The E-waybill is like a digital passport for transporting the goods, generated from the government portals. It is an important document that ensures transportation complies with the GST norms and enables the tax authorities to track for smooth movement.

E-waybill holds information like shipment details, origin and destination of the goods, contact details of the supplier along with the receiver, and their GSTINs. The main objective of E-waybill is to curb tax evasion.

So, in this comprehensive guide we will see everything related to how goods are being transported by Government departments from point A to point B.

E-waybill for Government Transport Procedure

An E-waybill plays a pivotal role in securing the digital documentation of the movement of goods. It replaces the physical waybill and makes the entire process more transparent. It is generated on the GST E-Way Portal. You will need a GST registration and transporter registration.

Here is the procedure to generate an E-Way Bill for government transport:

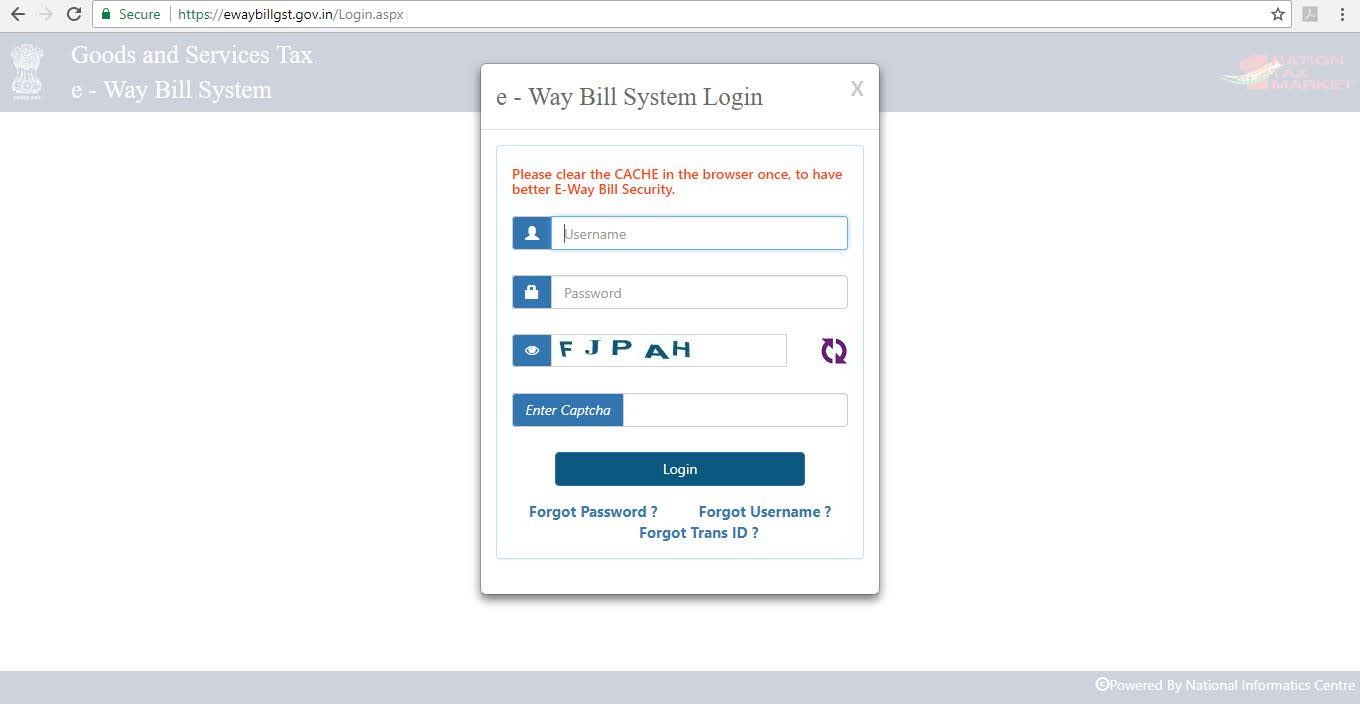

Step 1- Access to the E-Way bill generation portal at https://ewaybill.nic.in/

and enter the login details to enter the platform.

