Have you ever heard the term MSME? Well, it is, in fact, a category of enterprises that receive special benefits and assistance from banks and the government, thereby ensuring sustenance in the market. This special treatment is given to MSMEs because, in turn, they immensely contribute to the country’s employment rates. Moreover, 96% of the Indian market comprises small companies.

Thus, it is normal to mistake a non-MSME firm for an MSME firm. If you, too, face the same issue. Then, read the article below till the end. It will give you a list of businesses that come under MSME.

What is an MSME and Its Full Form?

MSME is an abbreviation for Micro, Small, and Medium Enterprises. It also consists of enterprises in critical economic positions. These companies are involved mainly in the production and processing of commodities. MSMEs are often smaller in scale than major enterprises.

This component, therefore, often helps greatly with local development by providing a level of flexibility and creativity. They also play an important part in a variety of industries, from small bakeries and workshops to growing Internet businesses. As a result, MSMEs are regarded as the backbone of many communities.

How are MSMEs classified?

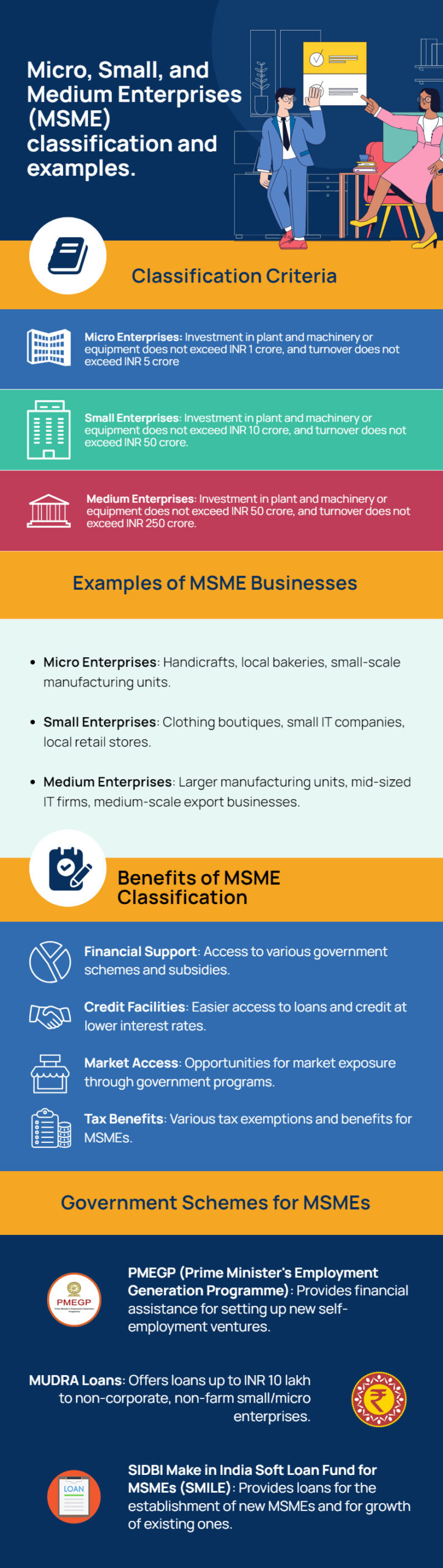

MSMEs are classified into three primary categories, thus ensuring businesses receive appropriate support and benefits. This classification is also done based on their investment and annual turnover.

1. Micro Enterprises

Micro Enterprises, therefore, represent the smallest category of MSMEs, characterised by relatively modest investment in plant and machinery or equipment. Specifically, these businesses have an investment ceiling of up to ₹25 lakh and, in addition, maintain a turnover of up to ₹5 crore annually. Moreover, Micro enterprises play a crucial role in local economies. In many cases, They often embody entrepreneurial spirit and contribute to community development.

2. Small Enterprises

Small Enterprises fall within an intermediate range, demonstrating a moderate level of investment in both plant and machinery or equipment. These businesses, in particular, have an investment ranging from ₹25 lakh to ₹100 crore, with an annual turnover spanning from ₹5 crore to ₹50 crore.

