I. Introduction to GST and Compliance

The Goods and Services Tax (GST) represents a significant shift in India’s indirect tax structure, unifying numerous central and state taxes into a single tax system. This comprehensive tax system aims to eliminate the cascading effect of taxes, fostering a more seamless national market and a transparent tax regime.

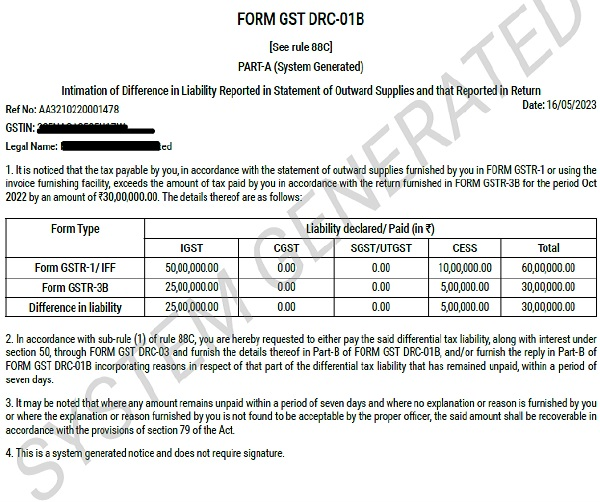

Compliance within this GST framework is paramount, as it ensures the smooth functioning of the tax system and fair competition among businesses. A thorough understanding of GST compliance forms is essential for accuracy in tax filings, as it impacts everything from input tax credits to final tax liability. Understanding GST forms like GST Form DRC-01B is crucial for any business. These forms help make sure that you’re paying the right amount of taxes. Getting these forms right keeps your business in good standing and avoids trouble with tax authorities.

We’re going to look closely at what you need to fill out Form DRC-01B and compare two other forms, GSTR-1 and GSTR-3B. Knowing the differences between them is important for managing your taxes well.

II. Understanding Form DRC-01B

GST Form DRC-01B is a form of significant importance used within the GST framework, primarily serving the purpose of tax discrepancy resolution. This form acts as a formal intimation to taxpayers when a discrepancy in tax payment is identified by tax authorities during an audit, inspection, or assessment, requiring the taxpayer to explain or rectify the issue.

Businesses may need to use GST Form DRC-01B under various circumstances, typically when notified of a mismatch or additional liability after a government tax audit. The form is integral to ensuring that businesses and the GST authorities are on the same page regarding tax dues and payments.

The context in which GST Form DRC-01B is employed is crucial as it underscores the importance of accurate GST filings and adherence to compliance standards. It is a response mechanism that allows taxpayers to address and rectify discrepancies, thus avoiding potential penalties or interest on delayed payments. By fulfilling Form DRC-01B filing requirements, businesses demonstrate their commitment to maintaining compliance with GST regulations, which is instrumental in the transparent functioning of the tax system.

III. Key Components of Form DRC-01B

Form DRC-01B is essential in GST compliance, facilitating communication between taxpayers and authorities regarding tax discrepancies. The form includes several key components:

- Tax Period: The specific period during which the discrepancy occurred.

- Reference Numbers: Any associated audit or investigation reference numbers.

- Discrepancy Details: Description of the nature of the tax discrepancy.

- Tax Amounts: The amount of tax and interest involved.

- Documents Attached: A checklist of documents submitted along with the form.

To accurately complete each section of GST Form DRC-01B, businesses must refer to the corresponding audit or assessment reports, accurately reflect the tax period in question, describe the discrepancy in clear terms, specify the correct tax and interest amounts involved, and attach any supporting documents as required. Following these steps ensures compliance with the Form DRC-01B filing requirements.

