here |

| 28% | Luxury & sin items like BMWs, cigarettes and aerated drinks (+15% cess) |

|

Note: Beginning July 18, 2022, labeled and pre-packaged paneer, buttermilk, and curd will be subject to a 5% GST.

Also Read: Different GST Tax Rates

What are the GST rates in India in 2025?

The year 2025 began with significant increases to GST rates passed during the final week of December 2022. During its meetings, the GST Council also amended the GST rates on some essential commodities for 2022. Some were done to fix the current inverted tax structure, while others were updated for revenue purposes. The sections below provide a summary of changes to GST rates in India, including the new GST rates in 2025.

Also Read: Revision Of GST Rate From 1 Jan 2024

GST Rate Changes at 49th GST Council Meeting

Key GST rate revisions

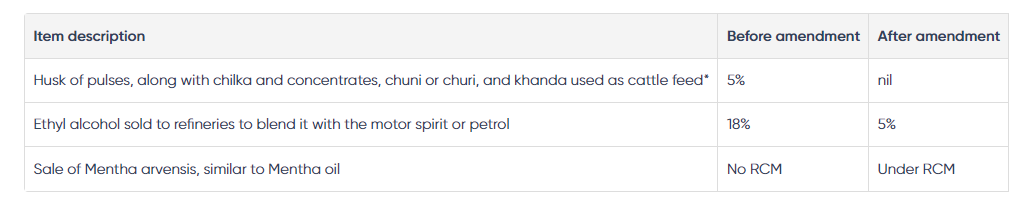

The 49th GST Council meeting took place on February 18, 2023, to consider specific GST rate modifications as follows:

Other important GST rate-related decisions

- Due to scheduling constraints, the issue of MUV classification in accordance with SUVs was not addressed.

- GST on cement was not brought up by the fitment committee for further review; it may be on the agenda for the next Council meeting.

- There has been no agreement achieved on lowering the GST rate for millet-based health goods, and further discussions are required.

- Services such as renting premises for commercial use to local bodies and others given by registrars of courts/tribunals would be subject to GST on reverse charge beginning March 1, 2023, as per CGST (Rate) Notification no. 2/2023 issued February 28, 2023.

Also Read: 49th GST Council Meeting Highlights, Updates, Outcome, and More

GST Rate Changes at 48th GST Council Meeting

At the 48th GST Council meeting held on December 17, 2022, the following amendments were suggested by the GST Council and notified by CBIC to take effect on January 1, 2023.

Clarifications on tax rates for the delivery of goods and services include the following:

- Rab, also known as rab-salawat, is classed under HSN code 1702 and has an 18% GST rate.

- GST at 18% is levied on “fryums” created through extrusion, which are mainly covered under HSN number 19059030.

- The SUV cess of 22% applies if four criteria are met: 5% GST on imported equipment or items in the concessional, 5% GST rate category for petroleum operations, and 12% GST if the general GST rate exceeds 12%.

- No GST is paid if the residential dwelling is rented to a GST-registered person for personal use/account as a residence rather than for business.

- The Central Government provides incentives to banks as a subsidy for the development of RuPay Debit Cards and low-value BHIM-UPI transaction systems, which are not subject to GST.

Also Read: 48th GST Council Meeting Highlights, Updates, Outcome and More

New GST Rate Notifications Issued on July 15, 2025 For Goods & Services July 12, 2025

In New Delhi, the 53rd GST Council convened under the direction of Smt. Nirmala Sitharaman, the Union Minister for Finance and Corporate Affairs. Along with senior officials from the Ministry of Finance & States/UTs, Finance Ministers of States & UTs (with legislature), and the chief ministers of Goa, Meghalaya, Bihar, Haryana, Madhya Pradesh, and Odisha, the meeting was also attended by Union Minister of State for Finance Shri Pankaj Chaudhary.

Changes in IGST Rates for Goods as of the 53rd GST Council Meeting are Notified by CBIC

By the suggestions made at the 53rd GST Council Meeting, the Central Board of Indirect Taxes and Customs (CBIC) published Notification No. 02/2025-Integrated Tax (Rate) on July 12th, 2025. Significant adjustments to the rates of the Goods and Services Tax (GST) on several goods were disclosed in the notification. Reducing taxes on necessities and streamlining the tax code are the main goals of these modifications. These modifications will become operative on July 15, 2025. The new GST rates and their effects are thoroughly examined in this article.