Small enterprises strike a balance between scalability and adaptability. As a result, these features promote innovation and create employment opportunities in various sectors.

3. Medium Enterprises

Medium enterprises represent a larger and more established category of MSMEs. Furthermore, they have significant investments in plants, machinery, or equipment. Specifically, falling within the investment range of ₹100 crore to ₹250 crore, these businesses also maintain an annual turnover ranging from ₹50 crore to ₹250 crore.

Medium enterprises play a critical role in driving economic growth. Specifically, they contribute substantially to local and national economies through enhanced production capacity and market presence.

Also Read: Difference Between Micro, Small, And Medium Enterprises

What are the Types of Businesses That Fall Under MSME?

MSMEs encompass a vast array of businesses. In particular, here are some of the major types of businesses found within MSMEs:

1. Manufacturing

Manufacturing is a type of business where MSMEs create products on a larger scale. Moreover, it involves making things like clothes, gadgets, or food.

2. Services

Services in MSMEs involve providing helpful actions instead of physical products. For instance, small businesses often offer consulting, repairs, or cleaning services. As a result, these enterprises contribute to the economy by delivering valuable assistance, creating jobs, and meeting various community needs.

3. Retail

Retail is a type of business where MSMEs sell goods directly to consumers. For instance, think of local shops or online stores. Additionally, small and medium-sized retail enterprises offer various products, making them accessible to people in communities.

4. Food Processing

Food processing is an MSME business involving transforming raw ingredients into edible products. Moreover, small and medium-sized enterprises in this sector create foods like snacks, beverages, and packaged items. Additionally, they enhance the value of raw materials, ensuring a diverse range of tasty and convenient food choices for consumers.

5. Handicrafts and Artisanal Work

Handicrafts and artisanal work are MSME businesses where skilled individuals create unique handmade products. In addition, these enterprises produce items like pottery, jewellery, and textiles, showcasing traditional craftsmanship.

6. Technology and Innovation

Technology and innovation in MSMEs involve creative solutions and advancements. Furthermore, small and medium-sized enterprises contribute significantly by developing new software, gadgets, or services.

List of Businesses That Come Under MSME

MSMEs comprise a diverse ecosystem with a wide range of businesses. Some of them are listed as follows:

1. Manufacturing

a. Textile & Garments

These MSMEs weave fabrics and craft garments, ensuring we stay clothed and comfortable.

b. Food Processing

From preserving produce to baking treats, these businesses, in turn, ensure food security and culinary delight.

c. Furniture & Woodworks

Skilled artisans, for instance, carve elegant furniture, craft decorative pieces, and build sturdy shelves, thereby shaping wood into functional beauty.

d. Metal & Steelworks

These MSMEs, for example, forge tools, machinery, and intricate metal structures, thereby breathing life into steel

2. Services

a. Retail

Local grocery stores, bookshops, and boutiques, in addition, bring convenience and variety to daily life.

b. IT & Software

Tech-savvy businesses, for example, build websites, develop apps, and offer tech support, thereby keeping us connected and informed.

c. Hospitality & Tourism

Bed-and-breakfasts, travel agencies, and tour operators, in addition, fuel wanderlust and showcase local charm.

d. Education & Training

Coaching centres, vocational institutes, and language schools, moreover, invest in knowledge and skills.

3. Other Prominent Industries

a. Agriculture & Animal Husbandry

Small farms, poultry, and dairy cooperatives, in turn, nourish communities, thereby keeping food production thriving.

b. Healthcare & Wellness

Local pharmacies, dental clinics, and physiotherapy centers furthermore contribute to community health and well-being.

c. Construction & Infrastructure

Skilled professionals like building contractors, electricians, and plumbers, in addition, lay the foundation for development.

d. Arts & Crafts

Artisans, ranging from potters to weavers, furthermore, preserve cultural heritage and offer unique, handcrafted products.

List of Businesses That Do Not Come Under MSME

While MSMEs encompass a vast array of businesses, certain activities fall outside their scope due to their nature, size, or focus. Here are some of its prominent examples:

- Financial and Insurance Services

- Public Utilities and Infrastructure

- Educational Institutions

- Extractive Industries

- Professional Services

- Gambling and Betting

- Retail Trade (Specific Exclusions)

- Activities of Households

- Extraterritorial Organisations

Each of these businesses does not comply with the core features of an MSME. Thus, they are not considered as one.

