INTRODUCTION

Navigating the intricacies of international trade often involves dealing with various types of documentation, including commercial invoices and proforma invoices. These documents play pivotal roles in different stages of a transaction, yet they serve distinct purposes.

Understanding the disparity between a commercial invoice and a proforma invoice is crucial for businesses engaged in global trade.

This article delves into the key disparities between these two vital documents, elucidating their functions, significance, and how they facilitate seamless cross-border transactions.

Explaining Commercial Invoices

A Commercial Invoice is like the basic need of international sales receipts. It’s the official document that sellers use to bill their buyers for the goods and services shipped across borders. Imagine it as your shopping receipt but with international trade invoices.

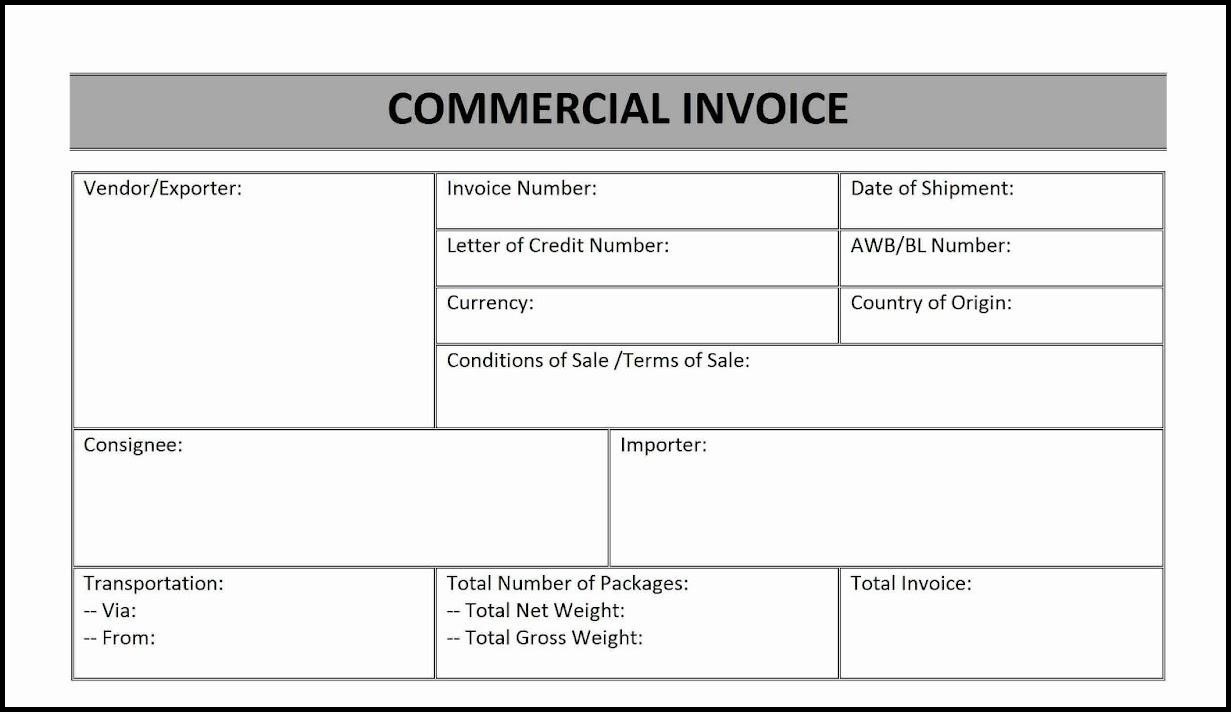

Features of Commercial Invoice

- Seller and Buyer Details: Seller details include the individual or company selling goods, providing name, address, and contact info. Buyer details include the individual or company purchasing, with similar identification details.

- Shipping Details: Where are the goods coming from, and where are they going? The Commercial Invoice takes control of the origin and destination of goods.

- Description of Goods: This section includes the description of goods and services along with other necessary details. The Commercial Invoice details what’s being sold – from the number of items to their weight and value.

- Prices and Currency: The document specifies the prices of each item and the total cost. Plus, it tells you the currency used for the transaction.

- Terms of Sale: It clarifies the agreed-upon responsibilities and costs between the buyer and seller, This agreement is legally binding and serves as the official record of the transaction for customs, payment, and legal purposes.

