E-Invoice Big Update – Change in Invoice Number Format (Effective 1st June 2025)

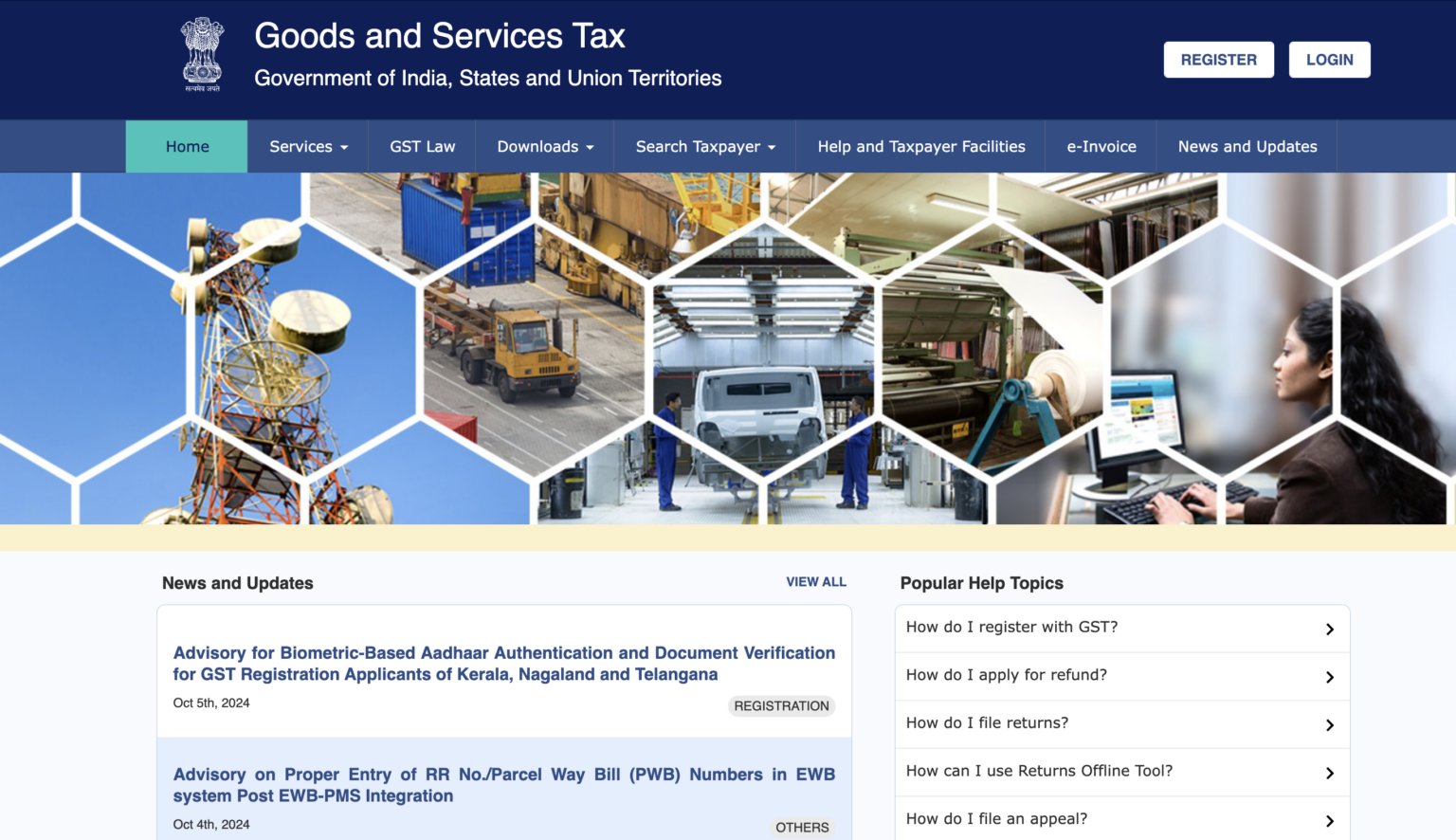

Introduction In a significant move aimed at enhancing GST compliance and removing data duplication errors, the Goods and Services Tax Network (GSTN) has issued a

Introduction In a significant move aimed at enhancing GST compliance and removing data duplication errors, the Goods and Services Tax Network (GSTN) has issued a

Introduction In today’s rapidly digitizing economy, the traditional methods of invoicing and taxation are being replaced by faster, smarter, and more automated digital solutions. Among

