Introduction

Paying tax is the duty of a responsible citizen and a business setup of a country. The amount helps in the development of various services of a nation. Hence, trying to escape from the procedure should be an avoided practice. People with the mindset of being exempt from paying taxes are staying true to their duties as responsible citizens.

The taxation system in India is divided into different belts. The classification helps to quickly calculate the revenue amount to be used for the country’s development procedure. The classification procedure is further divided into various segments depending upon the type of transaction in case of tax to be levied upon goods and services. It also makes it easier for respective state governments to calculate the revenue and its appropriate use.

1.1 Types of Taxes

Tax is a certain percentage of the income paid to the government for the use of services the state provides. The amount is also applicable for goods and services.

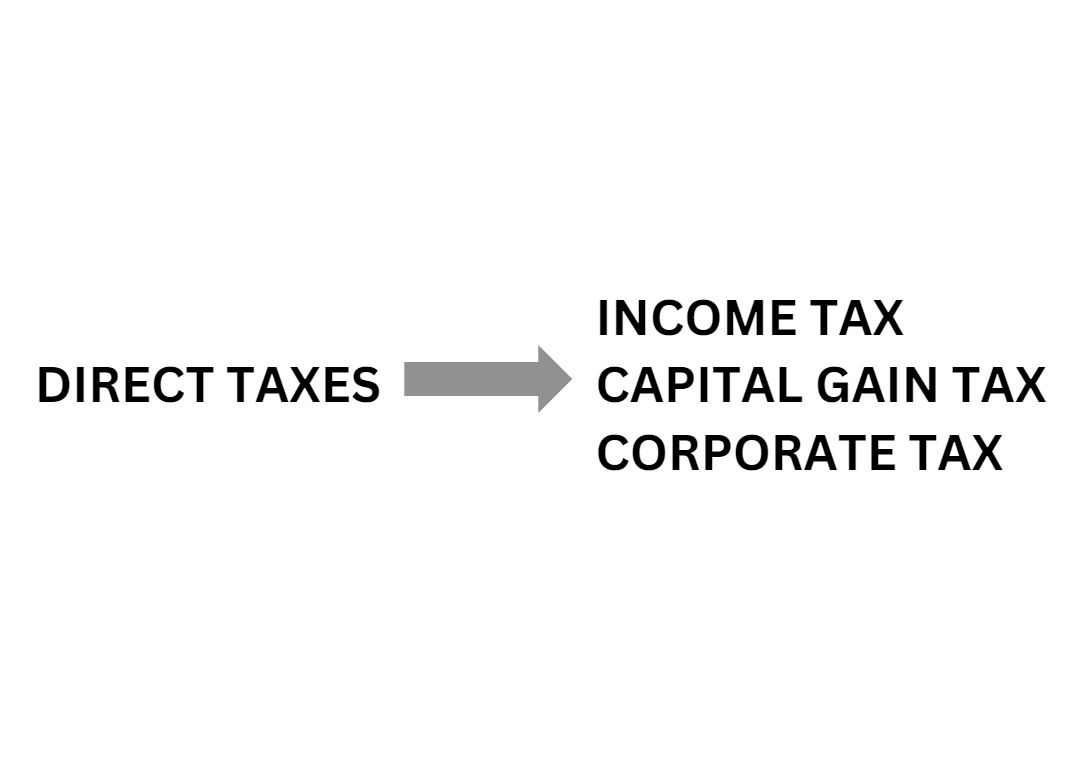

1.2 Direct Tax

The tax paid by individual and corporate entities is known as direct tax. The tax form is further divided into income, capital gain, and corporate tax. Direct taxes are levied each assessment year, i.e., from 1st April to 31st March. The payment of tax is mandatory, and it is non-transferable as well.