Significance of Commercial Invoice

| Customs Clearance | Countries want to know what’s coming in and out. The Commercial Invoice helps customs officers understand and approve the shipment. |

| Payment Proof | Buyers need proof of purchase to pay up. The Commercial Invoice is their go-to receipt. |

| Legal Stuff | It’s a legal document, making the deal official and binding. |

The Commercial Invoice details are the paperwork sidekick that ensures everyone is on the same page when things are shipped between countries. It’s the key to smooth customs clearance and a happy transaction for both buyer and seller.

Unveiling Proforma Invoices

A Proforma Invoice is a preliminary bill sent by a seller to a buyer before shipping goods or providing services. It outlines the estimated cost, quantities, and other details of the transaction, serving as a preview or proposal for the final invoice.

Features of Proforma Invoice

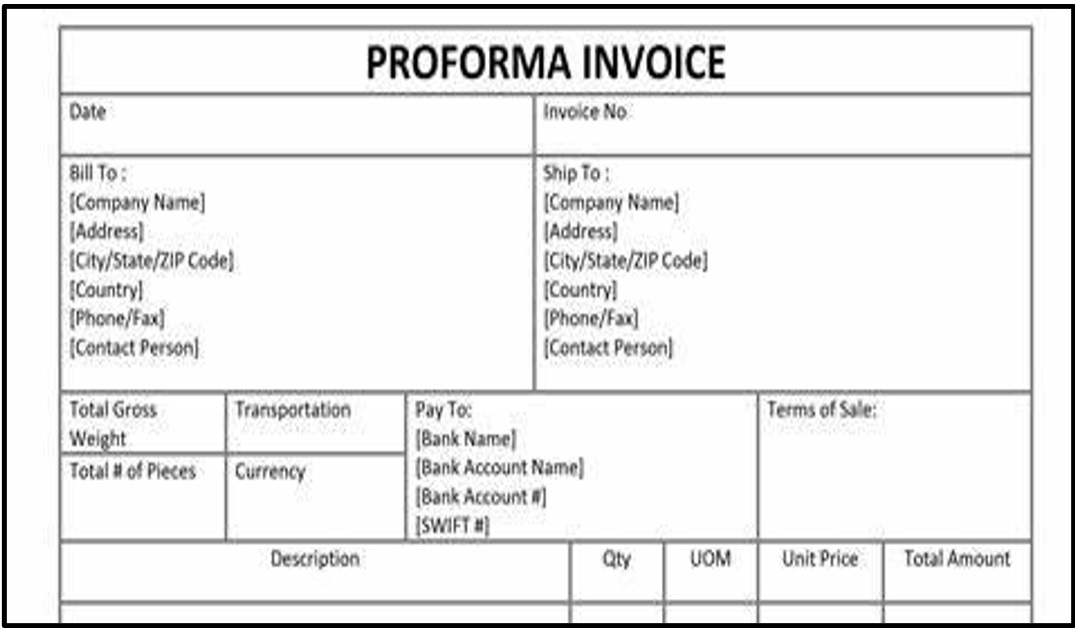

- Seller and Buyer Details: In Proforma Invoice, the first step is introducing the key stakeholders involved in the transaction—the seller and the buyer. It’s akin to the initial financial picture that sets the groundwork for the entire deal.

- Product Details: In a proforma invoice, product details include a brief description of the goods or services being offered, their quantities, prices, and any specific characteristics or terms related to the items being proposed for sale.

- Prices and Currency: It specifies the cost of the goods or services being offered in a particular currency. The unit prices, total amounts, and the currency in which the transaction will be conducted ensure clarity for both the buyer and seller regarding the financial aspects of the proposed deal.

- Validity Period: Unlike your typical grocery list, the Proforma Invoice comes with a timestamp. It’s like a limited-time offer, stating how long the prices and terms remain valid. So, think of it as a deal with an expiration date, keeping things time-sensitive and clear.

- Terms of Sale: Proforma invoice refers to the agreement between the buyer and seller regarding who is responsible for certain costs and risks during the shipment process. It indicates whether the seller or the buyer will cover expenses like shipping, insurance, and customs duties.

Significance of Proforma Invoice

| Decision-Making Tool | Buyers use the Proforma Invoice to decide if they want to go ahead with the deal. It’s like a preview that helps them decide. |

| Planning and Budgeting | Sellers and buyers can plan ahead with the Proforma Invoice, knowing what to expect in terms of costs and quantities. |

| Customs and Import Regulations | Some countries need a heads-up about what’s coming. The Proforma Invoice helps with customs clearance and navigating import rules. |

The Proforma Invoice is your go-to tool, making sure everything is set up nicely before the beginning of the financial process.

