Introduction to DRC 07 Summary Orders

Have you ever thought about what will happen if you have a large sum of tax liability left Or what if you make some trick game and don’t show demand orders in GST? Nothing except you will be welcoming tax authorities for a cup of tea in your home with some legal implications of DRC 07 summary orders.

DRC 07 is a platform to interconnect taxpayers and tax authorities. This ensures transparency and fair methods to resolve the common fighting hurdles between the relation of taxpayers and tax authorities. Tax authorities issue them in a situation when there is a huge sum of liability on the taxpayers.

As per Section 62(1) of the CGST Act, 2017, an assessment order is issued in FORM GST ASMT-13 in accordance with Rule 100(1) of the CGST Rules, 2017, and an electronic summary of the assessment must be submitted on the GST portal in FORM GST DRC 07. This will also include demand details like interest, penalty or any amount payable by taxpayers. As soon as these are issued by tax authorities, the taxpayer receives mail or sms and the form is uploaded on the dashboard for further clearance. This form can only be issued by the investigation officer or the jurisdictional officer.

GST has made life easier when it comes to the taxation system and form GST DRC 07 is a part of this pathway. This form is very important when it comes to tax failure. This helps the tax authority initiate demand and recovery procedures during failure of paying tax. For tax payers there are three ways to respond i.e… appeal, explanation or payment rearrangements.

Exploring the Legal Framework of DRC 07 Summary Orders

The Central Goods and Services Tax (CGST) Act, 2017’s Sections 73(9), 74(9), and 76(3) provide the legal foundation for issuing summary orders in legal proceedings in Form GST DRC-07. Following the issuance of the final order under section(52), section(62), section(63), section(64), section(73), section(75), section(76), section(122), section(123), section(124), section(125), section(127), section(129), or section(130), the appropriate officer electronically uploads this form, in accordance with Rule 142(5) of the rules.

This form specifies the amount of tax that must be paid, along with interest and penalties. A demand ID is created together with an accretion of responsibility in the responsibility Register Part II (Other than returns related liability) upon submission of the DRC-07 to the GSTN.

An essential part of the GST compliance and adjudication process, the form provides a standard way to capture and share order-related data. Certain notices and regulations, such rule 142(5) of the CGST Rules, 2017, regulate the issuing and processing of DRC-07 summary orders in legal proceedings.

Key Components of DRC 07 Summary Orders

DRC 07 form include following key points :