Lowering the GST Rate on Cases, Boxes, and Cartons

A significant modification is the lower GST rate on cases, cartons, and boxes composed of paper or paper board, whether corrugated or not. These products will now be subject to a decreased GST rate of 12%, from their previous 18% tax rate. This modification specifically affects the Harmonised System (HS) codes 4819 10 and 4819 20.

Standardized GST Rate on Milk Cans

All milk cans will henceforth be subject to a flat 12% GST charge, regardless of their usage or the material composition (aluminum, steel, or iron). The affected HS codes are 7612, 7615, 7323, and 7310. This standardization guarantees consistent taxation of all milk cans while streamlining the tax system.

Lower Solar Cooker GST Rate

The GST rate for solar cookers has been lowered, which is another noteworthy modification. Whether they use one or two energy sources, these environmentally friendly kitchen appliances will now be subject to a 12% GST charge. The HS codes 7321 and 8516 are pertinent to this modification.

GST Rate on Brooder Parts

Parts of brooders are subject to a 12% GST charge. For the poultry industry, which depends on brooders and their parts to run efficiently, this move is especially important.

With effect from July 15, 2025, the CBIC’s Notification No. 02/2025-Integrated Tax (Rate) makes several advantageous adjustments to the GST rates on particular commodities. These modifications show the government’s dedication to streamlining the tax code and lowering taxes on necessities. Both companies and customers should benefit from the lower GST rates on cartons, milk cans, solar cookers, and components of brooders.

Other Key Changes Discussed in 53rd GST Council

The following suggestions were made by the GST Council, among other things, about adjustments to the GST tax rates, steps to ease commerce, and steps to simplify GST compliance.

Changes in GST Tax Rates

Recommendations relating to GST rates on Goods

- To support MRO activities, a consistent 5% IGST rate will be applied to imports of “Parts, components, testing equipment, tools, and toolkits of aircraft, irrespective of their HS classification,” subject to certain requirements.

- In light of legitimate interpretational concerns, to make clear that all types of sprinklers, including fire water sprinklers, would be subject to 12% GST and to reinstate the previous practice of treating everything ‘as is, where is’.

- To prolong the five-year, IGST-free import exemption for military forces’ purchases of specific commodities till June 30, 2029.

- To prolong, subject to certain requirements, the IGST exemption on research equipment and buoys imported under the Research Moored Array for African-Asian-Australian Monsoon Analysis and Prediction (RAMA) program.

- To exclude compensation cess from SEZ Units/developers on imports for approved activities starting on July 1, 2017.

- To exclude compensation cessation on permitted customers’ purchases of aerated beverages and energy drinks from Unit Run Canteens under the Ministry of Defence.

- To provide the Indian Defence Forces with an Ad Hoc IGST exemption on the import of technical documents for AK-203 rifle kits.

Recommendations relating to GST rates on services

- To exclude the following services offered by Indian Railways to the general public: the sale of platform tickets; the provision of retiring or waiting rooms; the services of cloakrooms and battery-operated cars; and intra-railway transactions. In this regard, the problem for the previous time shall be regularized from October 20, 2023, until the date of the notice of exemption.

- To exempt Special Purpose Vehicles (SPV) from paying GST on the services they offer to the Indian Railway. This would enable Indian Railway to use infrastructure that SPV developed and held during the concession period, as well as maintenance services that Indian Railways provides to SPV.

- To add a new entry under heading 9963 of notification No. 12/2017-CTR 28.06.2017 to exempt accommodation services in the amount of up to Rs. 20,000/-per person per month, provided that the accommodation service is provided for a minimum of 90 consecutive days. To provide a comparable advantage for earlier situations.

- Under Schedule III of the CGST Act, 2017, co-insurance premiums allocated by the lead insurer to the co-insurer for the supply of insurance services by the lead and co-insurer to the insured may be declared as no supply.

- Under Schedule III of the CGST Act, 2017, transactions involving ceding commissions or reinsurance commissions between insurers and reinsurers may be seen as no supply.

- To make it clear that further incentive sharing by the acquiring bank with other stakeholders is not taxable insofar as it is clearly defined under the Incentive scheme for the promotion of low-value BHIM-UPI transactions and RuPay Debit Cards, and is determined in the manner and proportion determined by NPCI in consultation with the participating banks.

