Once you load the consignment onto the smaller vehicle, update Part B of the E-waybill with the vehicle number and the quantity loaded, and proceed with moving the consignment.

Transporting consignments via rail, air, or ship demands meticulous coordination and compliance with specialized regulations. E-waybill systems play a crucial role in facilitating the smooth movement of goods across these diverse transport modes.

However, each mode presents unique challenges and intricacies that necessitate special provisions within e-waybill frameworks.

This article delves into the nuances of e-waybill usage for consignments transported by rail, air, or ship, exploring the specific provisions, regulations, and operational considerations essential for seamless logistics management across these varied transportation channels.

E-waybill for Rail Consignments

While transporting goods by rail, one should include the following information in the E-waybill:

| Transport document number (RR Number) |

| Date of the Transport document number |

| Approximate distance to be covered in km |

You will receive a receipt known as a Railway Receipt or RR from the railways as an acknowledgment that your goods will be transported by rail. It consists of an 11-digit number called FNR in the top left corner, which transporters use to track the status of goods.

You transport goods by rail after bringing them via road to the railway station. For this transportation, an e-way bill would have already generated. Part B of the e-way bill can update with the RR number either before or after the journey. You must complete the update before the final delivery; otherwise, you will consider it invalid.

E-waybill for Air Consignments

In order to generate a valid e-way bill, the supplier or the recipient of goods has to submit part A of the form EWB 01 on the common portal i.e. Airway bill login. The following documents are require to generate an E-waybill for goods transportation by air:

| Invoice |

| Delivery Challan |

| Airway bill number |

| Details of the supplier |

| Details of the recipient |

| Details of the transporter |

You must generate the Air India GST invoice bill before the goods leave the airport. If the supplier has not generated the e-way bill when applicable, the transporter must generate it. Once you receive the transport documents, you must update Part EWB 2.

E-waybill for Ship Consignments

An E-way Bill Number must be generated when there is any movement of goods. In the Bill-to and Ship-to case, although there are two invoices, the physical movement of goods takes place only once.

Thus the E-way bill is compulsory only once and could be based on either of the invoices. In the Bill-to and Ship-to, there are mainly four places and parties. The following details about persons and places are necessary to generate an E-waybill on the portal:

| Party / Place | Meaning |

| Bill – from party and place | The person who supplies the goods |

| Dispatch- from party and place | The person from where the goods are dispatched. |

| Bill – to party and place | The person placing the order is supposed to make the payment. |

| Ship – to party and place | The person/ place who is supposed to receive the goods. |

Special Provisions of e-way bill as applicable to Railways

Below is the curated list of the special provisions of e-way bills that are applicable to railways-

According to Rule 138 (2A), when you transport goods by rail (whether by goods train or passenger train), either the recipient or the supplier—whoever is the registered person—must generate the E-way bill. They must submit the information in Part B of FORM GST EWB-01 on the common portal, either before or after the commencement of movement.

The railways cannot deliver the goods unless the registered person submits the required E-way bill at the time of delivery.

- As per the provision of Rule 138A, a copy of the e-Way Bill is not mandatory to carry when goods are in movement by rail. However, when transporting goods by rail, you must carry a copy of the Invoice, Bill of Supply, or Delivery Challan.

- An E-waybill is not necessery if the Railway is transporting its own goods, meaning when the Railway is the Consignor of the goods (as per Rule 138 (14)(l)).

E-waybill for Air Freight Documentation

To generate an E-waybill for goods transportation by air, you must submit the documents listed below:

| Invoice |

| Delivery Challan |

| Airway Bill Number |

| Details of Supplier of Goods |

| Details of Recipient of Goods |

| Details of Transporter of Goods |

Compliance Obligations for Ship Consignments in E-waybill

Below are some of the compliance obligations for ship consignments in E-waybill-

- The e-way bill portal has clarified that a suspended GSTIN cannot generate an e-way bill.

- ‘Ship’ has now been updated to ‘Ship/Road cum Ship’ so that the user can enter a vehicle number where goods are first moved by road and a bill of lading number and also the date for movement by ship.

- This aids in availing the ODC benefits for movement using ships and benefits the updating of vehicle details.

Legal Requirements for E-waybill in Multimodal Transport

Below is the list of the legal requirements for E-waybills in Multimodal transport-

