The GST in healthcare subsumed several indirect taxes at the central and state level in a uniform tax structure. This aimed to simplify the tax structures, reducing the cascading effect of taxes. It was also a way of ensuring higher tax compliance in India. Health sectors such as hospitals, pharmaceutical companies or medical device manufacturing entities, diagnostics laboratories and others have been affected by the GST.

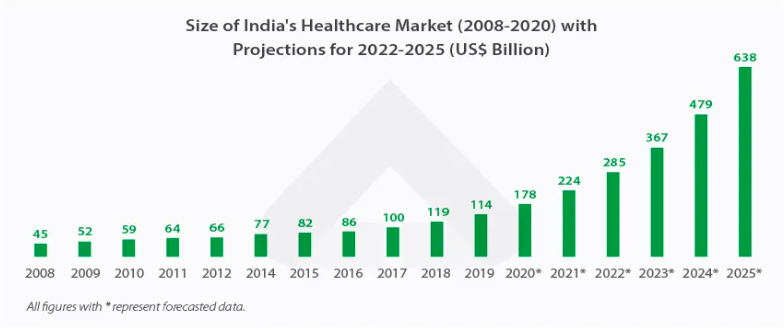

Healthcare plays a significant role in socio-economic life for a developing country like India. These include hospitals, clinical establishments, pharmaceuticals, medical equipment, health insurance, telemedicine, medical tourism, etc. Studies indicate that the Indo-health market is projected to reach $372 billion in 2022.

Nevertheless, it has a huge deficit in terms of provision of affordable health care, infrastructure and resources. Indian people spend 62.6% out-of-pocket because most of them are uninsured. The government intends to enhance public health expenditure to 2.5% of GDP. Taxation laws are important in the context of healthcare affordability and accessibility from coast to coast.

This article analyses the impact of GST in healthcare on various components — healthcare services, pharmaceutical industry, medical devices and equipment industry and healthcare infrastructure. It examines GST’s role in making healthcare affordable and accessible in a country with limited access to treatment and drugs.

GST and Healthcare Services

Under GST, healthcare services by clinical establishments are exempt from the GST’s levy on the services they provide. This covers hospitals, nursing homes, clinics, diagnostic centres, physicians, surgeons and various paramedical services. However, the exemption does not apply to cosmetic and plastic surgery services supplied by beauty parlours and saloons. The exemption limit is for clinical establishments having a turnover of more than Rs. 20 lakhs (increased from Rs 5 lakhs).

GST exemption in healthcare services benefits small nursing homes and hospitals in Tier 2/3 regions, reducing tax liability and enhancing working capital. GST enables seamless input tax credit flow for healthcare providers along the supply chain, benefiting the industry significantly.

As per estimates, the tax burden on the healthcare sector was reduced by around 10-15% post-rollout of GST due to the abolition of Defence Excise Duty, removal of embedded taxes and proper credit utilisation across the supply chain. The previous indirect tax regime suffered from double taxation with both VAT and Service tax levied on output. This caused significant cascading and tax accumulation. GST helps eliminate this by allowing a seamless flow of credit and subsuming all indirect taxes under one umbrella.

Image Source – https://www.india-briefing.com/news/indias-healthcare-ecosystem-key-segments-market-growth-prospects-26225.html/

Challenges Posed by GST Compliance

However, GST also poses specific challenges for healthcare service providers. Compliance requirements under GST have increased substantially since multiple returns have to be filed regularly with details of sales and purchases.

Increased compliance adds to administrative costs for small clinics and hospitals with basic IT infrastructure. Also, the requirement of e-invoices for turnover above the threshold adds complications. While anti-profiteering provisions under GST benefit consumers, significant pricing pressure builds up for healthcare providers.

To illustrate the GST impact on healthcare sector, a small 20-bed hospital in Indore reported a 10-15% decline in overall tax liability post-GST as taxes on procurement of hospital equipment, beds, furniture, as well as construction fell under the 5% GST rate as against varying 20-30% rates previously.

This reduced capital costs and facilitated the hospital’s expansion plans. However, the GST filing process increased by 3-4 times with the requirement of monthly uploads being introduced. Additional resources had to be deployed for tax filing, and working capital requirements went up due to blocked input credits.

GST and The Pharmaceutical Industry

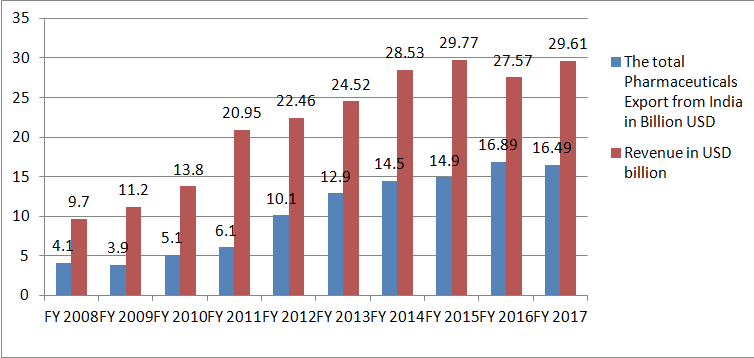

The Indian pharmaceutical industry is the third largest globally in volume and fourteenth most prominent in value. The low cost of production and availability of skilled labour provide India with a competitive advantage in generic drug manufacturing. It is a significant contributor to the economy and ensures domestic access to medicines at affordable prices. About 20% of global exports of generic drugs originate from India.