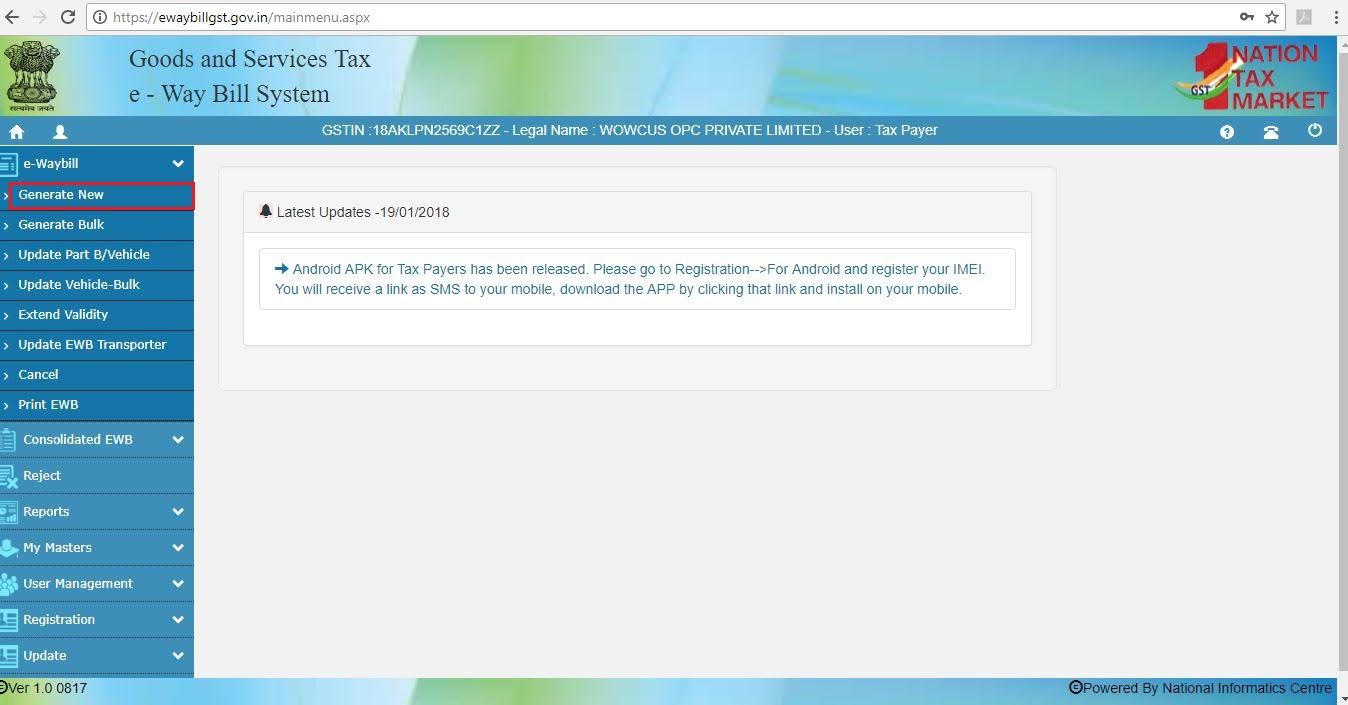

Step 2- Click on the ‘Generate New’ option from the E-Way bill- Main menu page to create a new E-Way bill.

