INTRODUCTION

In the ever-evolving landscape of modern logistics and trade, efficient management of E-waybills stands as a cornerstone for seamless and compliant transportation of goods.

The essence of timely renewal and vigilant monitoring of E-waybill validity cannot be overstated in today’s dynamic business environment.

This article delves into the pivotal role played by proactive E-waybill validity management, outlining best practices and strategies essential for businesses to navigate through regulatory requirements while optimizing their logistical operations.

Best practices for the timely renewal of E-waybills

Below given are some of the best practices for timely E-waybill renewal:

- Plan Earlier: It will be best to set a reminder before the E-waybill expires. It will automatically initiate the process.

- Active Monitoring: Keep a regular check on the E-waybill status to avoid expansion.

- Streamline The Process: Establish a clear communication channel with the concerned departments for E-waybill renewal. And follow standard operating procedures for quick renewal.

- Training and Awareness: Stuff should be well trained about the consequences of E-waybill expiry, also they should stay updated about any changes in regulations.

- Emergency Preparedness: In case of any unexpected delay or technical issues, stay ready with backup plans. It will help to carry on with shipments at the last moment.

Monitoring strategies for efficient E-waybill validity management

Monitoring strategies for timely E-waybill validity management consist of several methodical procedures. A few of them are mentioned below:

| Monitoring Tools | E-waybill systems with advanced monitoring tools allow for in-depth analysis of data trends, and performance metrics. |

| User Activity Monitoring | Monitoring user activities within the E-waybill process is the key management thing. This enhances security, prevents unauthorized access, and ensures accountability. |

| Real-time Tracking Systems | Real-time Tracking Systems are good for monitoring the movement of goods and the status of E-waybills. This includes immediate identification of any discrepancies, delays, or potential issues. |

| Automated Alerts and Notifications | Stakeholders need to be updated about upcoming E-waybill expirations. For that try to use automated notifications which ensure timely renewal and minimize transportation disruptions. |

| Data Accuracy Checks | E-waybill system data accuracy needs to be checked regularly. To verify the consistency and correctness of the information, automated tools can be utilized. |

Also Read: Role of Technology in E-waybill Validity Management

Compliance obligations for adhering to best practices

Adhering to best practices in E-waybill validity management gets a range of compliance obligations. These compliance obligations are crucial for maintaining transparency in the logistics process. Let’s delve into these:

- Enter Your Clients/Customers and Suppliers Master in the Master Menu:

On the E-waybill system, the taxpayer can create a one-time master menu for his/her supplier and consumers. It just has to put the supplier’s name in the name field during the e-Way Bill generation process and the system automatically fills in the customer and supplier details. It will avoid errors in the GSTIN, Place, State, and PIN numbers of clients or vendors.

- Enter Your Products Master in the Master Menu:

In the master menu, the taxpayer can put product details such as name, HSN, tax rate, etc. The system will automatically fill in the product data using just the first two to three characters of the product name. It will help to avoid errors in the HSN code, tax rate, UQC, etc.

- Verify Before Submission:

It is essential to cross-check the details of parameters entered before final submission.

- Handle sub-users with caution:

In some cases, taxpayers may not operate directly and they may have several locations from where they need to generate E-way bills for the transportation of products. In this situation, taxpayers can designate sub-users to manage the E-way bill system depending upon the specifications. These users can also be assigned other roles.

- API Interface:

The best way to generate E-waybills in bulk numbers is the API interface. This is a site-to-site integration of the system. In this, the taxpayers will be able to request directly for an E-waybill number and get it. However, this facility is available only for a few selected taxpayers who generate E-waybill in large numbers.

Documentation for implementing best practices in E-waybill renewal

Documents play a vital role in ensuring clarity, consistency, and compliance within an organization’s operation. Here is how to approach this:

- Procedure Manual: Make a detailed procedure manual with step-by-step instructions for timely renewal. Include all the details like screenshots, examples, and explanations to guide the users through the process.

- Checklist: Design a checklist with key points for E-waybill renewal. The checklist will serve as a quick reference for not to miss any crucial step.

- Make Templates: Create templates to capture important information that is needed for renewal to streamline the entire data input process.

- Policy Documents: Ensure the policies related to E-waybill renewals, including timelines, compliance requirements, escalation procedures for delays, and consequences of non-compliance align with regulatory guidelines.

