Introduction

In the realm of taxes, having a standardized GST invoice format is essential for businesses, serving as a meticulous record-keeper for transactions. Acting as a paper trail, these invoices document every buying and selling activity, fulfilling the GST invoice requirements and aiding in accurate tax calculations. To streamline this process, businesses often utilize GST billing software, ensuring adherence to specific GST invoice rules and templates. Similar to a recipe, these invoices provide a clear breakdown of transactions, preventing mistakes and promoting transparency in the taxation system. Understanding GST Invoice Basics

Understanding the basics of GST invoicing is like learning the ABCs of how businesses document their transactions. When we talk about GST (Goods and Services Tax), it’s a type of tax imposed by the government on the things we buy and the services we use. Now, the invoicing part is like creating a special kind of receipt called an invoice.

In simple terms, businesses use invoices to show what they’re selling and who they’re selling it to. For example, if you buy something from a store, they give you a receipt that lists the items you bought and how much they cost. In the world of GST, businesses do something similar, but they also need to show how much GST is included in the price.

The issuance of GST invoices follows some basic rules and principles. Let’s understand in simple words:

- When to Issue an Invoice:

- Businesses need to issue an invoice whenever they sell goods or provide services. It’s like a receipt that shows what was sold and for how much.

- Invoice Format:

- There’s a specific format for GST invoices in India. It includes details like the business name, GSTIN (Goods and Services Tax Identification Number), date, and a unique invoice number.

- Details of Parties Involved:

- The invoice should have information about both the seller (the business) and the buyer. This includes names, addresses, and their respective GSTINs.

- Description of Goods or Services:

- The invoice must clearly mention what is being sold or the services provided. This involves providing a description, quantity, and the price.

- GST Rates:

- For each item on the invoice, the applicable GST rate needs to be mentioned. This indicates the percentage of GST included in the price.

- Hassle-Free Invoicing for Small Businesses:

- There are simplified rules for small businesses to make invoicing easier. They have the option to issue a ‘Bill of Supply’ instead of a regular tax invoice under certain conditions.

- Time Limit for Issuing Invoices:

- In general, invoices should be issued before or at the time of the supply of goods or services. However, for some services, there’s a specific time limit for issuing invoices.

- Credit and Debit Notes:

- If there are changes or corrections to an invoice, businesses can issue credit or debit notes to adjust the amount of tax.

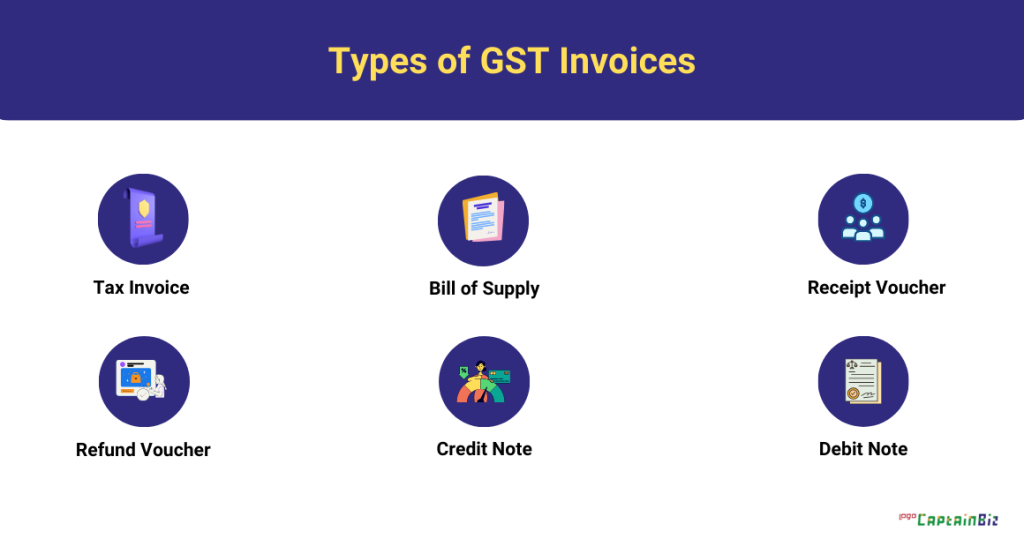

Types of GST Invoices

When it comes to GST (Goods and Services Tax) invoices, there are different types, each serving a specific purpose. It’s a bit like having different tools for different jobs. Here are the main types:

-

Tax Invoice:

- This is the regular invoice that businesses use when they sell goods or services. It includes the details of the transaction, like what was sold, how much it cost, and the applicable GST.

