Generating e-way Bills involves the entry of mandatory details like Customer name & address, shipping form & shipping to location, supplier name & address, HSN (Harmonized System of Nomenclature) codes, product names, and transporter information. Entering these details each time you make a bill can feel like a herculean; there is a high possibility of data entry errors, and time-consuming. To avoid these challenges or the pain points for the taxpayers or transporters, the e-waybill has provided the facility of Master Data. In Master Data, the users have to enter the data only once and then reuse the same again and again. Now let’s understand the various masters of the e-waybill, which will make the process of generation of e-waybill error-free and simple.

Master 1: Product Master

e-waybill is required to be generated at the time of movement of goods, and for this, the user has to enter the item name along with the HSN code, Unit of measure, quantity and price. All these details are to be entered once in the Master Data for “Products” : To Navigate to the Product Master follow the steps given below

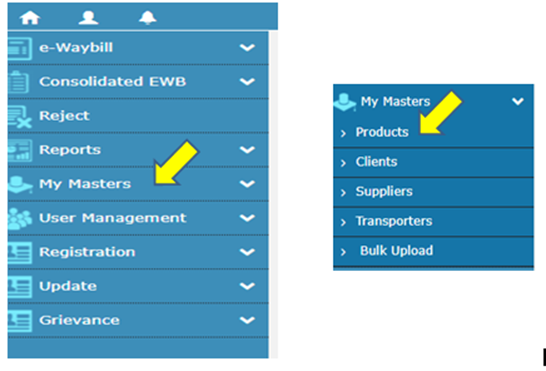

Step 1: Log in to your account and find ‘My Masters’ on the left panel.

Step 2: Navigate to the “Master” section on the left side of the portal.

Step 3: Select “Product” as the sub-option.

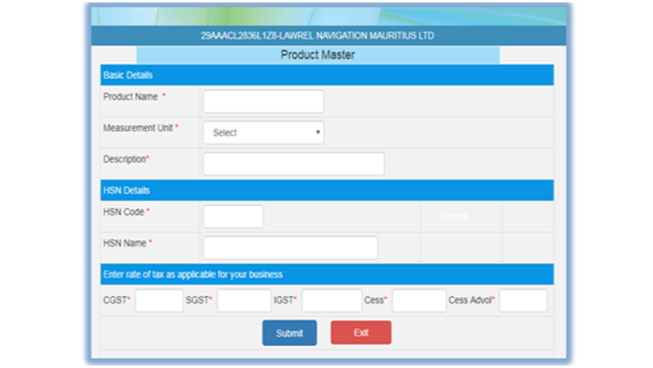

Step 4: Fill in the following details:

Product Name: Give your item/product.

Unit of Measurement: Specify how you measure your product (e.g., pieces, kilograms, liters).

Description: Description of the product/item.

HSN Code: Enter the HSN code of the item and it is recommended to enter all the 8 digits of the HSN

Tax Rate: Specify the applicable tax rates (CGST, SGST, IGST, Cess).

Step 5: Click ‘Submit.’ The system checks for errors and shows them on the screen. Correct any mistakes and submit again.

Read more: Common Issues and Solutions for E-way Bill Errors

Note: User can enter multiple times for the same product/item if the tax rates are different or the Unit of measure are different. There are multiple instances in GST where the tax rates differ to whom Items/products are supplied like ethanol when supplied to oil marketing companies, it is 5% and When suppliers to customers who are not oil manufacturing companies, it is 18%.

Master 2: Clients

In this section, you will store the Customer/Client details like his Name, GST Registration Number, Ship To Address, Bill To Address, along with the Pin Codes.

Step 1: Choose ‘Clients’ under ‘My Masters.’

Step 2: Select if the Client is registered or unregistered.

For Registered Clients :

Select ‘GST Registered’ and enter the GSTIN of the customer. Click ‘Submit.’ The customer’s name appears automatically. The system will also show the Principal Place of Business and Additional Places of business of the client/Customer. From the list the user can select the respective locations and delete the others to avoid wrong Selection by the persons who generate the e-waybill. Of the client/customer. Choose the place of business and distance in KMs from your location. Click ‘Submit.’ You’ll see a success message.

For Unregistered Clients/Customers

Choose ‘Unregistered GST’ and click ‘Submit.’ Enter the details as shown.

State: Select the name of the state where the client/customer is based out

Name: Enter the name of the Client/Customer

Address: Enter the address of the Client/Customer in the two lines provided. Ensure that the address provided is correct, else it may lead to the issue of notices and confiscation of the goods and the conveyance.

Pin Code: Enter the Pin code of the unregistered client/customer correctly, as this pin code will be used to determine the distance between your shipping location and, based on that, the validity of the e-waybill is determined.

Mobile Number: Enter the mobile number of the unregistered client/customer. The SMS alert will be sent to this mobile number only.

E-mail: enter the email of the unregistered client/customer correctly. E-waybill details will be mailed to this mail id only.

Approximate Distance in Kms: enter the distance between your shipping location to the unregistered Client/customer location. Basis of this, only the validity of the e-waybill is determined. Click ‘Submit.’ You’ll get a success message.

Master Data 3: Supplier Master

Similar to the Client/Customer Master, there is a necessity to save the data. Similar to managing clients, you also handle supplier details like the Name, GST Registration, Principal Place of Business, Additional Place of Business, along with the PIN Codes.

Step 1: Access “Master” and select “Suppliers.”

Step 2: Fill in the appropriate details for registered and unregistered suppliers. Step 3: Click “Submit” to save the supplier details.

Master Data 4: Transporter’s Master

Transporter Master is very essential for taxpayers as it will help them to complete the process of Generation of the e-waybill. In the normal course of business, the material will be shipped from the Taxpayers’ location to the transporters office, and from there, it will be shipped to the client/ Customer’s location. As the Vehicle number is not available at the time of movement of Goods. In Part A of the e-waybill, all the details will be entered, and in Part B of the e-waybill the vehicle number will be entered, and this will be entered by the transporter. To enable the transporter to enter the vehicle details, the taxpayer has to register the transporter in the master data.

Step 1: Under “My Masters,” select “Transporters.”

Step 2: Enter the transporter’s number and submit.

It will show the names of the Transporter’s GSTINs, Name, and address along with the Pin Code

Step – 5 : Creating Masters in Bulk Upload

Any Registered taxpayer has to deal with many suppliers, clients, products/items etc., It is not an easy task to enter the data of each and every supplier, customer, or item manually. To handle this requirement, the e-waybill portal provides a bulk upload facility for all the masters in one go in simple steps. To upload multiple masters in one go

Step 1: Go to the homepage at www.ewaybill.nic.in (remember, not the other similar addresses)

Step 2: Choose “My Masters”, “Bulk Upload”

Step 3: Now, the user has to select the option for which the bulk upload is being done. The options are

- Item

- Client

- Supplier

- Transporter

The bulk upload is done through a JSON file format, the users have to update the file with all the required data and then upload the same on the e-waybill portal. If the file contains all the required data and there are no errors, the data will be imported into the e-waybill system successfully. Once the data is uploaded, it is available for the taxpayer to generate the e-waybills without any challenges.

Related Read: e-Way Bill Registration Process: A Complete Guide

The usage of digitalization will help taxpayers to comply with the GST Requirements from to Time to time and be a 100% tax-compliant taxpayer. CaptainBiz recommends using the e-waybill Portal for the generation of e-waybill and also use the masters to update the data once and Re-use it without any human errors.