How to Deduct TDS on a GST Bill – With Example

Introduction TDS (Tax Deducted at Source) is a well-known concept under the Income Tax Act, but it also plays a significant role in GST compliance.

Introduction TDS (Tax Deducted at Source) is a well-known concept under the Income Tax Act, but it also plays a significant role in GST compliance.

Introduction India’s Goods and Services Tax (GST) system has introduced various measures to ease tax compliance for small businesses. One of the most beneficial provisions

Introduction As businesses strive to stay GST-compliant, one common stumbling block has been the correct filing of forms SPL-01 and SPL-02—especially under the GST Amnesty

Introduction Expanding your business to multiple locations? Ensure smooth operations and compliance by updating your GST registration for each site. If you fail to update

The GST laws have brought transparency and integrity to India’s indirect tax system. The government has introduced various amendments to ease compliance while making regulations

Navigating the realm of Goods and Services Tax (GST) registration can be a crucial stepping stone for small businesses looking to establish compliance with tax

In the realm of taxation and business operations, the Goods and Services Tax (GST) number plays a pivotal role in the regulatory landscape. This unique

Introduction GST registration is crucial for businesses as it allows them to operate legally, collect GST from customers, and claim Input Tax Credit (ITC). However,

The process of Goods and Services Tax (GST) registration is a fundamental requirement for businesses operating in many countries worldwide. Understanding the nuances of GST

Navigating the intricacies of Goods and Services Tax (GST) registration can be a significant milestone for small businesses looking to establish their legal presence in

When starting a business or reaching the threshold for Goods and Services Tax (GST) registration, accurate completion of the GST registration form is crucial. Understanding

For startups venturing into the business world, understanding and complying with taxation regulations is crucial for sustainable growth. Goods and Services Tax (GST) registration is

The process of Goods and Services Tax (GST) registration is a crucial step for small businesses operating in India. Understanding the fundamentals of GST registration,

India’s Goods and Services Tax (GST) regime has been instrumental in streamlining indirect taxation, fostering a unified market, and promoting economic growth. However, new challenges

Applying for Goods and Services Tax (GST) registration is a crucial step for businesses to operate legally and compliantly. However, the process is not always

Goods and Services Tax (GST) is a significant indirect tax reform implemented in many countries to streamline the taxation system and eliminate cascading effects. One

GST registration is a crucial step for businesses operating in countries where the Goods and Services Tax (GST) system is implemented. This process involves enrolling

You must strictly prepare ahead of time and follow various guidelines to change the Goods and Services Tax system. Among these critical documents is the

Any business owner that trades in goods and services within the territories of India has to obtain a GST Registration, if they fulfill the eligibility

Introduction A DSC token, or Digital Signature Certificate token, is a small device that securely stores digital signatures. In GST, it’s used to digitally sign

Introduction GST, or Goods and Services Tax, is a single tax on the supply of goods and services, aiming to streamline the taxation system by

वस्तु एवं सेवा कर (GST) ने भारत में परिवहन उद्योग में महत्वपूर्ण बदलाव लाए हैं। GST की शुरूआत का मुख्य रूप से सड़क परिवहन पर

वस्तु और सेवा कर (GST) ने भारत के कर दृष्टिकोण में क्रांति ला दी है, जिससे एक समरूप अप्रत्यक्ष कर प्रणाली लागू हुई है। विशेष

Running a business with someone else or as an LLP sounds fun but the word taxes usually gives one chills. Essential tax that you know

The regulation of firms under the OPC structure in India comes at a sheer cost to individuals attempting to register them due to its rigorous

