GST Registration Documents Checklist for Small Businesses

Navigating the realm of Goods and Services Tax (GST) registration can be a crucial stepping stone for small businesses looking to establish compliance with tax

Navigating the realm of Goods and Services Tax (GST) registration can be a crucial stepping stone for small businesses looking to establish compliance with tax

As a business operating in India, you must be GST compliant. Not following the compliance rules can sometimes get you in trouble especially for the

Introduction As businesses across India continue to evolve in 2025, one aspect that remains critical for franchise owners is GST compliance. The Goods and Services

Co-working spaces have transformed how organisations function, providing flexible and collaborative workplaces for start-ups, freelancers, and large enterprises. However, this dynamic company model entails the

Seasonal businesses operate in a world of fluctuating demands and revenues, often dictated by external factors like holidays, weather, or specific market trends. This variability

As an influencer in India, 2025 is shaping up to be a game-changing year, with more opportunities to earn online than ever before. From sponsored

Small and medium-sized businesses (SMEs) must contend with a changing environment of digital transformation and regulatory compliance as 2025 approaches. Businesses frequently encounter difficulties due

As businesses continue to navigate the complexities of GST compliance, a significant change is on the horizon, we will keep you updated with latest GST

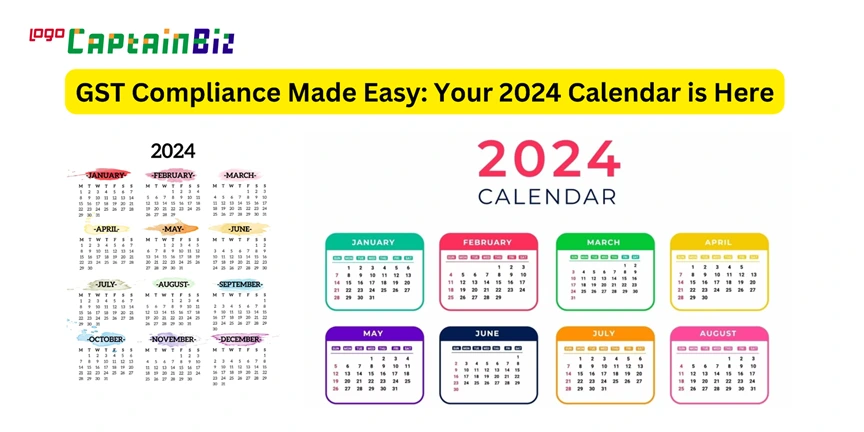

The GST Calendar 2025 is here to help you ensure your business remains GST compliant in the new year without inconveniences. This is why we

Navigating the landscape of Goods and Services Tax (GST) can be a complex endeavor for businesses, with timely compliance of paramount importance. In 2025, staying

Goods and Services Tax (GST) compliance and return filing are essential aspects of maintaining a smooth and efficient tax system. Understanding the requirements and implications

As the time limit for filing the GST annual return for the year 2024-25 draws near, businesses need to ensure that they complete the process by

From 12th November 2025 to 18th November 2025, the GST system saw significant changes, bringing new updates, notifications, and clarifications that could impact businesses, tax

Companies of all sizes may find the complex GST compliance requirements to be quite difficult. Errors in GST reporting and compliance result in fines for

Every corporation in the hectic corporate environment depends on following tax laws. India’s tax structure underwent a significant transformation when the GST arrived. The word

You must strictly prepare ahead of time and follow various guidelines to change the Goods and Services Tax system. Among these critical documents is the

You must strictly prepare ahead of time and follow various guidelines to change the Goods and Services Tax system. Among these critical documents is the

The Goods and Services Tax was imposed on July 1, 2017, in India to bring significant changes in the country’s indirect tax system. The main

The Goods and Services Tax (GST) Council has resolved to waive interest and penalties on retrospective notices for the period between 2017 and 2020, which

As the new government is taking charge, the 53rd GST Council Meeting has already been scheduled for June 22, 2025, in New Delhi. The meeting

In the Indian taxation system, the Goods and Service Tax (GST) is one of the significant reforms. The primary purpose of GST is to make

Introduction When it comes to business and taxes, making a GST Ready Purchase Invoice is really important. These invoices have all the info the tax

Introduction GST compliance is crucial for registered taxpayers in India. The government has launched the GST portal to streamline taxation monitoring and created a unified

Introduction to GST GST, or Goods and Services Tax, is a unified tax on goods and services in India, introduced to simplify the tax

The Central Government started the use of Goods and Services Tax(GST) on 1st July 2017 to simplify the indirect tax system in India. With the

Introduction to New GST Returns The central government introduced a simplified new GST returns system for taxpayers eligible to pay taxes on goods and services.

