Introduction

The GST Act outlines that certain products and services are excluded from the GST system, and these items are known as GST exemptions. This list of exempted products is subject to periodic changes, but some goods, such as agriculture-related products and services, remain on the list. Tax exemption can be granted by the government for several purposes, such as assisting certain industries or lowering the cost of taxes on necessities. When a transporter moves these exempt products, they don’t require an e-way bill.

Well, now you may be asking, what is an e-way bill? An electronic document known as an e-way bill is necessary for the transportation of goods inside India valued at more than INR 50,000. The Indian government launched the e-way bill system in 2018 to assist companies in adhering to the tax regulations and streamlining the movement of products. So, carrying exempted products without e-way bills means the government needs to ensure compliance from the transporters in other ways.

Determining the item’s GST exemption status is necessary to comprehend the taxability of the item. Understanding the implications of an item’s exemption is just as crucial as being aware of the exemption list.

Let us walk you through the confusing area of e-way bill exemption and compliance. We will discuss these topics to give you a thorough idea.

- Types of exempted transactions and their documentation requirements

- Navigating E-waybill compliance in transactions without exemptions

- Strategies for businesses to ensure compliance in exempted transactions

- Legal considerations in documenting exempted transactions without E-waybills

- Addressing challenges in documentation for exempted transactions

- Industry-specific insights into compliance for exempted transactions

- Continuous improvement in documentation practices for exempted transactions

- Proactive measures for businesses to streamline exempted transaction processes

- Analyzing industry best practices for compliance without E-waybills

- Staying informed about changes in documentation requirements for exempted transactions

Types of Exempted Transactions and Their Documentation Requirements

The GST Act was introduced to create a common taxation system in the country. The exempt product list of the GST also applies to the whole country. Let us first check the products that are exempt so that the transporters can carry those without creating an e-way bill.

List of exempted goods:

1. Food

- Cereals, fruits, vegetables

- Edible roots and tubers

- Fish and meat

- Coconut, jaggery, tea leaves

- Coffee beans

- Seeds, ginger, turmeric, betel leaves, papad, flour

- Curd, lassi, buttermilk, milk

- Aquatic feeds and supplements.

2. Raw materials

- Raw silk, silk waste

- Wool (not processed), khadi fabric, cotton used for yarn

- Raw jute fiber, handloom fabrics

- Firewood, charcoal

3. Tools/Instruments

- Hearing aids

- Hand tools used for agricultural purposes

- Handmade musical instruments

- Aids used by physically challenged people

4. Miscellaneous

- Books, maps, newspapers, journals

- Non-judicial stamps, postal items

- Live animals (except horses), beehives

- Human blood, contraceptives

- Earthen pots, props used in pooja

- Kites, organic manure

- Vaccines

Types of Exemptions

-

Absolute exemption

A condition-free exemption means no tax must be paid.

Example: An electrical transmission or distribution utility that handles the transmission or distribution of power.

-

Conditional Exemption

An exemption that is contingent on a few requirements.

Example: a clinical facility may offer health care services in exchange for a room that costs more than Rs. 5,000 per day (other than an intensive care unit (ICU), critical care unit (CCU), intensive cardiac care unit (ICCU), or neonatal intensive care unit (NICU).

-

Partial exemption

When a taxpayer receives intra-state supplies of goods and services from an unregistered person, they are not required to pay tax under reverse charge as long as the total value of the supplies they receive from all or any of the suppliers does not exceed ~Rs 5000/- per day.

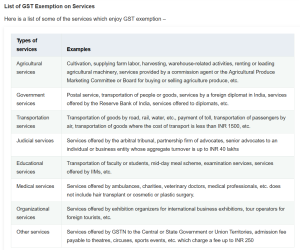

GST exemption also applies to services, check this image for a clear idea of those services.

Also Read: Exemptions From E-Waybill: Understanding The Criteria And Categories

Navigating E-waybill Compliance in Transactions without Exemptions

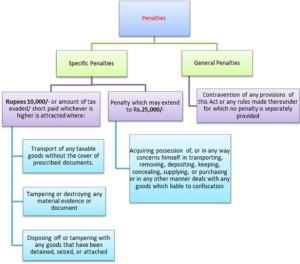

E-way bill compliance rules are very clear, and all transporters must abide by them to avoid penalties. There may be dire repercussions if the CGST legislation is violated by a transporter of non-exempt goods. The penalties for not carrying e-way bills vary, and any vehicle transporting products may be stopped at checkpoints by the authorities to ensure all necessary documentation, including the e-way bill, is in order.

- If an e-way bill is not carried for non-exempt goods, there is a minimum fine of Rs. 10,000.

- The authorities are also able to charge a fine that is equivalent to the amount of tax due for that particular shipment. The offender shall pay the tax value if the amount of taxes due exceeds Rs. 10,000.

- There are occasions when the seizure of the transport vehicle and its contents is mandated; these are usually orders given to repeat offenders.

- The goods can only be released to the owner after they got seized if the outstanding tax is paid within seven days.

Take a look at this image for a detailed understanding of the penalty amounts.