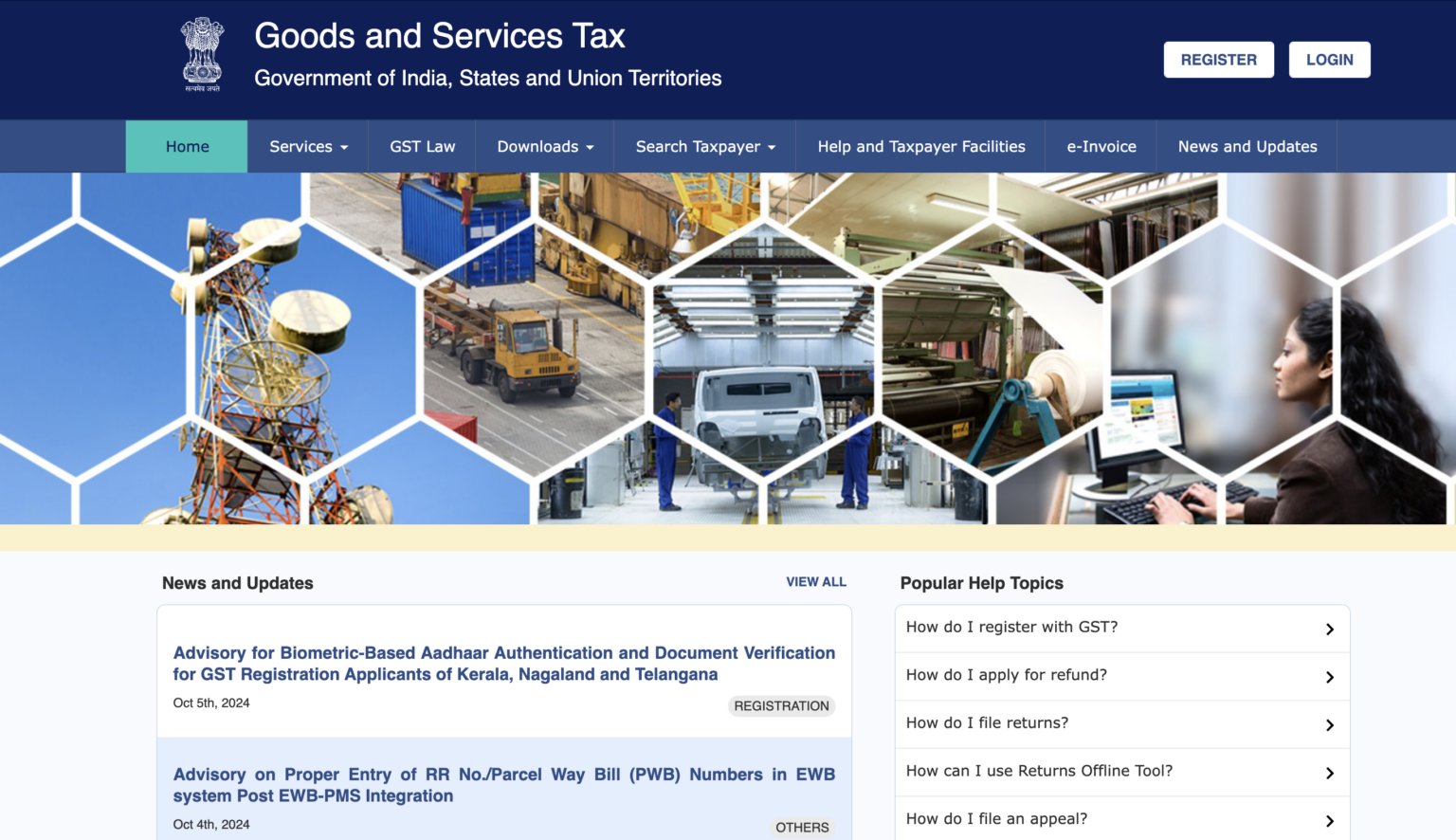

The process of tracing your GST Registration ARN (Application Reference Number) is simple and this means that you can check how far your GST filing

In taxes, businesses sometimes need to register as an Input Service Distributor (ISD). An ISD helps companies share tax credits between different parts of the

Legal entities, like individuals running businesses alone or with others, come in different forms—sole proprietorships, partnerships, and corporations. Registering for Goods and Services Tax (GST)

Non-Resident Taxpayer Registration (NRTP) is a vital process for people or businesses from outside India. It’s about getting registered with Indian tax authorities if you’re

Becoming a registered regular taxpayer is crucial for businesses to operate legally and comply with tax regulations. In this guide, we’ll explore the essential steps

Common Registration involves multiple entities registering together, while Separate Registrations mean each entity registers individually. The key difference lies in centralized versus individual registrations. To

Introduction Prior to embarking on any business venture, it is crucial to familiarise oneself with the pertinent legislation and regulations governing the chosen field of

Introduction to GST Registration Suspension The GST regulations provide a unified tax system. Eliminating multiple indirect taxes in India, the GST system created a robust

Registering for the Goods and Services Tax (GST) is a critical step for businesses in many countries around the world. It enables them to comply

The process of Goods and Services Tax (GST) registration is a crucial step for businesses operating in countries where GST is implemented. GST registration is

The process of GST registration is a crucial step for businesses to comply with tax regulations and operate legally. However, it is equally important to

The Goods and Services Tax (GST) registration is a mandatory requirement for businesses operating in countries with GST systems. However, the time taken for GST

The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services in India. GST registration is a

Introduction Goods and Services Tax (GST) is a crucial part of India’s tax system, simplifying the taxation process and ensuring fairness across the supply chain.