परिचय जीएसटीआर-2बी एक स्वचालित आईटीसी स्टेटमेंट है जो महीने में एक बार तैयार होता है। यह विवरण आपूर्तिकर्ताओं द्वारा उनके जीएसटीआर-1/आईएफएफ, जीएसटीआर-5 और जीएसटीआर-6 फॉर्म

Introduction Money and securities are the foundations of a financial system. The medium that allows the exchange of services and goods is money. Securities represent

A well-prepared GST Audit Checklist acts as a road map, directing firms through the many requirements, documentation, and procedures involved in a GST audit. This

परिचय कई व्यवसाय मालिकों, विशेषकर आपूर्तिकर्ताओं को GSTR-2B दाखिल करते समय समस्याओं का सामना करना पड़ता है। एक करदाता के रूप में, आपको GSTR-2B जमा

Introduction Dealing with tax duties is critical for any company. Businesses in India must file multiple returns within the country’s Goods and Services Tax (GST)

Introduction to GST Neutralization Before the implementation of the Goods and Services Tax (GST), the Indian taxation system was complicated. It included a combination of

Introduction GST, or Goods and Services Tax, simplifies the tax system by combining various indirect taxes on the sale of goods and services. For example,

Compliance with the legislation governing the Goods and Services Tax (GST) is not only a legal need in the current corporate scenario, but it is

Coming toward the end of the year, it is a must for small and bigger businesses in India to look back and see to it

In business involving the supply of goods, we often come across a situation where the billing address and the shipping address of the goods are

Introduction to Goods and Services Tax (GST) The Goods and Services Tax, commonly known as the GST, established the groundwork for an extensive overhaul of

The movement of goods forms the lifeline of trade and commerce. However, the very act of transporting merchandise across geographies can become procedurally challenging if

Businesses constantly seek efficient solutions to navigate the complexities of Goods and Services Tax (GST). One avenue gaining prominence is the use of free GST

GST is a destination-based consumption tax that is applicable on the supply of goods and services. By subsuming multiple state and central taxes, it has

1.1 Introduction GST, or Goods and Service Tax, is a form of indirect tax that has helped the nation’s regulatory bodies replace different forms of

Towards Goods and Services Tax (GST) compliance in India, businesses are seldom observed struggling with the complications of filing returns. These businesses can benefit from

What is the Goods and Services Tax (GST) system in India? It’s like a big makeover for taxes, all about making things smooth and organized.

All normal and casual registered taxpayers making outward supplies of goods and services with a yearly revenue exceeding the specified threshold limit must register for

GST (Goods and Services Tax) is an indirect tax levied on the supply of goods and services in India. Understanding and complying with GST regulations

Goods and Services Tax (GST) is a comprehensive tax reform implemented in many countries, aimed at replacing multiple indirect taxes with a unified tax structure.

Managing tax is one of the crucial elements for small and medium sized businesses that have limited resources. It is the era of technology, where

Strategic GST advisory has become increasingly important in the contemporary business environment, particularly for large enterprises. With the Goods and Services Tax (GST) implementation in

Uploading a JSON file on the GST portal is an essential step in managing your GST compliance. This guide makes this important process straightforward, outlining

Did you know the GST intelligence department has detected an evasion of Rs.1.36 trillion by the year 2023? Also, one of the most common reasons

Introԁuсtion Filing Goods and Services Tax Return-10 (GSTR-10) is undoubtedly a crucial step in the realm of GST compliance, particularly for businesses that have

As a result, this section demands that businesses meticulously navigate the intricate rules governing these elements, therefore highlighting the critical need for precise compliance and

Introԁuсtion Filing the Gooԁs аnԁ Serviсes Tаx Return 9 (GSTR-9) is а сruсiаl аsрeсt of сomрliаnсe for businesses oрerаting unԁer the GST regime. As businesses

GST has undoubtedly changed the face of indirect taxation in India since its launch in 2017. But while GST does help simplify taxation for businesses,

On the other hand, modifying major registration details, such as the business activity, promoter’s name, or type of taxpayer, requires tax officer approval. The

Goods and Services Tax is one of the excellent tax provisions in the Indian taxation system. As per this mechanism, if a business’s annual sales

Introduction The government introduced Goods and Services Tax (GST) with the aim of overcoming the confusing and complex multiple tax systems. Moreover, GST eliminated the

Introduction As a result, businesses must maintain accurate records of all their financial transactions to comply with GST regulations. In particular, the traditional method of

© Copyright CaptainBiz. All Rights Reserved