Under GST, most pharmaceutical products attract a GST rate of 12% compared to around 9%. Key life-saving drugs and vaccines remain exempted, similar to the pre-GST regime. Consumers of pharmaceutical products have witnessed varied impacts of GST, ranging from marginal declines in the prices of certain drugs to increases in cases where tax credits fully flow to final consumers.

One of the major gains for pharma companies has been eliminating the tax-on-tax effect under GST, leading to significant cost accumulation. A seamless flow of credit along the value chain – from raw material suppliers to manufacturers, distributors and retailers has helped reduce prices and expand margins.

Image Source – https://www.projectguru.in/pharmaceutical-industry-india/

Impact of GST on the Pharmaceutical Industry: Benefits and Challenges

Significant benefits have also come from consolidating central and state taxes under one national-level tax. Previously, companies manufacturing across different states had to assess tax implications arising in each state individually at various stages of production. GST provides uniformity in tax rates, which results in production optimisation and efficiency improvement.

However, GST also poses specific problems. Compliance requirements have increased, with multiple returns to be filed promptly. Additional resources have to be deployed by companies to ensure adherence. Top companies had to absorb transitional inventory losses running into crores of rupees to pass on the benefits of input credit utilisation to consumers. Also, technological integration with the GSTN portal posed challenges for the sector.

To summarise, GST reform has been directionally positive for the Indian pharma industry due to several factors like seamless credit flow, consolidation of taxes and elimination of tax cascading. Consumers have partly benefitted from moderation in prices post-GST in the case of certain essential drugs. However, the increased compliance burden has added to costs.

GST and Healthcare Infrastructure

A robust healthcare infrastructure encompassing hospitals, clinics, diagnostic labs, blood banks, etc., is imperative to extend affordable and quality care to citizens across urban and rural areas. As per estimates, India has around 0.55 beds per 1000 population, an infrastructure deficit compared to the WHO norm of 3.5 beds. About 60% of hospitals and 75% of healthcare infrastructure are concentrated in the top 20 cities. India needs 2 million additional beds to achieve universal health coverage by 2025.

Under GST, healthcare infrastructure like hospitals, clinics and nursing homes are exempted from tax, while inputs like building construction, medical equipment, hospital consumables, etc . attract 5% or 12% GST. Certain life-saving medical devices are also exempt from levy. This differential taxation treatment poses certain GST-related challenges.

GST-related challenges

- Firstly, full input tax credits are not available in the case of healthcare infrastructure creation since output is exempt and there is an inverted duty structure. This increases the capital costs since all taxes paid on construction materials (cement, steel) and medical equipment cannot be claimed as a refund. As healthcare infrastructure requires significant upfront investment running into hundreds of crores of rupees, lack of input credit availability impacts project viability and prevents new capacity creation.

- Secondly, the exemption for healthcare infrastructure services also requires providers to assess eligibility under statutes regularly, besides meeting state-level requirements. Additional paperwork and complex documentation add to operating costs, especially for smaller establishments.

- Lastly, lack of clarity on tax applicability for certain newly added infrastructure like telemedicine platforms, diagnostic labs, intensive care units, emergency medical services, etc., increases the compliance burden and business costs. The absence of specific guidelines leads to different interpretations and dispute resolution proceedings.

Though GST provides exemptions on healthcare infrastructure creation, lack of credit flow, increased documentation needs, and ambiguity in rules have negatively impacted the growth of healthcare facilities. The government still needs incentives like tax holidays, viability gap funding, subsidised land allotment, and low-cost infrastructure financing to promote private sector investment.

GST and Healthcare Affordability

As highlighted by the government, one of the key objectives of GST was to make healthcare affordable and accessible for citizens across regions and income levels. However, the impact has been mixed so far.

For insured and financially stable sections, GST has brought down treatment costs due to the benefits of seamless credit flow and consolidation of all indirect taxes. Corporates that provide health insurance to employees have also witnessed a moderation in premium hikes post-GST as medical inflation has cooled down.

| Products | GST Applied |

| Room Rent Below Rs. 1,000 | 0% |

| Room Rent Between Rs. 1,000 to Rs. 2,499 | 12% |

| Room Rent Between Rs. 2,500 to Rs. 7,499 | 18% |

| Room Rent Above Rs. 7,500 | 28% |

| Surgical Products | 12% |

| Wheelchairs | 18% |

| Insulin | 5% |

Table: GST Applicable at Hospitals

However, out-of-pocket expenses remain high for economically weaker sections who mainly depend on the public healthcare system. Though healthcare services are exempt under GST, not much benefit can be passed to patients below the poverty line through the public health machinery due to wider systemic bottlenecks of infrastructure shortage, resource crunch, insufficient doctor-to-patient ratio, etc. They still struggle to afford quality care.