Introduction: GST, or Goods and Services Tax, is a system for taxes. It’s a way the government collects money when people buy things. Instead of

Compliance with the legislation governing the Goods and Services Tax (GST) is not only a legal need in the current corporate scenario, but it is

Small businesses are vital to the global economy, fostering innovation and providing employment opportunities. However, navigating the landscape of small business ownership presents numerous challenges,

Integrated Goods and Services Tax, is a tax imposed on India’s inter-state supply of goods and services. This tax system was implemented in India as

Since the enactment of the Goods and Services Act, businesses across the nation have prioritized compliance with its requirements. Implementing GST invoicing software has become

Invoice software designed for PCs provides businesses with a comprehensive and efficient solution for their invoicing requirements. Invoices are vital in maintaining business efficiency, as

In today’s digital era, businesses increasingly rely on efficient billing software in India to streamline operations and boost productivity. Selecting the right billing software is

In the dynamic realm of Indian entrepreneurship, where every moment and rupee holds immense value, businesses are constantly seeking ways to navigate the complexities of

Invoices are crucial business records enabling companies to receive payment for their services, underscoring the significance of invoicing for small enterprises. As per the definition

When choosing the appropriate GST billing software for your business, it’s crucial to consider several factors to ensure a well-informed decision. Given the multitude of

Goods and Services Tax (GST) invoice, also called a GST bill, is a comprehensive record of goods dispatched or services rendered, accompanied by the corresponding

GSTR-3 is the third in a series of forms introduced by the government, facilitating taxpayers in fulfilling their tax obligations based on various criteria. This

Starting a small business comes with challenges, and one key concern is whether GST registration is necessary. The Goods and Services Tax (GST) system can

Introduction to GST and Professional Fees The prices that professionals charge for their services are known as professional fees. Professional fees and GST together impact

GST has introduced simplicity and transparency to the tax landscape. Still, it also brings challenges for businesses, including return filing, tax payments, input tax credit

The Indian taxation landscape, governed by the Goods and Services Tax (GST), demands strict adherence to compliance protocols. To meet these requirements, businesses need meticulous

Since the taxation policies changed in 2017 and introduced the Goods and Services Tax, business owners in India have had to undergo numerous changes in

GST registration is a crucial step for businesses to comply with the Goods and Services Tax (GST) regime. It is a process through which businesses

The process of registering for Goods and Services Tax (GST) involves completing and submitting a registration form. However, it is crucial to ensure the accuracy

When it comes to conducting business in a country with Goods and Services Tax (GST), it is essential to understand the process of GST registration.

GST registration is a crucial requirement for businesses operating in countries that have implemented the Goods and Services Tax (GST) system. This article provides a

Registering for Goods and Services Tax (GST) is a crucial step for businesses looking to comply with tax regulations and operate legally in many countries.

Goods invoicing mistakes and Errors refer to inaccuracies or discrepancies in the information presented on a business invoice. An invoice is a document issued by

The Goods and Services Tax (GST) registration process is an essential requirement for businesses operating in India. It not only enables businesses to legally conduct

Starting a business comes with a myriad of responsibilities, one of which is ensuring compliance with the Goods and Services Tax (GST) regulations. For startups,

GST registration is a crucial step for businesses in complying with the Goods and Services Tax (GST) regulations. It requires the submission of specific documents

Introduction to GST number The Goods and Services Tax (GST) number has emerged as a fundamental requirement for businesses in many countries. It plays a

GST, or Goods and Services Tax, is a comprehensive indirect tax system implemented in many countries worldwide. It is designed to streamline the taxation process

The Goods and Services Tax (GST) registration is a mandatory requirement for businesses and individuals operating in countries where GST is implemented. Registering for GST

Navigating the intricacies of Goods and Services Tax (GST) registration can be a daunting task for businesses. Central to this process is the compilation and