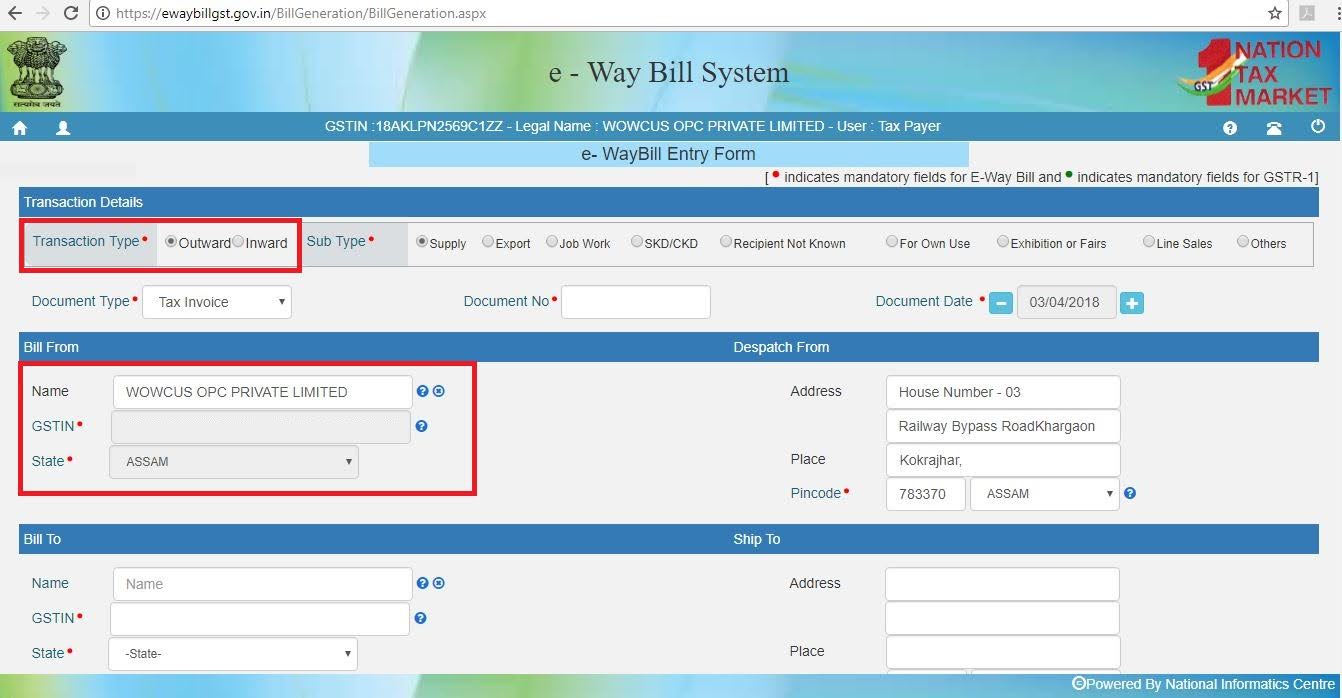

Step 3– A new E-waybill generation form will appear. Fill in the details to create a GST invoice. When a registered GSTIN is entered in the field provided in the form, other details get pulled into the empty fields. Before proceeding to the next step kindly check the details.