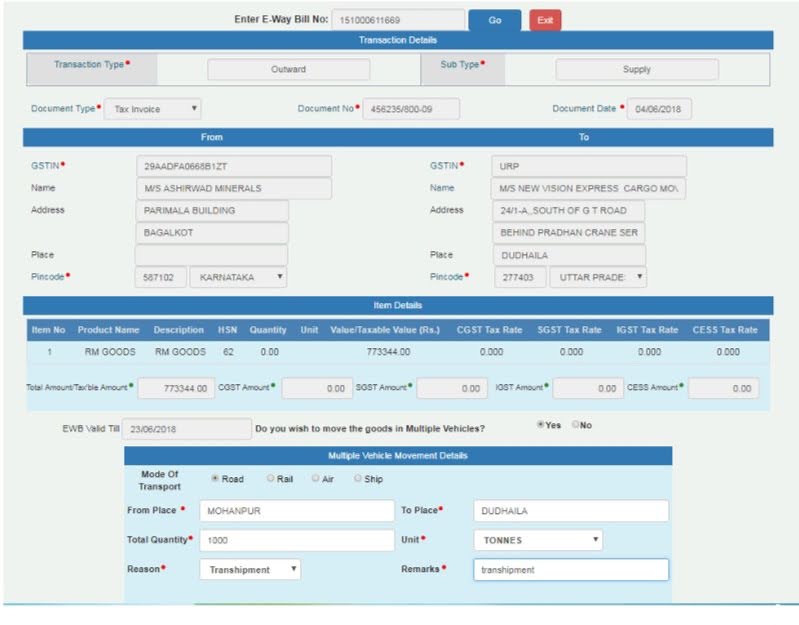

- The E-waybill is first generated based on the source and destination information from the document or invoice.

- The first step is to continue the movement of the consignment to the transshipment point.

- Next, select the ‘Change to Multi-vehicle’ option, and then you must update the e-way bill for multi-vehicle movement. Here, the total quantity of the consignment and movement from and to place for the multiple vehicles requirement has to be entered.

- Once you load the consignment onto the smaller vehicle, update Part B of the E-waybill with the vehicle number and the quantity loaded, then continue moving the consignment.

- You can repeat Step No. 4 until you load and move the total quantity. The system won’t allow you to ship more quantity in various vehicles than what you declared when marking the e-way bill for multi-vehicles.

E-waybill for International Shipping

You generate an E-way Bill based on an invoice or any document showing the movement, and you provide the details of this document in Part A along with the item details. You include the transportation details in Part B. To complete an export transaction, you should provide the information for Part A and B as given below:

Challenges in E waybill for Rail, Air, or Ship Transport

Below, you will find the structured list of challenges you face in generating E-waybills for Rail, Air, or Ship Transport.

- You cannot combine numerous invoices or delivery challans to generate one e-way bill. You will take each invoice as one consignment to generate e-way bills.

After generating all these E-waybills, the transporter may prepare one consolidated E-waybill for transportation purposes if all such goods are going in one vehicle.

- When you transport goods for a purpose other than supply and cannot issue an invoice, you can raise the e-way bill against any other document, such as a delivery challan or bill of supply. You may need to confirm the value of such goods as per the valuation provisions under GST.

- An e-way bill would be applicable even for the movement of goods as the courier provided the consignment value exceeds INR 50,000/-. The courier industry may follow different business practices, and you must consider them appropriately when generating an e-way bill.

- Once you generate the e-way bill, you cannot edit or change it. In such a situation, e-way bills generat with wrong information need to be cancel and generate again. The cancellation is required to be done within twenty-four hours from the time it is generated.

- If the e-way bill is once generated it cannot be deleted. If it is verified by any proper officer within 24 hours, then it cannot be canceled. You can cancel e-way bills if you do not transport the goods or if you do not transport them as per the details provided in the e-way bill.

- If the consignor fails to generate the eway bill, it may be generated by the transporter also. In case of the supply of goods by an unregistered person to a registered person, the responsibility to generate e–way bill is on the recipient.

- You must generate the e-way bill even if you are moving goods within 10 km.

Exemptions for Certain Consignments in E-waybill

E-Way Bill is not compulsory for goods of value less than Rs. 50,000 (except in cases of mandatory e-way bill provisions like the movement of Handicraft goods and movement of goods for Interstate Job work):

- If goods are transported by a non-motorized conveyance (Ex. Horse carts or manual carts).

- In case goods are transported:

- Goods transported within the notified area.

- Goods transported are transited from/ to Nepal/ Bhutan.

- To a weighbridge within 20 km and then return to the place of business under a Delivery Challan (DC).

- Where Government or local authorities transport goods by rail as a consignor.

- Goods transported to/from the Ministry of Defence.

Audit and Verification of Multimodal E-waybill

Steps involved in the verification of the Multimodal E-Way bill:

Step 1: The officer appointed begins with verification of documents and/or inspection of goods.

Step 2: The person in charge of the conveyance must then produce the documents related to the goods and conveyance.

Step 3: The officer in charge will verify these documents. If no discrepancies are found, they will allow the conveyance to move further.

Discrepancies during verification of Multimodal E-way Bill:

Action 1:The person in charge of the conveyance must record a statement.

Action 2: An order, needing the person in charge of conveyance to station conveyance at the place mentioned in such order and allowing inspection of goods, will be issued.

Security measures for E-waybill in Consignments by Rail, air, or Ship

Below given are some of the security measures for E-waybill in Consignments by rail, air, or Ship-

- Encryption: Ensure that you encrypt the e-waybill data during transmission and storage. This protects it from unauthorized access to sensitive information.

- Digital Signatures: Execute digital signatures to authenticate the e-waybill sender and make sure the integrity of the data is maintained. This helps in verification and checks that the document has not been tampered with during transit.