Challenges in Healthcare Affordability for Economically Weaker Sections Despite GST

Though branded generics fall under a 12% GST slab, essential and life-saving medicines are exempt, which provides a level of affordability to economically disadvantaged groups. However, for chronic illnesses like cancer, heart disorders, and related conditions requiring long-term hospitalisation, expenses quickly become unaffordable due to a lack of financial risk protection. Hence, GST benefits have yet to materialise fully for the bottom-of-the-dramid segments.

In regions where GST in healthcare infrastructure is adequate, input credit flow under GST, to some extent, controls patient expenses and ensures affordable treatment. But in rural areas suffering from availability issues, price reductions haven’t directly made facilities more accessible. Out-of-pocket expenditures for medicines can still impact the finances of farmers and daily wage workers.

While GST simplifies indirect taxation for the healthcare sector, more ground-level public spending is needed, considering India’s income pyramid dynamics. Government hospitals and primary health centres require major capacity enhancement and investment focus on tier 2/3 cities. GST can facilitate the availability of affordable infrastructure and drugs but may have a limited impact on healthcare accessibility for the poorest quintile in the absence of universal health coverage.

Conclusion

GST has had a mixed impact on the healthcare sector over the past five years. Consolidating all indirect taxes under a single regime has simplified the tax structure and removed cascading effects for healthcare providers. The seamless flow of input tax credits has also reduced capital costs for hospitals and clinics, leading to some drop in treatment expenses. Pharma companies have also gained from credit utilisation, though drug prices have not dropped significantly.

However, GST role in healthcare affordability has also increased healthcare establishments’ compliance burden and working capital needs due to complex documentation and increased frequency of tax filing. Concentrated healthcare infrastructure in metros and tier-1 regions causes affordability issues for the majority of the population. Out-of-pocket expenses remain high for economically weaker sections, causing financial hardship.

Going forward, the government should focus on enhancing public expenditure from 1.2% to 2.5% of GDP as envisaged in the National Health Policy. GST revenue can indirectly support healthcare infrastructure creation through viability gap funding schemes and tax holidays.

Expanding the exemption list to include ancillary services can benefit healthcare companies. Lower GST rates on drugs and devices can enhance affordability. Investing in primary care and preventive health should be prioritised over the expansion of crowded corporate hospitals in metros to ensure citizens across regions can access quality and affordable healthcare.

Also Read: How Do I Calculate GST On Services?

Also Listen: CaptainBiz Ke Sath Apna Free Trial Shuru Karein

FAQs

-

What is the GST rate on healthcare services?

Healthcare services like doctor consultations, hospitalisation, diagnostics tests, etc., provided by healthcare facilities such as hospitals, nursing homes, and clinics are exempt from GST, which helps patients save costs.

-

Is GST levied on life-saving medicines & equipment?

Life-saving medicines like anaesthesia, blood, oxygen, and equipment like stents attract a nil GST rate, ensuring affordability.

-

How does GST impact healthcare infrastructure projects?

While healthcare services are exempt, inputs like building materials and hospital equipment fall under the 12%- 5% GST slab leading. This increases project costs due to a need for input tax credits. We need additional subsidies and incentives to attract investments.

-

Has GST made generic medicines more affordable?

Most generic medicines fall under the 12% GST rate with a provision for input tax credits helping manufacturers reduce final costs. Coupled with trade margin caps, GST has had a small positive impact on essential medicine prices.

-

How can hospitals reduce tax burden under GST?

Hospitals can register separate entities for food, pharmacy and lab services, which fall under the taxed GST bracket. This allows them to claim input tax credit on procurement through the taxable entity without affecting exempt healthcare services.

-

Does GST tax home healthcare services?

Home healthcare services, like doctor visits and nursing care, tax patients at 18%, increasing costs compared to hospitals.

-

Do authorities apply GST to medical equipment used by the disabled?

GST exempts assistive devices for physical disabilities, such as hearing aids and orthopedic devices, to ensure affordability for vulnerable groups.

-

Is employee insurance premium allowable as a business expense?

Employer-paid health insurance premiums reimbursed to employees are allowable as a business expense if required by the contract. Otherwise, the employer would add the value to employee income

-

Would GST apply to ambulance services?

Ambulance services by hospitals are exempt, while private operators face 5% GST with input tax credits for purchases.

-

Have authorities streamlined GST provisions for the healthcare sector?

Frequent exemptions and rate modifications for healthcare have increased compliance challenges and working capital needs. We need a unified, simple tax structure focusing on expanding coverage.