In the dynamic world of business finance, the terms “billing” and “invoicing” frequently confused, but they’re not interchangeable! Think of billing as the initial request for payment—a bit like the price tag on an item you want to buy.

In contrast, invoicing is like the detailed receipt you receive after making a purchase, outlining what you bought, how much it cost, and any additional details.

To put it simply, billing definition means kicking off the process by stating the amount due, while invoicing provides a breakdown of the charges and serves as a formal request for payment. Understanding these distinctions is crucial for smooth financial operations within any business.

So, let’s try to understand the difference between both terms in detail through this article.

Understanding Billing

Billing, in the context of financial transactions, is the systematic process by which a business communicates the amount owed by a customer for goods or services rendered. It serves as the initial stage in the financial interaction between a business and its clients.

At its core, billing involves the issuance of a bill or invoice outlining the products or services provided, their respective quantities, and the associated costs.

The billing process typically commences with the generation of a pre-invoice, which acts as a preliminary document detailing the impending charges. This pre-invoice serves as a point of confirmation before the final bill is sent to the customer.

Once validated, the actual invoice is crafted with meticulous attention to detail, encompassing a breakdown of costs, applicable taxes, and any additional charges.

In the digital age, billing systems are often automated, leveraging technology to generate invoices promptly and reduce the margin for errors. These automated systems not only enhance efficiency but also provide a secure and organized platform for storing billing information.

The features of billing include:

| Customization |

|

| Integration and Analytics |

|

Unpacking Invoicing

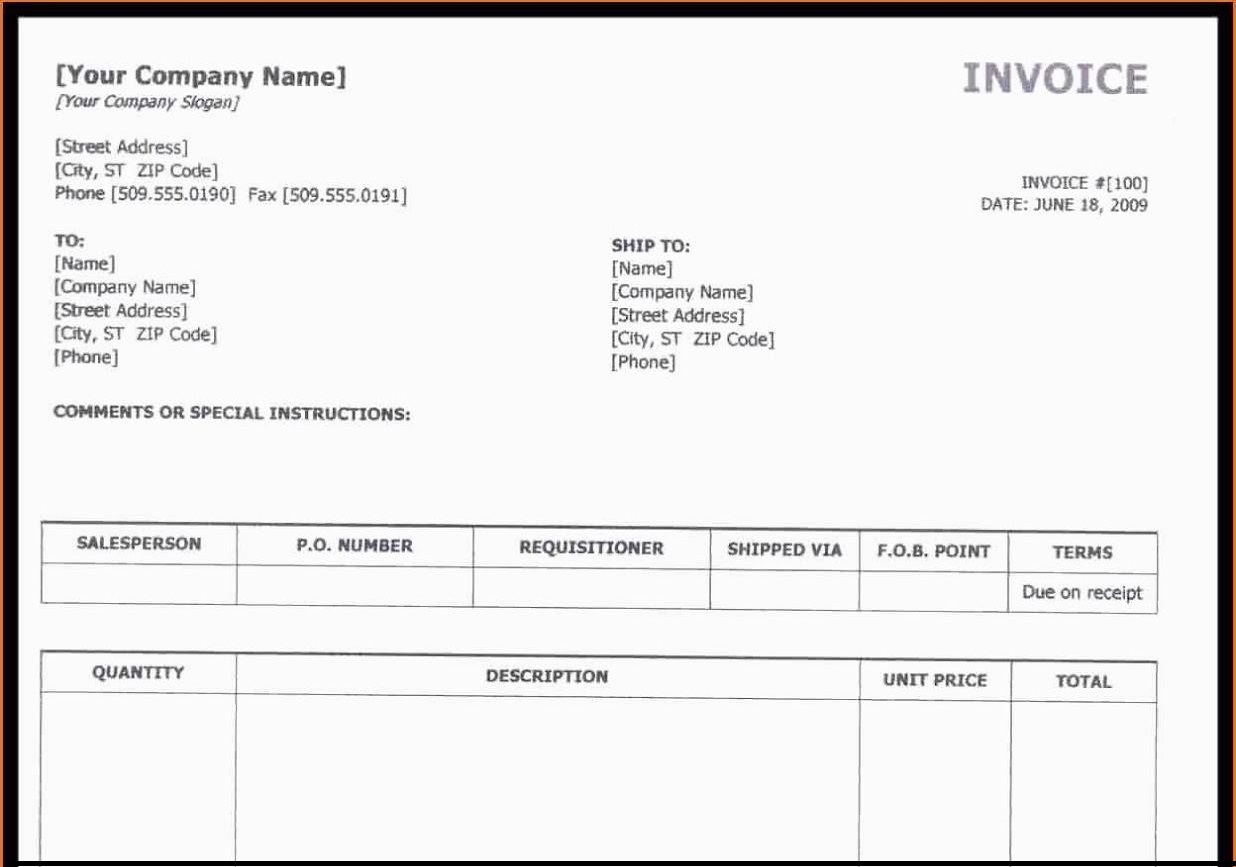

Invoicing represents the subsequent phase in the financial transaction process, following billing. It is a detailed document that provides a comprehensive breakdown of the costs incurred by a customer for the products or services received.

Unlike billing, which often serves as an initial communication of charges, an invoice is a formal payment request. Let’s unpack the key components and nuances of invoicing:

| Detailed Line Items |

|

| Terms and Conditions |

|

| Unique Invoice Number |

|

| Tax Information |

|

| Total Amount Due |

|

| Professional Branding |

|

| Record-Keeping |

|

| Automation and Efficiency |

|

Understanding the intricacies of the invoicing process is indispensable for businesses aiming to streamline their financial operations. It not only facilitates prompt and accurate payments but also contributes to fostering trust and long-term relationships with clients.

Also Read: E-invoice and Tax Invoice for Goods: Integration and Digital Invoicing Benefits

Key Differences Between Billing and Invoicing

Billing vs. Invoicing: What’s the Difference Between Billing and Invoicing? Let’s dissect these fundamental processes, exploring their timing, content, and functions to demystify the intricacies of billing and invoicing.

| Factors | Billing | Invoicing |

| Timing and Purpose |

|

|

| Contact Details |

|

|

| Function in Financial Flow |

|

|

| Legal and Regulatory Aspects |

|

|

These key differences are crucial for businesses to implement effective financial management strategies.

The Significance in Business Operations

The significance of billing and invoicing extends far beyond mere documentation; it has become the heartbeat of business transactions. Each, with its own unique role, contributes profoundly to the seamless functioning of a business. Let’s delve into their individual significance:

- Establishing Trust Through Transparency

Billing: Acts as the initial handshake, offering a preliminary glimpse into upcoming financial commitments. This transparency forms the bedrock for a trusting relationship between businesses and their clientele.

Invoicing: Elevates transparency by presenting a meticulous breakdown of costs. This detailed revelation not only builds trust but also acts as a preventative measure against potential misunderstandings.

- Fueling Financial Planning and Reporting

Billing: Begins the financial journey, allowing businesses to anticipate and strategize around incoming revenue. It kickstarts the financial planning engine.

Invoicing marks the conclusion of the financial transaction, serving as a cornerstone for accurate revenue recognition and meticulous financial reporting. Well-structured invoices become essential tools for insightful financial analysis.

- Nurturing Customer Relationships

Billing: Sets the stage for positive customer interactions through an efficient and transparent transaction process. Timely and clear billing cultivates customer confidence.

Invoicing goes beyond the transactional, reinforcing the professionalism of a business. A well-crafted invoice becomes a tangible representation of reliability, fostering enduring customer relationships.

- Ensuring Legal Compliance and Accountability

Billing: It lays the groundwork for a transaction, contributing to a level of legal accountability less formally.

Invoicing: Steps into the legal forefront with explicit terms and conditions. It becomes a crucial document in the event of disputes or legal inquiries, ensuring businesses adhere to regulatory standards and compliance.

- Driving Operational Efficiency

Billing: Choke up the financial engine, ensuring customers are cognizant of their impending financial commitments.

Invoicing: This represents the final lap in the transaction race, prompting timely payments. Automation injects efficiency into both processes, minimizing errors and accelerating the financial workflow.