Introduction Did you know that by 2025, over 90% of businesses will rely on e-invoicing for GST compliance? With rapid advancements in AI-driven automation, blockchain

Introduction Starting April 1, 2025, businesses registered under the Goods and Services Tax (GST) regime in India must comply with a new 30-day e-invoice rule,

Introduction A recent report by the Public Accounts Committee (PAC) has put the spotlight on the difficulties faced by Micro, Small, and Medium Enterprises (MSMEs)

Introduction In a noteworthy move aimed at easing the tax compliance burden and encouraging the settlement of past disputes, the Central Board of Indirect Taxes

Introduction TDS (Tax Deducted at Source) is a well-known concept under the Income Tax Act, but it also plays a significant role in GST compliance.

Introduction India’s Goods and Services Tax (GST) system has introduced various measures to ease tax compliance for small businesses. One of the most beneficial provisions

Introduction As businesses strive to stay GST-compliant, one common stumbling block has been the correct filing of forms SPL-01 and SPL-02—especially under the GST Amnesty

Introduction Expanding your business to multiple locations? Ensure smooth operations and compliance by updating your GST registration for each site. If you fail to update

Introduction The introduction of GST has brought many benefits to both consumers and the government by streamlining the indirect tax system in India. The significant

The GST laws have brought transparency and integrity to India’s indirect tax system. The government has introduced various amendments to ease compliance while making regulations

Input tax credit is an essential component of GST, which eliminates the cascading effect of taxes and brings transparency and efficiency to the indirect tax

The GST Council is reportedly considering a reduction in the Goods and Services Tax (GST) on health and life insurance policies from the current 18%

Navigating the realm of Goods and Services Tax (GST) registration can be a crucial stepping stone for small businesses looking to establish compliance with tax

In the realm of taxation and business operations, the Goods and Services Tax (GST) number plays a pivotal role in the regulatory landscape. This unique

The GST Composite Taxpayer Scheme is a game-changer for small businesses and startups in India, offering a simplified tax compliance framework. With cost-saving benefits, streamlined

Introduction As the financial year 2024-25 draws to a close, businesses across India must gear up for the crucial task of GST compliance. Adhering to

The composite taxpayer scheme under the Goods and Services Tax (GST) regime offers small businesses a simplified approach to taxation aimed at reducing compliance burdens

Introduction GST registration is crucial for businesses as it allows them to operate legally, collect GST from customers, and claim Input Tax Credit (ITC). However,

The process of Goods and Services Tax (GST) registration is a fundamental requirement for businesses operating in many countries worldwide. Understanding the nuances of GST

Navigating the intricacies of Goods and Services Tax (GST) registration can be a significant milestone for small businesses looking to establish their legal presence in

When starting a business or reaching the threshold for Goods and Services Tax (GST) registration, accurate completion of the GST registration form is crucial. Understanding

For startups venturing into the business world, understanding and complying with taxation regulations is crucial for sustainable growth. Goods and Services Tax (GST) registration is

The process of Goods and Services Tax (GST) registration is a crucial step for small businesses operating in India. Understanding the fundamentals of GST registration,

Navigating the realm of Goods and Services Tax (GST) as a casual taxpayer introduces unique considerations and responsibilities. Understanding the invoicing and payment requirements is

As a business operating in India, you must be GST compliant. Not following the compliance rules can sometimes get you in trouble especially for the

Introduction As businesses across India continue to evolve in 2025, one aspect that remains critical for franchise owners is GST compliance. The Goods and Services

Second-hand products, from cars to furniture, from electronics to clothing, have a significant position in today’s busy marketplace. The appeal of affordability and the aim

Co-working spaces have transformed how organisations function, providing flexible and collaborative workplaces for start-ups, freelancers, and large enterprises. However, this dynamic company model entails the

Seasonal businesses operate in a world of fluctuating demands and revenues, often dictated by external factors like holidays, weather, or specific market trends. This variability

As an influencer in India, 2025 is shaping up to be a game-changing year, with more opportunities to earn online than ever before. From sponsored

Small and medium-sized businesses (SMEs) must contend with a changing environment of digital transformation and regulatory compliance as 2025 approaches. Businesses frequently encounter difficulties due

Ensuring compliance with Goods and Services Tax (GST) regulations is crucial for businesses to avoid penalties and maintain financial stability. In 2025, there are specific