What are the Factors Promoting MSME Growth in Various Sectors?

MSMEs are very critical to economic growth. Furthermore, several variables significantly contribute to their growth and sustainability across a variety of industries.

1. Government Initiatives and Policies

Government assistance for MSME growth is provided through favourable policies, subsidies, and easy access to finance. Additionally, tailored programmes encourage entrepreneurship, thereby establishing a favourable business climate.

2. Access to Finance

MSMEs benefit from adequate and easily available financial resources. These businesses can invest in technology and expansion because they have access to loans and financial inclusion efforts.

3. Technological Advances

Adopting modern technology significantly enhances production and efficiency. In addition, MSMEs leveraging digital tools, automation, and e-commerce platforms can streamline operations, access new markets, and ultimately maintain a competitive edge in the industry.

4. Skill Development Programs

Continuous training and skill development programmes help to build a capable workforce. MSME personnel who are equipped with current skills contribute to creativity, quality, and the overall growth of the firm.

5. Market Access and Globalisation

Facilitating local and international market access significantly enhances the growth prospects for MSMEs. Active participation in global value chains and overseas marketplaces not only boosts sales but also helps diversify income streams, ensuring greater resilience and sustainability.

6. Infrastructure Development

Reliable infrastructure, such as transportation, electricity, and communication networks, supports the operations of small and medium-sized businesses. Improved logistics save money, increase efficiency, and contribute to overall corporate success.

7. Collaboration and networking

MSMEs benefit significantly from the synergies fostered by collaborative platforms, industry alliances, and networking events. Such collaboration, as a result, facilitates information exchange, encourages joint ventures, and supports collective activities, thereby enhancing the market influence and competitiveness of these businesses.

8. Social and Environmental Responsibility

Sustainable practices and social responsibility, consequently, improve MSME credibility. Moreover, consumers increasingly favour firms committed to environmental protection and community welfare. Thus, their efforts benefit the brand and market position.

What are the Various Sector Specific MSME Schemes?

Governments have introduced a variety of sector-specific schemes to drive growth and additionally address the unique challenges faced by different industries. Some of these initiatives include:

1. Micro Enterprises

A. Credit Linked Capital Subsidy Scheme (CLCSS)

- Provides capital subsidy for technology upgradation.

- Covers 15% of project cost for micro-enterprises.

- Aims to improve productivity and competitiveness.

B. Micro and Small Enterprises Cluster Development Programme (MSE-CDP)

- Supports infrastructure development and common facilities in clusters.

- Enhances competitiveness and promotes specialisation.

- Builds strong networks and facilitates knowledge sharing.

2. Small Enterprises

A. Technology Upgradation Scheme (TUS)

- Provides financial assistance for the adoption of modern technologies.

- Covers up to 15% of project costs for small enterprises.

- Helps improve quality, productivity, and market access.

B. Market Development Assistance (MDA) Scheme

- Supports participation in trade fairs and exhibitions.

- Offers financial assistance for branding and marketing activities.

- Helps expand market reach and visibility.

3. Medium Enterprises

A. Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

- Provides credit guarantee to banks for lending to MSMEs.

- Eases credit access for medium enterprises.

- Reduces credit risk for lenders and facilitates growth.

B. Scheme for Promoting Innovation, Rural Industry & Entrepreneurship (ASPIRE)

- Fosters innovation and entrepreneurship in rural areas.

- Provides financial support for product development and commercialisation.

- Encourages job creation and rural development.

These schemes’ availability and eligibility criteria may differ across regions and sectors. It is also crucial to visit their official websites for the latest details or consult relevant government agencies to access accurate and up-to-date information. MSMEs can strategise these sector-specific schemes to overcome challenges and seize opportunities.

Also Read: Importance Of MSME Loan For Small Business Owners

Conclusion

MSMEs have proven to be the backbone of economies throughout the world. These enterprises play an essential role in both local and worldwide marketplaces. The investment and turnover categorisation enables personalised assistance.

