Invoice discounting serves as a good approach for the growth of your company. You can get quick cash by obtaining a short-term loan with your outstanding invoices. It acts as a deposit. This improves your cash flow so you may wait for your clients to pay before investing in expansion or covering expenses.

Also, you maintain control over customer relationships and collections. It is a helpful tool to run your business smoothly and seize opportunities without the wait.

In this article, we will examine the invoice discounting process, its mechanics, eligibility details, and benefits. Also, we compare invoice discounting with other invoice financing options. So, let’s get started….

Introduction to Invoice Discounting

Invoice discounting is a professional accounting and finance method. It enables you to receive funds from unpaid bills before your clients do. Businesses that discount invoices provide you with credit in the form of money, often up to 95% of the invoice value.

Once you have received payment from the client invoices, you repay the loan balance. Since invoice discounting is frequently private, your clients are unaware of it.

Types of invoice discounting:

Invoice discounting is classified as follows:

- Whole turnover invoice discounting: With this kind of invoice discounting, a loan is available for each invoice the company generates. As a result, money on the entire turnover can be raised.

It gives the invoice discounting company access to a greater range of risks. It is frequently advantageous for companies with consistent clients and customers.

- Selective invoice discounting: Selective invoice discounting allows an organization to finance its operations. You can obtain cash from a late invoice in the form of a loan. If the firm pays a charge, a finance provider will lend the company a portion of the invoice’s value.

- Confidential invoice discounting: Unlike normal invoice discounting, this kind gives firms control over credit management and collections.

Businesses can receive funding based on delinquent invoices while maintaining client confidentiality.

This enables businesses to preserve client relationships and credit management while enhancing cash flow and offering a covert financing choice without revealing third-party involvement.

- Disclosed invoice discounting: A disclosed invoice discounting facility is one in which the loan provider makes it obvious to the client that they are involved by prominently labeling invoices that should be paid to the lender rather than the client.

This type of discounting allows for transparent communication between the company, the finance company, and the clients because everyone is aware of the financing arrangement.

The Mechanics of the Invoice Discounting Process

Based on the bills you have delivered to your clients, invoice discounting works similarly to obtaining a short-term loan. Here are the mechanics of the invoice discounting process:

|

|

|

|

|

|

Advantages of Invoice Discounting

Invoice discounting offers several advantages for businesses. Here are some:

- Improved Cash Flow: Invoice discounting provides instant cash access. Transforming accounts receivable financing into capital for operating needs improves the liquidity of your company.

- Flexibility: It provides flexibility in handling changes in cash flow. You can be free from a set payback schedule to utilize the funding as needed.

- Confidentiality: Invoice discounting can be done in confidence. It protects your business’s connection with clients. Unlike with invoice factoring, they might not be aware of the financial arrangement.

- Maintaining Credit Control: You are still in charge of your client relations and credit management. Maintaining your business-client relationships and getting income from your clients are your responsibilities.

- Reduced Dependency on Traditional Loans: Invoice discounting offers a substitute for conventional loans. You can obtain funds by using your current invoices without incurring new debt.

- Quick Access to Funds: Invoice discounting often ends in a shorter funding process than conventional finance techniques. It is an effective business cash flow solution.

- Reduced Bad Debt Risk: Companies that discount invoices frequently run credit checks. It helps to lower the possibility of nonpayment. This might shield your company from possible damages due to bad debt.

- Less Financial Stress: It relieves financial strain by giving you money ahead of time. It can improve growth possibilities, pay for unforeseen bills, or cover operating costs.

- Improved Supplier Relations: You can utilize invoice discounting to facilitate prompt payments. It may strengthen your connections with suppliers and help to negotiate for better conditions and savings.

Eligibility and Criteria for Invoice Discounting

The method of discounting invoices is simple to understand. However, there are different qualifying standards for businesses to be eligible for invoice discounting. Some of as follows:

|

|

|

|

|

|

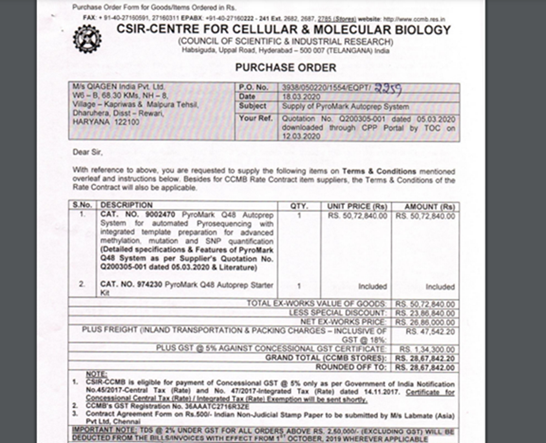

Sample Purchase Order

The list of documentation you must submit to receive invoice discounting is given below:

|

|

|

|

|

|

|

Remember that the documents needed may change based on the lender you select. You can make sure you have all the necessary paperwork. It can easily obtain financing by checking in advance with the lender.

Process of Invoice Discounting

You can get a short-term credit facility called invoice discounting by keeping your credit invoices as collateral. The lender will provide you with a set proportion of the invoice amount.

Once the consumer pays the invoice, the lender pays you the excess amount after deducting any applicable fees, interest, and other costs. The invoice discounting process consists of five major steps. Here are they:

- Each customer receives an invoice from the business that includes details about the buyer and seller and the date and amount owed. When a client doesn’t pay, the business uses invoice discounting in addition to debt collection.

