For any registration, be it Professional Tax or MSME, Income Tax, PF, etc., the place of business, i.e., the premises from where the business is being operated, is very vital. The place of business determines which Department to assign to a particular jurisdiction. The same is the case with GST Registration. During the early days of the GST rollout, there was no control or check on the GST Registration as the Government trusted the taxpayers. But in some cases, it has been observed that the privilege given is being misused by a section of the taxpayers while obtaining GST Registration in a fraudulent manner. To minimise or eliminate such misusage, the Government has introduced various measures like linking Aadhar Numbers, picking up the mobile number and email ID from the PAN data, and geotagging the locations of the place of business. Now let’s understand what geotagging is, how it works in GST, and the dos and don’ts.

Geotagging refers to the procedure of including geographical data about a specific location, typically comprising latitude and longitude coordinates.

For persons or entities who are obtaining a new registration, geotagging is mandatory. For existing ones, they can change their place of business or add an additional place of business by making amendments to the core fields in the GST portal (i.e., www.gst.gov.in). For adding a geotag to the principal place of business or additional place of business, the taxpayers must use Form GST REG, and new taxpayers have to use Form GST REG 01.

The process of making amendments to the existing place of business or adding a place of business shall be as follows:

- Go to the GST Portal

- Login with the credentials

- Go to Services, User Services, My Applications, and Saved Applications.

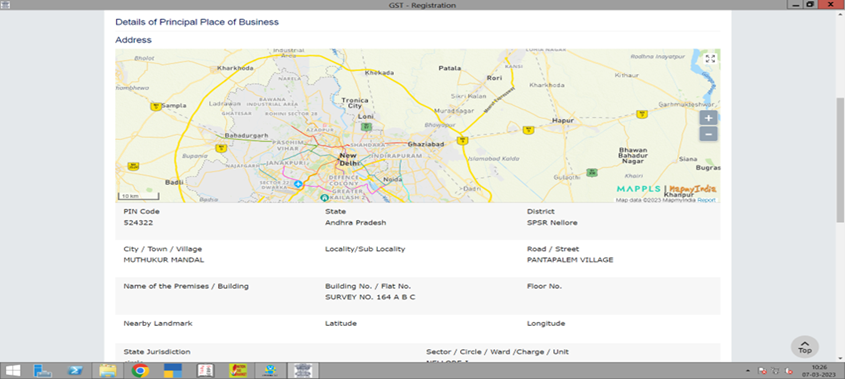

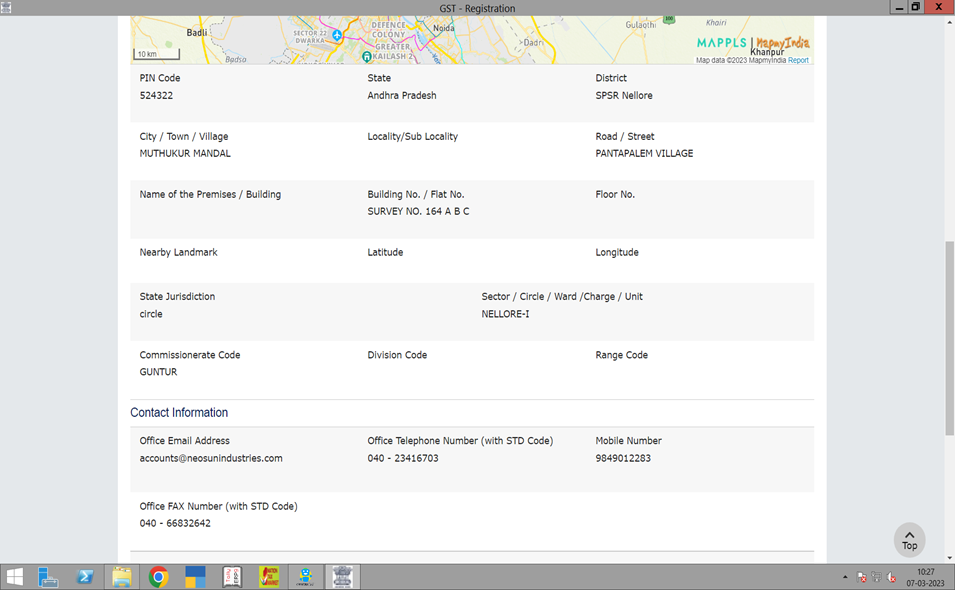

- Fill in the details as shown in the below picture.

If we locate the exact location, i.,e the principal place of business premises or additional place of business premises, the details such as Pin Code, State, District, Town, etc., are auto-populated. The particulars shall be filed manually if there is an error in locating the place of business, as shown here.

The following documents should be attached to show the ownership of the place of business

- Electricity bill

- Municipal taxes paid receipt

- Rental deed

- Sale deed

Once verified, the taxpayer has to submit the data recorded by accepting the Terms and Conditions through Electronic Verification Code (EVC), aka Or Digital Signature.

Read More : A Step-by-Step Guide to GST Registration for E-Commerce Businesses

CaptainBiz recommends that existing taxpayers complete the Geotag on the portal at the earliest. Currently, there is no time limit imposed by the Government now, but going forward, it can be imposed. To avoid the last-minute rush, it can be completed immediately.