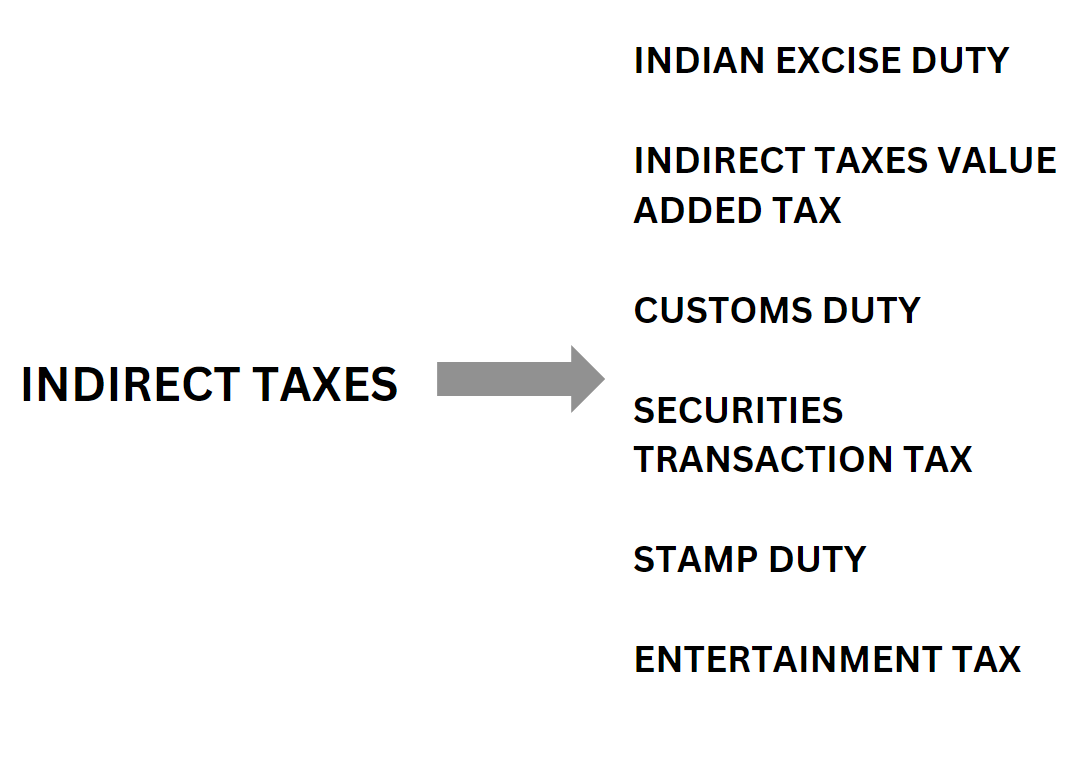

1.3 Indirect Tax

Tax levied upon goods and services is known as indirect tax. The form of tax is further divided into different segments such as VAT, service tax, Indian excise duty, customs duty, stamp duty, entertainment tax, and others. The tax is also termed as Goods and Service Tax or GST. The consumer pays the tax when purchasing a product as the amount is included in the final price of a product.

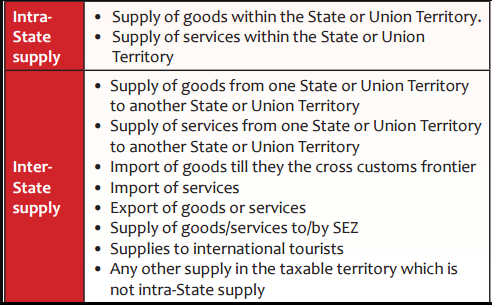

2.1 What are inter-state and intra-state supplies of goods and services?

When the goods and services are transported by the seller to the buyer from one state to another, the procedure is termed inter-state supply, whereas when the goods and services are transported in the same state, the procedure is known as intra-state supply. The classification helps decide the right amount of tax to levy on goods and services.

Also Read: Tax Invoice For Inter-State And Intra-State Supply Of Goods: Compliance Considerations

3.1 GST Rates for Intra-State Supplies

The GST rate slabs in India fall under four slabs, i.e., 5%, 12%, 18%, and 28%. The correct rate to be levied depends upon the type of transaction. GST rates for goods falling under a particular category and nil for essential goods are also categorized in GST law.

The GST rates applied to the intra-state supply of goods and services are divided into CGST and SGST categories. CGST stands for Central Goods and Services Tax, and SGST stands for State Goods and Service Tax. Section 8 of the CGST Act under GST law clearly states that taxes levied on the intrastate supply of goods and services should not exceed 14%.

In the case of such transactions, both CGST and SGST are applied to goods and services. GSTIN is another crucial factor in the case of such transactions to identify the applicability of tax components. GST is a destination-based tax; hence, the classification belts help the governments of each state to decide the right amount of revenue to collect in case of different transactions.

CGST and SGST taxes are levied on goods and services for such transactions. Hence, the tax amount is set by the central and state governments, respectively.

4.1 Tax Rate Structure for Intra-State Transactions

The right amount of tax to be paid to the specific government depends upon the type of movement of goods and services. When the buyer and seller of goods and services are under the same state, the transaction is called intra-state. Taxes such as CGST and SGST are applicable under such circumstances, which state that Central and State governments levy taxes on the movement of goods and services in case of intra-state supply.

The classification helps in the collection and segregation of taxes. It makes it easy for the one entitled to collect tax and for the taxpayer to decide the correct form of tax to be levied on the movement of goods and services. It is also helpful for the respective governments to collect the rightful revenue. The CGST act under GST law clearly defines that the decided amount of tax to be paid for intra-state transactions is 14%.

5.1 Understanding GST Rates on Intra-State Trade

GST is a form of destination-based tax. The tax to be applied on goods and services transported from one place to another depends upon the location of the seller and buyer of goods. In the intra-state supply of goods and services, where the buyer and seller belong to the same state, CGST and SGST tax forms are applicable. It states that the central and state governments are eligible to tax the intra-state supply of goods and services.

