In the realm of business, navigating through the complexities of Goods and Services Tax (GST) is crucial for compliance and operational efficiency. When it comes to GST registration, understanding the nuances of essential documents is paramount. Among these, the rent agreement holds a pivotal role.

This article aims to shed light on the indispensable pointers within a rent agreement that businesses must consider to facilitate a smooth and seamless GST registration process.

By delving into the intricacies of this document, businesses can ensure compliance with GST regulations and avoid potential pitfalls, fostering a foundation for successful and hassle-free operations within the GST framework.

Introduction to GST Registration for Rent Agreement

Goods and Services Tax (GST) is a crucial indirect tax reform that has transformed the Indian Taxation System’s scenario. Businesses that are involved in taxable supplies with a yearly turnover beyond the mentioned limit are required to register for GST. One of the indispensable documents required during GST registration is an authentic rent agreement.

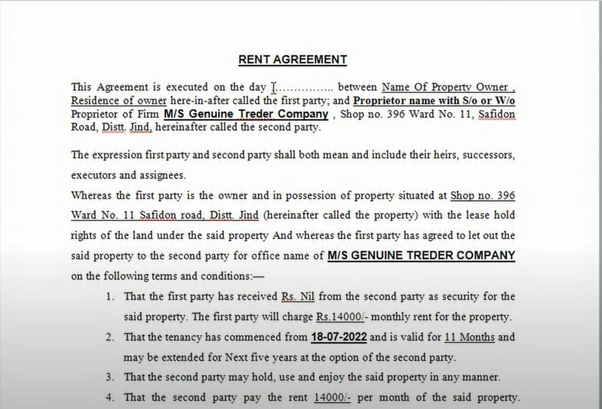

A rent agreement GST implications is a legal document that states the terms and conditions between a landlord and tenant. The businesses that are operated from rental properties must have a valid rental agreement while applying for GST registration on the rent agreement.

Key Components of Rent Agreements

A rent agreement GST implications must have certain elements that are compulsory to be included. The key components of a perfectly drafted rent agreement are as follows:

- Names and Contact Details of Parties Involved: The rent agreement must clearly mention the names, addresses, and contact details of both the landlord (lessor) and the tenant (lessee).

- Details of the Property: The agreement must have the complete address of the rented property, along with details like floor number, unit number, and the additional facilities that are provided.

- Rent and Security Deposit: The rent amount is to be paid by the tenant and the mode of payment should be clearly mentioned. Moreover, the security deposit paid by the tenant to the landlord must be mentioned along with the conditions related to its refund.

- Duration and Commencement of the Agreement: The agreement must show the rental tenure, including the starting date and ending date. It must also mention the notice period required for termination.

- Maintenance and Utilities: The agreement must define the responsibilities of both parties regarding the maintenance of the property and payment of utility bills.

- Termination and Renewal Clauses: The terms and conditions for terminating the agreement should be clearly mentioned, along with the provisions for renewal and any related rent revisions.

Impact Of GST on Rent Agreement

In the pre-GST period, the landlord obtained a service tax registration if their total taxable services, including the rental income from all properties, exceeded Rs.10 lakh per year. The landlord would not be attracted to service tax as long as the rental income from all the properties that have been rented out does not exceed Rs.10 lakh per year.

As per the previous tax regime, commercial properties alone that were let out would attract service tax. This was applied even if a residential property was used for commercial purposes. Service tax was levied at 15% of the rent, for commercial properties. Additionally, the rental income from residential properties did not attract service tax.

According to the GST Act, renting out an immobile property would be considered as a supply of services. GST, however, will be applied only to specific types of rent:

- When a property is given out on lease, rent, easement, or licensed to occupy.

- When any property is leased out including a commercial, industrial, or residential property for business.

This type of renting is considered a supply of services and thus attracts tax. When you rent out a residential property for residential purposes, it is exempted from GST. Any other type of lease or renting out of the immovable property for doing business would attract GST at 18%, as it would be treated as a supply of service.

In the 48th GST Council meeting, the Council clarified that no GST is payable where a residential dwelling is rented to a registered person if the same is rented in their personal capacity and for use as their own residence, which means that where a registered person is a proprietor of a firm and they have rented out a residential property in their personal capacity and the property is for use as their own residence, then no GST will be applicable.