-

Bill of Supply:

- Small businesses, especially those registered under the composition scheme, use a Bill of Supply instead of a regular tax invoice. It doesn’t include the tax amount but still shows what was sold and for how much.

-

Receipt Voucher:

- When a business receives advance payment for goods or services, they issue a Receipt Voucher. It’s like a confirmation that they got the money and will provide the goods or services later.

- Also Read: Can GST Be Collected On A Receipt Voucher?

-

Refund Voucher:

- In cases where a refund is made, a Refund Voucher is issued. It details the refund amount and the reason for the refund.

-

Credit Note:

- If there’s a reduction in the invoice amount, perhaps due to returns or corrections, a Credit Note is issued. It adjusts the tax amount accordingly.

-

Debit Note:

- On the flip side, if there’s an increase in the invoice amount, a Debit Note is issued. It accounts for additional payments that need to be made.

Detailed Breakdown of Mandatory Information on a GST Invoice

When businesses create a GST invoice, there are some important things they must include to make sure everything is clear and accurate. It’s like putting all the necessary ingredients in a recipe. Here’s a breakdown of what needs to be on the invoice:

- Business Details:

- Start with the name, address, and GSTIN (Goods and Services Tax Identification Number) of the business that’s selling the goods or services.

- Invoice Number and Date:

- Every invoice needs a unique number, and it should also show the date when the transaction happened. It’s like giving each transaction its own ID.

- Buyer’s Details:

- Include the name, address, and GSTIN of the person or business that’s buying the goods or services.

- Description of Goods or Services:

- Clearly list what is being sold or the services provided. It’s like describing each item on a menu.

- Quantity and Unit:

- Show how much of each item is being sold, and in what unit (like kilograms, liters, etc.).

- Price and Total Amount:

- Mention the price of each item and calculate the total amount. It’s like adding up the costs.

- GST Rates:

- Specify the GST rates applicable to each item. This tells everyone how much tax is included in the price.

- HSN or SAC Code:

- Include the HSN (Harmonized System of Nomenclature) or SAC (Services Accounting Code) for goods or services. It helps in classifying them properly.

Also read: Mandatory Information To Include In A Tax Invoice For Reverse Charge Outward Supplies

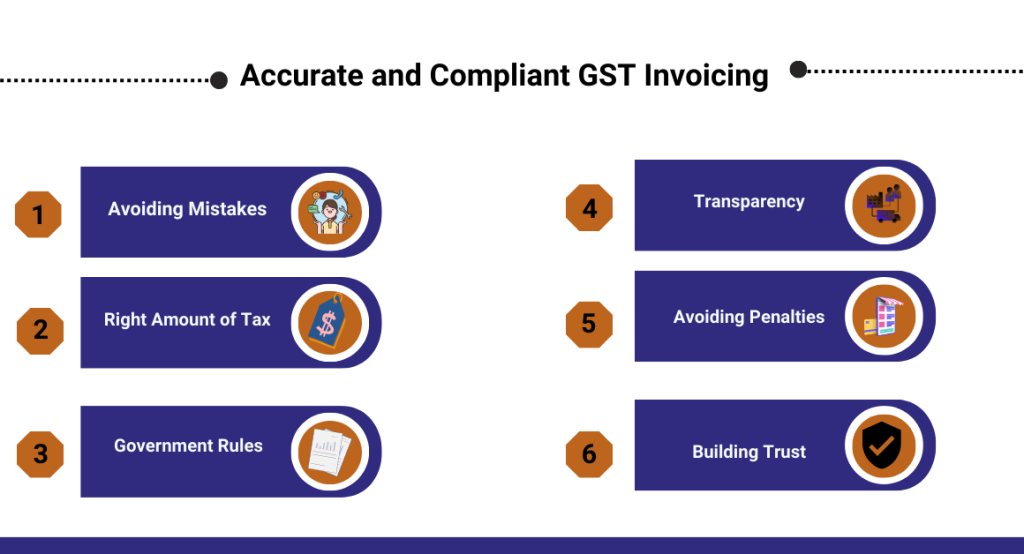

Importance of Accurate and Compliant GST Invoicing

Imagine you’re playing a game, and there are rules to follow. Accurate and compliant GST invoicing is like playing by those rules in the world of buying and selling. Here’s why it’s so important:

- Avoiding Mistakes:

- Accurate invoicing ensures that everyone knows exactly what’s being bought or sold. It’s like making sure everyone is on the same page to avoid confusion or mistakes.

