Non-Resident Taxpayer Registration (NRTP) is a vital process for people or businesses from outside India. It’s about getting registered with Indian tax authorities if you’re involved in economic activities here. The need for this registration arises when non-residents take part in transactions like selling goods or providing services within India. It’s basically following the rules.

Registering as a taxpayer in India has perks for non-residents. It allows them to be part of the Indian market, engaging in transactions while meeting legal requirements. This registration also helps in understanding and dealing with the Goods and Services Tax (GST) system. Knowing the GST rules for non-residents is crucial as it sets the criteria for eligibility and makes it easier to integrate into the tax structure.

In our exploration, we’ll dig into registration, Implications, Legal Entities and many more!

GST registration requirements for non-resident businesses

Understanding the Goods and Services Tax (GST) system is key for non-resident businesses in India. GST registration is necessary if you’re a non-resident involved in supplying goods or services in the country. This requirement ensures that non-residents comply with the tax rules related to their transactions within India. Exploring the GST registration requirements for non-residents becomes crucial, as it outlines the specific criteria and steps they need to follow to smoothly integrate into the Indian tax structure. This process not only facilitates legal compliance but also enables non-resident businesses to actively participate in the Indian market.

-

Here is the simplified process GST registration for Non-resident businesses:

- Step 1- Determine Eligibility

- Step 2- provide Authorization to Authorized Signatory

- Step 3- Apply for GST Registration by accessing https://www.gst.gov.in/

- Step 5- GST Registration Certificate is Issued

-

Document required:

- Permanent Account Number (PAN) or Tax Identification Number of the Applicant

- Proof of Business Incorporation

-

The taxpayer needs to provide the following proof of the principal place of business:

- Own Premises- For verification of ownership, documentation like property tax receipts, municipal khata copies, or electricity bills (not older than 3 months) may be necessary for one’s own premises.

- Rented or Leased Premises- A valid Rent/Lease Agreement, along with supporting documents like the lessor’s latest Property Tax Paid Receipt, Municipal Khata copy, or Electricity Bill, is required.

- In cases other than above, 2- A consent letter, accompanied by supporting documents like the consenter’s Municipal Khata copy or Electricity Bill copy, is needed.

- Bank Account Statement

Also Read: GST Registration For Non-Resident Taxable Person

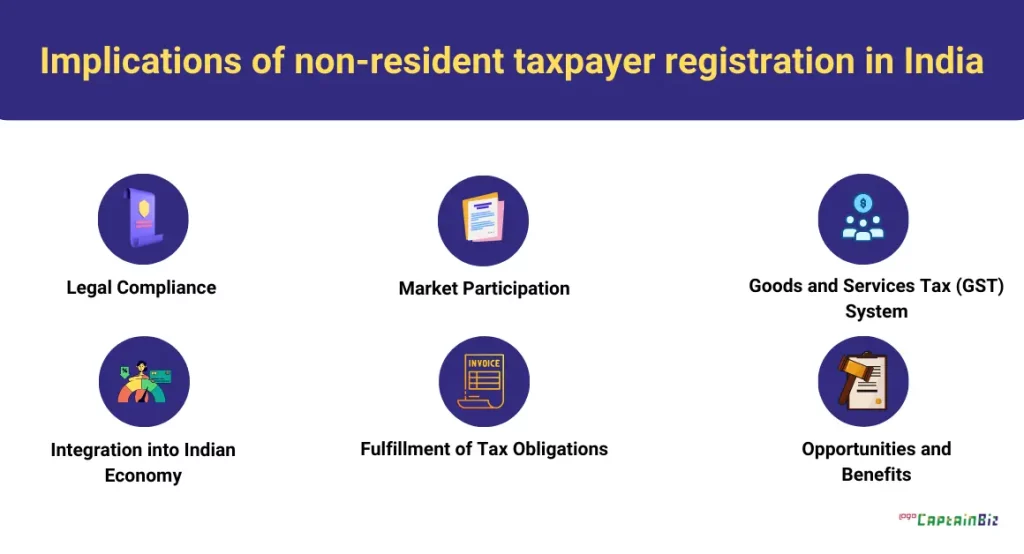

Implications of non-resident taxpayer registration in India

The implications of non-resident taxpayer registration in India include:

- Legal Compliance:

- Non-resident taxpayer registration ensures adherence to Indian tax regulations.

- It establishes a legal framework for individuals or businesses engaged in economic activities within the country.

- Market Participation:

- Registration facilitates active participation in the Indian market.

- Non-resident entities can undertake transactions, such as supplying goods or services, contributing to the economic landscape.

- Goods and Services Tax (GST) System:

- Understanding and complying with the GST system becomes crucial.

- GST registration is often a prerequisite for non-residents, enabling them to navigate the consumption-based tax system.

- Integration into Indian Economy:

- Non-resident taxpayer registration serves as a gateway for integration into the broader Indian economy.