Strategies for Businesses to Ensure Compliance in Exempted Transactions

A list of articles exempt from the CGST is available in Regulation 138(14) of the 2017 act. This list ensures that people and businesses are not required by law to prepare e-way bills for some products in certain transportation situations. However, just because businesses are not required to produce an e-way bill for exempted transactions doesn’t mean they can transport the goods without any documents.

- Transporters that do not require e-way bills must still carry proper documentation.

- If the supplier or transporter paid the tax on the specified items but carried them without the required paperwork, the importer is obligated to pay a penalty.

- If the person or business carried items exempt from customs duty, they would be penalized Rs. 25,000, or five percent of the value of the commodities, whichever is lower.

Legal Considerations in Documenting Exempted Transactions without E-way Bills

Certain items, services, and transactions are excluded from the items and Services Tax (GST), meaning they are not subject to GST taxes. For these products, no e-way bill required for their transportation. Exemptions can be granted for several reasons, including administrative ease, socioeconomic factors, and policy purposes.

The following are some typical justifications for providing GST exemptions:

1. Social Welfare

There are important products and services that are excluded from GST because they are deemed necessary for societal well-being. This process covers staple foods, medical care, and educational services.

2. Interstate Supplies

To encourage the free flow of goods and services across state boundaries, some specified commodities and services that are supplied between states may be exempt from taxation.

3. Agriculture

A large number of goods and services connected to agriculture are GST-free to assist the agriculture industry, which makes a substantial economic contribution to India.

4. Financial Services

Depending on the specifics, certain financial services, such as banking, loan interest, and insurance, may be free from GST or subject to special rules to benefit the public and social services.

Also Read: Inter-state vs. Intra-state Exemptions: Navigating the Variation in E-waybill Regulations

Addressing Challenges in Documentation for Exempted Transactions

Different tax regimes for supply (goods and services) are described by many categories under the GST, including “Exempt,” “Nil Rated,” “Zero Rated,” and “Non-GST Supplies.” It can be confusing to understand the difference between non-GST, nil-rated, zero-rated, and exempt goods. Documenting the exempt products from the GST-approved product list is crucial to maintain compliance, and the regulations.

The application of GST varies depending on the category. The distinctions between these categories are as follows:

| Supply Name | Description |

| Exempt | Supplies are taxable but do not attract GST and for which ITC cannot be claimed |

| Zero-Rated | Exports Supplies made to SEZ or SEZ Developers |

| Nil Rated | Supplies that have a declared rate of 0% GST |

| Non-GST | These supplies do not come under the purview of GST law |

Also Read: What are the Exemptions from Generating an E-way bill?

Industry-specific Insights into Compliance for Exempted Transactions

Different industries benefit from the GST exempt laws in different ways, and deal differently with the compliance laws. The government takes into consideration how the industries will be affected by this law and decides on the matter upon reflection on various factors.

The government states that the public may benefit from the GST exemptions, and that is the priority. Any industry that cannot contribute to public benefit should not have their goods in the exempt category.

It is clear from the aforementioned considerations that several industries may be eligible for a GST exemption as long as they meet requirements. Gaining a thorough understanding of those requirements will enable a taxpayer to register for GST exemption.

Continuous Improvement in Documentation Practices for Exempted Transactions

An e-Way Bill is a useful method to keep an eye on product movement and control tax evasion. However, the e-way bill isn’t applicable for exempt goods and services. That is why, if a transporter is moving exempted goods, he/she is responsible for ensuring a copy of the tax invoice or a bill of supply gets carried while the transport vehicles are in transit.

Individuals who are only involved in the exempt supply of goods or services, or both, are exempt from having to register for GST under clause (a) of Section 23(1) of the CGST Act,2017, even if their total turnover exceeds the threshold outlined in Section 22(1).

Proactive Measures for Businesses to Streamline Exempted Transaction Processes

The exempted product list was created by the GST act so that goods required for public benefits can be transported quickly without a lot of legal papers. The entire reasoning behind the exemption list was to streamline the transport process of those goods.

The businesses also try to streamline this process and they have legal backing too. According to the Central Goods and Services Tax Act, Rule 138(14), no e-way bill is needed in the following situations:

- When goods are being transported to an inland container depot (ICD) for customs clearance from customs ports, air cargo, airport complexes, and land customs stations.

- An e-way bill is not necessary when the Federal government, a state government, or any other local government acting as a consignor conveys the goods by rail.

- There is no need for an E-way bill when the Ministry of Defence is the consignor or consignee.

- No e-way bill is needed if the items are being carried for weighing and the trip from the consignor’s place of business to the weighbridge, or vice versa, is less than 20 km. A delivery challan, however, is required with the items.

Analyzing Industry Best Practices for Compliance without E-way Bills

Industries have taken notice of the exemption rules and acted accordingly. They have trained their workers on how to deal with exempt products and streamline the process of transportation.