IV. Comparison: GSTR-1 vs. GSTR-3B

| Feature | GSTR-1 | GSTR-3B |

| Purpose | Reports details of outward supplies | Summarizes tax liability, claims ITC |

| Filing Frequency | Monthly or quarterly | Monthly or quarterly for all taxpayers |

| Who Files | All registered taxpayers except those on the composition scheme | All regular taxpayers |

| Contents | Detailed invoice-wise information for all outward supplies | Consolidated summary of inward and outward supplies, including tax liability and ITC claimed |

| Used for | Compliance and transparency in sales transactions | Payment of tax and filing of tax summary |

| Impact on ITC | Does not directly impact ITC claims | Crucial for claiming and reconciling ITC |

| Deadline | 11th of the following month for monthly filers or last day of the month following the quarter for quarterly filers | 20th of the following month |

GSTR-1 and GSTR-3B serve distinct roles in GST compliance. GSTR-1 is a detailed report of a business’s sales transactions for a tax period, whereas GSTR-3B is a summary return that includes consolidated details of outward supplies, input tax credits claimed, and the resulting tax liability.

The GSTR-1 vs GSTR-3B difference also extends to their filing frequency and deadlines. GSTR-1 is filed monthly or quarterly, depending on the business’s turnover, with specific deadlines set for each type of filer. On the other hand, GSTR-3B must be filed monthly by all regular taxpayers, typically by the 20th of the following month.

Understanding these distinctions is vital for businesses to manage their tax filings accurately. GSTR-1 requires meticulous record-keeping for each invoice, while GSTR-3B demands a high-level summary that should match the details reported in GSTR-1 to ensure a seamless Input Tax Credit (ITC) mismatches and reconciliation process. Timely and accurate filings of both returns are crucial due to the importance of accurate GST filings, as any discrepancies can lead to financial penalties and complicate the compliance process.

V. Understanding GST Compliance

The system of GST compliance is designed to streamline the tax regime across India, making it essential for businesses to adhere to a set of rules and filing requirements. Timely and accurate filings are the foundation of this system, which prevents tax evasion and ensures transparency. Each GST return, from GST Form DRC-01B to the more frequently used GSTR-1 and GSTR-3B, plays a specific role in this process.

The importance of understanding these compliance requirements cannot be overstated. A solid grasp of these obligations helps businesses to avoid penalties, interest, or even legal action due to non-compliance. It also helps in maximizing the benefits of ITC and maintaining healthy cash flows, underpinning the importance of accurate GST filings.

VI. Detailed Analysis of GSTR-1

GSTR-1 is a return form that is an integral part of the GST compliance process. It is required to be filed by all registered businesses except those opting for the composition scheme. GSTR-1 captures details of all outward supplies or sales, making it crucial for the calculation of a business’s GST liability.

In understanding this form, it becomes clear that it is not just about reporting sales but also about ensuring that the input tax credits are correctly claimed by recipients. Any errors in GSTR-1 can lead to ITC issues for the buyers, which is why understanding GST compliance forms, particularly GSTR-1, is critical. It directly affects the accuracy of GST calculations and, by extension, the entire tax liability of the businesses involved. Thus, a detailed analysis of GSTR-1 should cover its structure, filing deadlines, and its role in the reconciliation of ITC, highlighting its significance in the broader context of GST compliance.

VII. In-depth Examination of GSTR-3B

GSTR-3B functions as a self-declaration summary of taxes payable and Input Tax Credit (ITC) claimed for a particular tax period. This form encapsulates consolidated information about GST liabilities and credits, including details of outward supplies, inward supplies subject to reverse charge, and the total tax payable.

The reconciliation of GSTR-3B with GSTR-1 is an important aspect of GST compliance. GSTR-3B is designed to confirm the ITC amounts and tax payments declared in GSTR-1, ensuring they align with the actual tax liability. This process helps in identifying any GSTR-1 vs GSTR-3B difference that may exist due to reporting errors or omission of transactions. Accurate reconciliation supports the importance of accurate GST filings and allows taxpayers to rectify any discrepancies in subsequent filings.

VIII. Form DRC-01B in Practice

In the practical GST compliance process, GST Form DRC-01B is a crucial document for businesses facing additional tax liability post-audit. For example, a manufacturing company audited by GST authorities might receive a notice of tax discrepancy based on unreported sales. The company would then utilize Form DRC-01B to declare this additional liability and provide explanations or documentation to substantiate its case.