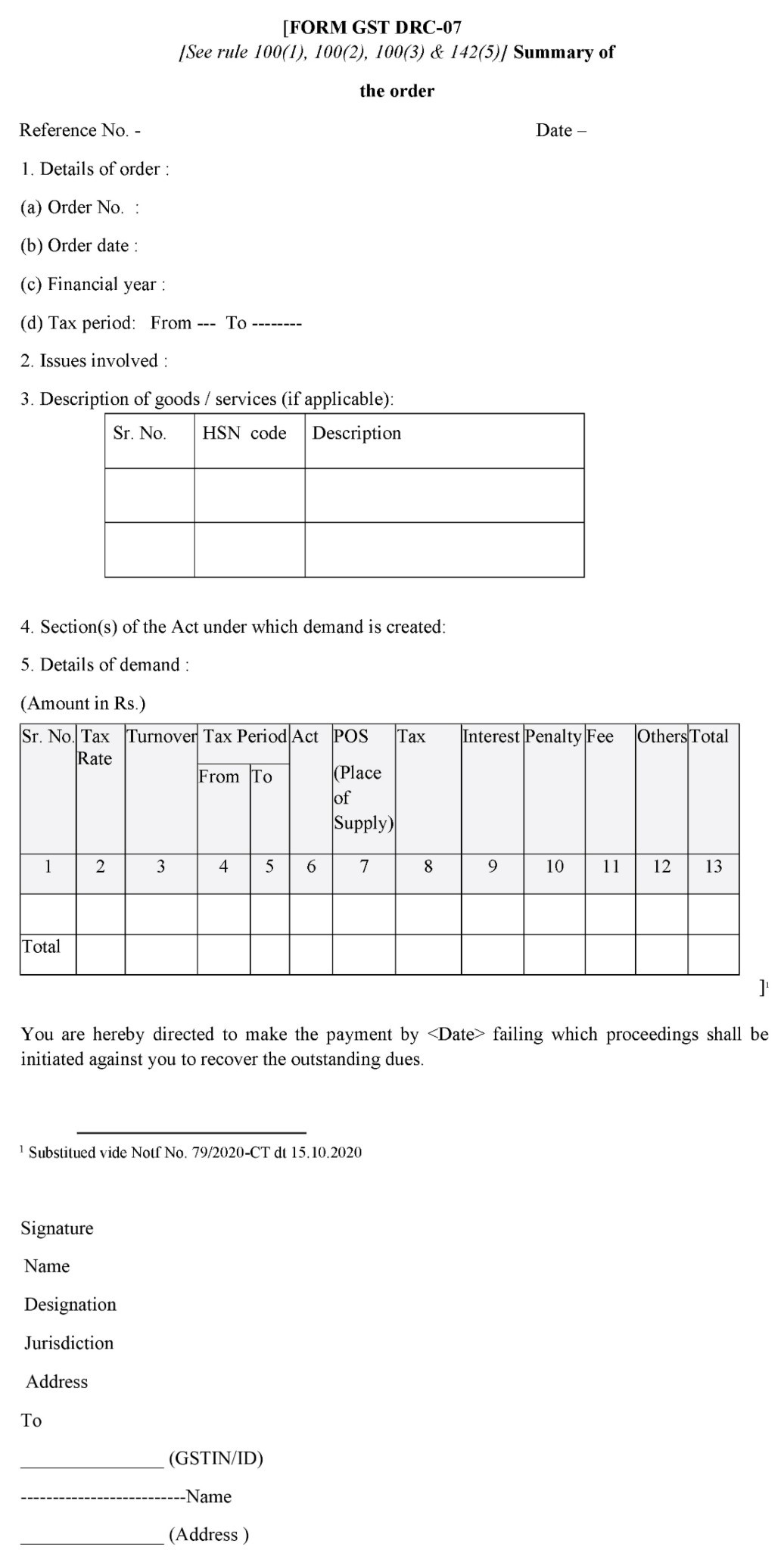

- Details of Order:

- Order number

- order date

- tax period

- Issues Involved : It outlines the specific issues involved, such as classification, valuation, rate of tax, suppression of turnover, excess input tax credit claimed, excess refund released, place of supply, and others

- Description of Goods/Services: This section includes the serial number and HSN description of the goods or services involved.

- Details of Demand: It specifies the amount of demand, typically in the form of the tax, interest, and penalty payable by the person chargeable with tax

- Personal Information : This includes signature, Name, designation, jurisdiction, address and ‘To’ details.

In the below image you can have a look over the DRC-07 form and there key components.

Importance of Compliance with DRC 07 Summary Orders

For taxpayers operating in India under the Goods and Services Tax (GST) regime, DRC 07 summary orders compliance is very essential. When there are unpaid tax liabilities, the tax authorities issue this form, which describes the contents of the demand and gives the taxpayer a chance to contest or refute it. Taxpayers have a limited amount of time after obtaining Form DRC-07 to submit an appeal against the demand. This deadline is critical since missing it could lead to the start of recovery procedures, which could involve the issuing of a final demand notice and further recovery orders.

One should always maintain openness and compliance with the applicable legislation as it is crucial to make sure taxpayers fulfil their tax duties and stay away from penalties and interest charges. This is why DRC-07 compliance is crucial. Taxpayers can assure compliance with GST legislation and efficiently respond to demands by comprehending the essential elements of Form DRC-07 and the legal foundation for its issuing. There are many benefits of maintaining DRC 07 compliance like :

- Ensures transparency and compliance with GST laws and regulations.

- Allows taxpayers to engage with tax authorities and present their case if needed.

- Ensures proper recording and processing of tax demands and recoveries.

- Promotes adherence to the time limit for responding to demands, avoiding late payment penalties.

- Facilitates the issuance of show cause notices and subsequent recovery orders if necessary.

- Supports the GST ecosystem by offering a reliable and open tax administration system.

- Makes it easier for complaints to be resolved through the GST adjudication process.

- Supports the proper functioning of the GST supply chain.

- Facilitates the issuance of final demand notices and subsequent recovery orders if necessary.

- Supports the timely identification and resolution of tax-related issues.

- Guarantees that taxpayers are given enough time to react to tax demands and notification.

- Facilitates the issuance of orders under Section 73(9), Section 74(9), or Section 76(3) of the CGST Act, 2017

- Supports the efficient administration of the GST system and the collection of tax revenues

Challenges and Complexities in Implementing DRC 07 Summary Orders

Implementing DRC-07 summary orders can present several challenges and complexities, which can be highlighted in the following points

-

Complex tax calculations

DRC-07 summary orders may involve intricate tax calculations, such as classification, valuation, and rate of tax, which can be difficult for taxpayers to understand and comply with.

-

Multiple issues involved

It may be difficult for taxpayers to properly reply to the form due to its potential to cover a variety of topics, including categorization, value, tax rate, suppression of turnover, excess input tax credit claimed, and excess refund released.