- Access Control: Restrict access to e-waybill systems and data to authorized persons only. Use strong authentication processes like passwords, two-factor authentication, or biometrics.

- Tracking and Monitoring: Implement tracking systems to check the movement of consignments in real time. This comprises GPS tracking for vehicles or RFID for containers, allowing constant oversight.

- Audit Trails: Always maintain detailed logs of all E-waybill activities, recording who accessed the data, when it occurred, and whether you made any changes. This aids in tracing any discrepancies or security breaches.”

Conclusion

In summary, e-waybill systems tailored for rail, air, or ship consignments offer vital provisions addressing specific challenges. These provisions ensure compliance, security, and efficient logistics across diverse transportation modes. Embracing these tailored measures fosters smoother operations, heightened transparency, and better regulatory adherence, crucial for enhancing the reliability of e-waybill management in modern supply chains.

FAQs

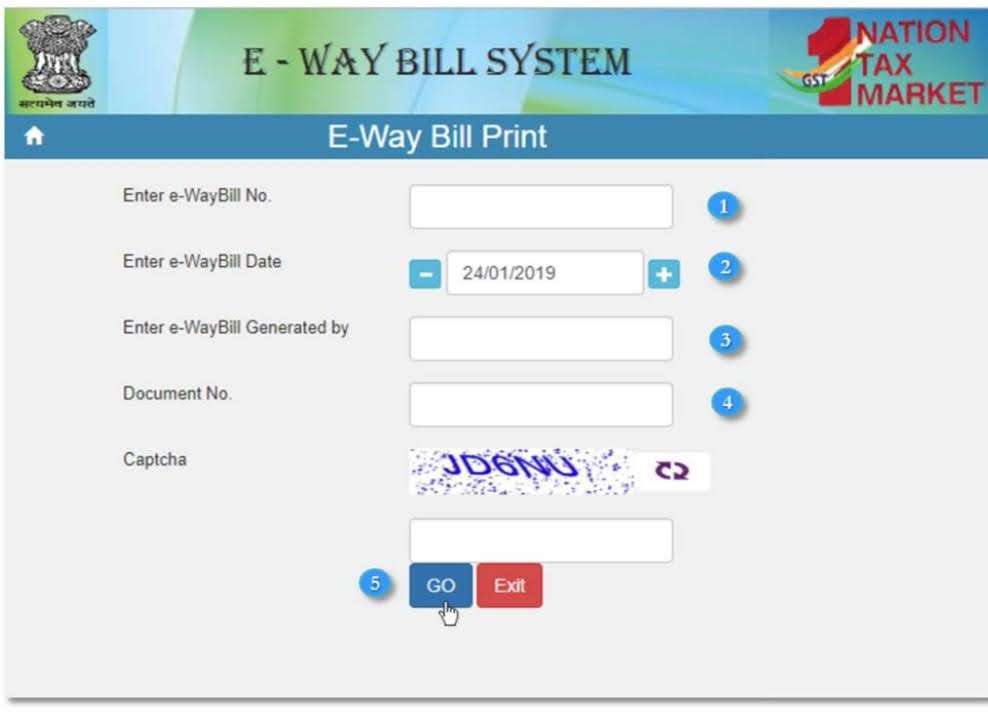

Q1.How can I generate the e-way bill?

You can generate an e-way bill through – https://ewaybillgst.gov.in/.

Q2.What is the time limit for e-way bills?

If there are regular transportation modes, for every 100 km or part of its movement, a 1-day limit has been provided.

Q3. If I have registered in the GST Portal, is it necessary to register in the eWay Portal?

Yes, need to register on the e-way Portal although you have registered on the GST portal.

Q4.What if there is a wrong entry or mistake in the e-way bill?

You cannot make rectifications after you generate the e-waybill. If there is a mistake you must cancel the e-way bill and generate a new one.

Q5.How long is the e-way Bill valid?

If it is less than 100 Km the validity is 1 Day and For every added 100 Km or part there is an additional 1 Day.

Q6.Is e-way Bill printout mandatory?

It is not compulsory to carry e-way bills printed out.

Q7.What is the URP in the e-way Bill?

URP means Unregistered Person. In the e-way bill, you must mention URP if a party is not registered.

Q8.What if I am unable to receive the OTP on my registered mobile number while generating the e-way bill?

If you have not received the OTP on your registered phone number, you can access the OTP sent on your registered email ID.

Q9.In which case is e-Waybill not required?

You need not generate an E-Way Bill when the value of your goods is less than ₹50,000. However, while moving handicraft goods or moving goods interstate the generation of E-Way Bills is compulsory. When the goods are transported within the state or the mentioned arena.

Q10.What is the distance rule for the eWay bill?

The e-Way bill limit period starts when the first entry is made in Part-B (Vehicle entry) or the first transportation document number entry in rail/air/ship. The time limit is not re-calculated for the following entries in Part B. The distance that can be entered in the e-way bill is 4,000 km.