- It allows for a structured approach to conducting transactions and engaging with the Indian business environment.

- Fulfillment of Tax Obligations:

- Registered non-resident taxpayers are obligated to fulfill their tax obligations.

- This includes timely filing of returns, maintaining records, and complying with other regulatory requirements.

- Opportunities and Benefits:

- Registration opens opportunities for non-residents to benefit from economic activities in India.

- It provides a platform for growth and collaboration within the Indian market.

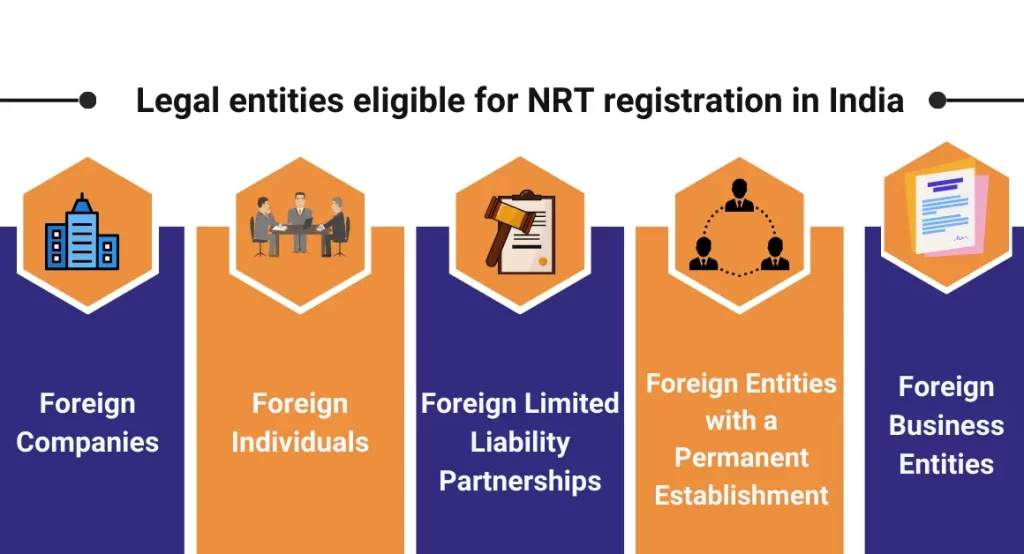

Legal entities eligible for NRT registration in India

Legal entities eligible for Non-Resident Taxpayer (NRT) registration in India include:

- Foreign Companies:

- Companies incorporated outside India that engage in economic activities within the country may be eligible for NRT registration.

- Foreign Individuals:

- Non-resident individuals conducting business or earning income in India may need to register as non-resident taxpayers.

- Foreign Limited Liability Partnerships (LLPs):

- Limited Liability Partnerships incorporated outside India, involved in economic activities within the country, may be eligible for NRT registration.

- Foreign Entities with a Permanent Establishment:

- Entities having a permanent establishment in India, even if not incorporated in the country, may need to register as non-resident taxpayers.

- Foreign Business Entities:

- Various forms of foreign business entities, such as branches, subsidiaries, or representative offices, engaged in economic activities in India, may be eligible for NRT registration.

Common vs. separate NRT registration: A comparative analysis

| Criteria | Common NRT Registration | Separate NRT Registration |

| Definition | One registration for multiple entities under a common umbrella or ownership. | Each entity obtains an individual registration. |

| Entities Covered | Multiple entities or business units can operate under a single registration. | Each entity or business unit requires its own distinct registration. |

| Simplicity of Compliance | Simplifies compliance as all entities follow a unified process under one registration. | Requires separate compliance efforts for each registered entity. |

| Control and Management | Centralized control and management of compliance procedures. | Allows for independent control and management for each registered entity. |

| Ease of Administration | Streamlines administrative processes for multiple entities. | Administration may be more complex due to individual registrations. |

| Changes in Information | Changes in information are reflected across all covered entities simultaneously. | Each entity must individually update and manage changes in information. |

| Costs and Fees | Potential cost savings as fees and compliance costs are consolidated. | May result in higher costs due to separate fees and compliance efforts for each entity. |

| Flexibility | Offers flexibility for entities to operate together seamlessly. | Provides autonomy to each entity, allowing for independent operations. |

| Risk Management | Collective risk management approach for all entities under common registration. | Individual risk management for each registered entity. |

| Scalability | Efficient for entities with shared resources and operations. | Suitable for entities with distinct operations or business models. |

This comparative analysis provides an overview of the key differences between Common and Separate NRT registration, considering factors such as compliance, control, administration, and overall feasibility for entities operating in India.

Also Read: Common vs. Separate NRT GST Registrations: Analyzing the Pros and Cons

Tax obligations of non-resident taxpayers in India

- Filing Income Tax Returns:

- Non-resident individuals and entities must file income tax returns if they earn income in India. The income can be from various sources such as salary, business profits, capital gains, or other taxable activities.

