Introduction to Invoices and Bills

In the domain of business and finance, “invoice” and “bill” frequently appear the same way. Even though these phrases have similar meanings and functions, it’s essential to grasp their minor distinctions for effective financial planning.

In this article, we will clarify the misunderstandings surrounding invoices vs bills, explaining their functions and distinctions and how understanding their intricacies may lead to more efficient and successful transaction procedures.

Join us as we explain the complexity of invoices and bills for improved transaction management, whether you’re an accountant, a business owner, or just someone curious about financial operations.

Unraveling Invoices: What They Entail

A document that offers a thorough account of the products sold or services given through a company to its clients is called an invoice. It acts as the buyer’s request for payment to the vendor. When a company sells products or services to a customer, it needs to have a clear and concise record of each transaction. An invoice is useful in this situation.

The seller ensures accountability and transparency by providing the buyer with a detailed invoice that includes all transactional facts. The invoice serves as a formal record that both parties can use as a reference and to see the terms of the sale.

An invoice also functions as a legitimate document that has tax-related uses. Invoices are an essential part of the proper record-keeping that businesses must maintain about their sales and expenses. They aid in the computation of taxable income for firms and offer proof of the transaction.

The information included in the Invoice

Invoices are essential pieces of documentation because they are a vital source of financial information that helps companies track sales and manage cash flows. The following essential details must be included in an invoice for it to be considered full and consistent with law:

|

|

|

|

|

|

|

|

|

|

Also Read: Mandatory Information To Include In A Tax Invoice For Goods

Delving into Bills: A Comprehensive Overview

A formal statement a company sends to its clients outlining the sum owing for goods acquired or services rendered is called a bill. The buyer generates a bill, usually in reaction to an invoice received, as opposed to the seller, who generates an invoice.

It specifies the due date and available payment methods and acts as a formal demand for payment. Bills often serve as a tool for recurring payments, such as monthly service fees, subscription fees, and utility payments.

When a buyer receives an invoice from a seller, they verify the accuracy of the data by reviewing the contents. When the customer decides to pay and accepts the invoice, they create a bill to initiate the payment process.

In addition to regular payments, you may also generate Bills for one-time purchases or services. A contractor you hire to renovate your home may send you an invoice for the down payment and further bills for the balance. Bills provide a clear indication of the amount owed, so buyers may keep an eye on their financial obligations.

The Information included in the Bill

Business bills need to include a few essential details to guarantee correct and prompt payment. Among them are:

|

|

|

|

|

|

|

Also Read: Understanding The Basics Of A Bill Of Supply

Key Distinctions Between Invoices and Bills

Even though the terms invoice and bill are frequently used interchangeably, there are some important distinctions between them, such as how they function and who they are sent to.

- Details of the sale: Companies that demand prompt payment, including internet service providers and utilities, typically send bills. In the meanwhile, providers of goods or services will often submit an invoice outlining the goods provided, the buyer, and the terms of payment.

- Documentation type: A bill is a straightforward document that demands payment right away, whereas an invoice may be made and issued at any point during the manufacturing process. Upon delivery of items, invoices are frequently enclosed in packages so that both the client and the business have accurate records for inventory management.

- Order numbers: All invoices contain a unique order or transaction number, even though some bills do not. This allows businesses to utilise it for both financial records and inventory monitoring systems.

- Payment terms: Payment terms are often not allowed on bills, but invoices occasionally are. The exact amount due, the accepted payment methods, and the length of time the buyer has to make payment are all included in the invoice.

Also Read: Tax Invoice Vs Bill Of Supply: Understanding The Distinction

Importance of Clear Documentation in Invoice Management

To ensure smooth operations and uphold financial correctness in the field of invoice management and bill processing, precise documentation is essential. This is particularly true when using cutting-edge instruments to expedite the invoicing process, such as billing software. The following are some major points that emphasize how crucial proper documentation is in this situation:

- Legal Compliance: An invoice or bill that has adequate documentation adheres to all applicable laws and regulations. This can assist in preventing fines or legal problems and is necessary for tax purposes.

- Payment Clarity: Transparent documentation makes it easier for the receiver to comprehend the specifics of the transaction, such as the amount owed, the date it is due, and the accepted forms of payment. This clarity guarantees prompt payments and lowers the possibility of conflicts.

- Transparency: Transparent documents enhance communication and trust. It fosters an open and sincere business connection by making the terms and circumstances of the transaction understandable to both the buyer and the seller.

- Financial Planning: Clear documentation is essential for businesses to use in their financial planning. Bills and invoices reveal information about cash flow, overdue payments, and general financial health.

- Efficient Processing: The recipient’s payment procedure is streamlined by well-organized paperwork. It makes understanding the invoice data easier and takes less time, which speeds up bill processing and payment.

