With a maximum number of assets and minimum liabilities, financial independence is within everyone’s reach. However, managing your finances and keeping your assets from turning into liabilities is not particularly easy.

India has only about 27% financial literacy because it is not a topic covered in many educational institutions.

This blog will tell you all that you need to know about what an asset is and what some of the top assets have proven themselves time after time. It also includes a super helpful section from Robert Kiyoski (author of Rich Dad Poor Dad) about ‘how to turn a liability into an asset.’

What are Assets?

Assets are resources owned by an individual with a particular value that can be used to support someone’s financial well-being. These resources are not limited to cash or even property; they can be anything that can potentially be sold or converted into cash. Assets are often classified based on how they appreciate or increase in value after you invest in them.

Examples of Assets

- Savings: Savings that you have set aside in a savings account, often earning interest, can be used in emergencies and can be classified as an asset.

- Real estate: A house or property that you can sell and whose value increases over time.

- Investments: Stocks, bonds or retirement accounts that provide financial security and can be exchanged for cash in the future.

Also Read: Clearance of Stock and Assets in GSTR-10

What are Liabilities?

Liabilities are seen as the opposite of assets. These are financial obligations that one needs to settle over time. Liabilities are classified by their future outflow of resources, usually, money. Similar to assets they can include a wide range of things. Liabilities can also be classified based on their due date or repayment period (within a year or long-term liabilities extending beyond a year).

Examples of Liabilities

- Credit card debt: Money owed to credit card companies usually accumulates over time and carries high interest rates.

- Student loans: Debt taken to fund your education and is typically repaired over many years with considerable interest is an unavoidable liability for many students throughout their careers.

- Mortgages: A loan taken for purchasing real estate and repaid over a long term is classified as a liability.

Also Read: How do businesses and individuals calculate the GST liability for a supply?

Types of Assets and Liabilities

Assets are further classified into different types:

-

Current Assets

Also known as short-term assets, they are classified by how easily they can be converted into cash. They typically yield cash within a year. Current assets include:

- CASH OR CASH EQUIVALENT: Cash is the most immediate asset a person can hold. Highly liquid investments are also included.

- ACCOUNTS RECEIVABLE: Money that you have loaned to someone for a short period (less than a year) can also be classified as an asset.

- SHORT-TERM INVESTMENTS: If you have invested money that can be liquidated or will yield results quickly, they are called short-term investments.

-

Fixed Assets

Fixed assets are investments you have made for a longer period, typically over 10 years. These assets are mostly tangible but not necessarily. For example:

- REAL ESTATE: Any land or property you have purchased and expect to appreciate over the years can be classified as an asset.

- PRODUCTION EQUIPMENT: Businesses often invest in equipment that reduces their cost of production and saves them a lot of time. They might not appreciate in value but can be classified as fixed assets.

- RENEWABLE ENERGY: Renewable energy, such as solar panels, is also an asset since it can save you a ton of money.

-

Financial Assets

Financial assets include investments or resources expected to generate further cash flow. They are highly liquid and valued according to their current market price.

- STOCKS OR BONDS: Investment in stocks or bonds can appreciate over the years and lead to huge profits.

- RETIREMENT ACCOUNTS: Long-term saving accounts also yield a lot of interest and are meant to accumulate wealth over a lifetime.

Liabilities are divided into two types based on their repayment period:

-

Current Liabilities

Current liabilities are obligations that are expected to be settled within one year. These are also called short-term liabilities. Current liabilities are crucial in day-to-day operations, as they reflect a person’s short-term financial commitments.

- ACCOUNTS PAYABLE: money that a person or business owes to someone else for goods or services received on credit is counted under current liabilities.

- SHORT-TERM LOANS: personal or bank loans that are taken for a short period and need to be paid within a year.

- UNEARNED REVENUE: payments received in advance for something that is to be delivered later are known as unearned revenue.

-

Non-Current Liabilities

Also called long-term liabilities, these are debts or obligations that are due over a longer period (More than 12 months). These are the largest liabilities, and they are often at the top of the list:

- MORTGAGES: a recurrent payment on your house also adds to your overall expenditure and can be seen as a liability.

- BONDS PAYABLE: companies often issue bonds to raise large sums of capital. Repayment is due over an extended period.

- LONG-TERM LOANS: loans with terms longer than one year, mostly used by businesses for food expansion, purchasing assets, or by individuals for buying a home.

7 Assets that are Making People Money

Financial independence is directly tied to how many assets you have and how much you expect them to yield in the future. Investing in the right assets at the right time is very important. Over the years, certain assets have yielded consistent profit. Here are 7 top assets that are making people rich –

1. Cash Reserve

Source – https://in.pinterest.com/pin/950611433843842792/

Top companies like Apple (with a cash reserve of $150 billion) always keep huge amounts of cash reserves.

They do this so that when profitable deals and opportunities come their way, they don’t have to wait to liquidate their other assets.

