Introduction

There are several types of business structures, including sole proprietorship, partnership, limited liability partnership (LLP), and private limited company. Each structure offers different levels of liability protection, tax obligations, and management flexibility.

A Limited Liability Partnership (LLP) is a type of business structure where partners have limited personal liability, meaning they are not personally responsible for the debts of the business beyond their investment. It combines the flexibility of a partnership with the legal protection of a company.

For example, if two friends, Karan and Ashu, start a tech consulting firm as an LLP, they can both manage the business without risking their personal savings and property if the business incurs debt or faces legal issues. GST (Goods and Services Tax) registration is important for LLPs to comply with tax laws and get tax benefits. This blog will explain everything about GST registration for LLPs, including who needs to register, what documents are needed, how to register online, fees, timelines, and compliance requirements.

In this blog, we will discuss the LLP GST registration process, GST registration eligibility for LLPs, Documents required for LLP GST registration, Online GST registration for LLPs, GST compliance challenges for LLPs and many more!

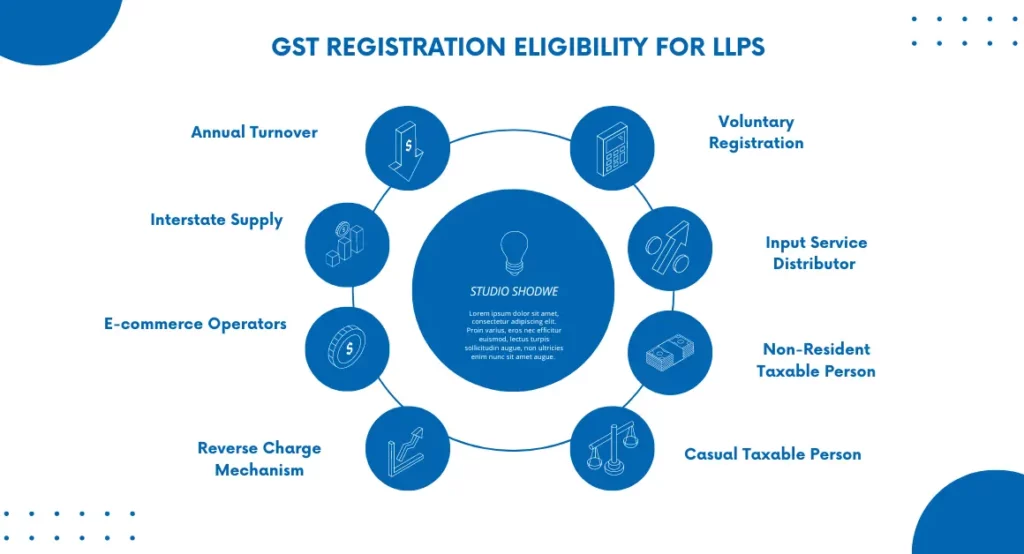

GST Registration Eligibility for LLPs

GST registration is mandatory for LLPs under specific conditions to ensure compliance with tax regulations and to avail the benefits of input tax credit. Here are the detailed eligibility criteria for GST registration for LLPs:

-

Annual Turnover:

- General Threshold: LLPs with an annual turnover exceeding ₹20 lakhs must register for GST.

- Special Category States: In states categorized as special (like those in the North-Eastern region), the threshold for mandatory registration is reduced to ₹10 lakhs.

-

Interstate Supply:

- LLPs involved in the supply of goods or services across state borders must register for GST regardless of their turnover. This is to ensure that interstate transactions are appropriately taxed.

-

E-commerce Operators:

- LLPs supplying goods or services through e-commerce platforms such as Amazon, Flipkart, or any other online marketplace must register for GST, regardless of their turnover.

-

Reverse Charge Mechanism:

- If an LLP is required to pay tax under the reverse charge mechanism (where the recipient of goods or services is liable to pay GST instead of the supplier), it must register for GST.

-

Casual Taxable Person:

- LLPs that occasionally undertake supply of goods or services in a taxable territory where they do not have a fixed place of business must register as a casual taxable person.

-

Non-Resident Taxable Person:

- LLPs based outside India but supplying goods or services to India need to register as a non-resident taxable person.

-

Input Service Distributor (ISD):

- LLPs that distribute the credit of GST paid on services to its branches having different GSTINs (under the same PAN) need to register as an ISD.

-

Voluntary Registration:

- LLPs can opt for voluntary GST registration even if they do not meet the above criteria. This can be beneficial for claiming input

Documentation Required for GST Registration

The following documents are required for GST registration of an LLP:

Document Type |

Details |

| PAN Card | PAN card of the LLP |

| Incorporation Certificate | LLP incorporation certificate issued by MCA |

| LLP Agreement | Copy of the LLP agreement |

| Proof of Address | Business address proof (electricity bill, rent agreement, etc.) |

| Bank Account Proof | Canceled cheque or bank statement |

| Authorized Signatory Details | PAN and Aadhaar of authorized signatories |

| Photographs | Passport-sized photographs of authorized signatories |

| Digital Signature Certificate (DSC) | Class 2 or 3 DSC of authorized partners |

Also Read: Documents Required For GST Registration For LLP Companies

Online Process for GST Registration of LLPs

The online process for GST registration is straightforward and can be completed by following these steps:

- Visit the GST Portal: Go to the official GST portal (www.gst.gov.in).