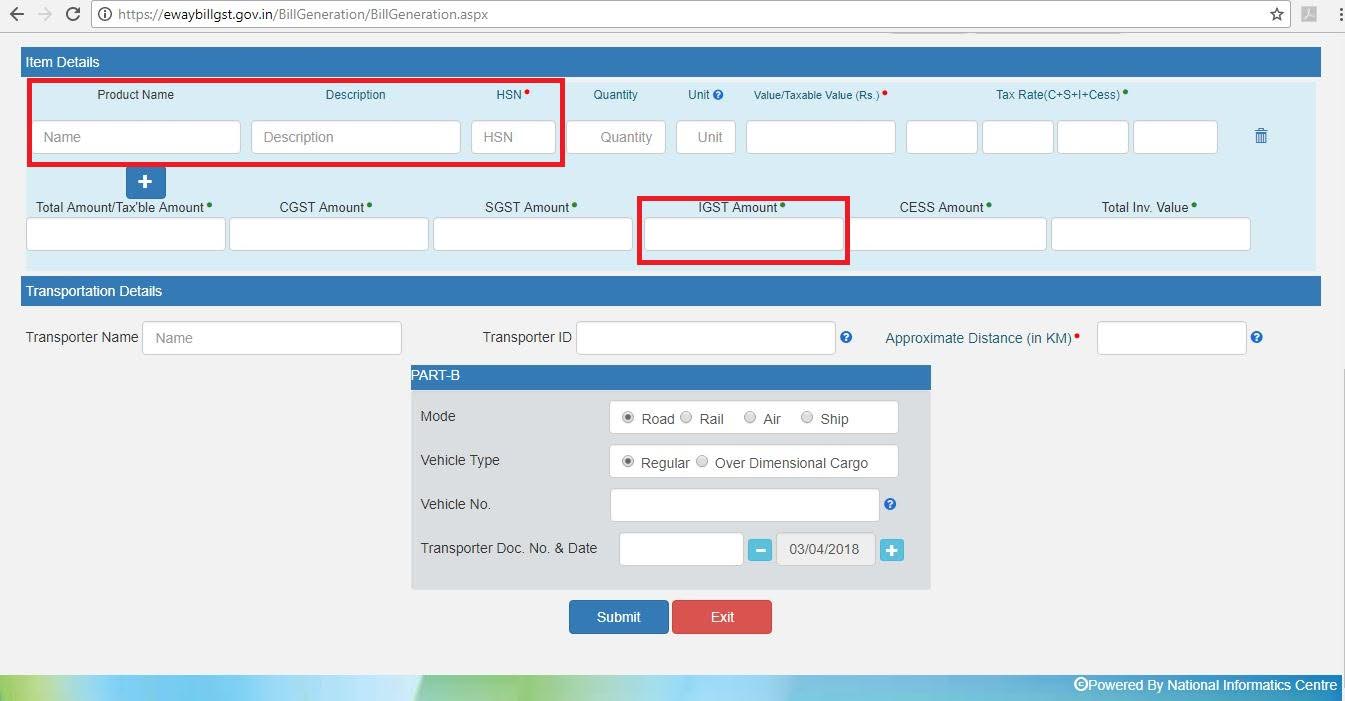

Step 4- The second half of the page will contain information to be filled as follows:

| Product Name and Description must be completed similarly to a tax invoice. |

| HSN Code for the Product must be entered. Click here to find the HSN code. |

| Quantity and Unit of the goods. |

| Value of the products along with Tax rate. |

| IGST or CGST Rates are applicable. IGST would be applicable for inter-state transport and SGST / CGST for intra-state transport. |

| Approximate distance of transport along with Transporter Name and Transporter ID. This shall determine the validity of the E-Way bill. |

Step 5– Generate E-way bill: After filling in all the necessary details, click on the ‘SUBMIT’ button to create the E-way bill. The Portal shall display the E-Way bill containing the E-Way Bill number and the QR Code with details in the digital format. The printed copy of the bill should be provided to the transporter who will carry it throughout the trip till it is handed over to the consignee.

Step 6- Consolidate E-way Bill Generation: A consolidated E-waybill can also be created which contains all the details on the transaction and is also easy to create by providing just the ‘E-Way bill number’ in the required field. Click on ‘SUBMIT’ to generate the consolidated E-waybill.

Step 6- Consolidate E-way Bill Generation: A consolidated E-waybill can also be created which contains all the details on the transaction and is also easy to create by providing just the ‘E-Way bill number’ in the required field. Click on ‘SUBMIT’ to generate the consolidated E-waybill.

An E-Way bill can be updated once it is created. Details on the transporter, consignment, consignor, and also the GSTIN of both parties can be updated in the existing E-Way bill provided the bill is not due on its validity.

Reporting requirements for E-waybill in Government Shipments

E-waybill reporting requirements for government shipments are resolved and governed by the Goods and Services Tax (GST) regime. It requires documents like information about the consignment, vehicle registration number, vehicle details, GSTIN (Goods and Services Tax Identification Number) of the consignor and consignee, HSN (Harmonised System of Nomenclature) code of the goods, and the details of parties involved in.

E-waybill reporting requirements for government shipments in India need a regular check for updates on the Goods and Services Tax Network (GSTN) and the official E-waybill portal. Refer to the latest official documentation and consider seeking guidance from tax professionals to stay informed about any changes in regulations.

Documentation for E-waybill in government agency transport

Creating an E-waybill through the government agency’s transport system requires some valid documents. Below is a list of them:

| Consignment Details | It means a detailed description of the goods that are being transported with quantities, weight, and any other relevant characteristics of the consignment. |

| Source & Destination Details | Clear mention of the starting location of the consignments to the end location where to be delivered must be mentioned. |

| Transport Details | This includes details of the transporter of any government agency responsible for the transportation along with the vehicle registration number, model, and capacity. |

| E-waybill number & generation date | Mention the E-waybill numbers assigned to each consignment with the time and date when it was generated. |

| Validity period | Mention the E-waybill validity period and check if the validity aligns with the duration of transportation or not. |

| Governments norm compliance | Comply with all the government regulations regarding goods transportation. |

Compliance obligations for E-waybill in government departments

Compliance obligations for E-waybills in government departments are regulated by specific regulations and guidelines. Here is a detail:

- You must ensure E-waybill generation with all the details of the consignment, vehicle, and parties involved.

- Maintain high levels of data accuracy to prevent discrepancies, and the details of the consignor and consignee should match with the actual shipment.

- Government departments need to submit all the E-waybill information by the due date or late submission will lead to penalties for non-compliance issues.

- For efficient compliance, integrate the E-waybill generation process with the department’s Enterprise Resource Planning (ERP) on relevant systems.

With these compliance obligations, government departments can contribute to the smooth functioning of the E-waybill system, avoid penalties, and a transparent and lawful movement of goods.