India’s Goods and Services Tax (GST) revolutionised how businesses handle taxation, and now, as the nation braces for GST 2.0 in 2025 significant changes are

India’s Goods and Services Tax (GST) regime has been instrumental in streamlining indirect taxation, fostering a unified market, and promoting economic growth. However, new challenges

Consider a world in which all financial transactions are traceable, transparent, and tamperproof. Tax evasion, which has long been a problem for countries around the

Navigating the complexities of tax compliance is an essential part of managing a business, particularly for exporters. In India, the tax system has become more

As businesses continue to navigate the complexities of GST compliance, a significant change is on the horizon, we will keep you updated with latest GST

The Goods and Services Tax (GST) is integral to India’s tax system because it ensures all states’ taxes are identical. Following the rules, you could

E-billing, or electronic invoicing, has changed India’s GST system, making it more open and easier for people to avoid paying taxes. It has become necessary

It may surprise you to learn that handling GST-compliant invoices might be similar to traversing a maze. You will have to deal with fines, inaccurate

The GST Calendar 2025 is here to help you ensure your business remains GST compliant in the new year without inconveniences. This is why we

Goods and Services Tax (GST) has emerged as a crucial global tax reform, revolutionizing how indirect taxes are levied on goods and services. Understanding the

In the realm of taxation in India, the Goods and Services Tax (GST) has emerged as a game-changer, streamlining the indirect tax structure and fostering

Navigating the complexities of the Goods and Services Tax (GST) application process can be a daunting task for businesses and individuals alike. However, facing the

Goods and Services Tax (GST) numbers play a crucial role in the taxation system of many countries by providing a unique identification for businesses and

Navigating the complexities of the Goods and Services Tax (GST) system in India can be daunting for businesses, especially for those looking to optimize their

Navigating the complex landscape of Goods and Services Tax (GST) obligations is crucial for businesses and individuals alike. Understanding the obligations of a GST taxpayer

Navigating the complexities of Goods and Services Tax (GST) registration is a pivotal step for businesses looking to operate in compliance with taxation laws. Understanding

Having a Goods and Services Tax (GST) number is essential for businesses operating in India, as it streamlines tax compliance and offers a multitude of

Understanding the fees involved in GST registration is essential for businesses looking to comply with tax regulations and operate legally. This article provides a detailed

Regular taxpayers under the Goods and Services Tax (GST) regime play a crucial role in the economy by fulfilling their tax obligations consistently. However, despite

Regular taxpayers under the Goods and Services Tax (GST) system enjoy a multitude of benefits that contribute to their financial stability and business growth. Understanding

The Kerala High Court’s recent ruling on Section 16 (4) of the Goods and Services Tax (GST) Act has stirred discussions within the taxation community.

Navigating the landscape of Goods and Services Tax (GST) can be a complex endeavor for businesses, with timely compliance of paramount importance. In 2025, staying

Applying for Goods and Services Tax (GST) registration is a crucial step for businesses to operate legally and compliantly. However, the process is not always

Goods and Services Tax (GST) is a significant indirect tax reform implemented in many countries to streamline the taxation system and eliminate cascading effects. One

Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services in India, aimed at simplifying the overall tax

Navigating the process of filling up the GST registration application form is a crucial step for businesses seeking compliance with tax regulations. Understanding the intricacies

Goods and Services Tax (GST) is a significant indirect tax system that has been implemented in many countries worldwide. As a GST taxpayer, individuals and

Goods and Services Tax (GST) compliance and return filing are essential aspects of maintaining a smooth and efficient tax system. Understanding the requirements and implications

Navigating the complexities of Goods and Services Tax (GST) regulations is essential for businesses classified as GST regular taxpayers. This article delves into the fundamental

GST registration is a crucial step for businesses operating in countries where the Goods and Services Tax (GST) system is implemented. This process involves enrolling

Understanding GST and its Importance: Goods and Services Tax (GST) is a significant indirect tax reform in India aimed at unifying the country’s fragmented tax

Navigating the complex maze of Goods and Services Tax (GST) registration can be a daunting task for businesses across various industries. Understanding the specific documents

Getting registered under the Goods and Services Tax (GST) regime is a crucial step for businesses in India to comply with tax regulations. This article

The Goods and Services Tax (GST) is a significant indirect tax reform introduced in India to streamline the taxation system. For small businesses, GST registration

The Goods and Services Tax (GST) is a significant indirect tax reform implemented in many countries, aimed at simplifying the taxation system and promoting transparency

As the time limit for filing the GST annual return for the year 2024-25 draws near, businesses need to ensure that they complete the process by

From 12th November 2025 to 18th November 2025, the GST system saw significant changes, bringing new updates, notifications, and clarifications that could impact businesses, tax

Introduction Cork is one of the buoyant and impermeable material, which contains phellem bark tissue layer harvested for several commercial purposes from the oak cork.