- Generate a TRN: Click on ‘Services’ > ‘Registration’ > ‘New Registration’. Fill in the required details and generate a Temporary Reference Number (TRN).

- OTP Verification: Verify your email and mobile number using the OTP sent to your registered details.

- Login with TRN: Log in using the TRN and complete the application form (Part-B).

- Upload Documents: Upload the required documents as mentioned above.

- Verification: Use DSC for verification of the application.

- ARN Generation: After submission, an Application Reference Number (ARN) will be generated.

- Processing: The application will be processed, and if all details are correct, the GSTIN (GST Identification Number) will be issued.

Also Read: How To Do GST Registration Online

GST Registration Fees and Timelines

- Fees: There are no government fees for GST registration. However, professional fees may apply if you seek assistance from tax consultants.

- Timelines: The GST registration process typically takes about 7-10 working days, provided all documents are in order and there are no discrepancies in the application.

Unique Considerations for LLPs in GST Compliance

LLPs must be aware of specific compliance requirements to ensure smooth GST operations:

- Regular Filing of GST Returns: LLPs must file monthly/quarterly returns and an annual return.

- Maintaining Records: Proper records of all transactions must be maintained for at least six years.

- Reverse Charge Mechanism: LLPs must account for GST under the reverse charge mechanism where applicable.

- Input Tax Credit (ITC): Proper documentation and timely filing are essential to avail ITC benefits.

GST Returns Filing for LLPs

LLPs need to file the following GST returns:

| Return Type | Frequency | Due Date | Details |

| GSTR-1 | Monthly/Quarterly | 11th of the next month/quarter | Details of outward supplies of goods or services |

| GSTR-3B | Monthly | 20th of the next month | Summary return including details of sales, purchases, ITC, and tax liability |

| GSTR-4 | Annually | 30th April of next financial year | For composition scheme taxpayers |

| GSTR-9 | Annually | 31st December of next financial year | Annual return providing comprehensive details of the entire financial year |

Also Read: Understanding LLP Annual Filing: Key Components and Deadlines

Conclusion

GST registration is a crucial step for LLPs to ensure legal compliance and benefit from the seamless flow of tax credit. Understanding the eligibility, documentation, and process for GST registration can help LLPs navigate the registration process efficiently. Regular compliance with GST regulations, timely return filings, and maintaining accurate records are essential for the smooth functioning of an LLP under the GST regime.

Frequently Asked Questions (FAQs)

-

Is GST registration mandatory for all LLPs?

No, GST registration is not mandatory for all LLPs. It is required if the LLP’s annual turnover exceeds ₹20 lakhs (₹10 lakhs for special category states) or if the LLP is involved in interstate supply, e-commerce, or under other specific conditions.

-

Can an LLP voluntarily register for GST?

Yes, an LLP can opt for voluntary GST registration even if it does not meet the mandatory criteria. Voluntary registration can help the LLP claim input tax credits and enhance its credibility with clients and suppliers.

-

What documents are required for GST registration of an LLP?

The documents required include:

- PAN card of the LLP

- LLP incorporation certificate

- LLP agreement

- Proof of business address

- Canceled cheque or bank statement

- PAN and Aadhaar of authorized signatories

- Passport-sized photographs of authorized signatories

- Digital Signature Certificate (DSC) of authorized partners

- How long does it take to get a GSTIN for an LLP?

It typically takes 7-10 working days to process the GST registration application and issue the GSTIN, provided all documents are accurate and complete.

-

Are there any fees for GST registration?

There are no government fees for GST registration. However, professional fees may apply if you seek assistance from tax consultants or professionals.

-

What is the penalty for not registering under GST when required?

Penalties for non-registration include a fine of 10% of the tax amount due or ₹10,000, whichever is higher. Continuous non-compliance can lead to higher penalties and legal consequences.

-

What are the benefits of GST registration for an LLP?

GST registration allows an LLP to:

- Legally collect GST from customers

- Claim input tax credits on purchases

- Avoid penalties for non-compliance

- Enhance business credibility

- Expand business operations interstate and through e-commerce

-

How does an LLP file GST returns?

An LLP must file various GST returns, such as:

- GSTR-1: Monthly/quarterly return for outward supplies

- GSTR-3B: Monthly summary return

- GSTR-4: Annual return for composition scheme taxpayers

- GSTR-9: Annual comprehensive return

-

What is the reverse charge mechanism in GST for LLPs?

Under the reverse charge mechanism, the recipient of goods or services is liable to pay GST instead of the supplier. LLPs must register for GST if they are required to pay tax under the reverse charge mechanism.

-

Can LLPs claim Input Tax Credit (ITC) after GST registration?

Yes, LLPs can claim ITC on their purchases after registering for GST, provided they comply with relevant conditions and timely file their GST returns. This helps reduce the overall tax liability.