- Audit Trail: Clear documentation on bills and invoices produces an extensive audit trail. This makes tracking and verifying financial transactions simple, which is crucial for both internal and external audits.

Streamlining Transaction Management Using Invoices and Bills

Using bills and invoices to streamline transaction management is essential for both efficient financial management and organizational effectiveness. Since they act as a record of the money transferred between businesses and their suppliers or consumers, bills and invoices are essential components of the accounting process.

The following are essential actions to simplify transaction management when utilizing bills and invoices:

-

Implementing a Robust Invoicing System:

- Using online invoicing solutions or sophisticated accounting software to produce expert invoices with the highest accuracy.

- Include automatic tools to improve overall invoice accuracy and eliminate manual mistakes.

-

Automation of Billing Processes:

- Adopt automation technologies to expedite bill processing, lowering the possibility of mistakes and guaranteeing constant correctness.

- Automate the computation of taxes, discounts, and other fees to improve the efficiency and accuracy of financial transactions.

-

Integration with Accounting Software:

- Create a single financial environment by easily integrating billing and invoicing software with accounting software.

- By reducing the possibility of disparities across several systems, this integration improves accuracy.

-

Electronic Invoicing (e-Invoicing):

- Make the switch to electronic invoicing to streamline transaction procedures and lessen dependency on old paper-based methods.

- Electronic invoicing expedites the Invoice Tracking process and encourages environmental sustainability.