- Complying with Goods and Services Tax (GST):

- If engaged in the supply of goods or services in India, non-resident businesses may have GST obligations. This includes GST registration, filing returns, and complying with GST regulations.

- Withholding Tax Compliance:

- Non-resident taxpayers are subject to withholding tax (TDS) on certain types of income, such as interest, dividends, royalties, or fees for technical services. Compliance involves deduction and deposit of TDS by the payer.

- Transfer Pricing Compliance:

- Non-resident entities engaged in transactions with their Indian subsidiaries or related parties must adhere to transfer pricing regulations to ensure fair valuation of transactions.

- Taxation of Capital Gains:

- Non-residents may have tax obligations on capital gains arising from the sale of assets in India, such as property, shares, or other investments.

- Taxation of Royalties and Fees for Technical Services:

- Non-residents receiving royalties or fees for technical services in India are subject to taxation on such income.

- Fulfilling Other Reporting Requirements:

- Non-resident taxpayers may have additional reporting requirements, such as providing information on foreign assets, foreign bank accounts, or other financial interests.

- Adhering to Double Taxation Avoidance Agreements (DTAA):

- Non-residents can benefit from DTAA to avoid being taxed on the same income in both their home country and India. Compliance involves availing treaty benefits and providing required documentation.

Conclusion:

To sum up, opting for Non-Resident Taxpayer (NRTP) registration under GST can be advantageous for businesses occasionally supplying goods or services in India from outside the country. The registration process is straightforward, and once completed, NRTPs follow the same rules as regular taxpayers. For NRTPs, seeking advice from a tax expert is advisable to grasp the registration intricacies and compliance obligations thoroughly. This ensures a smooth integration into the Indian taxation system and a clear understanding of the responsibilities that come with being a registered non-resident taxpayer.

Also Read: GSTR-5: Everything You Need To Know

FAQ’s

-

What is Non-Resident Taxpayer (NRTP) registration in India?

- NRTP registration in India refers to the process by which non-resident entities or individuals who engage in taxable activities within the country register themselves with the tax authorities to fulfill their tax obligations.

-

What are the GST registration requirements for non-resident businesses in India?

- Non-resident businesses supplying goods or services in India are required to obtain GST registration if their turnover exceeds the threshold limit prescribed by the GST law, currently set at INR 20 lakhs (INR 10 lakhs for special category states).

-

What are the implications of non-resident taxpayer registration in India?

- Non-resident taxpayer registration implicates compliance with Indian tax laws, including filing tax returns, payment of taxes, and maintaining proper records. It also enables non-resident taxpayers to avail themselves of input tax credit and claim refunds where applicable.

-

Which legal entities are eligible for NRT registration in India?

- Legal entities such as foreign companies, non-resident individuals, limited liability partnerships (LLPs), and any other entities conducting business activities in India that attract tax liabilities are eligible for NRTP registration.

-

What is the comparative analysis between common and separate NRT registration?

- Common NRT registration allows multiple business verticals of the same legal entity to be registered under a single GST registration, while separate NRT registration mandates individual registrations for each distinct business vertical. The choice between common and separate registration depends on various factors such as administrative ease, compliance requirements, and business structure.

-

What are the tax obligations of non-resident taxpayers in India?

- Non-resident taxpayers in India are required to comply with various tax obligations, including filing periodic tax returns, payment of applicable taxes, such as GST, withholding taxes, and adhering to transfer pricing regulations if applicable. They must also maintain proper documentation and records as mandated by Indian tax laws.

-

Is NRTP registration mandatory for non-resident businesses operating in India?

- Yes, NRTP registration is mandatory for non-resident businesses operating in India if they meet the prescribed threshold for GST registration or engage in any taxable activities as per Indian tax laws.

-

How does NRTP registration facilitate the ease of doing business for non-resident entities in India?

- NRTP registration streamlines the tax compliance process for non-resident entities by providing them with a formal recognition of their tax status in India. It enables them to participate in the Indian market more seamlessly while ensuring adherence to the country’s tax regulations.

-

Are there any exemptions or special provisions available for non-resident taxpayers in India?

- Yes, certain exemptions and special provisions are available for non-resident taxpayers under Indian tax laws, such as provisions for claiming tax credits, exemptions from certain taxes based on bilateral agreements, and relief from double taxation through tax treaties.

-

What are the consequences of non-compliance with NRTP registration and tax obligations in India?

- Non-compliance with NRTP registration and tax obligations in India can lead to penalties, fines, and legal actions by the tax authorities. It may also result in disruptions to business operations, loss of reputation, and hindered market access in India. Therefore, it is essential for non-resident taxpayers to ensure timely compliance with Indian tax laws.