Introduction

Goods and Services Tax (GST) implementation and its different types of GST registrations changed the history of taxation in India. These uniform tax systems eased and simplified indirect taxation of goods and services leading to various GST registration classes that fit every company and personal requirement.

Did you know in 2022, the number of GST registrants in India had surpassed 1 crore businesses and individuals?

This article explores the various types of GST registrations available in India, delving into GST registration categories, their eligibility criteria, tax rates, and step-by-step application process.

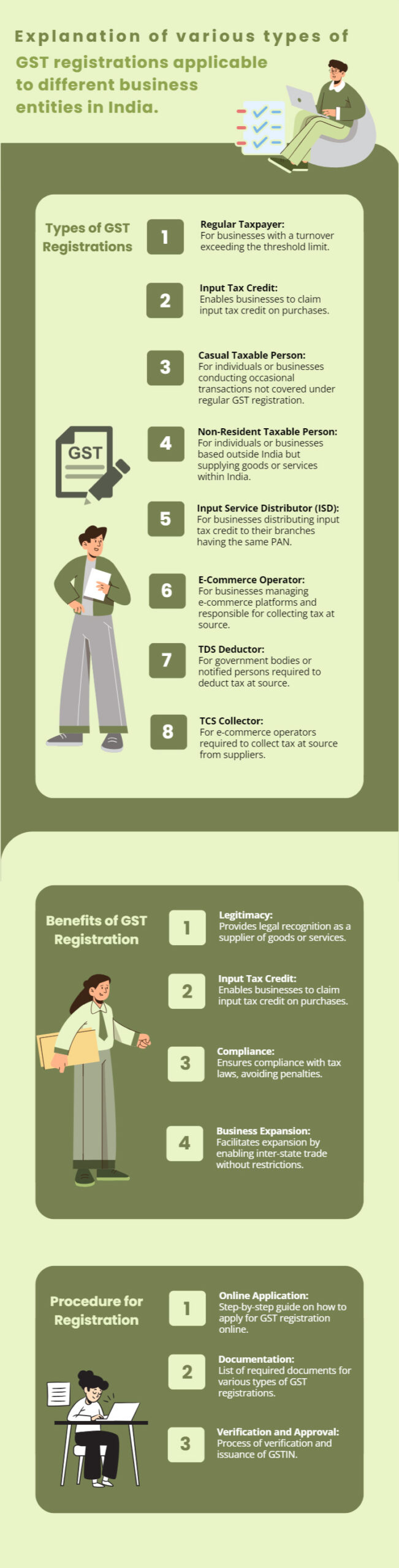

8 Types of GST Registrations

In this case, the GST registration in India caters to different entities. The different types of GST registrations are as follows:

- Regular GST Registration (GSTIN)

- Composition Scheme Registration

- Casual Taxable Person Registration

- Non-Resident Taxable Person Registration

- Input Service Distributor (ISD) Registration

- TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) Registration

- E-commerce Operator Registration

- URD (Unregistered Dealer) Composition Scheme

1. Regular GST Registration (GSTIN)

Regular GST Registration (GSTIN) is the fundamental type of GST registration in India. It’s the gateway for businesses and individuals to participate in the unified tax system, allowing them to collect and remit GST, claim Input Tax Credit (ITC), and meet tax obligations.

Eligibility Criteria

- Register if annual turnover exceeds the threshold (Rs. 20 lakhs, or Rs. 10 lakhs in special category states).

- Interstate suppliers must register, regardless of turnover.

- Register within 30 days of meeting the criteria to avoid penalties.

Tax Rates

GST Rate Slabs: GST is categorized into multiple tax rate slabs. These slabs include:

- 5%: This is typically applied to essential items.

- 12% and 18%: These rates are common for various goods and services.

- 28%: This is the highest standard rate applied to certain luxury and demerit goods.

- Nil Rate: Some goods and services are exempt from GST, meaning they are taxed at a nil rate. These often include basic food items, healthcare, and educational services.

- Compensation Cess: In addition to the standard GST rates, certain goods, such as tobacco and luxury cars, may be subject to Compensation Cess.

- Additional and Special Rates: Some specific items, like gold and precious metals, may have unique or additional rates.

Application Process

- Register as a new user on the GST portal ( https://www.gst.gov.in/ ).

- Complete the GST REG-01 form with business details.

- Verify your identity through OTP.

- Upload necessary documents and details.

- Await verification and responses from tax authorities.

- Once approved, receive your GSTIN and certificate.

- Start filing GST returns per your business activity.

2. Composition Scheme Registration

Composite GST Registration simplifies taxes for small businesses, reducing compliance and offering lower tax rates in exchange for restrictions, promoting ease of doing business for eligible entities.

