Input tax credit is an incredibly powerful tool in business, marketing, and promotions. The article will let you understand ITC, its benefits, how to claim it, its effect on businesses, and the challenges faced while following GST regulations.

This power move Input tax credit (ITC) can be explained through an example. Imagine yourself as a businessman who must pay tax while buying goods and must pay tax again while selling them. Naturally, this makes work rough for the seller, as paying double tax is responsible for the loss. However, with the emergence of ITC, tax payment on selling the product has been eliminated. Consequently, this comes under the Goods and Services Tax (GST) system.

So, a registered businessman pays GST when purchasing a product and deducts a certain amount to lower the tax paid when selling it. However, following specific rules and regulations is mandatory, and businesses must fulfill eligibility criteria and maintain proper documentation.

Claiming ITC on marketing expenses in GST

Claiming Input Tax Credit (ITC) on marketing expenses under GST demands a careful understanding of the rules. Generally, ITC is available for goods or services used for business purposes, including marketing. However, ensure that the expenses comply with GST regulations and fall within the ambit of eligible credits. You must maintain detailed records and invoices to substantiate your claim. Navigating this process diligently can contribute significantly to optimizing your tax liabilities while promoting your business.

To claim ITC on marketing expenses in GST, a few easy steps need to be followed:

-

Check the eligibility criteria:

You should correlate marketing expenditures to business activities, ensuring that expenses contribute to the growth and expansion of the business. Moreover, the expenses should fall under GST rules.

-

Invoice essential:

An invoice is an essential document that contains critical information like supplier and recipient details, GST identification number, and description of the goods.

-

Expenses should be business-related:

You should clearly distinguish between money spent on promoting the business and personal expenses. Anything unrelated to the business will not pass the criteria for ITC.

-

Maintaining the records:

organizing the documents, especially the invoices related to the expenditure, plays a key role in future references.

-

Reconciliation Routine:

involving ITC and GST means that one must consistently check and compare the ITC claims to avoid any kind of discrepancies.

-

Stay informed:

You any of the changes occurring in the GST regulations and make sure that you are still eligible to claim for ITC because rules evolve over time, and staying up to date with the modifications is the best solution.

Eligibility criteria for ITC on promotional costs

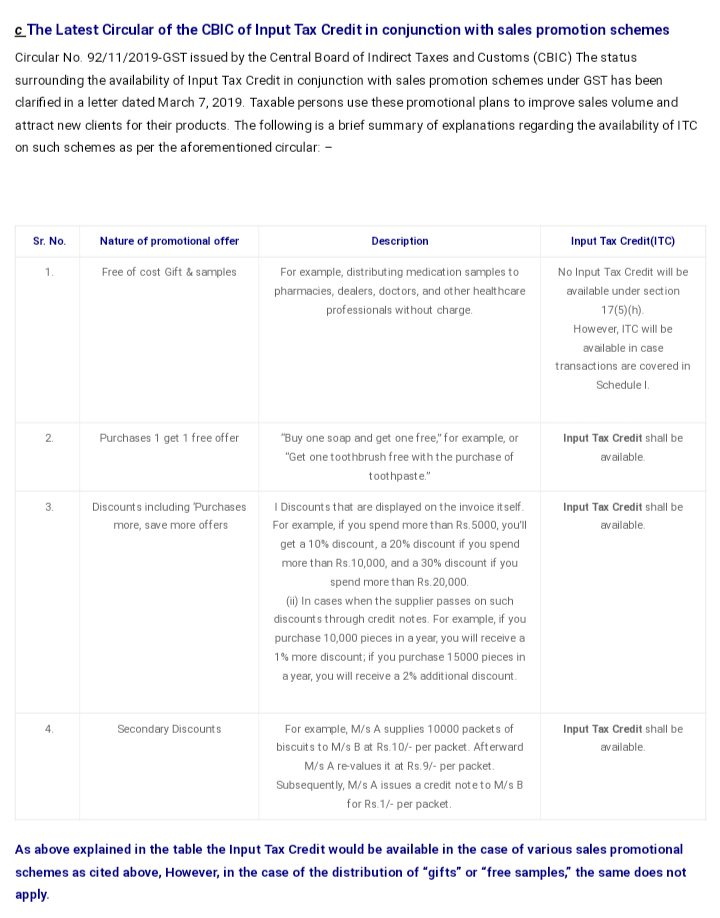

Businesses must directly link promotional expenses to their operations to claim Input Tax Credit (ITC) under GST. Meeting these eligibility criteria will ensure that businesses can legitimately claim ITC on promotional costs, thus optimizing tax benefits. Additionally, they must follow the GST framework to validate their claims.