Although banks give little to no interest on your money, it is still a good option to keep money handy so that you can use it to invest more when the opportunities present themselves. You can also lend this money and gain interest.

2. Real Estate

Source – https://in.pinterest.com/pin/276830708340264875/

For decades, real estate has always been a good investment.

With the world population on the rise, people need more places to stay leading to an increase in real estate cost. Renting your property as a commercial, business or even private space can make you a good passive income. If you take advantage of current technology, you can also rent the property for a shorter period like on a daily or weekly basis which will give you a higher income.

If you have bought the property in the right place, then the value of the land will increase with time.

3. Stocks

Source – https://in.pinterest.com/pin/295830269294154655/

I am sure you’ve heard stories in the news that someone found 50 shares that their grandfather bought from Tata in the 1900s that are now worth hundreds of crores.

Warren Buffet has always said that stocks are not something that will make you rich overnight, but with enough patience, they will surely yield huge amounts of profit. With thorough research, you can build a strong portfolio over the years instead of simply setting up a savings account and holding on to it for several years.

4. Patent

Source – https://in.pinterest.com/pin/908953137339796126/

When you invent something new, patents are a way to protect your invention from being copied and used by others.

Over the years, patents have made many people tremendous amounts of money. A patent becomes incredibly important in the business world to protect your products from being replicated.

If someone is trying to sell something that you have created, a patent allows you to take legal action against them.

5. Your Personal Brand

Source – https://in.pinterest.com/pin/363595369931671239/

With the advancement of technology, creating your personal brand has become very easy.

This has become one of the top income streams for people in recent years simply because it is not limited or bound to certain factors. Your brand can be anything that you are good at and want to share with the world. You can simply be an influencer and grow your audience.

Although it takes a lot of time and dedicated effort, your personal brand can be your biggest asset and a way to gain financial independence.

6. Royalties

Source – https://in.pinterest.com/pin/33214115995378057/

Royalty investing is also a great investment opportunity. In royalty investment, you pay a particular sum of money to buy the royalty for something like a musical record and then you receive the royalty for that. Over the years this royalty can remain the same or increase or decrease in value. That is a risk with royalty investment that you need to calculate.

7. Bonds

Source – https://in.pinterest.com/pin/623607879682738083/

In layman’s terms, bonds are merely loans made by an investor to someone over a certain period. Sometimes, bonds require certain periodic payments to the owner before the entire principal amount is paid back in full. Bonds can be of different types (government, fixed-rate, capital index, etc.), but each has its own merits and demerits. Bonds mostly have low interest rates, but the risk is also not very high.

How to Convert a Liability into an Asset

Robert Kiyosaki, the writer of the best-selling financial advice book ‘Rich Dad Poor Dad’, goes into detail about what a liability actually is and how it can be turned into an asset.

Source – https://in.pinterest.com/pin/557039047671271126/

In his book, he breaks down certain things that people perceive as an asset to actually be a liability. He distinguishes between assets and liabilities in a very simple manner – an asset is something that puts money into your pocket and a liability takes money out of your pocket.

- Let us take the example of a house. If you have just bought a house, it is not necessarily an asset for you as you will have to pay more in taxes, which takes more money out of your pocket.

- But if you rent that property out to someone, you have created a new income stream for yourself in the future, turning an asset into a liability.

The one thing that you need to understand about money is how you control your cash flow. People who are unable to control how their cash flows, create more liabilities than assets and end up struggling financially.

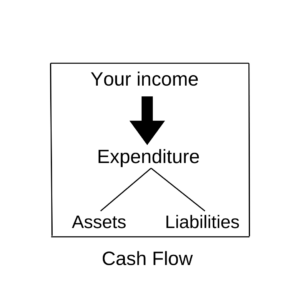

Consider the image below. At the first level, you have your income, followed by your expenditures, and at the bottom, your assets and liabilities, which constitute your cash flow.

If you can control the cash flow, you can use your money to create assets, not liabilities. An asset is not something that you can call your own but something that actively generates income for you.

To learn more about this, you can watch his YouTube video.

Assets and Liabilities Frequently Asked Questions

-

What are liabilities with examples?

Liabilities are debts or obligations that a person or company owes to someone else.

-

What are examples of assets vs liabilities?

A house that is costing you money through repeated mortgage and taxes is a good example of a liability. When you rent that house out to individuals and begin earning money, it becomes an asset.

-

What is the difference between assets and liabilities in banking?

For a bank, assets are the financial instruments that either the bank is holding or the bank is owed money from individuals.

-

Is a car an asset?

A car is considered an asset but a depreciating one. It can be sold for money but the second you buy it, its resale price will reduce drastically.

-

Is cash an asset?

Cash is one of the most liquid assets one can have. It enables one to be ready for any investment opportunity that might arise.

-

What is owner equity?

Owner’s equity is the amount of money a business owner has left after subtracting all liabilities from the business’s total assets. It’s the proportion of a company’s assets that the owner can claim.