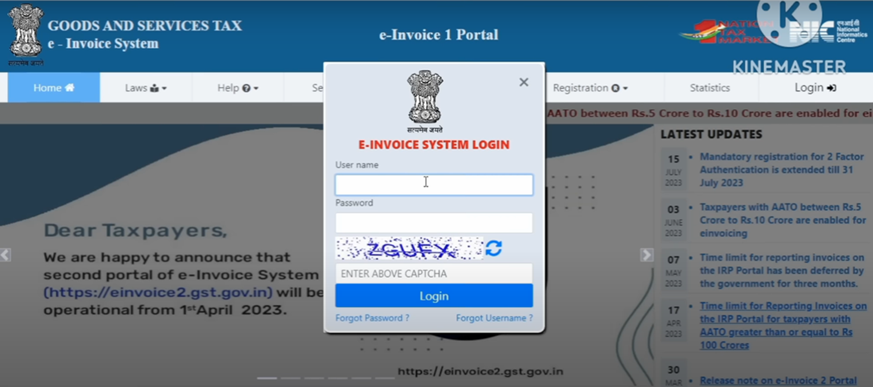

e-INVOICE REGISTRATION FORM 1

e-INVOICE REGISTRATION FORM 1

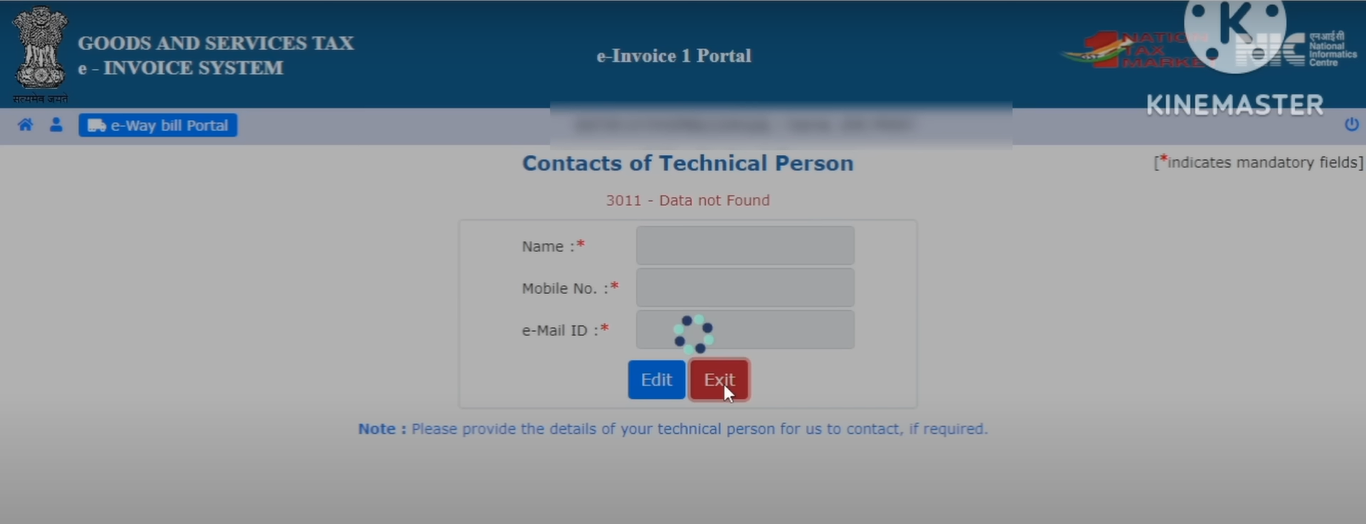

e-INVOICE REGISTRATION FORM 2

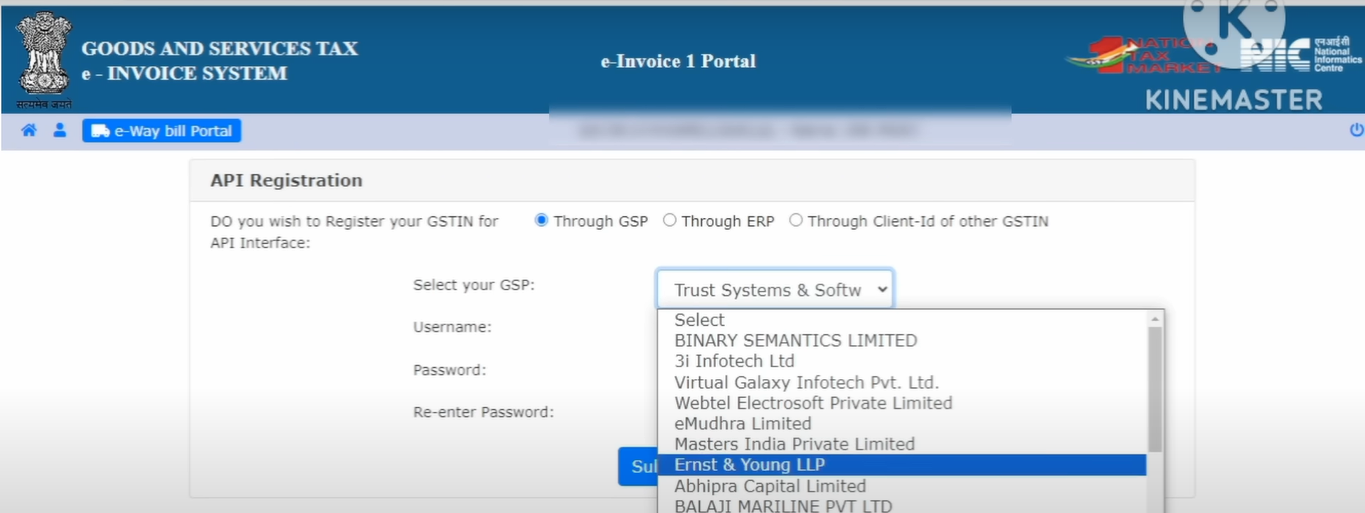

e-INVOICE REGISTRATION FORM 3

-

Centralized Document Management:

- Create a centralized system to store and arrange bills and invoices, making it simple to access and retrieve transaction details.

- This centralized method speeds up the auditing process and helps to preserve accuracy.

-

Tracking and Monitoring Invoice Status:

- Establish a strong monitoring system to keep up to date on invoice status updates in real-time.

- To improve invoice tracking and enable prompt follow-ups on past-due payments, make use of alerts and reminders.

-

Approval Workflows for Enhanced Accuracy:

- Create approval procedures to guarantee that bills are approved through a formal permission procedure before being paid.

- This helps to maintain high invoice accuracy and also protects unauthorized transactions.

-

Mobile Accessibility for On-the-Go Management:

- To enable on-the-go transaction management, use invoicing systems with mobile accessibility.

- Being mobile-friendly improves responsiveness and flexibility in handling financial issues quickly.

Common Challenges and Solutions

A vital component of running a business is managing invoices and bills. This process can present several difficulties. Here are some common challenges along with potential solutions:

-

Late Payments:

- Client late payments can cause cash flow problems and have an impact on stability.

- Establish explicit payment policy and terms. Before the deadline, send out reminders, provide early payment incentives, and think about charging late penalties.

-

Invoice Errors:

- Invoice errors may cause payment disputes and delays.

- Verify bills again for correctness before shipping. Reduce mistakes by using automated invoicing software. Provide comprehensive details on the goods or services, their quantities, costs, and any relevant taxes.

-

Manual Data Entry:

- Manual data input takes a lot of time and is prone to mistakes.

- Make use of data input billing software and automation technologies. Utilise OCR (optical character recognition) technology to retrieve data from paper bills. This expedites the procedure and lowers the possibility of human mistakes.

-

Inefficient Approval Processes:

- Payment delays may arise from delays in the approval procedure.

- Simplify the processes for approval. Install computerized approval systems to enable processing that is more efficient and rapid. Establish explicit approval hierarchies and make use of collaborative technologies to improve departmental communication.

-

Disorganized Record-Keeping:

- Inadequate documentation might make it harder to trace payments and conduct audits.

