India’s economic robustness hinges on the effective movement of goods and raw materials throughout the nation. A strong transportation network of rail, road, air, and waterways ensures smooth logistics. Simultaneously, the Goods and Services Tax guarantees that businesses utilizing these modes of transportation contribute their equitable portion of taxes.

What is an e-way Bill?

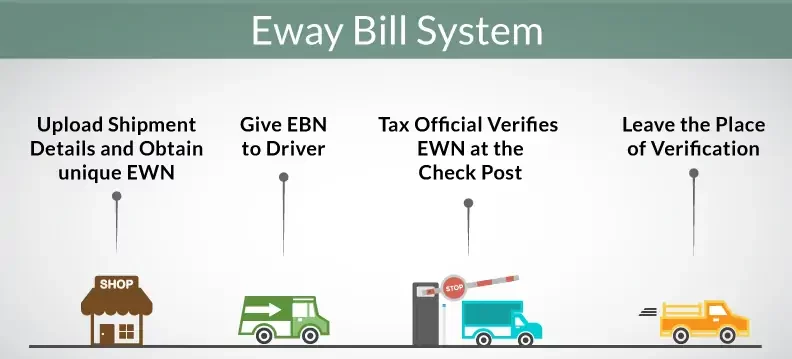

Simply put, it is an electronic permit generated on the GST portal that details the quantity and unit measurement of goods in transit within a state or interstate. It is a requirement for all transporters moving goods worth more than Rs. 50,000 to have an electronic permit. The e-way bill generated for the transportation of goods is valid across all states and union territories in India.

Generate the e-way bill before shipping goods worth over Rs. 50,000. The permit should include details of the shipped goods, the transporter handling the goods while in transit, the recipient and the consignor. An e-way bill authorizes goods supply and covers non-supply transactions like export, import, returns, or knocked-down shipments.

Who should generate an e-way Bill?

It’s common for consignments to move from one place to another before they reach their final destination. The transportation that takes place in this case may involve multiple vehicles as some goods go to different locations. If that were to happen, the transporter would have to provide the vehicle details using the Update Vehicle on the e-way bill portal to indicate the specific vehicle used to transport a given consignment.

Registered consignors, recipients, or transporters generate e-way bills for goods transport using their own or hired vehicles. If an unregistered person supplies the goods, the recipient must follow the compliance procedure. The transporter can also generate the e-way bill if the recipient and supplier fail to develop it.

A transporter generates a consolidated e-way bill for multiple consignments in transit. Nevertheless, the transporter transporting multiple consignments for various recipients in one vehicle has to have a consolidated e-way bill.

The e-way bill comprises two parts:

- The first part details the recipient of the goods in transit, the place of delivery, an invoice detailing the quantity and unit measure. In addition, it consists of the HSN code of the goods and a transport number in case of goods being transported on the road.

- The second part of the e-way bill provides details of the transporter tasked with moving the goods from one point to another. Use the transport details to generate the e-way bill.

Generation of e-way bill for Goods Transported on the Road

When transporting goods by road, transporters and logistics providers must follow essential guidelines.

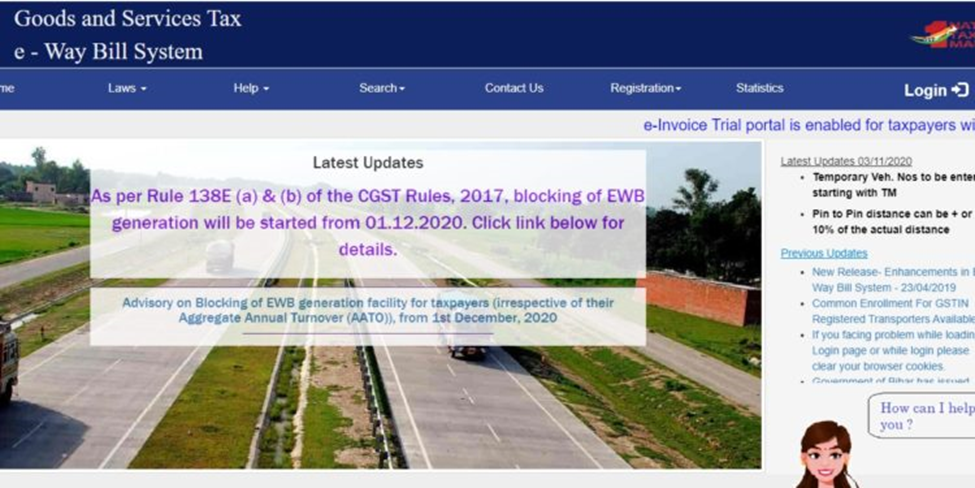

Step 1: Visit the e way bill portal and select enrolment for transporters under registration.

