On February 24, 2023, the Goods and Services Tax Network issued an advisory on geocoding of the principal place of business. Geo-coding is a mandatory process for address verification in India’s Goods and Services Tax (GST) system. It includes converting physical addresses into geographic coordinates (latitude and longitude) and has become a vital tool for ensuring the accuracy of a company’s or the vendor’s location.

Here, we will learn more about geocoding in GST registration, its advantages, procedures, and the need for geo-coding in address verification under GST in India.

Features of Geocoding in GST Registration

These are the features provided by the GST portal to the users to apply for Geocoding in GST registration:

- The GST department has included a map with a drop-down feature to help users pinpoint the exact location of their address.

- Once the place is picked on the map, the information is automatically filled in the address entry fields provided by the application’s interface. The user is responsible for reviewing the details and making any necessary changes.

- Also, the authorities ensured that the address fields were interlinked so that subsequent address entry forms would auto-fill based on the user’s information. For example, once the user enters the PIN code, the system will automatically recognize and populate the appropriate State and District.

- Another important feature added by the GST authorities is the ability for users to manually enter their address using suggested address input that appears in dropdown lists. The users can choose the suitable and necessary address fields. This would eliminate errors in address texts while also making it easier for the user to enter the correct address input fields in the GST portal.

- The authorities have also managed to properly separate the address fields in order to prevent user confusion while entering relevant inputs under distinct address categories. According to the address inputs provided by the user, the longitude/latitude of the address will be auto-generated, which is non-editable.

Implementation of Geocoding of Place of Business in GST

The introduction of geocoding of the place of business in GST took place in different phases. Let’s have a look at the various stages of its implementation.

| S. No. | Particulars | Month of Implementation |

|

|

Geocoding for new registrants | March, 2022 |

|

|

Geocoding for existing registrants’ principal place of business | February, 2023 |

|

|

Geocoding for extra place of business | September, 2023 |

What Are The Requirements For Geocoding?

There are a few requirements that business owners need to fulfill as they choose to utilize geocoding for GST registration:

- A physical address of the business or supplier that is legally valid.

- Capacity to access services for the geocoding procedure.

- A GST system is to be used for updating the verified address.

- Services for geocoding and a stable internet connection to allow smooth access to the GST system.

- Adequate information and knowledge about geocoding and steps to use it.

GSTIN Guidelines for Principal Place of Business Geocoding

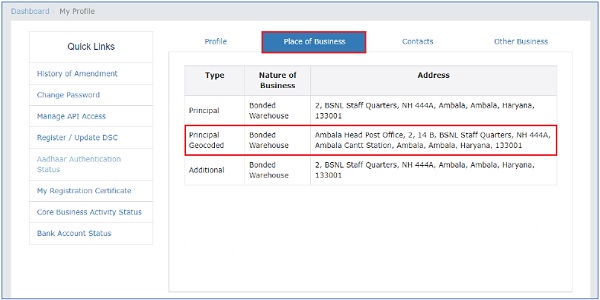

The Services/Registration page of the GST portal in the FO Portal includes the option to geocode the principal place of business. Taxpayers might review the geocoded address that the system has produced and decide whether to accept it or make changes based on their needs. The geocoded address information will be stored separately from the current address and kept under the “Principal Geocoded” page on the site.

The geocoding link will not be available at the portal upon submission of the geocoding details, and changes to the address will not be allowed anymore. Thus, it is a one-time procedure. General, Formation, SEZ Developers, SEZ Units, Casual Taxpayers, and ISD can all access this service, no matter if their status is active, canceled, or suspended.

Legal Aspects of Geocoding in GST

Geocoding in GST registration has a pivotal role to play. While geocoding basically aids in determining the pinpoint location of any business entity, it addresses several legal aspects of GST as well.

-

Avoiding Legal Disputes and Penalties:

Lack of accuracy in geocoding can lead to an incorrect calculation of applicable tax rates. This can lead to unwanted legal disputes and penalties. Thus, reliable and accurate geocoding methods must be employed to mitigate potential risks.

-

Intellectual Property Rights:

Many geocoding solutions rely on proprietary algorithms, software, or geographic data sources. Use of these resources must be in compliance with all relevant license agreements, terms of service, and intellectual property rights.

-

Compliance with Geospatial Regulations:

The accumulation, utilization, and distribution of geospatial data, especially geocoded addresses, may be subject to particular regulations or laws in particular regions or jurisdictions. Adherence to these regulations is essential to avoid legal consequences.

-

Auditing and Record-Keeping:

It can be advantageous to have reliable documents and audit trails of the geocoding procedure in the event of legal disputes or investigations. This can help demonstrate compliance with relevant laws and regulations.

It is recommended to consult with legal professionals, data protection officials, and other relevant authorities to navigate these legal issues and make sure that the geocoding procedure for GST registration complies with all necessary regulations and legislation. Regular reviews and updates to geocoding practices are also necessary to keep pace with evolving legal landscapes.

Step-by-Step Guide to Geocoding in GST Registration

Geocoding or Geolocating the place of business in GST registration is not a difficult task for taxpayers. The following are the steps that need to be taken for the purpose of Geocoding in GST registration:

STEP 1: Visit the GST portal using any of your devices. Log in to the portal using your login ID and password.

STEP 2: Once you log in successfully, your dashboard will display a message stating that the ‘address of the place of business is not geocoded’. To proceed, click on ‘Continue’.

