The importance of verifying the authenticity of a GST number cannot be overstated. It goes beyond mere compliance with tax regulations; it safeguards against fraud and ensures the legitimacy of transactions in a digital and interconnected world. In this digital age, where financial transactions are swift and dynamic, verifying a GST number is paramount to secure, transparent, and lawful business interactions.

What is the GST Number?

GSTIN is the GST identification number or GST number. A GSTIN is a 15-digit PAN-based unique identification number allotted to every registered person under GST. As a GST-registered dealer, please verify GST before entering it into your GST Returns.

An individual or entity registered under the Income Tax Act can possess multiple GSTINs, each GSTIN corresponding to the state or Union Territory in which they conduct business operations. The obligation to obtain a GSTIN arises when an individual or entity surpasses the threshold limit for GST registration specified under GST regulations.

In contrast to the prior indirect tax system, which required separate registration numbers for various laws like Excise, Service Tax, and VAT, GSTIN streamlines the process by providing a single registration number under the GST regime.

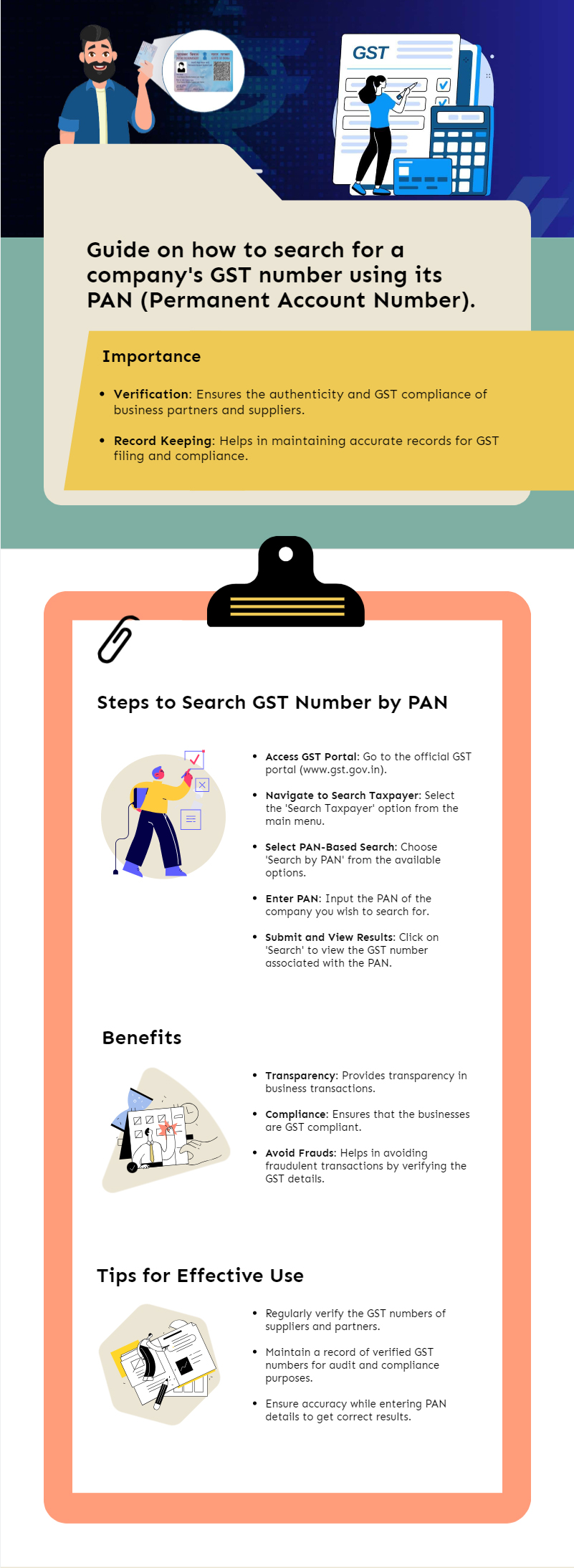

Importance of GST Number Verification

- GSTIN or GST number is public information, and it’s crucial for businesses dealing with GST-registered taxpayers to verify the authenticity of the vendor and the GSTIN or GST number on their invoices.