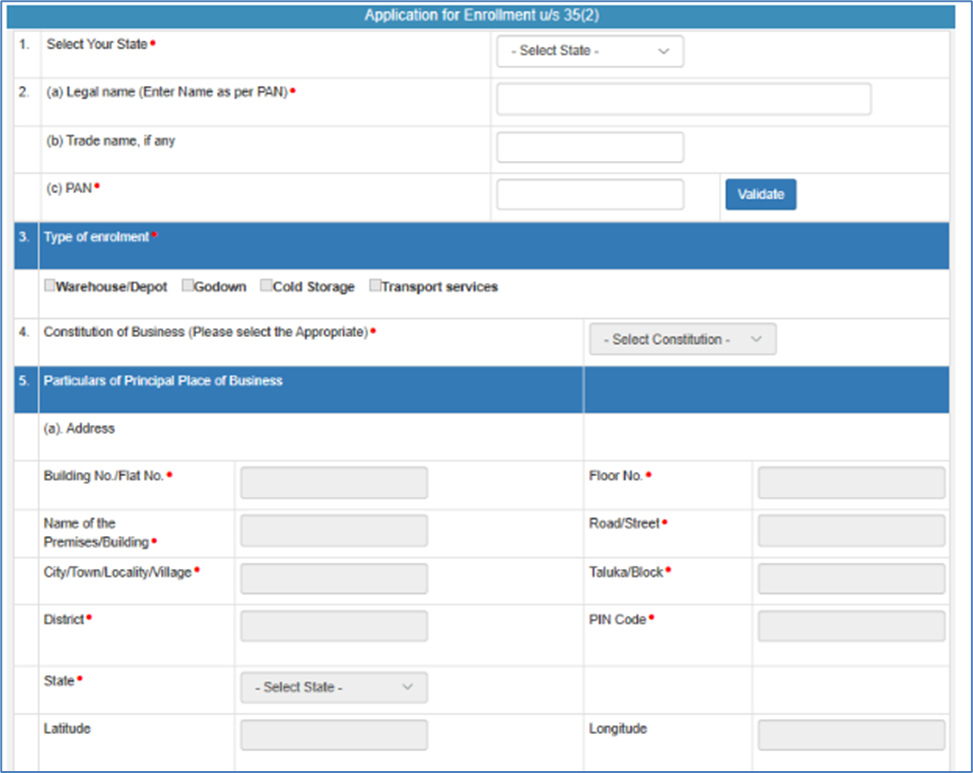

Step 2: Click “Enrolment for Transporters” under the Registration tab to access the Enrollment Form u/s 35(2). Fill out the form providing all the necessary information

Step 3: Provide a declaration regarding the correctness of the information by clicking on the checkbox.

Step 4: Click on the “Save” button and the system will generate your 15-digit TRANS ID.

Some of the things to remember while generating e way bill for transporting goods include:

- The vehicle number and the transporter ID handling the consignments should be provided for e-way bill generation.

- If a supplier transports goods using their own or a hired vehicle, they must enter all relevant details to generate the e-way bill.

- If the vehicle changes during transit, the transporter updates the e-way bill with the new vehicle and transporter ID.

- Finally, the e-way bill generated for a distance of 100 km is only applicable for a day. For every additional 100 km, the e-way bill will only be valid for an additional day. If transportation exceeds the specified period, the transporter must generate a new e-way bill and update the details.

Entering Multiple Modes of Transportation on an e-way bill

For consignments using multiple transport modes, the transporter must update the e-way bill each time the mode changes, including the ‘Updated Vehicle Number.’

For instance, let’s assume we are moving a consignment from Cochin to Chandigarh through road, ship, air and road again. During the initial road movement from the transporter’s location to the yard, they must generate an e-way bill with the vehicle number.

Once the goods reach the shipyard, the transporter must update the mode of transport to the ship and generate a new e-way bill. On reaching Mumbai, the transporter must update the e-way bill mode to the road from the ship.

When opting for air transport from Mumbai, the transporter needs to select the ‘update the vehicle number’ option and provide the Airway Bill number. Upon reaching Delhi, the transporter then updates the movement by road, including the vehicle number. This process updates the e-way bill to reflect multiple transport modes.

E-way Bill with Multiple Vehicles

There is always a likelihood that businesses with multiple locations or branches will have to transport goods using multiple vehicles. The E-way bill for multiple vehicles was enabled for this specific purpose to lessen the efforts of numerous transporters, and the option is available at the transhipment location rather than the supplier’s location.

Previously, generating separate e-way bills for each delivery mode was necessary when transporting goods to multiple locations using different vehicles. Now, with the multi-vehicle update, a single e-way bill can include details of multiple conveyances. This enables businesses to transport a consignment using multiple vehicles after it reaches the transshipment location.