The significance of billing and invoicing extends beyond their roles as financial documents; they serve as catalysts for trust, drivers of financial strategy, and guardians of legal adherence.

Billing and Invoicing Software Solutions

Let’s explore billing and invoicing software solutions in a different format:

1. Unified Financial Management

- Integrated Solutions: Some billing software features seamlessly combine and improve invoicing functionalities into a unified system. This approach ensures a cohesive financial management process, from initiating transactions to formal payment requests, and enhances the importance of proper invoicing.

2. Features for Efficiency

- Automation: Both billing and invoicing solutions incorporate automation, reducing manual efforts. Automated calculations, recurring billing, and invoice generation contribute to operational efficiency.

- Customization: Businesses can tailor the appearance of both bills and invoices, incorporating branding elements for a professional touch. Customization features are integral to maintaining a consistent brand image.

3. Comprehensive Record-Keeping

- Data Management: These solutions provide robust record-keeping capabilities. Businesses can track financial transactions, aiding in compliance and providing a historical overview for analysis and decision-making.

4. Scalability and Adaptability

- Scalable Solutions: Whether handling a small business or managing larger operations, these software solutions scale to accommodate varying transaction volumes. This scalability is crucial for growing enterprises.

- Adaptable Interfaces: User-friendly interfaces ensure that businesses can easily adapt these solutions to their specific needs without extensive training or system modifications.

5. Security and Accessibility

- Secure Transactions: Security measures are implemented to safeguard financial data. Encryption and secure storage protocols are common features.

- Cloud Accessibility: Many solutions leverage cloud technology, allowing users to access financial data and perform transactions from anywhere with an internet connection. This accessibility enhances flexibility in business operations.

6. Reporting for Informed Decision-Making

- Analytical Tools: Both billing and invoicing software solutions often include reporting tools. Businesses gain insights into financial trends, allowing for informed decision-making and strategic planning.

Unified software solutions for billing and invoicing provide a comprehensive and efficient approach to financial management.

Also Read: Know Everything About GST Billing Software

Listen Why GST Billing is so important for MSME’s ?

Conclusion

In the fast-paced world of business, understanding the difference between billing and invoicing is more than defining them. It’s the key to financial balancing. Imagine billing as the price tag and invoicing as the detailed receipt; both play vital roles in a transaction’s flow.

This distinction isn’t just about starting a payment process or listing costs. It’s about building trust.

Businesses that grasp this difference can fine-tune their financial operations, earning credibility through transparent and reliable practices. Mastering these details lets businesses conduct their financial flow uninterrupted.

FAQs

Q1. What is the primary difference between billing and invoicing?

Billing is a payment request, while an invoice is a detailed document that acts as a formal payment request, outlining the transaction’s specifics.

Q2. Are billing and invoicing terms interchangeable?

Though often used interchangeably, billing typically precedes invoicing and represents a simpler request for payment compared to the detailed nature of an invoice.

Q3. Can billing and invoicing be automated?

Yes, both billing and invoicing processes can be automated using specialized software, streamlining payment requests and documentation.

Q4. What information should a bill include?

A bill generally includes a summary of charges owed without detailed breakdowns or specific payment terms.

Q5. What components make up an invoice?

An invoice includes a detailed breakdown of goods or services provided, costs, any applicable taxes, and specific payment terms.

Q6. How are billing and invoicing important for business operations?

Both processes are crucial for maintaining financial records, ensuring timely payments, and establishing transparent customer communication.

Q7. Can an invoice serve as a legal document?

Yes, an invoice serves as a legal record of a transaction, outlining the terms and specifics of the goods or services provided and the amount owed.

Q8. Do billing and invoicing differ across industries?

While the fundamental concepts remain the same, specific practices might vary based on industry standards and regulations.

Q9. Is an invoice always generated after billing?

Yes, typically, billing precedes the creation of an invoice, as it is a simpler request for payment compared to the comprehensive nature of an invoice.

Q10. How do billing and invoicing impact cash flow?

Proper billing and invoicing practices ensure a steady cash flow by accurately recording transactions and facilitating timely payments, thereby enhancing financial stability for businesses.