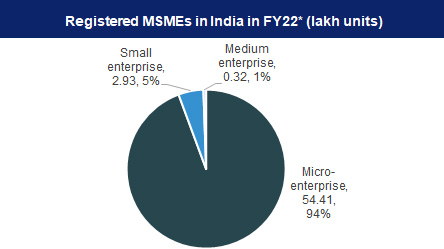

The Indian economy heavily depends on Micro, Small, and Medium Enterprises (MSMEs), which actively drive economic growth. Additionally, the Small and Medium Enterprise (SME) sector serves as the economy’s growth engine, as it significantly contributes nearly 45% of manufacturing output. Additionally, it contributes to over 40% of exports. Furthermore, it provides employment to over 111 million people. However, MSMEs often search for support on financial issues, technology, access to markets, infrastructure, and regulation.

Rolled out in 2017, GST actively creates a simplified, uniform, and integrated indirect tax system in India. By replacing multiple central and state taxes, it significantly eases business operations, enabling MSMEs to grow. Nevertheless, the sector has recorded mixed outcomes under the GST system.

This article critically analyzes the impact of GST implementation on the MSME sector. It actively highlights key benefits and challenges in GST compliance. Moreover, it examines how GST fosters or restricts MSME growth and recommends necessary reforms.

GST – Concept, Framework and Intended Benefits

GST actively replaces all central and state indirect taxes on goods and services. Since its implementation on July 1, 2017, it has consistently aimed to consolidate India into a unified market. GST replaced layers of taxes, such as excise duties, VAT/CST, service tax, CAD, SAD, and additional customs duties, with a simplified, consumption-based tax structure.

The GST framework is anchored around the following key principles:

- Consumption-based Value Added Tax:

GST actively applies to value addition at each supply chain stage, thereby ensuring seamless input tax credits for taxes paid on procurements.

- Destination-Based Consumption Tax:

GST accrues to the state where the final sale to consumers takes place rather than at production origin. - Unified Compliance Mechanism:

Single registration, return filing, and tax payment interface via GST portal for Central GST (CGST) and State GST (SGST) components.

The GST tax structure intends to benefit MSMEs through:

- Elimination of Cascading Taxes: Seamless flow of input tax credits expected to reduce production costs.

- Unified Common Market: Subsuming all indirect taxes under GST aimed to reduce fragmentation and enhance pan-India trade.

- Boosted Competitiveness: Simple tax regime focused on expanding MSME growth and development opportunities.

GST Registration and Compliance for MSMEs

GST registration offers MSMEs benefits like seamless input tax credit, simplified taxes, and wider market access across India. However, many small businesses need help with compliance requirements under the GST system.

| Financial Year | GST Paid by MSMEs (in Rs crore) |

| FY20 | 5,00,000 |

| FY21 | 4,70,000 |

| FY22 | 5,50,000 |

Table: Amount of GST paid by MSMEs per year

Benefits of GST Registration

- Input Tax Credit:One of the most significant advantages of GST registration is that businesses can actively claim input tax credit throughout the supply chain, thereby improving cash flows and enhancing working capital availability.

- Uniform Tax Rates:GST has actively subsumed the complex indirect tax structure, thereby creating a common national market across India. Additionally, the consistent tax rates actively reduce inconsistencies and lower compliance costs.

- Ease of Doing Business:A GST-registered business can actively expand to newer markets pan-India without facing location-based disadvantages, thereby boosting opportunities for business growth.

Also Read: The Benefits Of Each Type Of GST Registration

Compliance Requirements under GST

The GST regime has simplified taxes but increased compliance for small businesses with new procedures and mandatory digital filings.

- Threshold Exemption:

The ₹40 lakh annual turnover threshold for GST exemption helps minimize compliance burden for smaller enterprises. However, it limits their ability to claim input tax credits.

- Composition Levy Scheme:

The composition scheme taxes MSMEs at 1-5% and lets those with up to ₹1.5 crore turnover file simplified quarterly returns. However, they lose input tax credit benefits.

- Quarterly Filing of Returns:

All registered MSMEs need to file Form GSTR-1 sales returns monthly and GSTR-3B summarized returns quarterly online, increasing reporting requirements. - E-Way Bills:

MSMEs need to generate e-way bills for inter-state movement of goods worth over ₹50,000. This has increased transportation times and costs due to border check post verifications.

GST Registration and Exemptions

The ₹20 lakh threshold limits small units’ scaling, while the ₹1.5 crore turnover cap for the composition scheme denies input tax credits.

- Threshold Exemption: Units with <₹20 lakh annual turnover are exempt from GST registration. However, they are unable to claim input credits.

- Composition Scheme: Units with <₹1.5 crore turnover can opt for composition @1-5% GST rates. However, input tax credits are not available.

- Regular Registration: Deemed necessary for units aiming for business growth and market expansion.

Challenges in Meeting GST Compliances

Despite initiatives for easier digital compliances, procedural bottlenecks have prevailed, hampering the GST onboarding of MSMEs.