As you go over the list of businesses under MSMEs, it is evident that these enterprises contribute significantly to economic progress. They are a driving force for sustainable and equitable development because of their dedication to excellence.

Also Read: MSME Registration in India: Procedure, Documents Required

Also Read: Union Budget 2024-25: MSMEs Call For Focus On Infra, Tax Relief

Frequently Asked Questions

Q1. How do you Check if a Company is MSME Registered?

To verify your Udyam Registration, visit the Udyam Registration website and navigate to the ‘Verify Udyam Registration’ section. Then, enter your Udyam Registration number and input the corresponding verification code to complete the confirmation process.

Q2. Who is Eligible for MSME 2023?

Eligibility for MSME 2023 is primarily based on investment in plant and machinery or equipment, as well as annual turnover. Furthermore, micro, small, and medium enterprises must meet specific thresholds as per government guidelines to qualify.

Q3. Is MSME Registration Free?

The registration process for MSMEs on the Udyam Registration Portal is conducted entirely online and is completely free of charge, thus ensuring that MSME registrations are accessible without any associated costs, and making the process simple and convenient for all businesses.

Q4. What is the MSME Scheme 2023?

The ₹5 lakh crore Emergency Credit Line Guarantee Scheme (ECLGS) was introduced during the COVID-19 pandemic to address credit gaps in businesses, including MSMEs. Operational until March 31, 2023, it served as a crucial financial support measure.

Q5. Does MSME Require a License?

On August 27, the Urban Development Department issued a circular, which, as a result, garnered a positive response from micro, small, and medium enterprises (MSMEs). Moreover, they welcomed the exemption from the requirement to obtain trade licenses for operations within recognised industrial estates/areas. This move, therefore, is expected to streamline processes and promote ease of business for MSMEs.

Q6. How Many Companies are Registered in MSME?

In India, micro-enterprises dominate the MSME landscape, constituting over 99% of the total. In fact, micro-businesses play a significant role, with a staggering number of 630.5 lakh enterprises. On the other hand, small businesses, numbering 3.3 lakh, make up 0.5% of MSMEs. Whereas medium-sized businesses, totalling 0.05 lakh, constitute 0.01% of the MSME sector. Overall, this distribution highlights the prevalence of micro-enterprises in the Indian MSME ecosystem.

Q7. What Happens if an MSME loan is not Paid?

As per Section 16 of the Act, in the event of postponed payment or non-payment, the buyer is, therefore, required to pay interest with monthly rests to the supplier. Moreover, the interest is compounded at a rate three times the bank rate as notified by the RBI. This provision, therefore, aims to ensure timely and fair compensation to the supplier for any delays in payment by the buyer.

Q8. Can PVT LTD Register as MSME?

MSME registration in India is, therefore, inclusive, extending to various entities and encompassing micro, small, and medium-sized firms. Additionally, registration is available for diverse business structures, including limited liability partnerships (LLP), private limited companies, one-person companies (OPC), sole proprietorships, partnerships, and public companies. This flexibility, consequently, promotes accessibility for a broad spectrum of businesses seeking MSME recognition.

Q9. What is the Lowest Interest Rate for MSME?

Interest rates for MSME loans commence at 7.65% per annum. Moreover, the sanctioned loan amounts vary significantly, ranging from as low as Rs. 50,000 and extending to several crores, thereby providing a flexible financing option tailored to the diverse needs and scales of Micro, Small, and Medium Enterprises.

Q10. How Much Loan can you get on MSME without collateral?

Under the MUDRA (Micro Units Development and Refinance Agency) scheme, MSME loans, moreover, without the requirement of collateral, are categorised into three segments:

- Shishu: Loans up to ₹50,000, designed primarily for start-ups and businesses in their initial stages.

- Kishor: Loans ranging from ₹50,001 to ₹5,00,000 cater to businesses that have progressed beyond the start-up phase and require a higher funding limit.

- Tarun: Loans ranging from ₹5,00,001 to ₹10,00,000, providing a higher financial threshold for more established MSMEs with greater capital needs.

These categorisations, therefore, aim to facilitate accessible and targeted financial support for MSMEs at different stages of development.