The tax invoice is a crucial link that connects companies, tax authorities, and customers in the complex web of contemporary trade. It is essential for taxes and financial transparency, acting as a thorough record of financial transactions and highlighting the exchange of commodities and services.

It is crucial to comprehend the fundamental components of a tax invoice, regardless of whether you are in charge of a tiny local firm or a worldwide enterprise. These GST tax invoice elements guarantee that financial transactions are open and readily auditable, in addition to making it easier to comply with tax laws. We examine the essential elements of a tax invoice in this extensive tutorial, illuminating their importance and function within the context of financial accountability.

What is a tax invoice?

A tax invoice is similar to a regular business invoice in the sense that it is a document that records transactions between a supplier and a buyer. Because it also includes the amount of tax payable along with the transactions, it is, in that sense, different from a regular invoice.

Tax invoices are a registered business’s way of ensuring accurate records in a way that is compliant with the tax laws of the government. The main goal of a tax invoice is to give a thorough accounting of the products or services traded, including any applicable taxes.

Why are tax invoices important?

Here are some reasons why tax invoices are important for a business:

- Transaction Proof: Since tax invoices include elements like quantities and prices, they serve as good evidence that a deal between a buyer and a seller actually took place. This can prove to be very helpful in cases of disputes or disagreements.

- Tax Reporting: For firms to report taxes accurately, tax invoices are essential. They provide a transparent analysis of taxes that have been collected and paid, which is essential for determining the total amount of taxes owed. Well-maintained invoices assist businesses in avoiding problems with tax compliance.

- Financial Records: To keep accurate financial records, tax invoices are essential. These records are essential to the financial operations of a business. They are essential for budgeting, money management, and making wise business decisions.

- Legal Requirement: When selling products or services, businesses are required by law in many countries to provide tax invoices. This mandate helps tax authorities track and collect the proper taxes while also ensuring compliance with tax legislation.

Types of Tax Invoices

There are many types of tax invoices at different stages of a transaction. Some of them are listed below:

-

Standard Invoice

The most basic kind of invoice used for sales of goods and services includes information about the seller, the buyer, and a brief about the goods or service. It also includes the total amount to be paid and the payment terms.

-

Performa Invoice

Performa invoices are provided before the goods or services are delivered to the customer. It is basically an estimate and gives the expected cost of the transaction. It is not used as a demand for payment.

-

Interim Invoice

Also known as a progress invoice, it is used for projects that are long-term. A long-term project is one where the payments are made in stages. So, these invoices are issued regularly when a certain portion of the work is completed.

-

Recurring Invoice

Recurring invoices are used for subscription-based services or for contracts that are ongoing. They are automatically generated and sent monthly or annually for memberships and service subscriptions.

-

Commercial Invoice

In international trade, a commercial invoice is used to provide full details about the products being sent, their worth, and other customs-related information. It is necessary for the clearing of customs and aids in the calculation of import taxes and charges.

Every kind of invoice has a distinct function and is made to accommodate various business situations. Businesses can speed up their financial procedures and keep accurate transaction records by having a thorough understanding of these different sorts of invoices.

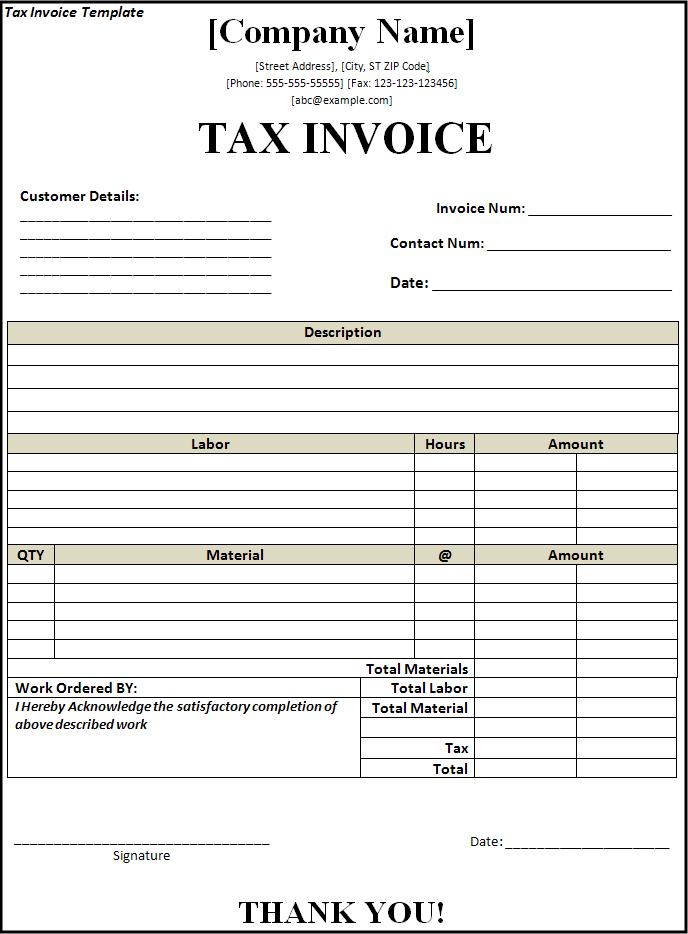

Elements of Tax Invoice

There are some tax invoice elements that every tax invoice must have to make it compliant with tax regulations, such as:

- Seller Details: It is important to provide the supplier’s (the seller’s) name, address, and phone number. This data is necessary to determine the origin of the products or services.