- Verifying the GSTIN is essential to prevent the generation of inaccurate invoices and e-invoices, ensure eligibility for genuine input tax credits, and correctly pass on tax credits to the rightful buyers, among other reasons.

- Accurate GSTIN verification is necessary to avoid potential legal and compliance issues. Incorrect or fraudulent GSTINs can lead to penalties or legal complications for the business issuing the invoice and the recipient.

- Validating GSTINs is essential for businesses and government authorities to maintain the tax system’s integrity, prevent tax evasion, and ensure that tax credits are correctly accounted for.

GST Identification Number Format

Here’s a breakdown of the components of a GSTIN:

- The first two characters represent the state code, indicating the state in India where the business is registered.

- The following ten characters represent the business or individual’s PAN (Permanent Account Number).

- The thirteenth character is assigned based on a person or business’s number of registrations within a state.

- The fourteenth character is typically “Z” by default.

- The fifteenth character is a checksum digit for error detection.

To learn more about GST Registration, click here: GST Registration For Services.

Instructions for Verifying a Company’s GST Number

Visit the GST Portal:

Go to the official Goods and Services Tax (GST) Portal for India. The website URL is https://www.gst.gov.in/.

Click on “Search Taxpayer”:

A “Search Taxpayer” option is on the GST Portal’s homepage. Click on it to begin your search.

Select the Appropriate Search Type:

You will have two search options:

- Search by GSTIN/ UIN: If you have the GSTIN or UIN (Unique Identification Number) of the company you want to search for, choose this option and enter the number.

- Search by Name: If you only have the name of the company and not the GSTIN, select this option. Enter the company’s name, as accurately as possible, in the search field.

Enter the Captcha:

Enter the captcha code on the screen to ensure you are not a robot.

Click “Search”:

After entering the GSTIN or company name and the captcha code, click the “Search” button.

View Search Results:

The system will generate a list of search results based on your input. You can click on the company name or GSTIN to view more details.

Verify GSTIN Details:

Examine the details provided to confirm their alignment with the intended company. You should verify essential information, including the GSTIN, trade name, state, and registration date.

Reporting a Fake GST Number

If you come across a potentially fraudulent GSTIN, you can report it to the GST authorities. You can contact them by emailing helpdesk@gst.gov.in. You can also get them at +91 124 4688999 or +91 120 4888999 to initiate the necessary actions.

Take control of your business today! Streamline operations, boost efficiency, and maximise profits with Captainbiz.

Start your Free trial for 14 days without any credit.

Conclusion:

In an era of digital transactions and evolving tax regulations, staying informed and vigilant is vital for businesses. Verifying a company’s GST number safeguards against fraudulent activities and ensures compliance with tax laws. The ease and accessibility of the GST portal’s search tools provide a straightforward means to verify a company’s GSTIN. By following the steps outlined in this blog, businesses can confidently engage, knowing they interact with legitimate, registered entities. In the ever-changing landscape of taxation and commerce, conducting a GST number search for a company is a valuable skill contributing to the efficiency and integrity of financial transactions in India.

Frequently Asked Questions(FAQs)

Q. What is a GST Number?

Ans. A unique 15-digit PAN-based identification number allocated to every registered person under GST.

Q. Why is GST Number Verification important?

Ans. To prevent fraud, ensure the legitimacy of transactions, and maintain the integrity of tax filings.

Q. How is the GST Identification Number (GSTIN) formatted?

Ans. Includes state code, PAN, registration number, a default character, and a checksum digit.

Q. Can individuals use the GST number search tool?

Ans. Yes, it’s available for both businesses and individuals for verifying GSTIN legitimacy.

Q. What are the legal implications of using a fake GSTIN?

Ans. It’s a breach of GST regulations, subject to fines and legal repercussions.

Q. How do I verify a company’s GST Number?

Ans. Use the GST portal’s “Search Taxpayer” option with the GSTIN or company name.

Q. What should I do if I find a fake GST Number?

Ans. Report it to the GST authorities via email or phone.

Q. What information is available when verifying a GST Number?

Ans. GSTIN, trade name, state, and registration date among other details.

Q. What are the steps for GSTIN verification?

Ans. Visit GST Portal, select search type, enter details, and view verification results.

Q. How does GSTIN verification aid businesses?

Ans. Ensures transaction legitimacy, compliance with tax laws, and prevents tax evasion.