Measures for facilitation of trade

- Insertion of Section 128A in CGST Act, to provide for conditional waiver of interest or penalty or both, relating to demands raised under Section 73, for FY 2017-18 to FY 2019-20: Section 128A of the CGST Act is included to offer a conditional remission of interest, penalty, or both about claims made under Section 73 for the fiscal years 2017–18 through 2019–20.

- The GST Council recommended waiving interest and penalties for demand notices issued under Section 73 of the CGST Act for the fiscal years 2017–18, 2018–19, and 2019–20 in cases where the taxpayer pays the full amount of tax demanded in the notice up until 31.03.2025 in light of the challenges faced by the taxpayers during the early years of the implementation of GST. The claim for incorrect reimbursements is not covered by the waiver. The GST Council has suggested adding Section 128A to the CGST Act, 2017 to carry this out.

- Reducing Government Litigation by Establishing Financial Boundaries for GST appeals: To cut down on government litigation, the Council suggested setting financial thresholds, with few exceptions, for the department to file appeals in GST before the Supreme Court, High Court, and GST Appellate Tribunal. The Council has suggested the following sums of money:

- GSTAT: Rs. 20 Lakhs

- High Court: Rs. 1 crore

- Supreme Court: Rs. 2 crores

- Modifications to CGST Act Sections 107 and 112 to lower the amount of pre-deposit needed to be paid to file an appeal under the GST: The GST Council suggested lowering the pre-deposit amount for submitting appeals under the GST to help taxpayers with cash flow and working capital blockages. 20 crores CGST and 20 crores SGST is the maximum sum that may be submitted with the appellate authority when submitting an appeal, instead of 25 crores CGST and 25 crores SGST.

- Additionally, the pre-deposit amount for filing an appeal with the Appellate Tribunal has been lowered from 20% to 10%, with a maximum of Rs. 20 crores in CGST and Rs. 20 crores in SGST. It was previously 20% with these limits.

- Extra Neutral Alcohol (ENA) is Subject to Goods and Services Tax Applicability Taxation of ENA under GST: During its 52nd meeting, the GST Council made a recommendation to change the GST Law to specifically exclude rectified spirit and extra-neutral alcohol (ENA) from GST when they are used to make alcoholic beverages intended for human use.

- The GST Council has now suggested amending Section 9 of the CGST Act, 2017 to remove the provision allowing GST to be applied on extra-neutral alcohol used in the production of alcoholic beverages intended for human use.

- A decrease in the amount of TCS that the ECOs will get for products purchased from them: Section 52(1) of the CGST Act mandates that Electronic Commerce Operators (ECOs) collect Tax Collected at Source (TCS) on net taxable supplies. To lessen the financial burden on the suppliers making supply through such ECOs, the GST Council has suggested lowering the TCS rate from the current 1% (0.5% CGST + 0.5% SGST/UTGST, or 1% IGST) to 0.5% (0.25% CGST + 0.25% SGST/UTGST, or 0.5% IGST).

- The GST Council suggested modifying Section 112 of the CGST Act, 2017 to extend the three-month window for submitting appeals to the GST Appellate Tribunal to begin on a date to be announced by the government for appeal/revision orders granted before the date of said notification. This will provide the taxpayers enough time to launch an appeal in the ongoing proceedings before the Appellate Tribunal.

- Reduction in the requirements of CGST Act section 16(4): The GST Council suggested that the deadline for obtaining input tax credit under Section 16(4) of the CGST Act for any invoice or debit note may be regarded to be November 30, 2021, provided that the return in FORM GSTR 3B is filed by that date for the fiscal years 2017–18, 2018–19, 2019–20, and 2020–21. The Council has proposed a necessary change to section 16(4) of the CGST Act, which would take effect retroactively on July 1, 2017.

- Concerning situations in which refunds are submitted after revocation: The GST Council proposed a retrospective amendment to Section 16(4) of the CGST Act, which would take effect on July 1st, 2017. The amendment would conditionally relax the provisions of Section 16(4) of the CGST Act in cases where returns are filed by the registered person within thirty days of the order of revocation for the period from the date of cancellation of registration or the effective date of cancellation of registration to the date of revocation of cancellation of the registration.