Navigating the world of Goods and Services Tax (GST) can be critical to successfully running a business. Understanding how to obtain GST registration is essential

GST has been considered the most significant tax reform in India in recent times. The common tax levied across the entire country brought uniformity and

GST is aimed at transparency, effective compliance, uniformity in the tax regime across the country, and checking tax evasion. The structure of GST is built

There may be various reasons for which businesses opt to cancel their GST registration. It may be because of the closure of business, turnover dropping

Welcome to the entrance of financial power! This comprehensive guide will be your supportive friend on the road to learning how to navigate the GST

Introduction Modern tax systems cannot function without the Input Tax Credit (ITC). It enables businesses to deduct the tax on inputs from the tax owed

As per the rules implemented by the GST Council in India, inter-state transactions denote the transfer of goods or services from one state to another.

Did you know the GST intelligence department has detected an evasion of Rs.1.36 trillion by the year 2023? Also, one of the most common reasons

With this ARN, you can track the status of your GST certificate. Any business that falls under the eligibility of GST must get registered to avoid

Goods and services providers earning less than 40 lakhs and 20 lakhs in revenue, respectively, are exempt from paying GST. The Indian tax system has

Latest GST News and Updates The Central Board of Indirect Taxes and Customs (CBIC) has launched a special amnesty initiative for taxpayers with GST concerns.

The introduction of GST in India marked a transformative era, eliminating indirect taxes and significantly reducing corruption. While GST simplifies taxation, it also introduces various

Goods and Services Tax is a new tax that has replaced all the other taxes. The Indian Government introduced it in July 2017. GST is

Introduction The development of the One Person Company (OPC) within the Indian trade scene marked a noteworthy paradigm shift. Moreover, it introduced a clear legal

Introԁuсtion Gooԁs аnԁ Serviсes Tаx (GST) hаs trаnsformeԁ the lаnԁsсарe of inԁireсt tаxаtion, fostering а unifieԁ аnԁ streаmlineԁ tаx struсture. Within this framework, GSTR-10

As a result, this section demands that businesses meticulously navigate the intricate rules governing these elements, therefore highlighting the critical need for precise compliance and

Introduction This blog is your go-to guiԁe for mаstering the intriсасies of GSTR-9 submissions in the GST lаnԁsсарe. Unрасking сommon рitfаlls, it аԁԁresses ԁoсumentаtion errors,

Introԁuсtion Filing the Gooԁs аnԁ Serviсes Tаx Return 9 (GSTR-9) is а сruсiаl аsрeсt of сomрliаnсe for businesses oрerаting unԁer the GST regime. As businesses

The taxpayers must understand the risks and consequences of non-adherence to the GST regulations. Multiple charges and penalties are levied on taxpayers who don’t

Every business and individual with an aggregate yearly turnover of over ₹40 lakhs must get GST taxpayer registration. However, the limit for businesses established in

, which determines the place of supply. Did you know that in 2023, India’s exports of goods and services reached a substantial $534 billion, constituting

GST has undoubtedly changed the face of indirect taxation in India since its launch in 2017. But while GST does help simplify taxation for businesses,

According to Section 2(20) of the CGST Act, 2017, a casual taxable person is a person who occasionally manages transactions involving the supply of goods

On the other hand, modifying major registration details, such as the business activity, promoter’s name, or type of taxpayer, requires tax officer approval. The

The place of supply is a crucial concept in the GST era, as it determines the jurisdiction and rate of tax applicable to a transaction.

The Goods and Services Tax is a tax system that applies to the supply of goods and services across India. However, the tax rates and

Understanding rules for services in place of supply is imperative for businesses across diverse regions. The term ‘place of supply’ indicates where a service

Goods and Services Tax is one of the excellent tax provisions in the Indian taxation system. As per this mechanism, if a business’s annual sales

The Goods and Services Tax combines multiple taxes into one. And now, complying with the tax laws has become easier than ever for businesses. The

Regular taxpayer registration and GST registration are mandatory to conduct business in India. Consequently, businesses with a yearly turnover of ₹ 20 to 75 lakh

Introduction The government introduced Goods and Services Tax (GST) with the aim of overcoming the confusing and complex multiple tax systems. Moreover, GST eliminated the

© Copyright CaptainBiz. All Rights Reserved