All managers prioritize the transport of these goods since they are useful for the public. The company management creates a timeline that helps move these exempt products as quickly as possible. Most importantly, the transporter always ensures that the transport vehicle drivers have the invoices of the goods and the bills of supply with them at all points since exempt products do not require e-way bills. With these four rules in place, the industries have created an efficient method to comply with the guidelines without e-way bills.

Staying Informed about Changes in Documentation Requirements for Exempted Transactions

The government is regularly amending the GST Act and making necessary changes in the rules. The transporters may regularly check after every update whether new products are added to the exempt product list or if some products that were on the list are excluded now. The transporter also needs to ensure that the documentation requirements for carrying exempt products haven’t changed, and if it has, they need to follow the new guidelines.

Conclusion

A transporter is not required to generate an e-way bill if the products he/she transports fall under the exempt product category. Taxpayers exempt from e-way bill compliance still need to make sure that all other documents are carried by the driver of the transport vehicle.

They also need to comply with other applicable laws and regulations, otherwise they face harsh penalties. We cannot overstate how important it is to ensure that a copy of the tax invoice or a bill of supply is carried by the transport vehicle driver when generating an e-way bill is not necessary.

Not following the regulations would lead to harsh penalties and even the seizure of goods and transport vehicles. To save them trouble, transporters can keep themselves updated on the GST exemption list for e-way bills, which currently consists of 153 products excluded from the e-way bill.

FAQs

-

What are the products and services exempt under the GST Act?

The most common goods exempt from GST are food products and fuel, and the most common services are agricultural, educational, transportation, and medical. Every product covered by GST is identified by its HSN code, or Harmonised System of Nomenclature, to ensure that GST’s invoicing procedures comply with international standards for product nomenclature.

-

How to create an e-way bill for non-exempt products?

You will need the necessary information to create an e-way bill, including the kind of goods being transported, the HSN code, the quantity and taxable value of the items, the recipient and transporter details, the vehicle number, etc. Before the items are in transit, an e-way bill must be generated and carried by the transporter to avoid regulation violation.

-

What is the applicability of an e-way bill?

Not every transaction a taxable person makes requires an e-way bill. However, all transactions involving the transfer of commodities, whether through a supplier or not, must include EWB. To put it another way, EWB will be necessary whenever there is a movement of products but EWB is not necessary for items used for services that do not need product transportation.

-

Is there a penalty for e-way bill mistakes for non-exempted products?

There are differences in the penalties for breaking e-way bill requirements for non-exempted products depending on the type of error. If there is a small mistake on the e-way bill, you or the registered company will be charged only Rs. 1,000. Section 129 of the CGST Act mentions these fines. Note that this sum is only relevant if the required taxes for the products being transported have already been paid. If the error is significant and has financial effects, the penalty would be much higher.

-

If I made a mistake in the e-way bill form, can I edit it?

If you filled out the form with inaccurate information, you can cancel it and get a new one. Only Part B of the e-way bill can be altered once it has been drafted. Recall that the cancellation needs to be finished within 24 hours of the e-way bill being generated. Remember that GST-exempted products do not require e-way bills, ensure that what you transport is not exempted.

-

What documents should I carry to transport exempt products?

A document called an e-way bill is used to track the movement of non-exempt goods and identify cases of tax evasion. Nonetheless, the government offers exceptions for situations in which the cargo being carried does not need the e-way bill. The transporter must make sure they have a copy of the tax invoice or a bill of supply when creating an e-way bill is not required.

-

Is there a regulation that must be adhered to while moving several exempted consignments at once?

Usually, for non-exempt goods, transporters submit the consignment’s e-way bill serial number on the e-way bill gateway while transporting several consignments in a single vehicle. However, for exempted products, you won’t require an e-way bill for any of the products. Remember, you must carry the bill of supply and invoice copies of all the products you carry without e-way bills.

-

What liability does a transporter have under the e-Way bill system?

If the supplier has not produced an e-way bill for any reason, transporters who are shipping products by air, land, sea, or other means must create an e-way bill if the goods are non-exempt. Create an e-way bill based on the details that suppliers and consignors have provided in the invoice. If the transporter fails to produce the aforementioned documents when he is supposed to, he may be subject to a fine of Rs 10,000 or the amount of tax being avoided, whichever is more. He may also be held accountable for having his vehicle seized and his products confiscated.

-

How to claim GST exemption for goods and services?

As a taxpayer, you may submit a combined report of goods that are GST-exempt under sections 8A, 8B, 8C, and 8D, and in your GSTR-1 returns, you can refer to this report as Nil Rated Supplies. Ideally, Section 3.1 should be titled “Tax on outward and reverse charge inward supplies” and should include information on exempted outward goods. Similar to this, information on exempt GST inward supplies in Section 5 of the GSTR-3B return may be headed “Exempt, nil, and non-GST inward supplies.”

-

Is there an exemption limit under the GST Act?

While registering for GST is not required for every firm, it becomes necessary for those that exceed a specific revenue cap. Depending on the type of business and the state in which the business is based, different thresholds apply. The Goods and Services Tax exemption limit varies according to the kind of business and the state in which it is located. The exemptions are mainly based on the products transported by the business.