- Buyer Details: For proper paperwork and taxation, the recipient’s (the buyer or customer’s) name, address, and contact information are usually provided.

- Invoice Number: Every tax invoice has to be uniquely identified by a number. For tracking and reference reasons, this number is used. It should be organised easily by following a progressive pattern.

- Invoice Date: For tax reasons, the invoice’s issuance date is important since it establishes the tax period within which the transaction must be recorded.

- Details of the products or services: A thorough explanation of the products or services rendered, together with the quantity, unit cost, and total for each line item. This facilitates the precise computation of the taxable amount.

- Taxable Amount: It is important to specify the whole cost of the products or services, exclusive of taxes. This serves as the basic amount for calculating taxes.

- Tax Amount and Rate: The relevant tax amount and the appropriate tax rate (such as sales tax, VAT, or GST) ought to be displayed individually. This guarantees tax computation transparency.

- Total Amount Payable: It is important to make explicit the whole amount owing, including the tax amount. This is the last sum that the beneficiary must pay.

- Terms of Payment: The invoice should include any special terms and circumstances pertaining to payment, such as discounts, deadlines, and late fees.

- Money: Particularly in international transactions, it is important to specify the currency being used.

- Numbers for Tax Identification: The tax identification numbers (such as the GSTIN or VAT number) of the supplier and the receiver must be listed on the invoice in many countries.

- Details of Business Registration: It could be required to obtain information on the supplier’s business entity’s legal status and registration specifics, including a business registration number.

- Rules & Regulations: The invoice should include a description of any applicable terms and conditions that apply to the transaction.

Benefits of Tax Invoice

Listed below are the benefits of tax invoices:

1) Assist Companies in Receiving Timely Payments

Chasing money that you need to obtain for goods or services offered is a common annoyance for most businesses. However, invoicing helps to solve this problem. Because the invoice provides important information such as the due date for payment, the manner of payment, the seller’s information, and the value of the products or services given, it allows the buyer to make payments more quickly. Each sort of invoice has a different purpose and is made to suit the requirements of various business scenarios. Understanding the different sorts of invoices may help organisations improve their financial procedures and keep accurate records of transactions.

2) Instrument for Keeping Records

If a difference or dispute occurs over a certain bill, the invoice data serves as proof of record. Businesses frequently save all records for eight years in order to present them if the authorities seek them. Invoicing acts as a record if there is a disagreement over a certain charge, which is typical in business.

3) Assistance in Legal Situations

In a legal disagreement, invoices may also be used as evidence. The details on an invoice, such as the date and invoice amount, are important if there is a lawsuit or other ongoing dispute about a particular transaction. The outcome of any related dispute settlement may be significantly influenced by the customer’s signature on the invoice.

4) Aids in the Development of Brand Image

The invoice’s layout, the logo’s positioning, and the quality of the wording all support the company’s image. Customers are contacted through invoices. Since it’s a part of the customer experience, billing needs to be done with extra care and thought.

Conclusion

Although a tax invoice is similar to a standard company invoice, it differs in that it includes transaction data and the amount of tax owed. This crucial document is the foundation of good financial record-keeping and legal compliance.

Tax invoices are used for a variety of tasks, including preserving financial records, supporting tax reporting, proving transactions, and meeting legal obligations. They are essential for preventing disagreements, making it easier to enforce rules related to payments, and improving a business’s reputation.

The mandatory tax invoice elements of a GST tax invoice, such as the seller and buyer’s information, the terms of payment, and the tax information, guarantee both the document’s correctness in financial accounting and compliance with tax laws. Appropriately formatted tax invoices are the cornerstone of the intricate network of trade, acting as the centre of transparency and responsibility in the business sector. Unlock the foundation of financial record-keeping and legal compliance by harnessing the potential of tax invoices with CaptainBiz.

Also Read: CaptainBiz Launches Unlimited e-Invoices and e-Way Bills on Mobile App

FAQs

Q1: What should be included in a tax invoice?

To charge the tax and transfer the input tax credit, a tax invoice is often generated. The following necessary fields must be present on a GST invoice: item information (description), quantity (number), unit (metre, kilogramme, etc.), and total value.

Q2: What is a tax invoice?

Like a standard business invoice, a tax invoice is a record of the transactions between a buyer and a seller. It is distinct from a standard invoice in that it contains the tax amount owing in addition to the transaction details.

Q3: What is an ideal tax invoice?

Typically, an excellent tax invoice includes the following details: For the recipient, obtaining input tax credit is the primary goal of a tax invoice. From the supplier’s perspective, they offer information for financial reporting needs and act as evidence of items supplied. As a result, a company may select the best format for its purposes.

Q4: What are the tax invoice elements for small businesses?

A small firm must produce many kinds of invoices due to a variety of circumstances. Various elements, such as the business you operate in, the sort of consumer you serve, geographical dependencies, compliance standards, etc., affect the kind of invoice you must produce.

Q5: What are the necessary tax invoice elements for exporters?

The important elements for tax invoices for exporters are the name, address, and contact details of the exporter, as well as the recipient, date of issue, due date, and invoice number.