-

Use of money for business:

You must ensure that the money you are spending has a direct connection to business-related activities only, and not for personal purposes.

-

Registration:

The recipient and the supplier who provide promotional services must register under GST. Additionally, both must have their unique GSTIN. Only after this, the individual is eligible for an ITC claim.

-

Maintenance of the documents:

Documents are the soul of the taxation process. Thus, giving a clear perspective for a claim. So, proper documentation and receipts need to be organized for taxation. This will serve as proof of the amount of money spent by an individual while promoting his business.

-

Have a good invoice:

An invoice is a document containing all the records and details required to claim ITC. Therefore, you need to ensure that the invoice has clear information about a transaction, promotional costs, personal information of the buyer and seller, and GST identification number.

-

Be updated about the tax rules:

As rules can change over time, it is crucial to be up to date on the latest GST regulations. By doing so, you can ensure your claim for ITC.

-

Make sure the other party has followed the tax regulations:

The supplier needs to handle and pay for the GST liabilities. When regulation is improper it can create impediments for the person trying to claim a tax credit associated with promotional costs.

Source: https://carajput.com/blog/itc-on-marketing-expense-sales-promotional-schemes/

Strategies for maximizing ITC on marketing

Input Tax Credits on marketing can be maximized using many strategies. To begin with, make sure to take care of exclusive business use, timely file returns, train employees for proper recording, and stay informed about GST laws for strategic compliance. Additionally, periodic internal audits and adherence to anti-profiteering rules contribute to an effective ITC optimization strategy. Some strategies to apply are as under:-

-

Proper Classification:

Marketing expenses need to be classified as per the GST guidelines. By doing so, this will help in smooth ITC claiming.

-

Valid Documentation:

Maintenance of documentation is a crucial part of claiming ITC during audits. Therefore, you need to ensure that your documentation like GST-compliant invoices, receipts, etc. is completely valid according to GST regulations.

-

GST-Registered Suppliers:

Moreover, in our country, under GST, all recipients and suppliers must be registered with a unique GSTIN. As a result, only the verified suppliers are applicable at the time of the ITC claim.

-

Input Services:

Additionally, you should carefully identify all the services which are eligible for ITC claiming. By doing so, this will help in a smooth ITC claim.

Documentation for ITC on marketing promotion

As it is clear by now, maintaining valid documentation in the taxation process is very crucial. For claiming Input Tax Credit (ITC), you need to maintain comprehensive documentation. This ensures accuracy and compliance. These documents support and strengthen your ITC claims during audits or assessments. Here is what needs to be included in the documentation:

-

GST-Compliant Invoices:

Make sure that you get valid GST invoices with all the necessary details. These details are related to transactions with your registered suppliers for marketing services. The details must meet the latest GST regulations.

-

Proof of Payment:

In addition to invoices, you need to make sure to keep evidence of payment transactions. These include bank statements or receipts, to substantiate the financial aspect of the marketing expenses.

-

Agreements and Contracts:

Furthermore, preserve all the agreements or contracts which are related to marketing services. Outline all the terms and conditions along with the scope of work.

-

Details of Input Services:

To support ITC claims and smooth processes, clearly identify and document input services related to marketing, such as advertising or promotional activities.

-

GST Returns:

Documents related to Marketing-related transactions in the GST returns must be taken care of. You can maintain copies of filed GST returns, showcasing accuracy.

-

Internal Records:

Keep internal records with details of the purpose and relevance of marketing expenses. This will aid in justifying ITC claims during audits.