- Training Materials: Conduct regular training programs to ensure all stakeholders stay updated about the renewal process. Create training resources such as presentations, guides, or videos to educate employees on E-waybill renewal best practices.

Also Read: Procedures and Documentation for Handling Expired E-waybills

Reporting requirements for showcasing best practices in E-waybill validity

Below is a summary of the fundamental reporting criteria for a successful renewal process:

- Reports on Renewal status: Make a summary of the current E-waybill validity status for all shipments and mention which are yet to renew and which are successfully renewed.

- Metrics of Compliance: Make a proportional report on the E-waybills that are renewed within time against renewed after expiration. Demonstrate how precise the information is in terms of data correctness and completeness.

- Analyze the trends: Compare the compliance metrics report to showcase improvement and where it needs more attention.

- Deviations and Exceptions: Mention the details of the E-waybills that were unable to renew within due time and also describe the causes of any delays or non-renewals along with the steps to be taken to address them.

- Engagement of Stakeholders: Provide an update on how you worked with stakeholders to make sure their adherence to renewed E-waybills maintaining compliance requirements.

Challenges in implementing and maintaining E-waybill best practices

E-waybills face several challenges in implementing and maintaining best practices. Such challenges affect the smooth functioning of logistics processes. These challenges arise mainly due to a combination of technical, regulatory, and operational factors. Some of them are given below:

- Technological barriers: Small and medium enterprises in particular lack the necessary technical infrastructure for effective e-way bill implementation. This may impact the cost of adopting new technologies and integrating them into existing systems.

- Resistance to change: Resistance to change within the organization may arise. Transitioning employees and stakeholders accustomed to traditional paper-based systems to electronic e-bills requires training and a cultural shift. This can be met with resistance if possible.

- Interoperability issues: Businesses and government agencies use separate systems due to inconsistencies in technology standards and interoperability between different e-waybill systems. These create complications in data exchange and collaboration.

- Data security: E-bills involve the exchange of sensitive information. So data security is a major concern in this era of cyber threats. Ensuring secure transmission, storage, and access to e-bill data can therefore be challenging.

- Enforcement and punishment: Inconsistent enforcement of e-waybill regulations and imposition of penalties for non-compliance are quite challenging. Businesses can struggle to align with best practices if the regulatory landscape lacks clarity and uniform enforcement.

Also Read: Challenges and Solutions in Tracking and Managing E-waybill Expiry

Exemption considerations for cases aligning with best practices

Specific goods that are exempt from E-way bill rules are:

|

|

|

|

|

|

|

|

|

|

|

Goods other than de-oiled cake being transported are specified in notification No. 2/2017– Central Tax (Rate) dated the 28th June 2017. A few of the goods that are included in the above notification are as follows:

|

|

|

|

|

|

|

|

|

|

|

Goods exempted under notification No. 7/2017– Central Tax (Rate) dated 28th June 2017 (supply by CSD to unit run canteens and authorized customers) and notification No. 26/2017– Central Tax (Rate) dated 21st September 2017 (consists of heavy water and nuclear fuels)

Legal considerations supporting E-waybill best practice

Integrating legal considerations into e-waybill best practices is essential to promote a seamless and legally sound logistics process while preventing legal issues. Let’s know more about Legal considerations supporting E-waybill best practices:

- Legal compliance: E-waybill practices must be aligned with local and national laws governing the movement of goods. This ensures legality in transport and prevents legal repercussions.

- Maintaining data privacy and security: Complying with e-waybill best practices requires robust measures to protect essential data. Ensure compliance with data protection laws to protect legal integrity, including customer personal information.

- Digital signature and authentication: Nowadays the era of scamming requires the implementation of a digital signature and authentication process. Because it ensures the legality as well as legal authenticity of the e-way bill.

- Training and maintaining awareness: Legal compliance depends on the knowledge and awareness of those involved in managing e-waybills. Regular training programs are therefore essential to keep stakeholders aware of legal considerations and regulations.

Audit and verification of adherence to best practices in E-waybill management

Here is a list of five essential points for auditing and verifying adherence to best practices in E-waybill management.

- Document Verification:

- Verify all the essential documents so that they align with actual practices of E-waybill management.

- Examine if the best practices adhere to industry standards and legal regulations.

- Sample Analysis:

- For in-depth analysis, thoroughly examine a sample of E-waybill renewal.