Requirements and Documentation for GST Registration for Rental Properties

The documents required for GST Registration for Rental properties are as follows:

| Pan Card of the Business Company |

| Proof of Business Registration |

| Photographs of all the Directors and Signatories |

| Bank Account Details |

| Address of Business Location |

- PAN card of the Business Company: A scanned copy of the proprietor’s PAN card is the basic requirement among the new GST registration documents for the rental agreement. The PAN card serves as a unique identifier for tax-related transactions, confirming accurate and secure documentation. It is an important element in establishing the proprietor’s identity within the GST framework, aligning with the broader taxation ecosystem in the country.

- Address Proof of Business Location: The documents required for GST registration for Proprietorship differ depending on the address situation. If the applicant proprietor owns the premises, proof like the most recent Property Tax Receipt, Municipal Khata, or Electricity Bill is required. If the premises are owned by any other person, then supporting documents with a consent letter are required. In the case of rented or leased premises, a valid Rent/Lease Agreement and documents proving the lessor’s ownership are compulsory.

- Photographs of all the Directors and Signatories: Recent passport-sized photographs of the proprietor are required. This requirement confirms an additional layer of verification, making sure that the person who is starting the registration corresponds with the provided identification documents.

- Bank Account Details: Submitting bank account details, including a canceled cheque or bank statement, is important for facilitating seamless transactions and refunds under GST. Basically, the stamp paper for almost all the Documents is of 100/- value. GST on commercial property the appropriate stamp duty is 100/- and 200/-. However, it also depends from state to state.

Legal Aspects and Compliance in Rent Agreement for GST

In order to confirm the legality and validity of the rent agreement for GST registration, businesses must consider the following:

- Drafting the Rent Agreement Correctly: The rent agreement must be drafted with clarity and perfection, comprising all necessary terms and conditions. It is suggested to take legal aid to ensure compliance with applicable laws.

- Notarization and Registration Requirements: Some states in India may require rent agreements to be notarized or registered. Businesses must check the local regulations and fulfill the necessary requirements.

- Avoid Common Mistakes: Common mistakes must be avoided, such as incorrect information or missing clauses in the rent agreement.

Conclusion

A valid rent agreement plays a major role during the registration process as it provides proof of business premises. Businesses should confirm that their rent agreements are framed correctly, have fulfilled all legal requirements and comprise all essential components. Hence, obtaining GST registration is crucial for businesses to function efficiently and legally.

Also Read: Navigating GST Registration: Documents Required for Specific Industries

Also Listen: How to create E-way Bill With CaptainBiz

FAQs

Q1. Is a rent agreement compulsory for GST registration?

Yes, a valid rent agreement is compulsory for GST registration when the business is operating from rented premises.

Q2. Can anyone use a sub-lease agreement for GST registration?

Sometimes in some cases, a sub-lease agreement might be acceptable, but it is suggested to consult a legal expert to ensure compliance with GST regulations.

Q3. What will happen if the rent agreement is in the name of a partner or director?

The rent agreement must be in the name of the business entity seeking GST registration and not in the name of individual partners or directors.

Q4. Can someone register more than one business location using the same rent agreement?

Yes, a single rent agreement can be used to register more than one business location, as a condition if they are covered under the same agreement.

Q5. Does the rental agreement need to be notarized?

It is not compulsory to notarize the rental agreement unless there is any specific need from the registration authorities. Mostly, rental agreements printed on stamp paper serve the purpose.

Q6. What are the key documents required during GST Compliance for Landlords and Tenants?

In order to start the GST registration process for a proprietorship, essential documents include PAN and Aadhaar details, business registration proofs, and address validations. These documents form the core requirements of a successful GST registration for proprietorships.

Q7. How can we verify the status of our GST registration application?

After submission of the GST registration application for a proprietorship, you can track the status using the Application Reference Number (ARN) generated during the process.

Q8. What must be included in the Rent Agreement for GST Registration?

In the Rent Agreement, it’s compulsory to include details like the names of both the party tenant and landlord, the address of the society, the tenure of the agreement, the Rent amount, and any terms and conditions agreed upon. It’s also suggested to include the clauses related to maintenance responsibilities, termination conditions, and any other related terms.

Q9. What is the limit of GST Registration?

There is no limit to the Rent Agreement for GST Registration since the Goods and Services Tax regulations in India do not have any specifications. Yet there are certain conditions applied for the registration of GST on commercial property. That is if there are cases of inter-state supply then the GST registration is compulsory.

Q10. Is commercial rent exempted from GST?

No, commercial rent is not exempted from GST. Under the GST Act, leasing or renting of commercial property, comprising shops, offices, or warehouses, falls under the category of supply of services and is applicable for GST @18%.