Legal considerations for E-waybill in government transport

Legal considerations for E-waybills in government transport may vary but some common aspects are:

- Compliance with Legislation: Ensure that E-waybill processes align with relevant legislation governing transportation and logistics.

- Data Privacy and Security: Take measures to protect all the sensitive information included in E-waybills from data theft.

- Authentication and Authorization: Establish secure methods for authenticating and authorizing access to E-waybill systems to prevent unauthorized use.

- Record Retention: Comply with regulations regarding the retention of electronic records, and specify the duration and accessibility of E-waybill data.

- Audit Trail: Implement mechanisms to create and maintain an audit trail, documenting the creation, modification, and transmission of E-waybills.

- Penalties for Non-Compliance: Be aware of penalties and consequences for non-compliance with E-waybill regulations. Late submissions or inaccuracies in information may result in negative consequences.

Always consult with legal professionals or regulatory authorities to ensure full compliance with current laws and regulations regarding E-waybills in government transport.

E-waybill best practices for government agency shipments

Below is the curated list of the E-waybill best practices for government agency shipments-

- Accurate Information: Ensure all details on the e-waybill are accurate, including the description of goods, quantity, and destination.

- Comply with The Regulations: Abide by the government regulations and guidelines for e-waybill generation. And take note of any specific requirements for government agency shipments.

- Timely Generate The E-waybills: Generate e-waybills well in advance to avoid delays in shipment and to comply with any time restrictions imposed by the government agency.

- Secure Data Transmission: Use secure channels for transmitting e-waybill data to prevent unauthorized access and data theft. It will ensure the confidentiality of sensitive information.

- Integration with Systems: Integrate e-waybill generation into your existing systems for smoother workflow and to minimize errors in data entry.

- Record Keeping: Maintain detailed records of e-waybills, as these may be required for auditing purposes by government agencies.

Challenges in E-waybill for government transport

The introduction of the electronic waybill brought along some challenges and problems with its perks. The logistics industry faced these problems and struggled to adapt and adjust to this new system.

The government, however, is constantly changing the procedures, rules, and laws to make things simpler and adaptable for dealers and transporters.

- The extension of the e-waybill: The extension of the bill creates multiple e-waybill numbers against a single dispatch or one single invoice. This is creating duplication. Moreover, the time span for the extension, 4 hours before and after the expiry of validity is also seemingly short.

- Compliance challenges for multiple daily movements: Companies that handle numerous shipments each day face new compliance hurdles with the E-waybill system. It requires dedicated software to consistently create electronic waybills and facilitate easy reconciliation of sales with E-way bills.

- Internet-based system: The electronic waybill system is an end-to-end internet-based system. For locations and areas where there is a poor internet connection, it can face problems in generating the E-way bill. Moreover, transporters and dealers face problems in dispatching goods because of unfamiliarity with the internet and technology.

- Technical glitch: Though the E-way bill portal has a daily proposed capacity of generating 75 lakh e-waybills, businesses are concerned when more states come under the intra-state E-way bill system, it will not work that smoothly. The technical glitches in generating e-waybills electronically are quite a challenge for the logistics industry.

Exemption for specific government transports in E-waybill

Specific transports exempted from E-way bill rules are:

- Liquefied petroleum gas for supply to household and non-domestic exempted category customers

- Kerosene oil sold under the Public Distribution System (PDS)

- Postal baggage transported by the Department of Posts

- Natural or cultured pearls and precious or semi-precious stones; precious metals and metals clad with precious metal

- Jewelry, goldsmiths’ and silversmiths’ wares and other articles

- Currency

- Used personal and household effects

- Unworked and worked coral

- Goods transported are alcoholic liquor for human consumption, petroleum crude, high-speed diesel, petrol, natural gas, or aviation turbine fuel.

- Goods being transported are not treated as supply under Schedule III of the Act. Schedule III consists of activities that would neither be a supply of goods nor service like service of an employee to an employer in his employment, functions performed by MP, MLA, etc.