Marketing expenses and GST credit benefits

To elaborate, marketing expenses are the costs of promoting goods and services. Under GST, businesses can claim Input Tax Credit, GST credit on these expenses. As a result, this helps in reducing the tax liability of businesses and encourages proper documentation of expenses in the GST framework. Here are some, marketing Expenses and GST Credit Benefits:

-

Reduction in Tax Liability:

When businesses successfully claim ITC on marketing services, their overall GST liability decreases. Thus, GST credits lead to cost savings.

-

Transparent Documentation:

To claim GST credits in the form of ITC, businesses are required to maintain valid documentation. So, indirectly you can ensure transparent and accurate documentation of marketing expenses.

-

Document Verification:

As all the documents are pre-verified and of assured validity, it helps in smooth document verification during audits. This also ensures that GST regulations are followed efficiently.

-

Financial Efficiency:

Marketing-related taxes are minimized when the use of GST credits is maximized. Therefore, financial efficiency is ensured.

-

Encourages Legitimate Business Practices:

The whole system is made in such a way that it encourages businesses to engage in legitimate practices. In addition, it discourages any attempts to manipulate or misuse the GST credit mechanism.

Compliance requirements for ITC on promotions

To claim Input Tax Credit (ITC) on promotions, businesses must ensure compliance with certain requirements. Businesses need to adhere to the rules outlined in the GST framework. Here are some compliance requirements for ITC on promotions:

-

Documentary Evidence:

You need to maintain detailed invoices and documentation for promotional expenses. The documentary evidence must specify the nature and purpose of the promotion. This will help in a seamless audit.

-

Business Purpose:

The promotional expenses must be directly related to taxable supplies only. Also, ensure that promotional expenses are incurred for business purposes only.

-

GST Registration:

Both the supplier and recipient must have their own unique GSTIN. This means that only registered members are eligible to claim ITC.

-

ITC Eligibility Criteria:

The businesses must verify that the promotional expenses comply with GST eligibility criteria.

-

Timely Filing:

Punctuality is very crucial for a smooth taxation process. Make sure to file GST returns on time to maintain compliance and facilitate the seamless claiming of Input Tax Credit.

Conclusion

To sum up, the claim for ITC can only be made by following the strict regulations under GST. Moreover, one must keep up with the modifications made over time to get the full benefit of the tax credit for promotional costs. In addition, you need to make sure that these costs are legitimately related to the business and not to any unrelated personal expenses. Furthermore, managing and organizing the records will give the person the benefit of paying less for the total tax.

Also Listen : CaptainBiz Ke Sath Apne Reports Ko Generate Karein

Frequently Asked Questions (FAQs)

-

What is the full form of ITC?

Input Tax Credit.

-

What is ITC or Input Tax Credit?

The input tax credit is the GST paid by a registered person (with GSTIN) on the purchase of goods or services that are used for the furtherance of business.

-

What is the Objective of ITC?

It is implemented with an objective to minimize the effect of taxes and thereby reduce the cost of doing business.

-

How does ITC assist in cost saving?

Input credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs, thus, helping in cost saving.

-

What is the use of ITC?

Input tax credit is an incredibly powerful tool in business, marketing, and promotions.

-

How does ITC work?

A registered businessman pays GST while buying a product, and some amount will be deducted, which lowers the tax paid while selling it.

-

What are the benefits of ITC?

Some benefits are a Reduction in Tax Liability, Transparent Documentation, Document Verification, Financial Efficiency and Legitimate Business Practices.

-

What are the eligibility criteria for claiming ITC?

Some conditions need to be met like the Use of money for business, Registration, Maintenance of the documents, having a good invoice, being updated about the tax rules, and making sure the other party has followed the tax regulations.

-

How do input services play a role in ITC claims?

Carefully identify all the services which are eligible for ITC claiming for smooth ITC claims such as advertising, market research, and promotional activities.

-

What does an invoice should contain for efficient documentation?

The invoice must include transaction, promotional costs, personal information of the buyer and seller, and GST identification number.