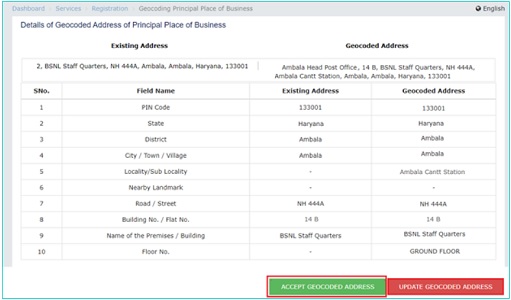

STEP 3: The current registered address for the major place of business will be shown to you. If the address presented is correct, click ‘Accept geocoded address’.

STEP 5: The accepted address will be displayed on the map. Verify it once again before proceeding.

STEP 6: Tick the verification box.

STEP 7: Select the authorized signatory’s name from the drop-down list and enter the location name.

STEP 8: At last, choose from DSC or EVC options whichever is applicable for you in order to submit Geoding. For DSC click on certificate, sign, and proceed. For EVC, an OTP will be sent to your registered mobile number and email ID. Just enter it and your work is done.

Steps to Update Geocoded Addresses

If the geocoded address does not appear on the screen or if you wish to make any changes, click the ‘Update geocoded address’ button and follow the steps mentioned below:

STEP 1: After clicking ‘Update geocoded address’, the data of the existing major place of business as per the Registration details will be displayed to you with the map.

STEP 2: Move the “pin” available on the map to mark the correct location, and click on “Confirm” to proceed. If you can’t locate your address on the map, manually type the address in the “Locate your address” field and choose from all the available options.

STEP 3: The address fields will be automatically filled after the second step. If there are any empty fields on the displayed screen, fill them manually

STEP 5: Tick the verification box, select the authorized signatory’s name from the drop-down list, and provide the filing location.

STEP 6: Based on your eligibility, choose ‘Submit with DSC’ or ‘Submit with EVC.’ If you wish to finish this later, use the ‘Remind me later’ option.

STEP 7: For DSC, pick and sign the certificate, and for EVC, input the OTP issued to your registered email and phone number.

STEP 8: A notice confirming the update will appear on the screen, and an email and SMS will be sent to the registered contacts.

Keep in mind that changing the geocoded location does not affect the principal place of business address listed on the Registration Certificate. If you are willing to change the principal location, you will have to file an amendment application.

Benefits of Geocoding Beyond GST Registration

There are a variety of benefits of Geocoding for address registration under the GST system in India. A few of the benefits of Geocoding in GST registration include:

-

Enhanced Accuracy:

Geocoding allows better accuracy in the procedure of address verification as it precisely pinpoints the exact location of the business or supplier.

-

Optimized Procedure:

The procedure is highly optimized and can be completed quickly with the availability of geocoding. This is possible with geocoding as it eliminates the requirement for a manual verification procedure.

-

Higher Compliance:

The importance of Geocoding requirements for GST compliance cannot be emphasized enough. Geocoding ensures overall compliance of the business and supplier with GST rules.

-

Reduced Errors:

Manual procedures are likely to lead to errors in the process of GST registration; however, geocoding reduces the risk of errors and improves precision.

Challenges And Solutions in Geocoding For GST Registration

The process of converting addresses as geographical coordinates for GST registration can be challenging due to certain factors. However, these challenges have solutions to them as well. Let’s have a look at these challenges and solutions:

Challenges

-

Standardization of Addresses

It is a major challenge to match addresses with geographical coordinates exactly as they can be available in various formats. For instance, geocoding algorithms may read “123 Main St.” and “123 Main Street” differently, even if they both refer to the same place.

-

Rural and Remote Areas

The data is likely to be less standardized or incomplete in rural and remote areas. Thus, geocoding can be challenging in such areas when compared to urban areas where street-level mapping is highly accurate.

-

Multi-unit Buildings and Complexes

It is common for businesses to be located in multi-unit businesses or complexes. A single address corresponds to geographical locations in such cases and geocoding can get complicated.

Solutions

-

Address Parsing and Standardization

Geocoding accuracy can be significantly improved with the implementation of parsing algorithms that allow the identification of standardized address components.

-

Geocoding Service Integration

Advanced geocoding services, geocoding tools for businesses, and APIs employ technologies like machine learning and crowd-sourced data for higher precision in geocoding. This can be particularly beneficial in rural and remote areas.

-

Multi-unit Buildings and Complex Handling

Incorporation of building footprints, unit numbers, or additional location identifiers like floors and wings can be a useful method for handling multi-unit buildings and complexes in geocoding.

-

Regular Data Updates

Regular data updates of geographic data used in geocoding to address the latest developments, modifications in address, and better mapping information are essential for accuracy.

Overcoming the challenges by implementing appropriate solutions can help businesses improve their accuracy and reliability of geocoding with GST registration. This would further result in better logistics, location-based services, and optimized business operations.

Tools for Geocoding in GST Registration

There is a high importance of accurate geocoding in GST and to provide accurate Geocoding for GST registration and other business purposes, there are multiple tools and APIs are available. These resources and tools can help you easily obtain latitude and longitude coordinates, verify addresses, and add geocoding features to your business. Read about the below-mentioned Geocoding tools for business to simplify your day-to-day operations:

- Google Maps Geocoding API

- Mapbox Geocoding API

- Bing Maps Geocoding API

- ArcGIS World Geocoding Service

- OpenCage Geocoder API

- SmartyStreets Geocoding API

- HERE Geocoding API

Conclusion and Key Takeaways

The importance of Geocoding as a crucial tool for verification of address under the Goods and Service Tax in India cannot be emphasized enough. Geocoding can significantly mitigate the risk of errors, ensure regulatory compliance, and enhance accuracy as well.

Use of Geocoding for verification of business address simply requires a physical valid address and knowledge to access and use a geocoding service. Following the right steps of the procedures for geocoding can assist businesses and suppliers in making sure that they fulfill GST requirements and avoid any kind of penalties.