The transaction structure has a rate similar to an inter-state trade and must be recorded in the books of account with the correct code on the day of sale. The respective state’s GST rate tables help define the correct code to enter the intra-state transaction in the account books. Calculating GST on intra-state transactions involves adding CGST and SGST amounts, where CGST is levied on the total value of goods and services. SGST also applies to the actual goods and services plus the CGST amount. The calculation reveals the tax value of CGST and SGST, when added together, equals IGST (tax levied on supply of goods and services from one state to another, also known as inter-state supply of goods and services).

6.1 Categories of GST Rates for Intra-State Supplies

GST rates differ for the supply of goods and services depending upon the destination of the supply of goods and services. Hence, GST is also abbreviated as a destination-based tax. Classification of GST helps the buyer and seller of goods, along with the government, to decide the right amount of revenue to be collected. The GST council revises the tax rates with the help of central and state government representatives at specific intervals.

It helps the state maintain its revenue for the development procedure and maintains a proper balance in the state’s economic condition. The rule also applies to goods and services under particular and essential categories. The GST law imposes a cess on selling items such as cigarettes, tobacco, aerated water, motor vehicles, and gasoline, ranging from 1% to 204%.

7.1 Applicable Tax Rates for Intra-State Transactions

The destination-based tax differs for goods and services depending upon the type of transaction. Hence, the tax levied for intra-state transactions varies depending upon the changing GST rates. It helps a state balance the revenue collected from the tax and balances the state’s economic condition. The tax rate for different belts of goods and commodities keeps changing depending upon the changing GST rates. It leads to high and low tax rates on other goods and services. These classifications help the buyer and seller of the goods and the government to identify the right amount of revenue to be collected.

CGST and SGST are the applicable GST tax rates for intra-state transactions. It clearly defines that the central and state governments can levy taxes on the movement of goods and services within the state. Proper tax calculation reveals that analysis of CGST and SGST equals the tax amount charged on goods and services for inter-state transactions.

Also Read: Determining Place Of Supply In Intra-State Transactions General Principles

8.1 Intra-State Supply and Corresponding GST Rates

When goods and services are transported in the same state, the activity is termed intra-state supply. Under such situations, CGST and SGST forms of GST taxes are applicable over the transaction. It states that the state and central government can levy taxes on the trade of goods and services. The tax rate keeps on fluctuating depending upon the changes done in the GST law.

Representatives from the central and state governments change the tax rates to balance the state’s economic scenario and maintain a healthy revenue. On 11th July 2023, the latest GST Council meeting to decide the tax rates was held. Generally, the tax rates in India are divided into the slabs of 5%, 12%, 18%, and 28%.

Conclusion

GST is a destination-based tax; hence, its rate changes depending upon the movement of goods and services. CGST and SGST of GST tax apply for intra-state supply of goods and services. The classification of taxes depending upon the final location of goods helps the buyer, seller, and the respective government of the state decide the tax revenue and use it for the betterment of the state.

Also Read: New GST Rates 2023 – List Of Latest Goods And Service Tax Rates Slabs

Frequently Asked Questions

-

What is tax defined as?

A certain percentage of the amount payable to the government from the income of an individual or a corporate entity is known as tax.

-

What are the different types of taxes?

Tax is divided into direct tax and indirect forms of taxation. Direct tax is payable by the citizens and corporate entities of the country, whereas indirect taxes apply to the use of goods and services.

-

What are different other sections in which direct tax is divided?

Direct tax is further divided into income, capital gain, and corporate tax.

-

What are the other sections in which indirect tax is divided?

Indirect tax is divided into VAT, service tax, Indian excise duty, customs duty, securities transaction tax, stamp duty, and entertainment tax.

-

What is GST?

GST stands for Goods and Service Tax, which is liable for moving goods and services. The tax is also known as a destination-based tax, as its rate keeps changing depending upon the location of the supply of goods and services.

-

What is intra-state supply?

The movement of goods and services from one place to another within the same state is known as the intra-state supply of goods and services.

-

What form of GST tax is applicable for intra-state transactions?

CGST and SGST forms of taxes are applicable for the intra-state supply of goods and services.

-

What do CGST and SGST stand for?

CGST stands for Central Goods and Services Tax, and SGST stands for State Goods and Services Tax. These taxes define that the Central and State governments are liable to levy taxes on intra-state transactions.

-

What are the different GST rate slabs in India?

5%, 12%, 18%, and 28% are the rate slabs in which GST is divided for different goods and commodities.

-

Which body is responsible for bringing changes in the GST tax rates?

The GST Council and representatives from the central and state Governments are responsible for changing the GST tax rates depending on the country’s economic condition and each state’s revenue status.