- Goods transported are empty cargo containers

- Goods other than de-oiled cake being transported are specified in notification No. 2/2017– Central Tax (Rate) dated the 28th of June 2017. A few of the goods that are included in the above notification are as follows:

- Curd, lassi, buttermilk

- Fresh milk and pasteurized milk not containing added sugar or other sweetening matter

- Vegetables

- Fruits

- Unprocessed tea leaves and unroasted coffee beans

- Live animals, plants, and trees

- Meat

- Cereals

- Unbranded rice and wheat flour

- Salt

- Items of educational importance (books, maps, periodicals)

- Goods exempted under notification No. 7/2017– Central Tax (Rate) dated 28th June 2017 (supply by CSD to unit-run canteens and authorized customers) and notification No. 26/2017– Central Tax (Rate) dated 21st September 2017 (consists of heavy water and nuclear fuels)

Audit and verification of E-waybill in government shipments

Below are some key audit and verification phases that are performed for checking the E-waybill within government shipments-

- Audit and verification of E-waybills in government shipments play a crucial role in ensuring transparency and compliance. E-waybills are electronic documents that contain details of the goods being transported, and they are essential for tracking and monitoring the shipments.

- During the audit process, government authorities review E-waybills to confirm the accuracy of information. This involves cross-referencing details of the consignor, consignee, goods description, and transportation details with the actual physical movement of goods.

- Verification procedures may involve real-time tracking of shipments using GPS technology or other tracking systems to ensure that the goods are moving according to the information provided in the E-waybill.

- Additionally, authorities may compare E-waybill data with other relevant documents, such as invoices and tax records, to verify the consistency of information across different channels.

- Ensuring the integrity of the E-waybill system is vital for preventing tax evasion, fraud, and unauthorized movement of goods. Regular audits and verifications contribute to a robust system that enhances the overall efficiency and trustworthiness of government shipments.

Coordination with government agencies in E-waybill compliance

E-waybill compliance involves effective coordination with government agencies. This means smooth communication, following regulations diligently, and accurate documentation. It establishes rules that are essential to avoid disruptions in logistics operations.

Accurate documentation plays a significant role in ensuring the seamless flow of goods. By staying in compliance, businesses may contribute to efficient logistics processes and avoid potential issues. Effective collaboration with government entities brings a smoother exchange of information and facilitates an easy logistics movement.

In essence, a proactive approach to E-waybill compliance, characterized by timely communication and adherence to regulations, paves the way for an efficient and hassle-free logistics operation.

Conclusion

The E-waybill system plays a pivotal role in facilitating the transportation of goods by government departments or agencies. With digitization of the documentation process, it enhances efficiency, reduces paperwork, and ensures better tracking of goods in transit.

This does not only save time and resources but also minimizes the chances of errors and delays. The E-waybill system contributes to transparency and accountability in government logistics, promoting a smoother flow of goods.

Overall, its implementation signifies a positive step toward modernizing and optimizing the logistics operations of government transports. The inclusion of an E-waybill is a more effective and accountable transportation process for the benefit of the public.

FAQs

Q1. What is the purpose of the E-way bill?

The whole purpose behind the introduction of e-way bills is to track the movement of goods and ensure payment of timely tax.

Q2. Is there any threshold for generating an E-way Bill?

E-way bill is required to be generated for goods of consignment value exceeding Rs. 50,000 (for the state of Maharashtra the limit is Rs.1 lakh).

Q3. When the E-way bill is required to be generated?

An e-Way Bill is required to be generated before the commencement of the movement of goods through motorized vehicles.

Q4. Whether an E-way bill is required to be generated for the transportation of goods by own conveyance?

Yes, an E-way bill is required to be generated for the transportation of goods whether by own conveyance or hired one.

Q5. What is the validity period of E-way bills?

E-way bill shall be valid for 1 day up to 100 km and 1 additional day for every 100 km or part thereof thereafter.

Q6. What is the common portal for the generation of E-waybills?

The common portal for the generation of E-way bills is http://e-waybill.nic.in.

Q7. How many types of E-waybills are there?

There are 4 types of E-waybills, such as:

- Regular E-waybill.

- Bill-to and Ship-to E-waybill.

- Bill from and dispatch from E-waybill.

- Bill-to-Ship and Bill from – dispatch from E-waybill.

Q8. Will the e-waybill be canceled? If yes, under what circumstances?

Yes, the E-waybill can be canceled if the goods are not transported as per the details furnished in the E-way bill within 24 hours from the time of generation.

Q9. What is the minimum distance for E-way bills?

The minimum distance necessary for an E-way bill is 50 km, while the maximum E-way distance limit is 4,000 km.

Q10. Whether an E-way bill is required for all the goods that are being transported?

The e-way bill is required to transport all the taxable goods with a value exceeding 50,000 rupees except 154 goods specified in the Annexure to the notification.