The Goods and Services Tax (GST) registration is a crucial process for businesses operating in India to comply with the tax regulations set forth by

A Goods and Services Tax (GST) number is a unique identification code for businesses registered under the GST regime. Understanding a GST number’s full form

In the realm of taxation and business operations, the Goods and Services Tax (GST) number plays a pivotal role in the regulatory landscape. This unique

In the realm of taxation, the Goods and Services Tax (GST) scheme in many countries includes provisions for composite taxpayers—a special category designed for small

Companies of all sizes may find the complex GST compliance requirements to be quite difficult. Errors in GST reporting and compliance result in fines for

The intricate GST rules might be difficult for small businesses. The GST Composition Scheme simplifies tax payments for small firms. Yet, companies that pick this

The authorities of the GST in India have lent giant tax notices, estimated to worth between Rs 8,000 crore and Rs 10,000 crore, to some

Beginning on October 8, 2024, the CBIC has added new regulation to the GST through the issuance of provision to sub-rule (1) to Rule 47A

A Specific unit involved in conducting cases of tax evasion prior to the introduction of the Goods and Services Tax (GST) regime may shut in

The CBIC has now issued a detailed circular recently on the GST rates and the classification of various products to bring out much-required clarity among

The CBIC has made a concerted effort to enhance the facility for healthcare services, with the action on the new amendments in GST rates which

The changes were implemented in 2024 on Goods and Services Tax (GST) in India concerning operating and providing the HSN codes. CBIC has for now

The usage of Goods and Services Tax (GST) in India has made various changes within the way the businesses work, particularly in respects to the

Through the Goods and Services Tax (GST) portal of its website, businesses computerizing invoice management processes can now avail of the government’s new ITC claims,

The GST return filing system in India has witnessed major transitions over the years. But starting the year 2025, starting from January, the scenario and

The current structure of the Goods and Services Tax (GST) in India may soon get a new look as the reconstituted Group of Ministers (GoM)

The GST Council meeting number 53 was recently held, where multiple strategies were discussed for initiating several modalities for offering financial reassurance and support to

The latest meeting of the GST Council held at the end of July with Union Finance Minister Nirmala Sitharaman this year resulted in several critical

For Indian taxpayers, the process of Tax Deducted at Source on a GST Bill is a crucial step. Understanding the steps and following the guidelines

Proper paperwork is essential for keeping things clear and ensuring business runs smoothly. The Proforma invoice and account sales are two important papers that often

Among the most critical changes to Indian taxes is the Goods and Services Tax. The GST structure has replaced multiple secondary levies with a single

The 54th GST Council took place on September 9, 2024, in New Delhi. The Union Finance and Corporate Affairs Minister presided over the meeting, which

పరిచయం పొదుపు ఖాతా అనేది మనలో చాలామంది వినే సాధారణ పదం. ఇది మీ పొదుపు ఖాతా. పొదుపు ఖాతా అంటే వారి డబ్బు సురక్షితంగా ఉండేలా, వారు దానిపై ఒక చిన్న వడ్డీ

அறிமுகம் சேமிப்பு கணக்கு என்பது நம்மில் பலரும் கேள்விப்பட்டிருப்போம். இது உங்கள் சேமிப்பு வங்கி கணக்கு. சேமிப்பு கணக்கு என்பது பணம் பாதுகாப்பாக இருப்பதை உறுதி செய்ய விரும்பும் தனிநபர்களுக்கு, அதன் மீது குறைந்த

Introduction The GST Council Meeting is scheduled in New Delhi. Following a record GST revenue collection of ₹1.82 lakh crore in July, discussions are expected

Starting on July 1, 2017, the Goods and Services Tax has been among the most important tax revisions India has undergone. It took the place

In India, the Goods and Services Tax (GST) has introduced a range of tax rates for pharmaceutical products. However, not all medicines are subject to

Medical equipment is essential in the healthcare industry for accurate diagnoses and effective treatments. As India’s Goods and Services Tax (GST) regime evolves, understanding the

© Copyright CaptainBiz. All Rights Reserved