- Multiplicity: Require separate registrations for different business verticals in each state. Annual consolidations take a lot of work.

- Frequency: Mandates monthly GSTR-1 invoice uploads and quarterly GSTR-3B return filing. Errors lead to fines.

- Reconciliation: GSTR-2A purchase mismatch and reporting majorly hampers working capital cycles for MSMEs.

- Cost: Deploying skilled manpower and accounting software for compliance is expensive for MSMEs.

Also Read: Role Of GST Registration Services In GST Compliances

GST Impact on the MSME Sector

The GST regime has actively benefited MSMEs by reducing tax incidence in many product categories, thereby easing logistics, providing input tax credits, offering broader market access, and promoting growth-oriented formalization.

| Category | Previous GST Rate | New |

| I. GST rate reduction on goods at 28% | ||

| A. 28% to 18% | ||

| Video game consoles and sports | 28% | 18% |

| Monitors and TVs (up to 32 inches) | 28% | 18% |

| Power banks of lithium-ion batteries | 28% | 18% |

| Re-treaded or used pneumatic tires | 28% | 18% |

| B. 28% to 5% | ||

| Parts and accessories for carriages | 28% | 5% |

| II. GST rate reduction on other goods | ||

| Articles of natural cork | 18% | 12% |

| Cork roughly squared or debagged | 18% | 12% |

| Marble rubble | 18% | 5% |

| Natural cork | 12% | 5% |

| Walking Stick | 12% | 5% |

Table: Difference in GST rates for multiple categories

However, procedural complexity, revenue uncertainty during transitions, infrastructure issues like difficult portal access, and delayed refunds have temporarily hindered the smooth onboarding of MSMEs into the GST ecosystem.

Key Positives

- Tax Burden Reduction: GST rate lower than total previous indirect taxes for major job-creating sectors like leather, gems & jewelry, textiles, furniture, etc., providing cost savings for producers and consumers.

- Logistics Efficiency: Faster movement of goods through check posts, lower fuel costs via input credit, and unified e-Way bills improve overall logistical efficiency.

- Cascading Taxes Reduction: By consolidating multi-point levies like octroi and entry tax into GST, the system significantly reduces the production cost burden caused by tax-on-tax for MSMEs.

- Access to Pan-India Market: Compared to multiple Central and State registrations earlier, a single permit requirement enables access to a more significant customer base across India.

- Formalization: The availability of input tax credits therefore incentivizes informal units to expand their customer base by registering under GST.

Key Negatives

- Procedural Complexities: Technical glitches on the GSTN portal, along with invoice mismatches and delays in tax refunds, have consequently increased process complexity for MSMEs.

- Revenue Uncertainty: The loss of fiscal autonomy for manufacturing states, as origin-based taxes are replaced by destination consumption-based tax under GST, consequently reduces income predictability.

- Infrastructure Bottlenecks: Erratic GSTN portal access, lack of adequate API integration, and refund delays have caused significant blockage of working capital for MSMEs.

- Cash Flow Constraints: The absence of input tax credit carryforwards and reimbursement of interest for delayed refunds hamper production viability due to strained cash flows for MSMEs.

The GST ecosystem holds substantial growth potential for MSMEs, provided teething transitional challenges are holistically addressed through coordinated policy initiatives focusing on simplifying procedures and access to formal credits.

Also Read: Understanding the Impact of GST on Indian Startups: Compliance and Benefits

Role of GST in Facilitating MSME Growth

While GST disrupted MSMEs in the short term, several pathbreaking reforms have been introduced to nurture MSME productivity and competitiveness, helping them integrate into the economic and export value chain.

Market Access and Competitiveness

- GeM (Government e-Marketplace): The dedicated online public procurement portal has over 46 lakh MSME product and service offerings, improving visibility and enhancing access to government departments.

- PSU Procurement Mandates: Mandating 25% procurement of inputs by PSUs from MSMEs has opened more extensive revenue opportunities.

- Capital Access Reforms: Collateral-free loans under CGTMSE, reduced corporate taxes, and equity funding via revised Funds-of-Funds operations focused primarily on MSMEs.

- Unified Logistics Interface Platform (ULIP): Integrates information available with various agencies across roads, rail, and waterways to enable transparent, foreseeable, and competitive logistics costs for MSMEs.

- National Logistics Policy: Proposed reforms include unified cabotage laws to lower freight costs and minimum warehousing standards to allow pan-India trade access to MSMEs.

- Exporter ID Card: Improves export ease for MSMEs by facilitating customs clearances, foreign trade policy incentives, and trade-related documentation.

Digitization

- Aadhaar Authentication: The eSign/Aadhaar-based trust mechanism for new GST registrations has simplified and secured the onboarding of MSMEs.

- Grievance Redressal: An RFID-based intelligence engine for verifying irregularities provides targeted resolution of mismatches in purchase filings by MSMEs.

- GST Saathi (Help) App: Provides essential registration requirements, nil filing facilities, document upload mechanisms, payment options, etc., via Android and iOS mobiles.

