All businesses whose turnover exceeds the specified threshold limit are required to register under GST mandatorily as per GST laws implemented on July 1st, 2017 in India. Registering with GST provides various benefits, of which the most significant ones are input tax credits, payment of taxes, and filing of returns online in the GST portal to stay compliant. Registration with GST lends credibility and transparency to the business.

While registering for GST, businesses must provide proof of the principal place of business, such as an ownership agreement when the place is owned by the business, a lease deed when the company is on leased premises, and a rent agreement when the place of business is rented, along with other documents. When the space is neither owned nor leased or rented, then the taxpayer is required to submit a consent letter for GST registration from the owner of the property where he intends to conduct his business.

What is a Consent Letter for GST Registration?

Many businesses carry out their business from their homes when they do not possess a registered commercial place of business. If the business owns the place, there can be a document proving ownership. When the principal place of business is neither owned nor rented or leased, then such taxpayers are required to submit a consent letter for GST or no objection certificate (NOC) to use the premises for their business operations.

For example, Mr. A, a practicing chartered accountant, wishes to register for GST and works from home, which is owned by his father. In such a situation, Mr. A must obtain the consent letter from his father and submit it at the time of registration with GST. There is no specific format for this consent letter.

Who Should Sign the Consent Letter?

The owner of the premises must sign the consent letter. The owner of the property must provide a consent letter confirming that they have no objection to the applicant using their premises for conducting business. GST officers can ask for the consent letter on stamped paper or for the document to be notarized. This consent letter has to be uploaded to the GST portal at the time of registration.

Documents to be Submitted along with the Consent Letter

The applicant should submit proof that they are the legal owner of the premises, such as an electricity bill, municipal khata copy, or other land records, along with the consent letter from the owner of the property.

Non-Submission of Consent Letter

If the taxpayer does not submit the consent letter and address proof while registering in the GST portal, he may receive an email or phone call from the GST officer asking them to submit the consent letter. On receipt of this intimation, the taxpayer can submit the consent letter in the portal.

Format of Consent Letter

Consent Letter To Whomsoever It May Concern

This is to certify that I… (Name of the Owner), owner of the property… (Address of Property), have permitted and allowed… (Name of the proprietor) to conduct their business from the address mentioned above.

I further state that I have no objection if… (Name of the Proprietor) uses the address of the mentioned premises as their mailing address.

This no-objection certificate is issued to facilitate GST registration.

Owner of the Property

Signature.

(Name of the Owner)

Date………………..

Place…………………

Requirements for a Consent Letter

- Persons or businesses that wish to register with GST but do not have their own registered commercial place of business are required to submit the consent letter.

- Businesses engaged in supplying goods and services whose turnover exceeds a specified limit are compulsorily required to register under GST and follow the rules and procedures for compliance as stated under GST law in India.

- Casual taxable persons, non-resident taxable persons, persons or businesses engaged in inter-state taxable supplies, e-commerce operators, TDS/TCS deductors, agents acting on behalf of registered taxpayers, import-export businesses, taxpayers subject to reverse charge taxation, input service distributors, OIDAE service providers, and other taxable persons as specified under GST Law are compulsorily required to register in GST in India.

- The consent letter has to be submitted when the primary place of business is neither owned, rented, nor leased by the applicant.

- The consent letter is required to be signed by the owner of the premises.

- Proof of ownership, like a property tax-paid receipt, an electricity bill, or a Khata certificate, has to be submitted along with the consent letter.

Steps to Upload Consent Letter in GST Portal

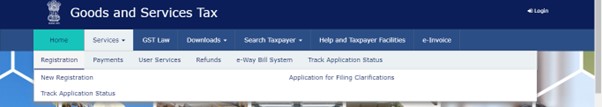

- Step 1: The taxpayer has to visit the GST portal and go to Services->Registration-> New Registration

- Step 2: While filling out the form for new registration, they have to select ‘consent’ under ‘nature of possession of premises.

- Step 3: Upload the GST consent letter, which must be in pdf or jpeg format. The maximum file size is 1 MB. It cannot be more than that.

Updating Address Change in the GST Portal

- When there is a change in the address of the principal place of business, an address change form (REG-14) can be generated.

- The taxpayer has to ensure that the new and previous addresses are in the same state or union territory because GST registration is done state-wise.

- When the taxpayer moves to a different state, he has to cancel the registration, and a new registration has to be done in the state that he has moved to.

- Proof of the new address must be included along with the consent letter for GST registration. The proof must be submitted in the GST registration amendment application for a change of address.

- Documents like property tax receipts, electricity bills, and Khata certificates are considered proof of ownership of property.

- A rental or lease agreement or an affidavit confirming legal possession by the applicant can also be submitted as proof of address for the place of business of the company.

- If the applicant’s primary place of business is in a special economic zone area, the applicant must upload the required specified documents issued by the government.

Frequently Asked Questions

1. In which option should the applicant submit the consent letter?

Answer: The consent letter is uploaded along with the proof of ownership on the GST portal while filing the GST registration form.

2. Can the applicant submit the consent letter after receiving the show cause notice from the GST officer?

Answer: Yes, the applicant can submit the consent letter after receiving the show cause notice. It can be uploaded along with the clarification application.

Conclusion

A consent letter is a vital document for businesses that do not possess their own registered commercial place of business. It is a formal document signed by the owner of the premises under GST. It states that the property owner has no objection to the business being conducted at his premises, where the applicant intends to conduct business, and has to be submitted at the time of registration. It is therefore important for the applicant to know the format of the consent letter and the rules pertaining to it while registering with GST.