Eligibility Criteria

- Turnover Limit: To qualify for the Composition Scheme, businesses must have an annual aggregate turnover below Rs. 1.5 crores.

- Nature of Business: Not all businesses are eligible for the composite GST registration. Certain businesses, like restaurants, manufacturers, and suppliers of specific goods, may not be eligible.

- Intra-State Supply: Businesses opting for the composite GST registration are allowed to supply goods or services only within the state in which they are registered. They cannot engage in interstate transactions.

Tax Rates

Manufacturers and Traders:

- 1% of the annual turnover for traders.

- 2% of the annual turnover for manufacturers.

Restaurants (Not Serving Alcohol):

- 5% of the annual turnover.

Application Process

- Check eligibility based on turnover and business type.

- Visit the official GST portal.

- Log in or register if you’re a new user.

- Access the Composition Scheme application.

- Fill out Form GST CMP-02 with business details.

- Make a declaration as required.

- Receive an Application Reference Number (ARN) upon submission.

- Await a review by the tax authority and respond to any notifications.

- Once approved, receive a confirmation via ARN.

- If transitioning from a regular to a composite GST registration, file Form GST ITC-03 for existing stock.

- Remember to adhere to the Composition Scheme’s specific rules and restrictions once registered.

3. Casual Taxable Person Registration

Casual GST registration in India is for those involved in occasional taxable activities, like trade fairs or events, offering flexibility without full-time GST registration.

Eligibility Criteria

- Occasional or non-regular taxable supplies.

- Non-resident or foreign entity temporarily conducting business in India.

- Engaged in taxable supplies.

- Temporary presence for specific events or activities.

- Compliance with GST rules during the temporary business activity.

Tax Rates

Casual GST registration are subject to the same GST tax rates as other regular taxpayers. The applicable GST rates for goods and services vary based on the nature of the supply, such as 5%, 12%, 18%, or 28%, as per the GST rate slabs.

It’s important to note that Casual Taxable Persons, despite their temporary or occasional nature, must charge and collect GST from their customers at the appropriate GST rate. The specific GST rate applicable to a particular supply depends on the classification of the goods or services being provided and is in line with the standard GST tax structure in India.

Application Process

- Register as a new user on the GST portal.

- Log in to the portal.

- Choose the ‘Casual Taxable Person’ category.

- Complete the registration form with business details.

- Upload necessary documents.

- Verify your identity through OTP.

- Await verification and responses from tax authorities.

- Once approved, receive your GSTIN and certificate.

- File returns during your temporary business activity.

4. Non-Resident Taxable Person Registration

Non-resident Taxable Person (NRTP) GST registration is for foreign entities participating in occasional taxable activities within India, like trade fairs or projects, offering flexibility without permanent presence.

Eligibility Criteria

- Non-resident status, not residing in India.

- Engaged in taxable supplies within India.

- Occasional and short-term business activities.

- An advance deposit of estimated tax liability is required.

- Compliance with GST rules during the temporary presence in India.

Tax Rates

- VAT/GST Rates: NRTPs may need to register for Value Added Tax (VAT) or Goods and Services Tax (GST) and charge the standard or reduced rates applicable to their goods or services.

- Withholding Tax: NRTPs might be subject to withholding tax on income like interest, dividends, royalties, or service payments. The withholding tax rates vary based on the type of income and tax treaties.

- Income Tax: NRTPs could be liable for income tax on earnings from their activities in the country. Income tax rates differ between countries and industries.

- Other Taxes: Depending on the country and specific activities, there might be additional taxes like excise taxes or local taxes applicable to NRTPs.

Application Process

- Check eligibility.

- Gather documents (ID, business info).

- Fill out the application form.

- Submit the form and pay fees (if any).

- Await approval.

- Receive a registration certificate.

- Follow tax compliance and reporting rules.

- De-register when no longer needed

5. Input Service Distributor (ISD) Registration

Input Service Distributor (ISD) Registration in GST facilitates distributing tax credits within a business entity. It permits a designated office to allocate input service tax credits to other units, streamlining the process for efficient credit utilization and tax compliance.

Eligibility Criteria

- Be GST registered.

- Have distinct branches or units within the same state/territory.

- Receive taxable input services.

- Intend to distribute input tax credit to branches/units.

- Comply with GST return filing.

Tax Rates

In India, ISD Registration focuses on distributing input tax credits within an organization under GST. It’s not related to setting tax rates. Tax rates vary per GST laws and regulations, including standard, reduced, zero, or exempt rates for different goods and services. Check local regulations for specific rates.

Application Process

To apply for ISD Registration:

- Check eligibility.

- Access the GST portal.

- Complete Form GSTR-6.

- Declare input services and units.

- Submit the form online.