- For storing and managing bills and invoices, choose a centralized system. Install a digital document management system to guarantee documents are stored securely and are easily retrieved. Reconcile financial records regularly.

-

Tax Compliance:

- Ensuring adherence to tax legislation can provide difficult challenges.

- Remain knowledgeable about the tax laws and rules that impact your company. Invest in accounting software that may help you produce correct tax reports by automating tax computations. Seek advice from tax specialists to guarantee adherence.

-

Communication Issues:

- Errors and delays may arise from inadequate communication between the finance and invoicing divisions.

- Promote direct contact across departments. Make sure that everyone engaged in the billing process is aware of the specified protocols and deadlines by using collaborative tools to promote communication.

-

Security Concerns:

- There is the possibility of data breaches and illegal access.

- Set strong cybersecurity safeguards in place to safeguard private financial information. When sending invoices, use safe, encrypted communication channels. Update systems and software often to fix security flaws.

-

Vendor Relationship Management:

- Sustaining good connections with suppliers is essential to the survival of any firm.

- Be open and honest in your communication with vendors. Deal with any problems right away and think about working out beneficial conditions for payment. Having solid relationships might help you be more adaptable when things are hard.

-

Adapting to Changes:

- Invoicing procedures must be modified as businesses and regulations change.

- Keep aware of regulatory developments and changes in the industry. Review and update invoicing methods often to ensure they meet compliance standards and best practices.

Best Practices for Effective Bill and Invoice Management

Using best practices to maintain operational efficiency and financial stability is essential to effective bill and invoice management for businesses. Establish clear and simple invoicing processes first, providing accurate information on the goods or services, their quantities, costs, and payment terms.

Use automated invoicing software to eliminate mistakes, save time, and simplify the billing process. Establish an organized, easily accessible record-keeping system that ensures frequent reconciliation of all invoices and bills.

To resolve problems as soon as they arise, maintain open communication channels between the billing departments. Keep up to date with tax laws and compliance standards; use accounting software to help with proper reporting.

Furthermore, cultivate a good relationship with suppliers by agreeing on advantageous terms of payment and working together to resolve issues. By using these best practices, small businesses may handle their invoices and bills more effectively, promoting sustainability and good financial health.

Conclusion

In summary, understanding the differences between invoices vs bills is crucial for effective transaction management. Businesses may assure timely payments, improve operations, and minimize errors by establishing good practices and comprehending the differences between various financial papers.

A well-managed financial system benefits from the use of automated instruments, precise record-keeping, and open communication. In short, understanding the intricacies of invoices and bills improves overall transaction efficiency, which has a favorable effect on the financial stability and operational success of a business.

Also Read: CaptainBiz Launches Unlimited e-Invoices and e-Way Bills on Mobile App

FAQs

Q1. What distinguishes a bill from an invoice?

A bill is a demand for payment made after the goods or services have been delivered, whereas an invoice is a request for payment made by the seller before the delivery of the goods or services.

Q2. Why is it important to include detailed information on an invoice?

Comprehensive details on an invoice, including quantities, pricing, and descriptions of the goods or services rendered, guarantee correct payment processing and help prevent misunderstandings and disagreements.

Q3. How can businesses prevent late payments from customers?

Effective methods to avoid late payments involve establishing explicit payment conditions, promptly reminding clients, and providing early payment discounts.

Q4. What is OCR, and how does it help in invoice processing?

Optical character recognition, or OCR, is a technique that turns various document formats—like scanned paper invoices—into data that can be edited and searched. It facilitates data input automation and lowers human error in processing invoices.

Q5. How can small businesses enhance invoice security?

Small businesses may improve the security of their bills by sending invoices over secure, encrypted communication channels and routinely upgrading software to fix security flaws.

Q6. What role does automation play in invoice management?

Automation in invoice management streamlines processes reduces errors, and enhances efficiency by automating tasks like data entry, approval workflows, and payment processing.

Q7. How can businesses adapt to changes in tax regulations affecting invoices?

Businesses may adjust to changes in tax legislation impacting invoices by keeping up with tax laws, routinely upgrading accounting software, and interacting with tax experts.

Q8. Why is it important to reconcile financial records regularly?

Frequent reconciliation helps firms spot inconsistencies, mistakes, or fraudulent activity by ensuring that financial records accurately reflect transactions.

Q9. What are some common invoicing mistakes to avoid?

Common invoicing mistakes to avoid include inaccurate information, missing details, inconsistent formatting, and failing to adhere to payment terms.

Q10. How can businesses build positive relationships with vendors through invoicing?

Efficient communication, timely resolution of issues, agreeable terms of payment, and a cooperative attitude to invoicing and billing procedures are all necessary for cultivating excellent relationships with suppliers.