- Extended deadline for composition taxpayers to file returns in FORM GSTR-4: 30 June instead of 30 April The GST Council suggested changing clause (ii) of sub-rule (1) of Rule 62 of the CGST Rules, 2017 and FORM GSTR-4 to move the deadline for composition taxpayers to file their returns in FORM GSTR-4 from April 30 to June 30 after the conclusion of the fiscal year. This will apply to returns starting with the fiscal year 2025–2026. The same would extend the deadline for submitting the aforementioned return to taxpayers who want to pay tax under the composition levy.

- The CGST Rules, 2017 have amended Rule 88B regarding interest under Section 50 of the CGST Act for late filing of returns. This pertains to situations where the credit is accessible in the Electronic Cash Ledger (ECL) on the day of filing the return. The GST Council proposed amending rule 88B of the CGST Rules to state that interest under section 50 of the CGST Act for late filing of the relevant return shall not be computed on an amount that is available in the Electronic Cash Ledger on the date of the return’s due submission in FORM GSTR-3B and debited during the return’s filing.

- The CGST Act’s Section 11A was added to provide the following authority to not be reimbursed for duties that were either under- or over-levied according to standard procedure under GST Acts: The GST Council suggested adding a new Section 11A to the CGST Act to provide the Government the authority to regularize non-levy or short levy of GST in cases where tax was being underpaid or not paid at all because of customary trade practices.

- Refund of additional Integrated Tax (IGST) paid due to upward revision in goods price after export: The GST Council suggested establishing a procedure for requesting a refund of additional IGST paid due to upward revision in goods price after export. This would make it easier for many taxpayers to receive a refund of the excess IGST they were forced to pay due to an increase in the price of the goods after they were exported.

- Clarification regarding valuation of supply of import of services by a related person where recipient is eligible for full input tax credit: The Council recommended making it clear that, under the second proviso to rule 28(1) of the CGST Rules, the value of such supply of services declared in the invoice by the said related domestic entity may be deemed as open market value in situations where the foreign affiliate is providing specific services to the related domestic entity for which the said related domestic entity is eligible for full input tax credit.

- Providing clarification on the eligibility of the Input Tax Credit (ITC) for manholes and ducts utilized in the network of optical fiber cables (OFCs): The Council suggested making it clear that, as per section 17 of the CGST Act, the input tax credit is not limited about ducts and manholes utilized in networks of optical fiber cables (OFCs).

- Explanation of the applicability of Section 16(4) of the CGST Act, 2017 to invoices that the receiver issues using the Reverse Charge Mechanism (RCM): The Council suggested making it clear that the relevant financial year for calculating the time limit for claiming input tax credit under the terms of section 16(4) of the CGST Act is the financial year in which the invoice was issued by the recipient in cases of supplies received from unregistered suppliers, where tax must be paid by the recipient under reverse charge mechanism (RCM) and invoice is to be issued by the recipient only.

- The Council suggested amending section 140(7) of the CGST Act retroactively with effect from July 1, 2017, to allow for transitional credit for invoices related to services rendered before the appointed date, as well as invoices received by the Input Service Distributor (ISD) before the appointed date.

- To let taxpayers alter information in FORM GSTR-1 for a tax period and disclose additional details, if applicable, before submitting a return in FORM GSTR-3B for the relevant tax period, the Council suggested creating a new optional capability via FORM GSTR-1A.

- The Council suggested that taxpayers with a yearly turnover of up to two crore rupees may be excluded from making an annual return in Form GSTR-9/9A for the FY 2025–2026.

- It was suggested that section 122(1B) of the CGST Act be amended retroactively with effect from January 10, 2023, to make it clear that the aforementioned penal provision only applies to e-commerce operators who are mandated by section 52 of the CGST Act to collect tax, and not to other e-commerce operators.

- The Council suggested amending CGST Rule 142 and issuing a circular outlining a procedure for adjusting the amount paid for a demand made using FORM GST DRC-03 against the amount required to be paid as a pre-deposit to file an appeal.

Additional actions related to laws and procedures

- Using biometric-based Aadhaar authentication across the nation: The GST Council suggested using a phased approach for the biometric-based Aadhaar authentication of registration applicants throughout the nation. This would fortify the GST registration procedure and aid in the fight against fictitious invoices used to submit fraudulent input tax credit (ITC) claims.