- To match the standards, examine the accuracy of the information in the E-waybill.

- Process Workflow Assessment:

- Search for any variations in the workflow that is used in E-waybill renewal.

- Analyze if the roles and actions of the people and teams really match with responsibilities mentioned in the documentation.

- Compliance with Deadlines:

- Examine if the E-waybill was really renewed within time or if there are any instances of delay.

- If delayed, analyze the reason and its impact on operations.

- Assessment of Corrective Actions

- During the audit, look for any discrepancies and non-compliance.

- Evaluate the corrective measures taken against the audit findings to make sure of continuous improvement.

Continuous improvement in E-waybill validity through best practices

Continuous improvement of the e-waybill term largely depends on the implementation of best practices. Regular training programs for stakeholders are very important in this regard.

They need to be taught proper methods to reduce errors. Advanced software solutions enhance e-way bill accuracy. They facilitate real-time data exchange by maintaining e-waybill information including transport management and invoicing. Routine audit and monitoring mechanisms detect discrepancies immediately while maintaining the validity of e-waybills.

Its periodic reviews, regulations, and changes in technology ensure the ongoing effectiveness of the e-waybill system. Businesses today can optimize logistics by adopting best practices such as training, automation, integration, monitoring, collaboration, and periodic reviews. This can also reduce compliance issues.

Conclusion

In Modern logistics, timely E-waybill management through stringent processes is very important. In our guide, we have mentioned all the needful steps for E-way management for an uninterrupted logistic process. For a smooth and compliant movement of goods, it needs a combination of proactive renewal methods and a careful monitoring system.

FAQs

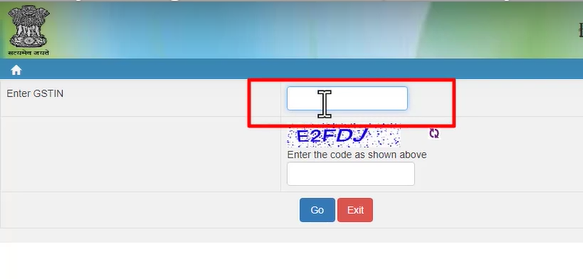

Q1. What is the common portal for generating the E-way bills?

The common portal for making E-way bills is https://ewaybillgst.gov.in.

Q2. If there is a mistake or wrong entry in the e-way bill, what should we do?

If there is a mistake, incorrect, or wrong entry in the E-way bills entry, it cannot be edited or corrected. The only option is to cancel the entire E-waybill and generate a new one with the correct details.

Q3. What has to be entered in the GSTIN column, if both the consignor or consignee do not have GSTIN?

If the consignor or consignee is an unregistered taxpayer and does not have GSTIN, then the user has to enter ‘URP’ [Unregistered Person] in the corresponding GSTIN column.

Q4. Can the e-way bill be modified or edited?

The e-way bill once generated cannot be edited or modified. Only Part B can be updated.

Q5. Who can verify the authenticity or the correctness of E-way bills?

Any person can verify the authenticity or the correctness of an E-way bill by entering EWB No, EWB Date, Generator ID, and Doc No in the search option of the EWB Portal.

Q6. What has to be done, if the validity of the E-way bill expires?

If the validity of the e-way bill expires, the goods are not supposed to be moved. However, under circumstances of ‘exceptional nature and trans-shipment’, the transporter may extend the validity period after updating the reason for the extension and the details in PART-B of FORM GST EWB-01.

Q7. Under what circumstances can the E-way bills be canceled?

E-way bills can be canceled if either goods are not transported or are not

transported as per the details mentioned in the e-way bill. The e-way bill can be canceled within 24 hours from the time of generation.

Q8. What are the modes of e-way bill generation that the taxpayer can use?

The e-way bill can be generated by using any of the following methods:

| 1. Android App |

| 2. Web-based system |

| 3. SMS-based facility |

| 4. generation facility |

| 5. Site-to-Site integration |

| 6. GSP (Goods and Services Tax Suvidha Provider) |

Q9. In the case of Public transport, how do you carry an E-way bill?

In case of movement of goods by public transport, an e-way bill shall be generated by the person who is causing the movement of the goods. In case of any verification, he can show an e-way bill number to the proper officer.

Q10. Is the E-way bill required for the movement of empty cargo containers?

No, empty cargo has been kept out of the E-way bills list.