44th GST Council Meeting Highlights, Updates, Outcome, and More

The 44th GST Council Meeting took place on the 12th of June 2021 in New Delhi, India. Led under the adept guidance of Finance Minister

Explore the vast landscape of GST such as GST information in different languages, GST billing software, GST calculator, e-invoicing, e-way bill, reverse charge mechanism (RCM), input tax credit (ITC), GST filing, GST return, GSTR, HSN code, finance, taxation and more.

Whether you’re a business owner, tax professional, or someone eager to stay informed, CaptainBiz is your go-to resource for GST guidance and billing software.

44th GST Council Meeting Highlights, Updates, Outcome, and More

The 44th GST Council Meeting took place on the 12th of June 2021 in New Delhi, India. Led under the adept guidance of Finance Minister

43rd GST Council Meeting Highlights, Updates, Outcome, and More

On May 28, 2021, the 43rd GST Council meeting took place. After more than half a year, the GST Council convened. The meeting was presided

42nd GST Council Meeting Highlights, Updates, Outcome, and More

The 42nd GST Council meeting was conducted virtually on October 5, 2020, with Smt. Nirmala Sitharaman, the Finance Minister, serving as chairperson. Along with senior

41st GST Council Meeting Highlights, Updates, Outcome and More

The 41st GST Council Meeting took place on August 27, 2020, virtually via a video call around 4:30 p.m. IST. It was held to specifically

What are the Different Tax Rates That Apply to Different Places of Supply?

Tax is one of the vital sources of income for the government. The amount collected from taxes is used to build helpful and required resources

What Is An Inter-State Supply, It’s Meaning in GST?

In the case of the Supply of a service or goods, when the provider of the goods or the service is situated in a different

How Does the Place Of Supply Affect Tax Determination?

Under the GST guidelines, when a transaction happens, the location of the person receiving the services or the goods is considered the place of supply.

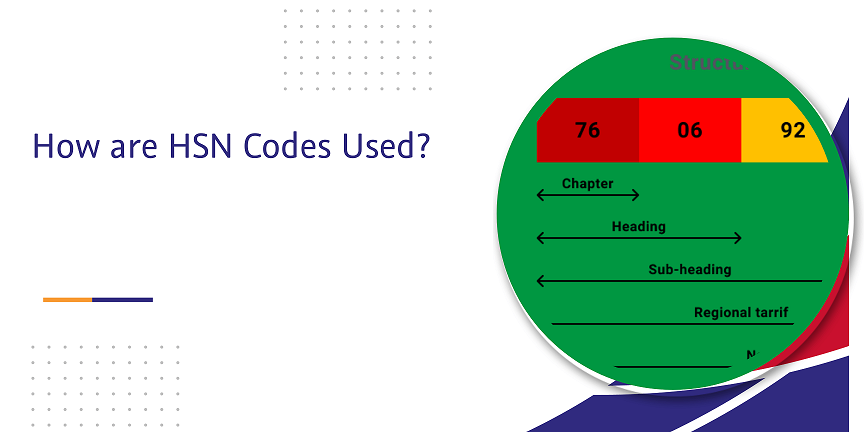

Harmonized System of Nomenclature (HSN) codes offer a uniform item classification system essential to global trade and business. Adopted by numerous nations globally, these codes

How Do I Calculate GST on Services?

Calculating Goods and Services Tax (GST) on services is complex and varies according to the kind of service and the applicable GST rate. In contrast

40th GST Council Meeting Highlights, Updates, Outcome and More

The 40th meeting of the Goods and Services Tax (GST) Council, held on June 12, 2020, emerged as a pivotal event amidst the challenges posed

39th GST Council Meeting Highlights, Updates, Outcome, and More

Chaired by the Union Finance Minister, Smt. Nirmala Sitharaman, the 39th GST Council meeting took place on March 14th, 2020. Several crucial issues were discussed

38th GST Council Meeting Highlights, Updates, Outcome, and More

On December 18, 2019, the 38th GST Council Meeting was presided over by Honorable Union Finance Minister Nirmala Sitharaman. The meeting was held amid anticipations

What are the GST Rates for Services?

An essential component of financial literacy is comprehending the intricacies of Goods and Services Tax (GST) rates for services. Various services fall under different tax

Taxability of Personal and Corporate Guarantees Clarified – GST Circular 204/16/2023

Clarification on the taxability of personal guarantee and corporate guarantee in GST – Circular No 204/16/2023-GST dated October 27, 2023 CBIC has recently issued a

37th GST Council Meeting Highlights, Updates, Outcome, and More

On September 20, 2019, the GST Council met in Panaji amidst industry demands for rate reductions. The 37th GST Council meeting, which was chaired by

© Copyright CaptainBiz. All Rights Reserved