For instance, when a consignment needs to move from point A to point C, the business might use rail or a larger vehicle from point A to point B. On the other hand, if the area is hilly and large vehicles or railways are not available, one might opt to use smaller vehicles from point B to C.

The multi-vehicle option is typically used when:

- When transporting goods to a single destination, businesses may use different modes of transport due to rough terrain, time efficiency, or other factors. For example, they can move goods by rail to a central point, offload them, and transfer them to smaller vehicles for final delivery.

- Transporting the goods to multiple destinations, such as business branches or locations, is necessary. In this case, the supplier will deliver the e-way bill to the transporter’s warehouse. From there, goods are distributed using multiple vehicles to various destinations. The transporter must update the e-way bill with details of the vehicles used for the remaining journey.

- Before moving goods from the supplier’s factory to the transporter’s warehouse, the supplier must generate an e-way bill. Before dispatching goods from the warehouse to multiple locations, the transporter must update the e-way bill with details of all vehicles and final destinations.

Generating e way bill for Multi-Vehicle Transportation

Whenever a business has to use multiple vehicles to transport goods between various points across the country, it’s required to create a unique e-way bill. The steps for developing an e-way bill are:

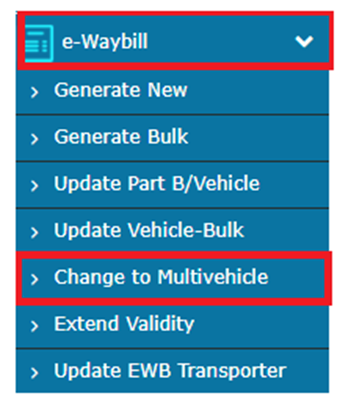

Step 1: Visit the e-Way Bill Portal and Navigate to the “e-Way Bill” drop-down list and click on Change to “Multi-Vehicle.

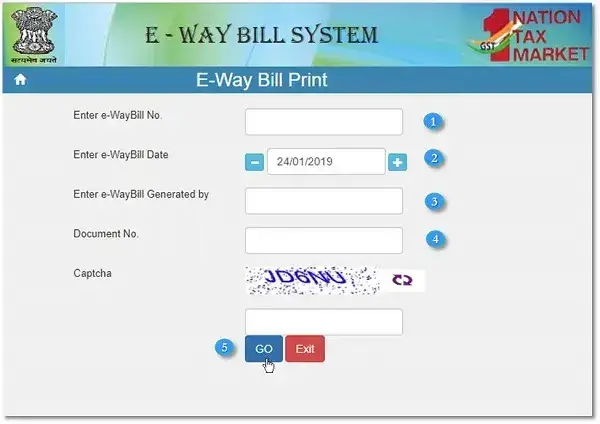

Step 2: Enter the e-Way Bill Number and click on “Go.”

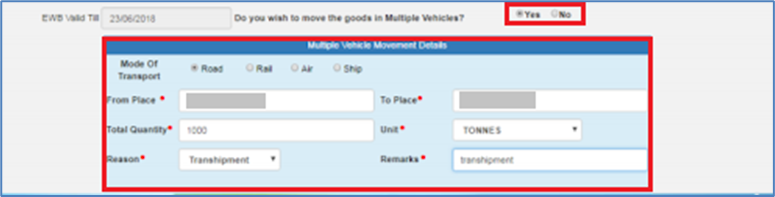

Step 3: Create a group to enter the details of transportation – destination and select mode whether it is by road, rail, air, or ship. Select “Yes” against the section “Do you wish to move goods in multiple vehicles?” Hence the multiple movement details box appears.

Source: learn.quicko.com

Step 4: Update multiple transport details. We have to enter ‘From’ and ‘To’ place, total quantity (that matches the quantity as per Invoice).