The Form DRC-01B filing requirements include a complete disclosure of additional tax due, along with interest or penalties, if applicable. Businesses must accurately fill and submit this form within the time frame specified by the authorities. Real-life case studies show that proper adherence to these requirements can help businesses manage potential tax disputes efficiently, further emphasizing the importance of accurate GST filings in maintaining compliance and ensuring fiscal responsibility.

IX. Conclusion

In conclusion, mastering GST forms like GSTR-1, GSTR-3B, and Form DRC-01B is essential for compliance and financial stability. Accurate filings prevent penalties and uphold business credibility. Looking ahead, it’s vital for businesses to stay updated with GST regulations to ensure continued compliance and make the most of tax benefits. Keeping up with these changes is crucial for maintaining a healthy financial standing and avoiding costly errors.

Also Watch: How to create E-way Bill With CaptainBiz

X. Frequently Asked Questions (FAQs)

-

What is GST Form DRC-01B and when is it used?

GST Form DRC-01B is a form issued by the tax authorities to a taxpayer when discrepancies are noticed in their GST filings. It’s part of the demand notice under the GST law. The form is used to communicate details of the tax amount payable or refundable to the taxpayer, often following an audit or assessment by GST officials.

-

Can you explain the GSTR-1 vs GSTR-3B difference?

GSTR-1 is a monthly or quarterly return that summarizes all sales (outward supplies) of a taxpayer, whereas GSTR-3B is a monthly summary return that includes details of both sales and purchases (inward supplies) along with the payment of tax. The critical difference is that GSTR-1 requires detailed invoice-wise information, whereas GSTR-3B is a consolidated summary.

-

What are the Form DRC-01B filing requirements?

The filing requirements for Form DRC-01B include a detailed response to the notice received, with documents supporting the taxpayer’s case. This may involve a reconciliation statement, evidence of tax payments, and other relevant documents. Taxpayers should carefully review the notice, as the form must address each point raised by the authorities.

-

Why is understanding GST compliance forms important for businesses?

Understanding GST compliance forms is critical for businesses as it helps ensure accurate reporting, timely payments, and avoidance of penalties. Each form serves a specific purpose, and incorrect or incomplete forms can result in legal repercussions, making it essential for businesses to be well-informed about their GST obligations.

-

Why is accurate GST filings important for a business?

The importance of accurate GST filings cannot be overstated, as they impact a business’s financial standing, legal compliance, and the ability to claim input tax credits. Accurate filings prevent financial penalties and maintain the company’s reputation with tax authorities and in the market.

-

How often should businesses review and submit GST Form DRC-01B?

GST Form DRC-01B should be submitted when a taxpayer discovers any tax liabilities that haven’t been declared previously in the GST returns. It’s not a regular form but rather occasion-based, triggered by specific circumstances such as audits or discrepancies found.

-

What happens if there’s an error in GST Form DRC-01B?

Errors in GST Form DRC-01B can lead to incorrect tax payments and potential disputes with the GST authorities. It is crucial to review the form thoroughly before submission to avoid any discrepancies that could complicate the tax process.

-

Can you highlight a significant GSTR-1 vs GSTR-3B difference in terms of ITC claims?

A key difference regarding ITC claims is that GSTR-1 does not deal with the input tax credit, as it’s solely for reporting outward supplies. Conversely, GSTR-3B is where taxpayers consolidate their ITC claims based on the purchases and inward supplies recorded.

-

Are there specific deadlines for the Form DRC-01B filing requirements?

Yes, the deadlines for filing Form DRC-01B are specified by the GST authorities in the notice served to the taxpayer. It’s imperative to adhere to these deadlines to avoid any compounding of interest or penalties.

-

In what ways can inaccuracies in understanding GST compliance forms affect a business?

Inaccuracies in understanding GST compliance forms can lead to misreported information, resulting in either excess payment or shortfall in tax liability. This can trigger audits and investigations, leading to a waste of resources, penalties, and in severe cases, legal action.