Key Differences between Commercial and Proforma Invoices

Let’s explore how the Commercial Invoice and, the Proforma Invoice, are different:

1. Purpose

Commercial Invoice: This one is the real deal, the official bill for the goods or services after they’ve been delivered. It’s all about closing the deal and getting paid.

Proforma Invoice: Its purpose is to provide an official record of the transaction between the seller and the buyer. It contains detailed and finalized information about the sold goods or services.

2. Legally Binding

Commercial Invoice: It’s a legal document that finalizes the sale. Once the goods are delivered, this invoice becomes the proof of the transaction.

Proforma Invoice: This is more like a friendly proposal. It outlines terms and details but isn’t a legally binding document. It’s more of a confirmation before the actual contract.

3. Timeline

Commercial Invoice: After the delivery of goods or services it finalizes the overall process in the end and makes the transactions accessible.

Proforma Invoice: It is required before the consignments are shipped. It’s the opening act, The parties are here allowed to agree on the terms of the delivery.

4. Details and Depth

Commercial Invoice: It’s comprehensive, detailing everything from the buyer and seller information to the basic details of the goods or services, prices, and terms.

Proforma Invoice: While it contains crucial details, it’s a condensed version, offering a snapshot of the upcoming transaction without going into as much detail as the Commercial Invoice.

5. Validity

Commercial Invoice: Once issued, it remains valid as long as it takes for the transaction to conclude. This is necessarily important when shipments are delivered.

Proforma Invoice: It has an expiration date. The terms and prices mentioned are only valid for a specified period, adding a sense of urgency for decision-making.

The Commercial Invoice is the official record of a completed transaction, while the Proforma Invoice is a preview, a prelude to the main event.

Also Read: Export Invoices And Commercial Invoices: Similarities And Differences

Advantages and Disadvantages of Commercial Invoices

As with any tool, the Commercial Invoice comes with its set of advantages and disadvantages. Let’s take a closer look at what makes it a powerhouse in international trade, as well as the potential challenges it may pose.

Advantages

- Legal Backbone: The Commercial Invoice serves as a legally binding document, offering a solid foundation for international transactions. Its official status provides a clear record of the agreement, which can be crucial in case of disputes.

- Customs Clearance: Commercial Invoice serves as a vital tool for customs officers, facilitating seamless clearance processes. A meticulously detailed document plays a pivotal role in elucidating the goods’ nature, value, and origin, ensuring compliance with regulatory requirements.

- Payment Proof: The Commercial Invoice acts as a receipt, proving that the buyer agreed to purchase the goods or services. It’s the go-to document when it’s time for the buyer to settle the bill.

Disadvantages

- Post-Delivery Issuance: The Commercial Invoice is issued after the goods or services have been delivered. In cases where payment is delayed or disputes arise, this timing can pose challenges for sellers seeking immediate payment.

- Complexity: Its comprehensive nature, while advantageous, can also be a drawback. The detailed information may be overwhelming for some, leading to potential errors in documentation if not carefully prepared.

- Potential Delays: Incomplete or inaccurate Commercial Invoices can lead to delays in customs clearance. This can be a hurdle for both buyers and sellers, especially when time-sensitive shipments are involved.

Understanding the advantages and disadvantages of the Commercial Invoice is crucial for businesses engaged in international trade.

Advantages and Disadvantages of Proforma Invoices

The Proforma Invoice, being a crucial thing when considering the upcoming international transaction, carries its own set of advantages and disadvantages. Let’s dive into the pros and cons of this preliminary document:

Advantages

- Decision-Making Tool: Buyers can use the Proforma Invoice as a decision-making tool. It provides a preview of the costs and terms, allowing them to assess whether they want to proceed with the transaction before any goods are shipped.

- Planning and Budgeting: Sellers and buyers benefit from the Proforma Invoice as it allows for effective planning and budgeting. Knowing the anticipated costs and quantities in advance enables better financial management.

- Negotiation Flexibility: Since it’s a preliminary document, there’s room for negotiation. Buyers and sellers can discuss and agree on terms before finalizing the deal, potentially avoiding misunderstandings later.

Disadvantages

- Not Legally Binding: One of the significant drawbacks is that the Proforma Invoice isn’t a legally binding document for goods. It’s more of a proposal than a contract, which means neither party is obligated until the actual Commercial Invoice is issued.

- Incomplete Information: While it provides essential details, the Proforma Invoice is a condensed version compared to the Commercial Invoice. This brevity may leave some aspects open to interpretation, potentially leading to misunderstandings.