-

Short response time

Taxpayers have a finite period within which to respond to DRC-07 summary orders, which can be challenging, especially when dealing with complex issues or multiple orders

-

Insufficient direction

The particular regulations and notifications controlling the issuing and processing of DRC-07 forms may be confusing to taxpayers.

-

Resolution of disputes

Legal implications of DRC 07 sometimes takes even years to resolve. Thus receiving DRC-07 may take one to the same long loop.

-

Adherence to the rules and laws governing GST

Sometimes it is difficult to ensure compliance with GST laws and regulations, especially when handling complicated matters or a large number of orders.

-

Identifying errors

Taxpayers must identify and address errors in the DRC-07 summary orders, which can be difficult when dealing with complex issues or multiple orders.

-

Lack of proper training

Taxpayers may lack the necessary training and resources to effectively respond to DRC-07 summary orders, making compliance challenging.

-

Manual processing

In some cases, DRC-07 summary orders may still be issued manually, making it difficult for taxpayers to track and comply with the orders.

-

Time-consuming processes

Taxpayers may face delays in the processing of DRC-07 summary orders, which can be frustrating and time consuming.

-

Implementation irregularities

Tax offices may apply DRC-07 summary orders differently, which makes it challenging for taxpayers to consistently abide with the directives.

-

Procedure for adjudication

It will be very important for taxpayers to participate in the adjudication process, which can be difficult and time-consuming.

-

Record-keeping

You must maintain accurate records to support their response to DRC-07 summary orders, which can be challenging, especially when dealing with complex issues or multiple orders.

-

Lack of clarity

Taxpayers may face difficulties in understanding the specific rules and notifications governing the issuance and processing of DRC-07 forms.

-

Regulatory changes

Taxpayers must stay updated with the latest regulatory changes, which can be challenging, especially when dealing with complex issues or multiple orders.

Conclusion

It is regulatory compliance requirements, for both taxpayers and the governing bodies overseeing them to have an understanding of how DRC 07 summary orders are utilised in legal proceedings.

They serve as a connection or aid in this process allowing for monitoring and exchange of order related information. Furthermore DRC 07 summary orders play a role in ensuring tax collection and resolving disputes.

The Central Goods and Services Tax (CGST) Act, 2017’s Sections 73(9), 74(9), and 76(3) give the legal foundation for issuing DRC-07 summary orders. To support a strong and transparent GST ecosystem, the ability to generate and upload Form DRC-07 electronically has been made available.

It is regulatory compliance requirements for taxpayers to maintain compliance with GST legislation and respond to demands in an effective manner by comprehending the essential elements of Form DRC-07 and the legal foundation behind its issuance. The significance of adhering to DRC-07 summary orders and the possible repercussions of non-compliance, including the start of recovery actions and the accrual of penalties and interest costs, must be communicated to taxpayers.

Features like DRC forms in our taxation system makes our tax system a fair and open ground for all players with a level playing field.

Fair tax system means working with people who look after taxes (tax authorities), using tools like computers for help. Setting up plans about staying in line is important too as well as educating staff members properly while monitoring them all the time side by side having discussions or chats with experts. Society’s health and the smooth work of the economy need people to pay taxes correctly. In short, fairness among people, money spent by the government and how well taxes are managed all depend on whether or not rules about tax payment are followed.

Also Read: GST: Everything You Need To Know

Also Listen: CaptainBiz Account Main Sales Invoice Banane ki Process

FAQS

-

What are DRC 07 summary orders?

Form DRC-07 is a specific type of demand summary order that is issued by tax authorities against taxpayers for having large sums of tax liabilities.

-

What is the time limit to appeal for taxpayers against DRC 07 order?

Taxpayers need to submit their appeal within one month(30 days) of the day they receive the order.

-

Is there any extension on time limit?

Generally there is no extension on time limit but one can apply for extension whose result will be decided by the authorities.

-

Where can I file form DRC 07?

You can file on the GST portal. GST Portal -> My Application -> Form DRC-07

-

Who can issue DRC-07?

Tax authorities have an authority to issue DRC-07 for outstanding tax liabilities.

-

What details are needed to be filled in the DRC-07 form?

There are mainly four parts in the form : Detail of order, Issues involved, Description of goods and services and details of demand.

-

Which section of the GST Act gives foundational pillars to DRC-07 ?

Section 73(9), or Section 74(9) or Section 76(3) of CGST Act, 2017 provides legal power to DRC-07.

-

What are the Legal implications of DRC 07?

Compliance with a DRC 07 summary order is important to avoid penalties and interest charges and to ensure transparency and compliance with the relevant regulations.

-

Can a DRC 07 summary order be issued without a show cause notice?

No, a DRC 07 summary order cannot be issued without a show cause notice.

-

Can a DRC 07 summary order be issued electronically?

Yes, a DRC 07 summary order can be issued electronically in the CBEC-GST portal.