- Right Amount of Tax:

- By following the rules of GST invoicing, businesses can calculate and pay the correct amount of tax. It’s like making sure you’re paying the right entry fee for the game.

- Government Rules:

- The government has set rules for invoicing to make sure everything is fair. Compliant invoicing means following these rules, just like playing by the game rules to keep things fair and square.

- Transparency:

- Accurate and compliant invoicing makes transactions transparent. It’s like having a clear scoreboard so everyone can see what’s happening in the game of buying and selling.

- Avoiding Penalties:

- If businesses don’t follow the invoicing rules, there might be penalties. It’s like getting a penalty in a game for not playing by the rules.

- Building Trust:

- When businesses provide accurate invoices, it builds trust with customers and other businesses. It’s like being a good player that others want to team up with in the game.

Best Practices for Effective GST Invoicing

Using the best methods for making GST invoices helps businesses do a good job. It’s like following the best ways to play a game so that everything goes smoothly. Here are some helpful tips:

- Write all the important details on the invoice, like who’s selling, who’s buying, and what’s being sold.

- Use the right format for the invoice, so it looks organized and clear.

- Double-check the numbers and calculations to make sure they are correct.

- Follow the rules set by the government for making invoices.

- Be on time – issue the invoice when it should be issued.

- If there are changes or corrections, use the right notes to fix them.

- Keep it simple, so everyone can understand the invoice easily.

By doing these things, businesses can make sure their invoices are well-made, accurate, and everyone knows what’s going on – just like playing the game the right way.

Also Read: GST Invoicing Best Practices For Indian Businesses

Also Listen: Process of Creating Purchase Orders and Invoices With CaptainBiz -Tutorials

Conclusion:

To wrap it up, following the rules for making GST invoices is really important for businesses. It’s like playing a game where everyone needs to follow the rules to make sure things work well. When businesses make invoices the right way, they can avoid mistakes, pay the right amount of tax, and keep things fair. It’s like being a good player in the world of buying and selling. So, by sticking to the GST invoicing rules, businesses can play the game smoothly, avoid penalties, and build trust with others. It’s the key to a successful and fair game in the business world.

FAQ’s

-

What is GST Invoicing?

- GST Invoicing is like making a special receipt when businesses sell things or provide services. It helps keep track of transactions for taxes.

-

Why do businesses need to make GST invoices?

- Businesses make GST invoices to show what they’re selling, who they’re selling it to, and how much tax is included. It’s like a clear record for taxes.

-

What are the different types of GST invoices?

- There are a few types, like Tax Invoice for regular sales, Bill of Supply for small businesses, and Receipt Voucher for advance payments.

-

What information should be on a GST invoice?

- A GST invoice should have details like business names, addresses, invoice numbers, dates, what’s being sold, and how much it costs.

-

Why is it important to be accurate in GST invoicing?

- Being accurate is crucial to make sure everyone knows what’s happening. It helps businesses pay the right amount of tax and avoid mistakes.

-

What happens if businesses don’t follow GST invoicing rules?

- If businesses don’t follow the rules, there might be penalties. It’s like getting a penalty in a game for not playing by the rules.

-

Are there specific rules for small businesses in GST invoicing?

- Yes, there are simpler rules for small businesses. They can use a Bill of Supply instead of a regular tax invoice under certain conditions.

-

How can businesses make sure their GST invoices are effective?

- Businesses can make effective invoices by including all the necessary details, using the right format, and double-checking for accuracy.

-

Why is transparency important in GST invoicing?

- Transparency means everyone can see what’s happening. It helps build trust and ensures that buying and selling are fair.

-

What are the best practices for making good GST invoices?

- The best practices include writing all important details, using the right format, double-checking numbers, following government rules, and keeping it simple so everyone understands.