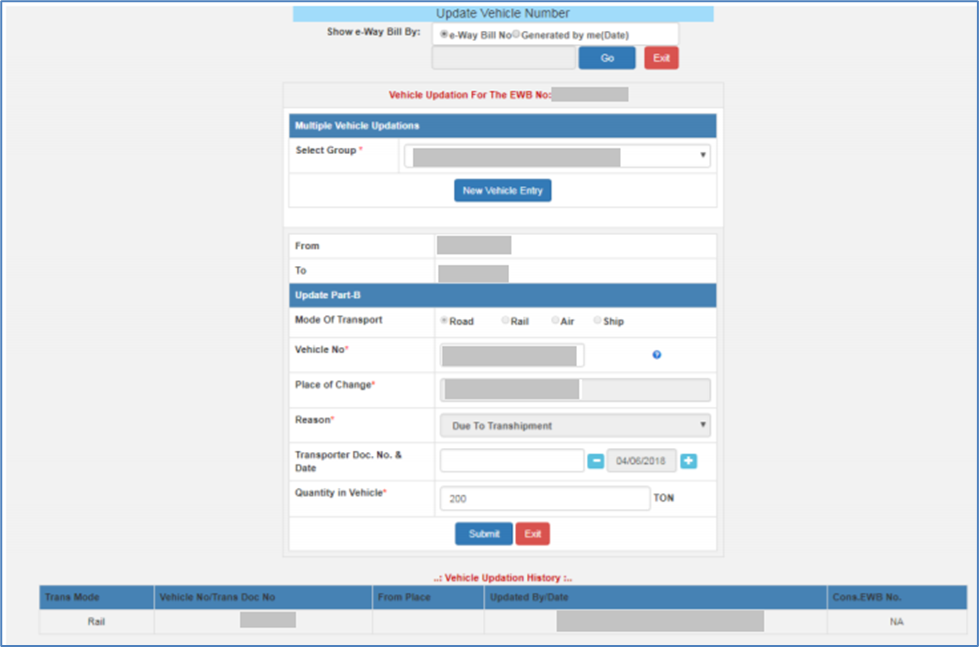

Step 5: Change to multiple vehicles

Conclusion

The Goods and Services Tax mandates any person transporting goods worth more than Rs. 50,000 to apply for an e-way bill. Generated on the GST Common Portal by registered persons or transporters, the permit details the quantity and unit measure of goods on transit from one place to another. In addition, it details the supplier, the transporter, the recipient and the mode of transport used. The permit is not applicable when transporting goods less than Rs. 50,000 in value and goods exempt from GST.

Frequently Asked Questions

1. Which documents must a transporter have while transporting goods?

The transporter is required to have either a tax invoice, bill of supply, or delivery challan, along with a duplicate of the e-way bill number generated from the common portal. This e-way bill number provides details on the quantity and unit measurement of the goods in their possession.

2. Is it a must for transporters to enroll in the e-way bill system?

Yes, it’s mandatory for transporters dealing in goods worth more than Rs. 50,000 to enroll in the e-way bill system and have a transporter ID. The transporter can achieve this by either generating the e-way bill for their clients or updating the vehicle number when the goods are in transit. By enrolling on the e-way bill portal, it’s possible to generate the 15-digit Unique Transporter ID.

3. Is it possible to transport the goods with an e-way bill without vehicle details?

No, it’s not possible. The e-way bill must detail the vehicle used in carrying the goods. The permit specifies the vehicle number. Nevertheless, the vehicle number is not a must when transporting goods over short distances, i.e. less than ten kilometers within the State.

4. How do you go about transporting goods using different modes of transport?

Due to differences in terrain, it’s possible to use different modes of transport to convey goods from one place to another. However, the e-way bill must always specify the mode of transport used at each stage of transit, along with the vehicle number and the responsible transporter.

5. Who is required to update the vehicle number on the e-way bill?

The transporter must update the vehicle number on the e-way bill before proceeding with the shipment. On the other hand, the e-way bill will only be valid with the vehicle number and the transporter ID.

6. What is the Validity of an e-way Bill?

The validity of the e-way bill depends on the distance on which the goods are being transported. In this case, the permit is valid for one day for up to 100 km of the transit distance, and every 100km after that, the validity is an additional day. The validity begins when the first entry is made in Part B.The permit is valid for different types of transactions, such as supply of goods within the State or interstate or inward supply.

7. What happens when a vehicle breaks down while transporting goods?

Whenever a vehicle transporting goods gets a mechanical breakdown and can no longer transport goods, a change of vehicle is inevitable. The transporter must enter the new vehicle and transporter details on the e-way bill portal using the ‘Update Vehicle Number’ option before continuing the journey.

8. What happens when the vehicle transporting goods is changed?

By law, the e-way bill should always detail the vehicle and the transporter ID transporting goods worth more than Rs. 50,000. If the vehicle or transporter changes, the transporter must update the e-way bill before continuing the goods’ transportation. The transporter or the individual generating the e-way bill has the authority to update the altered vehicle number.

9. What is the penalty for not carrying an e-way bill?

A transporter found without a waybill is liable to pay a penalty of Rs. 10,000 or the equivalent tax evaded, depending on the value of the goods being transported.

10. How does a transporter know the e-way bill assigned to them?

A transporter can know the e-way bill assigned to them by going to the reports section and selecting the ‘EWB assigned to me for trans’. The transporter can also go to ‘Update Vehicle No, select Generator GSTIN, and enter the taxpayer GSTIN who has assigned the EWB to them.

11. What happens if a recipient refuses to take in goods?

There is always a chance that a recipient may refuse to accept or take goods once they are transported to them. Under such circumstances, the transporter must visit the e-way bill portal and generate a Sales Return with all the relevant document details to return the goods to the supplier.

12. When is the e-way bill exempt while transporting goods?

Transporters might not need an e-way bill while transporting goods less than Rs 50,000. In addition, the permit is not required when dealing with goods exempt from GST.