- Modifications to Sections 73 and 74 of the CGST Act, 2017, and the addition of a new Section 74A to the Act to provide a uniform deadline for the issue of demand letters and orders, regardless of the existence of fraud, suppression, deliberate misrepresentation, etc.

- Demand orders and notifications of demand are now subject to varied time limits depending on whether fraud, suppression, deliberate misrepresentation, or other allegations are present or not. The GST Council recommended setting a common deadline for the issuance of demand notices and orders regarding demands for FY 2025–2026 in cases involving charges of fraud or wilful misstatement and cases not involving those charges, etc., to streamline the implementation of those provisions. It has also been suggested that the 30-day window during which taxpayers can pay the required tax plus interest and qualify for the lower penalty be extended to 60 days.

- To create a sunset provision for anti-profiteering under GST and to assign the Principal bench of the GST Appellate Tribunal (GSTAT) to handle anti-profiteering matters, the Council suggested amending sections 171 and 109 of the CGST Act, 2017. Additionally, the sundown date of April 1, 2025, has been suggested by the council for the receipt of any new anti-profiteering applications.

- The Council proposed amending section 16 of the IGST Act and section 54 of the CGST Act to stipulate that export duty-related refunds are restricted, regardless of whether the goods are exported tax-free or tax-paid. These restrictions should also apply in the case of goods supplied to SEZ developers or SEZ units for approved operations.

- It was suggested to lower the threshold from Rs 2.5 Lakh to Rs 1 Lakh for reporting B2C inter-state supplies invoice-wise in Table 5 of FORM GSTR-1.

- The Council suggested that, regardless of whether any tax was withheld during the given month, registered individuals who are obliged by section 51 of the CGST Act to deduct tax at source make a return in FORM GSTR-7 every month. It is also advised that there be no late fees associated with filing a delayed Nil FORM GSTR-7 form. Additionally, it has been suggested that the aforementioned FORM GSTR-7 report may need to include invoice-specific information.

Wrapping It Up

The trading community and the GST council have recently debated GST tax rates extensively. The GST council of members has held multiple rounds of meetings to adjust the GST rates. The most recent GST rates show a drop of 6% to 18% in GST rates for numerous commodities across most categories.

FAQs

-

What is the GST gold rate?

Under HSN Chapter 71, the GST rate for gold jewelry and gold biscuits, as well as any semi-manufactured form, is 3% (IGST or 1.5% each of CGST and SGST).

-

What is the GST rate applicable to mobile?

Currently, the GST rate on mobile phones is 18% under HSN Chapter 3 and HSN code 85171219.

-

What are the GST rates for goods and services?

GST rates for goods and services can range from 0% to 28%. Certain commodities, such as gold, diamonds, and valuable stones, may incur a 3% or 0.25% tax.

-

What are the correct GST slabs for goods and services?

The GST law specifies and classifies products and services as 5%, 12%, 18%, and 28%. However, a few commodities have a GST charge between 0.25% and 3%. These include gold, diamonds, and valuable stones.

-

What are the three types of GST?

Currently, there are three forms of GST: central goods and services tax (CGST), state goods and services tax (SGST), and integrated goods and services tax (IGST). While a taxpayer must deposit CGST and SGST for all intrastate transactions, IGST is required for imports and interstate transactions.

-

Who has to pay the GST rate?

Suppliers of taxable products and services must charge and collect GST at the specified rate from their buyers or customers. The collected GST must be submitted to the government after claiming the appropriate input tax credit on their purchases. It’s referred to as the forward charge. In other circumstances, the buyer or consumer pays the GST directly to the government as a reverse charge.

-

Is GST charged at the GST rate on all goods and services?

No, certain things are free from GST and do not require payment. Exempted products include those that are not rated, are not subject to GST, or are exempted by notification. Furthermore, when zero-rated products are sold, any GST paid will be refunded.

-

What are the most recent changes in GST rates?

New GST rates have been decreased for certain items classified as domestic goods.

-

What are HSN and SAC?

The SAC code stands for Services Accounting Code. It applies to all services delivered in India. In India, the SAC code system is used to identify, classify, measure, and determine the application of GST to services. The Harmonized System Nomenclature (HSN) code applies to Indian commodities.

-

Who decides the GST rates?

The central government sets the country’s GST rates.