- Cash Ledger and Challan Reconciliation: It actively automates the utilization of available cash balances for GST payments and provides tax head-wise analytics, preventing duplicate challan generation—a major cause of fines for MSMEs.

Analytics Adoption

- GSTN Analytics: It actively enables turnkey analytics, such as input tax credit reconciliation, self-declared income estimates to determine tax liabilities, and identifying supplier network gaps for MSMEs.

- ULIP Analytics: It actively enables accurate demand assessment, optimizes inventory requirements, and facilitates competitive logistics cost bargaining for MSMEs through data-driven decision-making on freight routes.

These pathbreaking initiatives around digitization, analytics adoption, and trade facilitation, coupled with awareness drives under capacity-building programs like SPEED MSME focused on skilling MSME leadership teams on best practices around GST compliance, export promotion, procurement contracts, and validating product quality, will catalyze the next wave of growth and employment generation through competitive MSMEs under the GST regime.

Conclusion

Implementing Goods and Services Tax (GST) has had a transformative impact on the Micro, Small, and Medium Enterprises (MSMEs) in India. The new tax regime has dismantled geographical barriers for MSMEs, enabling access to broader markets across India and empowering them to compete effectively with more prominent players.

By eliminating the cascading effect of multiple taxes and facilitating seamless input tax credits, GST has helped reduce production costs for the MSME sector. Further, aspects like a national common market, composition scheme, and export incentives have allowed MSMEs to enhance their capacity utilization and broaden revenue opportunities.

Despite some early transitional glitches regarding procedural complexities, revenue uncertainty, and infrastructure constraints, concerted efforts have been made to alleviate pain points for MSMEs through tax rationalization and reforms focusing on easier digital compliances, timely refunds, and single-window dispute resolution processes.

With MSMEs emerging as significant contributors to exports and employment in recent years under GST, there is tremendous potential for further growth through sustained policy initiatives to ease tax compliance burdens and access to formal credit for small businesses. By actively enhancing MSME competitiveness, India can leverage GST to position them as globally integrated innovators and key drivers of economic growth.

FAQs

-

What are the key benefits of GST for MSMEs in India?

Some significant benefits include – the seamless flow of input tax credit, simplification of tax structure, reduction in multiplicity of taxes, unified common market across India enabling access to a broader consumer base, improved logistics, and lowering of transportation costs due to abolition of check post clearances after e-Way bills.

-

How is GST compliance under the composition scheme beneficial for MSMEs?

The composition scheme with low flat tax rates allows MSMEs with turnover below ₹1.5 crore to quickly meet compliance burden, though it restricts their ability to claim input tax credit. It provides them with an easier transition option into the GST ecosystem.

-

What are some key challenges faced by MSMEs under GST?

Key challenges actively include complex return filing procedures, which increase compliance burdens for businesses. Additionally, frequent technical glitches on the GSTN portal disrupt smooth operations. Furthermore, delayed tax refunds block working capital, making cash flow management difficult. Moreover, cascading taxes for unregistered businesses raise costs, while inadequate awareness and preparedness for GST record-keeping requirements create further compliance hurdles.

-

How does GST registration impact access to finance for MSMEs?

GST registration provides access to collateral-free loans by enhancing the creditworthiness of MSMEs in front of banks and NBFCs. It also allows them to bid for orders from government units, as supplier registration eligibility necessitates GST compliance.

-

How does GST help MSMEs improve their competitiveness?

GST provides a level playing field for MSMEs to compete across India by reducing location-based tax disadvantages. By addressing earlier market fragmentation, GST enables MSMEs to access broader markets.

-

What measures have been taken to alleviate GST challenges for MSMEs?

The measures actively include raising the e-Way bill threshold exemption limit to reduce compliance burdens. Additionally, they increase thresholds for the composition scheme and registration exemption, making tax filing easier for small businesses. Furthermore, the launch of the GST Saathi mobile app enhances accessibility, while rationalizing tax rates ensures fairness. Moreover, implementing quicker refund mechanisms improves cash flow, and enhancing dispute resolution under the law strengthens regulatory clarity.

-

How does GST promote the formalization of the MSME sector?

The availability of input tax credits and a simplified compliance mechanism actively encourage informal and unregistered MSMEs to join the GST ecosystem. Consequently, they enhance their competitiveness and significantly expand their market access.

-

What is the outlook post-GST for the export potential of Indian MSMEs?

By eliminating domestic indirect tax inefficiencies, GST reforms have significantly enhanced the competitiveness of Indian MSMEs. Additionally, the MEIS scheme, stable exchange rates, and increasing outsourcing from China further strengthen their position to expand exports.

-

How does GST help MSMEs improve their supply chain effectiveness?

GST allows MSME suppliers and distributors to source raw materials and transport finished products across state borders without tax disadvantages, thus reducing inventory and logistics costs. This helps them enhance overall supply chain efficiencies.

-

What impact has GST had on MSME sector job creation?

While GST initially created disruptions that slowed job creation, the sector’s greater formalization of MSMEs, growth benefits from wider market access, improved competitiveness, and supply chain efficiencies have upheld medium-term job creation.