- Await acknowledgment and review.

- If approved, start credit distribution

6. TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) Registration

TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) Registration are essential compliance mechanisms in many tax systems. TDS involves deducting taxes from payments made to parties, while TCS entails collecting taxes at the source of specific transactions. Both registrations are critical for businesses to ensure accurate tax collection and reporting, and they are governed by the tax laws and regulations of the respective country.

Eligibility Criteria

For TDS Registration:

- Businesses making specified payments, like salary, interest, or rent.

- Individuals or entities required to deduct tax at source as per tax laws.

- Threshold limits and types of payments may vary by country and are subject to tax regulations.

For TCS Registration:

- Businesses engaged in specific activities, such as selling goods.

- Entities that are obligated to collect tax at source on particular transactions.

- The scope and types of transactions are determined by tax laws and can differ between countries.

Tax Rates

TDS Rates:

- Salary: Per income slab.

- Interest: Generally 10%.

- Rent: Typically 10%.

- Professional Fees: 10% for individuals, 2% for others.

TCS Rates:

- Sale of Goods: Rates range from 0.1% to 1% or more.

Application Process

For TDS and TCS Registration:

- Check eligibility.

- Access the tax portal.

- Fill out the registration form.

- Submit the form online.

- Await acknowledgment and review.

- If approved, get the registration certificate.

7. E-commerce Operator Registration

E-commerce Operator Registration is essential for e-commerce businesses to comply with tax, legal, and regulatory requirements, including tax collection, electronic transactions, and consumer protection.

Eligibility Criteria

To be eligible for E-commerce Operator Registration, you typically need to:

- Be a legally registered entity.

- Engage in e-commerce activities.

- Meet any transaction or revenue thresholds.

- Comply with tax laws and regulations.

- Adhere to local regulations and consumer protection laws.

- Register if you collect and remit taxes on behalf of sellers.

- Ensure data security and privacy compliance, especially with personal information.

Tax Rates

Goods and services tax (GST) is paid by e-commerce operators on certain transactions. The GST rates in India are typically structured into four tax slabs: This is made up of 5%, 12%, 18%, and 28%, with some items attracting a 0% tax rate.

E-commerce operators are responsible for collecting GST on taxable supplies made through their platform. The specific GST rate applicable to a transaction may depend on factors such as the type of product or service being sold.

Application Process

For E-commerce Operator Registration in India:

- Check eligibility.

- Complete GST registration (if not done already).

- Access the GST portal.

- Fill out the E-commerce Operator Registration form.

- Verify the information.

- Submit the form online.

- Await acknowledgment and review.

- If approved, receive E-commerce Operator Registration.

8. URD (Unregistered Dealer) Composition Scheme

The URD Composition Scheme simplifies taxes for small and unregistered dealers. They pay a fixed rate on turnover, reducing compliance and promoting voluntary tax adherence among small businesses.

Eligibility Criteria

- Stay below the turnover threshold.

- Not registered under GST.

- Primarily operate within one state.

- Limited tax liability.

- Check exclusions based on activities.

Tax Rates

The tax rates under the Unregistered Dealer (URD) Composition Scheme in India typically varied by state, but they were usually fixed and lower than the standard GST rates. The specific tax rates would be determined by the individual state governments, and they were usually expressed as a percentage of the taxpayer’s turnover.

Application Process

To apply for the URD Composition Scheme in India:

- Confirm eligibility.

- Access the GST portal.

- Opt for the Composition Scheme.

- Complete and submit the required form.

- Await acknowledgment and review.

- If approved, you’ll be enrolled in the scheme.

Frequently Asked Questions

What are the different types of registration in GST?

Different types of GST Registration schemes include Regular GST Registration (GSTIN), Composition Scheme Registration, Casual Taxable Person Registration, Non-Resident Taxable Person Registration, Input Service Distributor (ISD) Registration, TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) Registration, E-commerce Operator Registration, and URD (Unregistered Dealer) Composition Scheme.

Who is eligible for GST registration?

Individuals, businesses, or entities whose turnover exceeds the prescribed threshold limit, engage in interstate supply, or meet specific criteria like e-commerce operators or TDS/TCS deductors are eligible for GST registration in India.

Is GST registration free?

No, GST registration in India is not free. There may be fees associated with the registration process, depending on the type of business and the state in which it operates.

Who is not eligible for GST registration?

Those with turnover below the threshold, suppliers of exempt goods/services, some small businesses, and non-resident taxpayers with zero-rated supplies are generally not eligible for GST registration in India.

What is the age limit for GST registration?

There is no specific age limit for GST registration in India. GST registration is primarily based on business-related factors such as turnover, type of supply, and other criteria. Age is not a determining factor for GST registration eligibility.