- The discounting financing company receives unpaid invoices for bill discounting. Information is provided in accounts receivable financing records.

- After evaluating each invoice, the bill discount lender awards the business a percentage of its value. Funding rate and timeline may vary depending on business type, invoice volume, and discounting supplier.

- When a company uses a bill discount service, it frequently handles the debt collection procedure to recover outstanding invoices. In some cases, a lender may handle an organization’s invoice collection. However, the majority of companies that use invoice discount services handle collections on their own.

- After a consumer settles an invoice, the discounted service reimburses the company for the remaining balance, deducting the service fee and interest.

Comparing Invoice Discounting with Other Financing Options

There are other financial Options available for businesses to access capital. Traditional financing and Invoice factoring are mostly using alternatives to invoice discounting.

1. Traditional Financing

A loan or line of credit backed by a financial institution on conventional terms is referred to as “traditional” financing. These terms are often based on the “four Cs”: character, collateral, capital, and capacity. The procedure for obtaining this kind of funding is very basic; lenders evaluate your eligibility based on your assets, business strategy, and credit history.

The difference between invoice discounting and traditional financing is as follows:

Invoice Discounting vs. Traditional Financing

Although they both offer money access, traditional lending and invoice discounting are distinct. They vary based on:

- Speed: Invoice discounting allows quick access to funds. While traditional financing involves a prolonged process that can take weeks or months.

- Control: Companies keep authority with client interactions and debt collection for invoice discounting. Traditional financing requires collateral, granting the lender control over assets.

- Expense: Invoice Discounting is usually more expensive depending on creditworthiness. While traditional financing usually has cheaper interest rates but may have more stringent credit criteria and collateral requirements.

- Risk: Invoice discounting involves the risk of clients’ non-payment impacting cash flow. Traditional financing has the possibility of collateral loss and loan default risk.

2. Invoice Factoring

A way of easing cash flow issues is invoice factoring. A company that uses invoice factoring sells any number of outstanding invoices to a factor for less than what is due. Instead of having to wait for the 30-, 60-, or 90-day term indicated on the invoice, the firm receives the bulk of the invoice amount—up to 90%—within a few business days. The factor usually takes on the responsibility of invoice collection in factoring scenarios.

Invoice Discounting vs. Invoice Factoring

Invoice factoring and invoice discounting vary according to the following key factors:

- Payment Plan: Expenses of invoice discounting vary between 0.75 and 2.5% of the entire invoice. While fees for invoice factoring include an administration charge (1.5–5% of the total invoice amount) and a service charge.

- Available invoice amount: Variable percentage of invoice discounting determined by a simple check of the sales ledger. At the same time, 75–85% of the invoice amount is often provided through invoice factoring.

- Credit screening of customers: Invoice discounting has fewer credit control examinations. While invoice factoring needs thorough audits of the sales ledger and credit.

- Selling vs. Deposit: Invoice discounting uses invoices as a down payment on a quick loan. While selling invoices is part of invoice factoring.

- AR Invoice Processing & Sales Management Accountability: Invoice discounting still falls under your purview and has little effect on sales administration and collections. While, the provider assumes accountability for invoice factoring, which includes managing the sales ledger.

- Client Knowledge of Financing Invoices: Customers cannot determine invoice discounting. It seems like a straight payment. While the provider notifies customers and keeps in touch during the invoice factoring procedure.

- Risk and Accountability for Payment of Invoices: You are in charge of payment in the invoice discounting process. If the customers fail to pay, you have to reimburse the supplier. Invoice factoring is often non-recourse, indicating that you are not responsible for repayment if clients fail to make payments.

Conclusion

In summary, invoice discounting is a helpful strategy for businesses to improve their cash flow. You may utilize your invoices as a form of deposit to obtain a short-term loan with its rapid and flexible funding method.

The speed, the control over your connections with customers, and the flexibility to oversee your collection procedure make it worth a little more money than conventional financing.

Remember that you are still in charge of the invoice value, thus you must monitor your clients’ payments. In general, invoice discounting seems to be a useful and accessible choice for companies looking for quick and flexible business cash flow solutions.

Also Read: What Are The Benefits Of Integrating GST Registration With Your Invoice/ Billing Software?

FAQs

Q1. What is invoice discounting?

Invoice discounting is a financial strategy companies use to obtain quick cash by using outstanding invoices.

Q2. How does invoice discounting work?

You sell goods or services and create invoices and a company lends you money based on those invoices.

Q3. Why should I think about invoice discounting?

Invoice discounting gives you fast cash, enhances cash flow, and lets you use arrears to get short-term loans.

Q4. Do I maintain control over customer relationships with invoice discounting?

Yes, invoice discounting helps you control customer interactions and the collections process.

Q5. What percentage may I obtain by invoice discounting?

Invoice discounting allows you to obtain 75–85% of the whole invoice amount.

Q6. How can I pay back the loan?

You can return the loan to the discounting firm plus a charge once your clients pay the invoices.

Q7. Is Invoice discounting like a traditional loan?

No, it is more like using your invoices as a deposit for a short-term loan.

Q8. Does invoice discounting contribute to increased working capital?

Yes, invoice discounting is a method to improve the working capital of your company.

Q9. Do customers know about invoice discounting?

No, customers are usually unaware; they pay you directly, as usual.

Q10. What is invoice discounting’s main benefit to my company?

You may take advantage of company possibilities and effectively manage cash flow with speedy access to funds provided by invoice discounting.