- No Proof of Ownership: Unlike the Commercial Invoice, the Proforma Invoice doesn’t serve as proof of ownership or payment. It’s a preview document and doesn’t carry the same weight in terms of financial transactions.

It offers valuable insights and negotiation flexibility, it’s essential to recognize its limitations and the need for the subsequent Commercial Invoice to finalize the deal and provide legal invoice difference or standing.

Understanding their Role in International Trade

1. Commercial Invoice

The Commercial Invoice holds significant importance in international trade as a crucial document post-transaction. It emerges prominently after the delivery of goods or services, playing a pivotal role as a comprehensive record of the finalized deal.

This document encapsulates essential details, including information about both the buyer and seller, a detailed breakdown of the goods or services exchanged, their respective prices, and the mutually agreed-upon terms.

Functioning as the legal foundation of international transactions, the Commercial Invoice carries substantial weight in ensuring the validity and accuracy of the completed trade.

One of its primary functions is to provide concrete proof of the completed sale, ensuring that all parties involved have a detailed account of the transaction.

This document’s significance amplifies during customs clearance, where its thorough details aid authorities in understanding the nature, value, and origin of the goods, facilitating a smooth passage through regulatory processes.

2. Proforma Invoice

In contrast to the Commercial Invoice used after a transaction, the Proforma Invoice serves as an initial guide and comes into work in the early phases of international transactions.

It acts as a messenger, offering a preview of forthcoming details by outlining terms, quantities, and costs before the actual deal occurs. Although lacking the legally binding nature of a Commercial Invoice, the Proforma Invoice plays a crucial role in facilitating decision-making and negotiation processes.

The Proforma Invoice’s significance lies in its ability to serve as an upfront guide for both buyers and sellers. By offering insights into anticipated costs, quantities, and terms, it becomes a crucial tool for effective planning, budgeting, and early communication between trading parties.

Additionally, its role as an early notification for customs authorities aids in the preparation for seamless customs clearance.

Conclusion

Together, these documents form a powerful pair, both Commercial and Proforma invoices playing a unique and crucial role in international trade. While the Commercial Invoice concludes the transaction with legal precision, the Proforma Invoice sets the tone, ensuring a proper and informed cross-border business experience.

As businesses continue to navigate the complexities of global commerce, understanding and leveraging the distinct strengths of these documents becomes imperative for a seamless and successful international trade journey.

Also Read: What Are The Benefits Of Integrating GST Registration With Your Invoice/ Billing Software?

Also Listen: Process of Creating Purchase Orders and Invoices

FAQs

Q1: What is a Commercial Invoice?

A Commercial Invoice is a document used in international trade, providing a detailed record of goods or services delivered, including buyer and seller details, prices, and terms.

Q2: How is a Proforma Invoice different from a Commercial Invoice?

A Proforma Invoice is a preliminary document, offering a preview of upcoming international transactions, outlining terms, quantities, and costs. It precedes the actual delivery and is not legally binding.

Q3: Are Commercial Invoices legally binding?

Yes, Commercial Invoices are legally binding documents. They serve as proof of a completed international transaction and are crucial for customs clearance and legal purposes.

Q4: What information does a Proforma Invoice contain?

A Proforma Invoice includes buyer and seller details, a description of goods or services, quantities, costs, and terms. It acts as a decision-making tool before the actual transaction.

Q5: When is a Commercial Invoice issued?

Commercial Invoices are issued after the goods or services have been delivered, serving as a post-transaction record.

Q6: How long is a Proforma Invoice valid?

A Proforma Invoice has a validity period, and the terms and prices mentioned are only applicable within that specified timeframe.

Q7: Why is a Commercial Invoice crucial for customs clearance?

Commercial Invoices provide detailed information about the goods, aiding customs authorities in understanding their nature, value, and origin for seamless clearance.

Q8: Can a Proforma Invoice be used for payment proof?

No, a Proforma Invoice is not used for payment proof. It serves as a preview document and lacks the legal standing of a Commercial Invoice.

Q9: How does a Proforma Invoice aid in negotiation?

The Proforma Invoice allows buyers and sellers to discuss and agree on terms before the actual deal, providing room for negotiation and avoiding misunderstandings.

Q10: Do both Commercial and Proforma Invoices play roles in the same transaction?

Yes, Commercial and Proforma Invoices work together in international trade. The Proforma Invoice sets the stage, and the Commercial Invoice concludes the transaction, ensuring a seamless process.